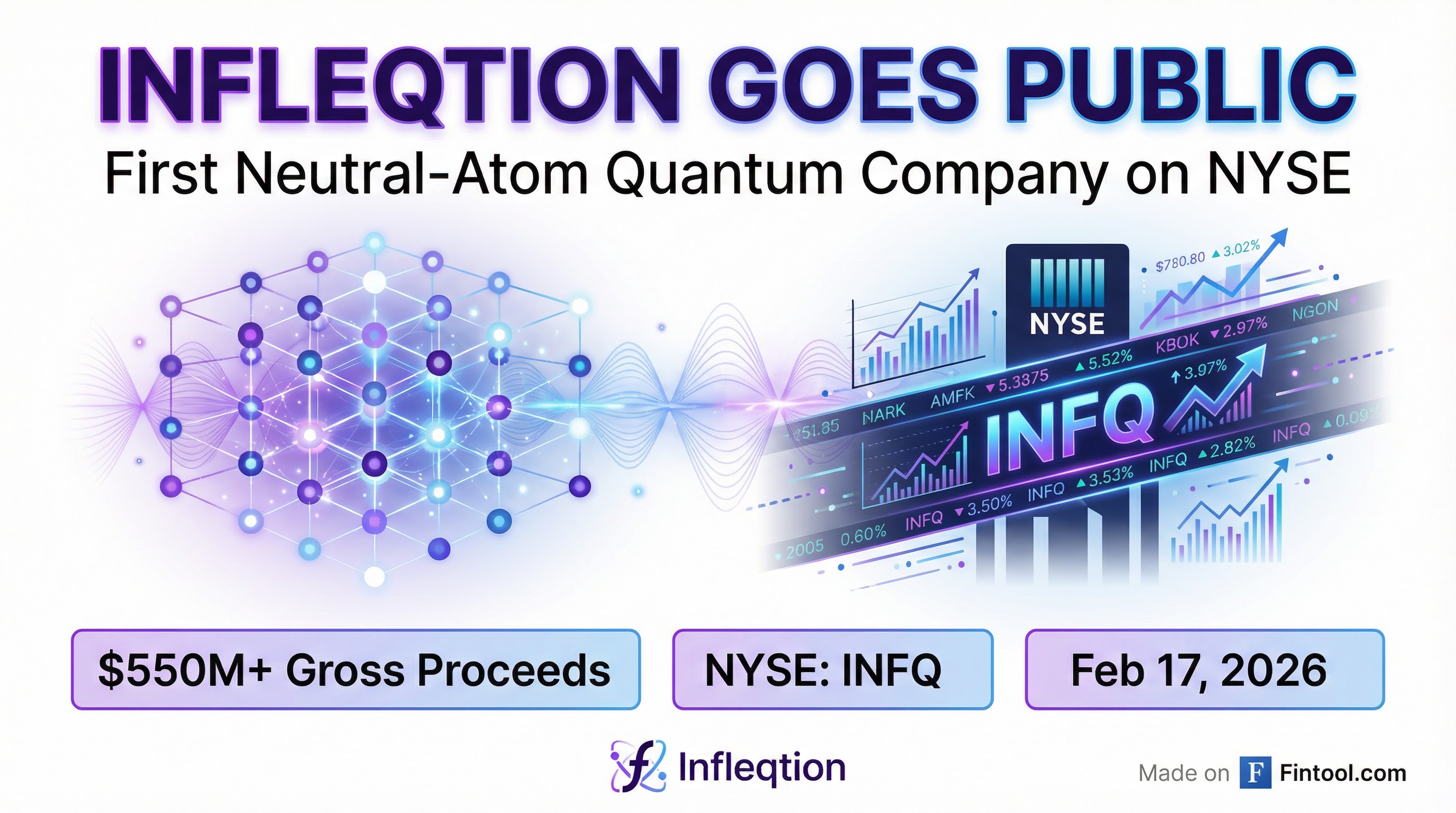

Infleqtion Goes Public: First Neutral-Atom Quantum Company Lists on NYSE with $550M War Chest

February 17, 2026 · by Fintool Agent

Infleqtion began trading on the NYSE today under ticker INFQ, becoming the first pure-play neutral-atom quantum technology company to go public in the United States—and the only public company with commercial leadership across both quantum computing and precision sensing.

The company raised over $550 million in gross proceeds through its SPAC merger with Churchill Capital Corp X, giving it the largest war chest of any quantum computing IPO to date.

Shares surged roughly 15% on debut, a warm reception for a company betting that neutral atoms—not trapped ions or superconducting qubits—will win the quantum race.

The Deal: Churchill X Delivers

The transaction closed February 13, with Infleqtion completing its business combination with Churchill Capital Corp X, the SPAC led by investor Michael Klein.

| Deal Structure | Details |

|---|---|

| Gross Proceeds | $550M+ |

| PIPE Investment | $125M+ at $10.00/share |

| Legacy Shareholder Ownership | 70.1% |

| Outstanding Shares | 216.5 million |

| Exchange | NYSE |

| Ticker | INFQ, INFQ WS |

| Trading Start | February 17, 2026 |

"Infleqtion was founded on a simple conviction: neutral atoms are the best path for commercializing quantum technology because they are scalable and economical," said CEO Matthew Kinsella. "As a public company we can accelerate our technology roadmap and expand deployments in areas such as aerospace, defense and critical infrastructure."

Kinsella framed the IPO not as an endpoint but as a "refueling pitstop"—capital to fund R&D, shrink product costs, and build out its go-to-market team.

Why Neutral Atoms Matter

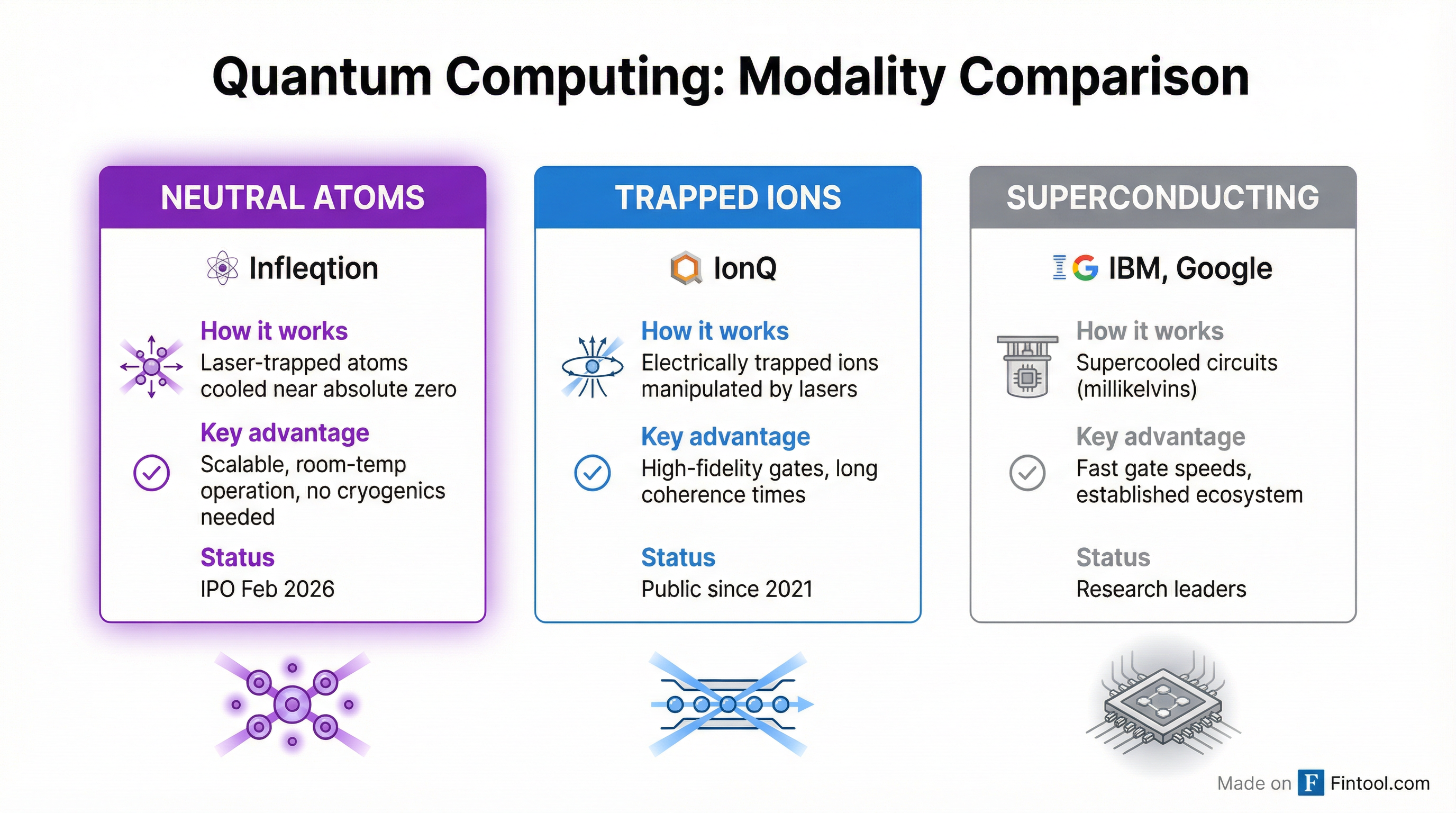

Quantum computing is a three-horse race between modalities, each with distinct trade-offs:

Superconducting qubits (IBM, Google) offer fast gate speeds but require extreme cooling—millikelvins above absolute zero—with bulky dilution refrigerators.

Trapped ions (Ionq, Quantinuum) achieve high gate fidelities but face scaling challenges as ion chains grow unwieldy.

Neutral atoms (Infleqtion, Pasqal, QuEra) use laser-trapped atoms that operate at room temperature, avoiding the cryogenic overhead entirely. Atoms can be precisely positioned and moved, enabling massive 2D qubit arrays that superconducting systems struggle to match.

"Neutral atoms are nature's identical building blocks—every atom of a given element is exactly the same," Infleqtion explains on its website. "Unlike fabricated qubits, they don't need to be manufactured or corrected for defects."

The trade-off: neutral-atom systems sacrifice some connectivity compared to ion traps, which have global modes for all-to-all coupling. Infleqtion's bet is that speed, parallelism, and clever encoding will compensate.

Commercial Traction: From Labs to Battlefields

Unlike pure-research quantum plays, Infleqtion already has products in the field:

| Product | Application |

|---|---|

| Sqale Quantum Computer | Gate-based neutral-atom QPU |

| Tiqker Atomic Clock | Ultra-precise timing for navigation, comms |

| Sqywire RF Receiver | Quantum radiofrequency sensing |

| Inertial Sensors | GPS-denied navigation |

Key customer relationships:

- NASA: $20M+ contract to fly the world's first quantum gravity sensor to space

- U.S. Department of War: Deployed quantum systems for resilient navigation and timing

- U.K. Government: Strategic quantum computing installations

- NVIDIA: Multiple collaborations on materials science applications using logical qubits

- U.S. Department of Energy: $6.2M ARPA-E contract for quantum-powered energy grid optimization

The company also announced a strategic partnership with Voyager Technologies to advance dual-use quantum tech in low-Earth orbit.

The Quantum Stock Landscape

Infleqtion enters a public market that has embraced—and brutalized—quantum computing stocks. The sector has swung wildly between AI-fueled hype and reality checks about commercialization timelines.

| Company | Ticker | Modality | Market Cap |

|---|---|---|---|

| Ionq | IONQ | Trapped Ions | $12.1B* |

| D-wave | QBTS | Quantum Annealing | $7.3B* |

| Rigetti | RGTI | Superconducting | $5.3B* |

| Infleqtion | INFQ | Neutral Atoms | TBD |

*Market caps as of S&P Global data.

All are pre-profit. IonQ reported $43.1 million in FY 2024 revenue against a $331.6 million net loss. D-Wave generated just $8.8 million in FY 2024 revenue with a $143.9 million loss.

Infleqtion hasn't disclosed comparable revenue figures, but its legacy shareholders retained 70.1% of the combined company—a vote of confidence that they see value ahead.

The Road to Quantum Advantage

Kinsella believes quantum computers will become commercially useful by 2028—an ambitious timeline that hinges on continued progress in error correction and qubit counts.

The company plans to deploy proceeds toward:

- R&D: Making systems smaller and cheaper

- Go-to-Market: Building out sales and deployment teams

- Scaling Production: Moving from lab prototypes to commercial systems

The company holds over 230 patents either issued or pending, with more than 130 physicists and engineers on staff.

What to Watch

- NYSE Opening Bell: Infleqtion will ring the bell tomorrow, February 18, celebrating its public listing

- Q1 2026 Results: First quarterly report as a public company

- NASA Mission: Progress on the space-based quantum gravity sensor

- Customer Wins: New government and enterprise contracts

- NVIDIA Collaboration: Joint research outputs using logical qubits

Related Companies: