Intuitive Surgical Beats on Earnings, But Guides to Slowdown as Tariffs Take 120 Basis Points Off Margins

January 22, 2026 · by Fintool Agent

Intuitive Surgical delivered a beat-and-lower-guidance quarter Thursday evening: Non-GAAP EPS of $2.53 crushed Street expectations by 11%, but management's 2026 outlook projects meaningful deceleration in the procedure growth that underpins the bull case.

The $186 billion robotic surgery pioneer guided to 13-15% worldwide da Vinci procedure growth in 2026—a notable step-down from the 18% achieved in 2025 . Shares rose 2.3% in after-hours trading to $538, suggesting investors are giving management credit for consistent execution even as headwinds mount.

The Quarter: Strong Execution Across the Board

Fourth-quarter revenue hit $2.87 billion, up 19% year-over-year, with recurring revenue (instruments, accessories, and services) growing 20% to represent 81% of total sales . The recurring revenue engine is crucial—it means Intuitive's business is anchored to procedure volumes rather than lumpy system sales.

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $2.87B | $2.41B | +19% |

| Non-GAAP EPS | $2.53 | $2.21 | +14% |

| da Vinci Procedures | +17% | — | — |

| Ion Procedures | +44% | — | — |

| System Placements | 532 | 493 | +8% |

Procedure growth of 18% (combined da Vinci and Ion) exceeded expectations, with the Ion lung biopsy platform emerging as a genuine growth driver at 44% volume expansion .

da Vinci 5: The Upgrade Cycle Accelerates

The rollout of da Vinci 5—Intuitive's next-generation system featuring force feedback technology—continued to gain momentum. Of the 532 systems placed in Q4, 303 were da Vinci 5 units (57% of placements), up from 174 in the prior-year quarter .

Force feedback, which allows surgeons to "feel" tissue resistance through the controls, represents the most significant capability advancement since the platform's introduction. Early clinical data is emerging: a study from Hackensack University Medical Center found that 83% of patients using force feedback instruments recovered bowel function within 24 hours versus just 25% with standard instruments .

The company ended Q4 with an installed base exceeding 11,100 da Vinci systems globally—up 12% year-over-year—and utilization increased 4% in the quarter, primarily driven by da Vinci 5 adoption in the U.S. .

The Tariff Math: 120 Basis Points of Margin Pressure

The guidance disappointment centers on two factors: slowing procedure growth and persistent tariff headwinds.

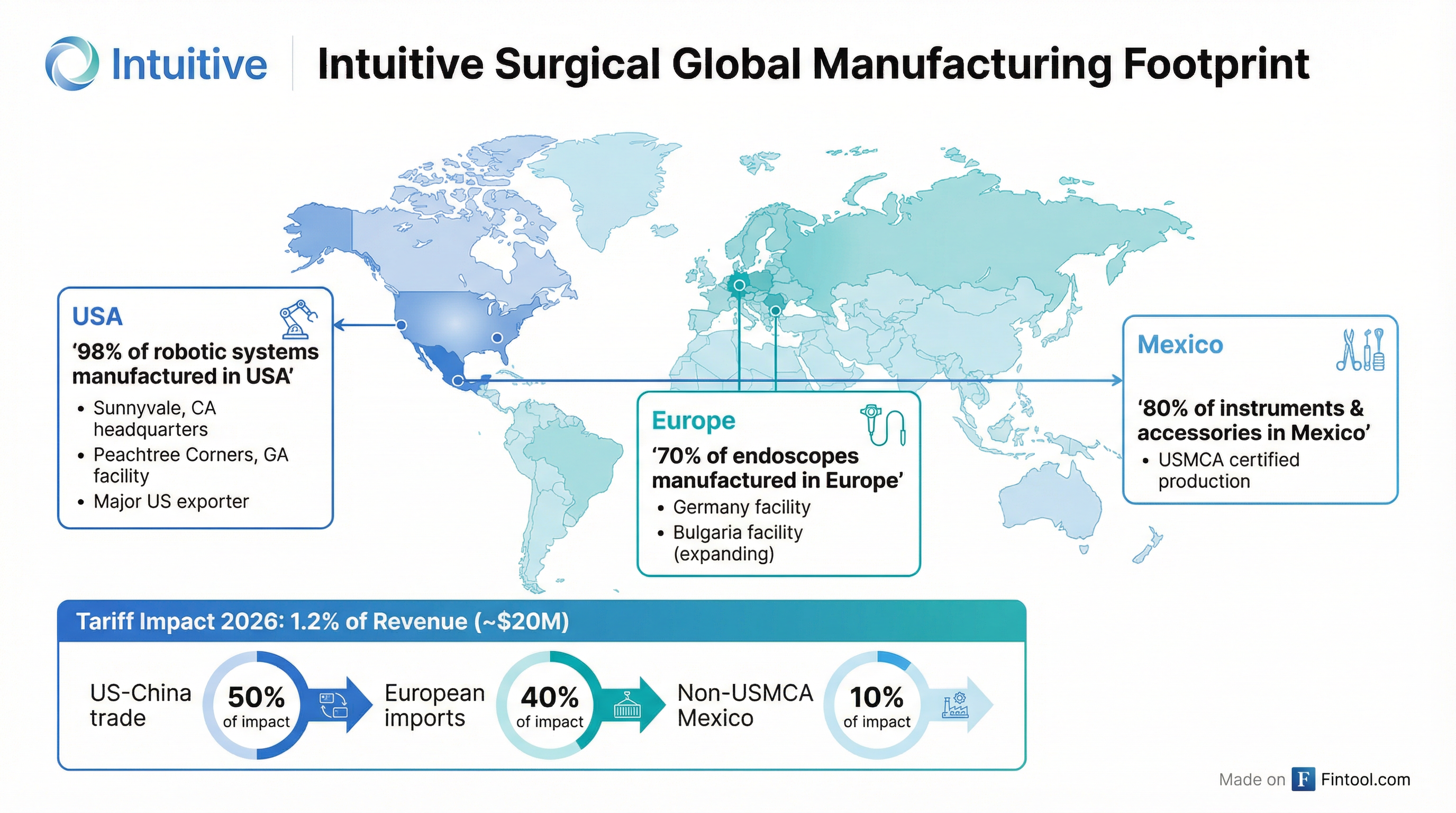

Management expects tariffs to cost 1.2% of revenue in 2026, up from roughly 65 basis points in 2024 . The exposure breaks down as follows:

US-China Trade (~50% of impact): Intuitive imports subassemblies into China for domestic system production and finished systems, facing 125% Chinese tariffs. Going the other direction, the company's China JV manufactures certain Ion platform products that face 145% U.S. tariffs when imported .

European Imports (~40% of impact): Seventy percent of Intuitive's endoscopes are manufactured in Germany, subject to 10% baseline tariffs with potential increases after the current pause period ends .

Mexico (~10% of impact): While most products manufactured in Mexico qualify for USMCA tariff exemptions, a small portion that doesn't meet certification requirements faces 25% tariffs .

CFO Jamie Samath noted that tariff costs flow through inventory and are recognized as products sell: "We would expect the impact of tariffs to increase each quarter over the remainder of the year" .

The Growth Deceleration: Multiple Headwinds Converging

The 13-15% procedure growth guidance for 2026 versus 18% in 2025 reflects several converging pressures:

GLP-1 Weight Loss Drugs: Bariatric procedures in the U.S. declined in the mid-single-digit range throughout 2025 , and management explicitly cited "new pharmaceutical products for obesity management" as a guidance consideration .

China Competitive Intensity: Domestic Chinese competitors continue to pressure pricing and win tenders. The 125% tariffs on imported systems further disadvantage Intuitive's cost position in the world's second-largest healthcare market .

European & Japanese Capital Constraints: Hospital CapEx budgets remain pressured across key international markets. "Governments in key OUS markets continue to constrain hospital CapEx budgets, which limits the expansion of capacity in the field," management noted .

Medicaid Uncertainty: The guidance range explicitly accounts for "potential impacts from changes to Affordable Care Act premium subsidies and Medicaid funding on hospital and patient behavior in the U.S." .

Financial Strength Remains a Buffer

Intuitive's balance sheet provides cushion for navigating the tariff environment. The company ended Q4 with $9.03 billion in cash and investments—and zero debt .

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $2.87B | $2.41B | +19% |

| Gross Margin | 66.4% | 68.0% | -160 bps |

| EBITDA Margin | 35.7% | 36.2% | -50 bps |

| Cash & Investments | $9.03B | $8.43B | +$0.6B |

Gross margins compressed 160 basis points year-over-year to 66.4%, reflecting both tariff impacts and the higher mix of newer platforms (da Vinci 5, Ion) that carry lower initial margins.

What to Watch

The investment case now hinges on several key questions:

Can da Vinci 5 reaccelerate U.S. growth? The force feedback technology is generating strong customer response, but the comparison base gets tougher through 2026 as the initial surge of upgrades normalizes.

Will tariff mitigation materialize? Management outlined several operational levers—USMCA qualification, dual-sourcing, manufacturing footprint optimization—but cautioned not to expect "significant beneficial impact in 2025" . The question is whether 2026 provides relief.

How deep is the GLP-1 impact? Bariatric volumes were already declining mid-single-digits before the latest generation of weight-loss drugs launched. The company's exposure here is meaningful but not existential—bariatrics represented roughly 15% of U.S. procedures.

Is China a lost cause? Domestic competitors, government-driven pricing pressure, and 125% tariffs create a challenging competitive environment. Intuitive's China strategy may need recalibration.

At 70x earnings, Intuitive trades at a substantial premium that assumes durable high-teens procedure growth. The 2026 guidance tests that assumption. Investors will need to decide whether this is a temporary soft patch driven by external factors—or the beginning of a structural deceleration in the robotic surgery adoption curve.

Related Companies