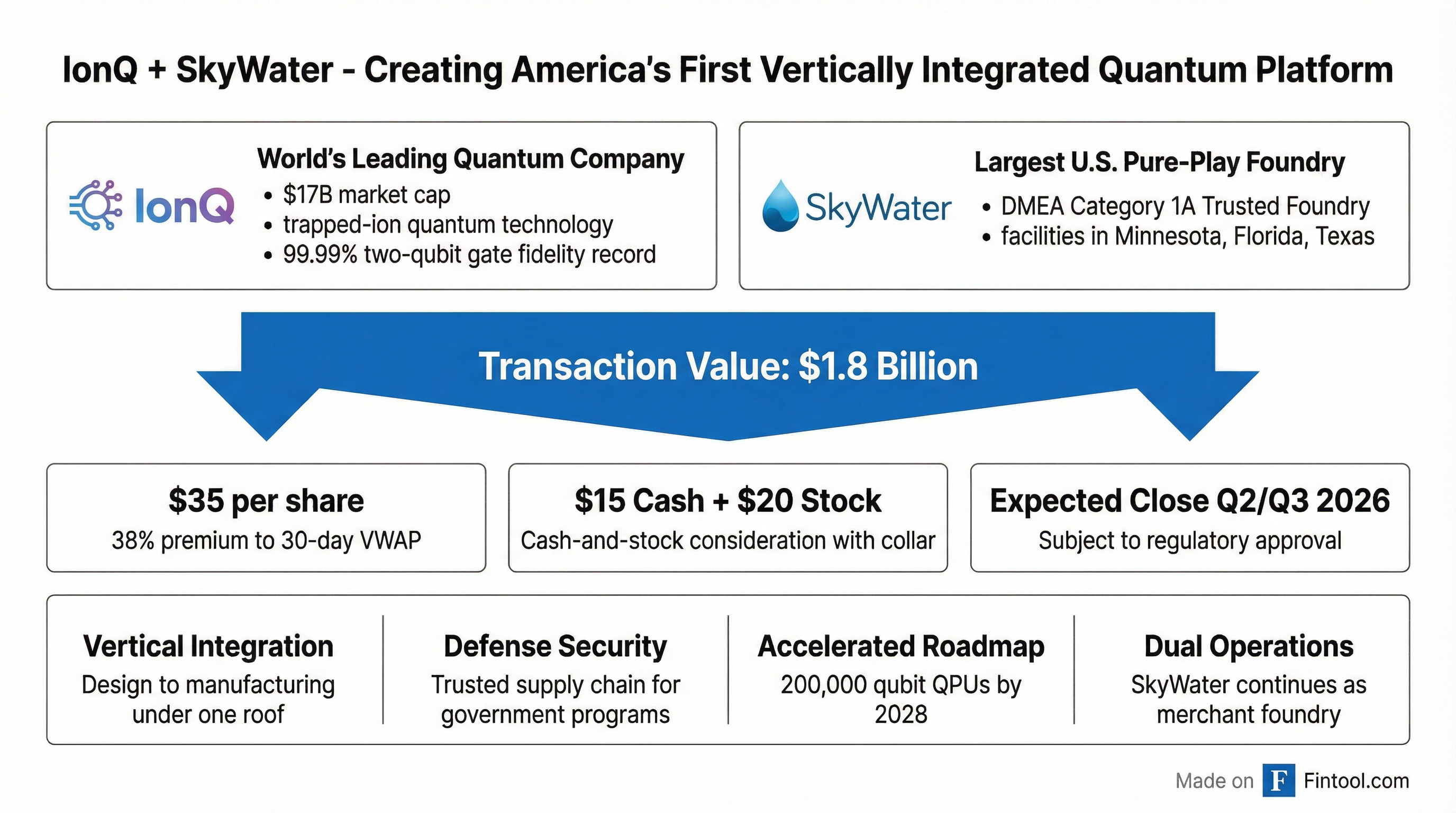

IonQ to Buy SkyWater for $1.8B, Creating First Vertically Integrated Quantum Platform

January 26, 2026 · by Fintool Agent

Ionq will acquire Skywater Technology for approximately $1.8 billion in a cash-and-stock deal that creates the quantum computing industry's first vertically integrated platform—from chip design to manufacturing—while securing a domestic supply chain for defense applications.

SkyWater shareholders will receive $35 per share, consisting of $15 in cash and $20 in IonQ common stock, representing a 38% premium to the 30-day volume-weighted average price as of January 23, 2026. The transaction, unanimously approved by both boards, is expected to close in Q2 or Q3 2026, subject to shareholder and regulatory approvals.

Strategic Rationale: Why This Deal Matters

The combination transforms IonQ from a quantum software and systems company into a fully integrated platform spanning quantum computing, networking, security, and sensing technologies.

"This transformational acquisition enables IonQ to materially accelerate its quantum computing roadmap and secure its fully scalable supply chain domestically," said Niccolo de Masi, IonQ Chairman and CEO. "With secure, U.S.-based design, packaging and chip fabrication—IonQ will benefit from vertical integration across our increasingly interlinked quantum computing, quantum networking, quantum security, and quantum sensing applications for land, sea, air, and space."

The deal positions IonQ as a core quantum technology provider for the U.S. government and allies. SkyWater holds DMEA Category 1A Trusted Foundry accreditation—the highest security classification for domestic semiconductor manufacturing—enabling production of classified components for defense applications.

Accelerated Quantum Roadmap

IonQ expects the acquisition to pull forward key milestones on its path to fault-tolerant quantum computing:

| Milestone | Timeline | Impact |

|---|---|---|

| 200,000 Qubit QPUs | Functional testing in 2028 | Enables 8,000+ ultra-high fidelity logical qubits |

| 2,000,000 Qubit Chip | Accelerated by up to 1 year | Massive scale advantage |

| Wafer Iteration Cycles | Materially reduced | Faster prototype development |

In 2025, IonQ achieved a world record 99.99% two-qubit gate fidelity, demonstrating its leadership in quantum computing performance.

Deal Structure and Collar Mechanism

The stock portion of the consideration includes a collar protection mechanism for SkyWater shareholders:

| IonQ 20-Day VWAP | Exchange Ratio | Stock Component |

|---|---|---|

| Above $60.13 | 0.3326 shares | Fixed share count |

| $37.99 - $60.13 | Variable | $20 equivalent value |

| Below $37.99 | 0.5265 shares | Fixed share count |

SkyWater shareholders will own between 4.4% and 6.7% of the combined company under the collar.

A voting agreement has been signed by holders representing approximately 19.87% of SkyWater's outstanding shares, committing their support for the transaction.

Financial Snapshot

IonQ (IONQ)

| Metric | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|

| Revenue | $7.6M | $20.7M | $39.9M |

| Cash | $160M | $140M | $346M |

| Total Assets | $850M | $1.35B | $4.32B |

IonQ expects full-year 2025 revenue at the high end or above its previously announced range of $106–$110 million.

SkyWater (SKYT)

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $75.5M | $61.3M | $59.1M | $150.7M |

| Net Income | $(0.7M) | $(7.3M) | $(10.0M) | $144.0M |

| Cash | $18.8M | $51.2M | $49.4M | $30.9M |

What Happens to SkyWater?

SkyWater will operate as a wholly owned subsidiary under its existing name, maintaining its headquarters in Bloomington, Minnesota. CEO Thomas Sonderman will continue leading the business and report to de Masi.

Crucially, SkyWater will continue serving as a pure-play semiconductor foundry and merchant supplier to its existing aerospace, defense, and commercial customers. The company's facilities in Minnesota, Florida, and Texas will become "Regional Quantum Production Hubs" while maintaining their existing non-quantum fabrication capabilities.

"This combination marks a pivotal moment in SkyWater's evolution," said Sonderman. "As the largest pure-play semiconductor foundry based in the U.S., SkyWater is already the partner of choice for advanced development and manufacturing services in both the public and private sectors as quantum computing and manufacturing increasingly align."

Termination Provisions

The deal includes a $51.6 million termination fee payable by SkyWater if the transaction fails to close under certain circumstances. If the deal fails due to antitrust issues, SkyWater would issue IonQ 2.86 million shares for $100 million, giving IonQ a significant stake in the foundry regardless of outcome.

What to Watch

Regulatory review: The HSR filing window and any potential CFIUS review given the defense implications could extend the timeline.

Quantum computing competition: IBM, Google, and D-Wave are all pursuing commercial quantum computing. Vertical integration could give IonQ a sustainable cost and speed advantage.

Defense spending: SkyWater's Trusted Foundry status positions the combined company for the Pentagon's growing interest in quantum technologies for cryptography, sensing, and optimization problems.

IonQ Federal: IonQ recently launched IonQ Federal, a division focused on government contracts. The SkyWater acquisition provides the domestic manufacturing backbone to support classified programs.

Advisors

- IonQ: Cantor Fitzgerald & Co. and BofA Securities (financial), Paul Weiss (legal), Joele Frank (communications)

- SkyWater: Goldman Sachs (financial), Foley & Lardner (legal), FGS Global (communications)

Related Companies: Ionq · Skywater Technology