IR-Med CEO Resigns After 17 Months as Stock Collapses 99.7% and Company Can't Pay Salaries

February 5, 2026 · by Fintool Agent

Ran Ziskind resigned as CEO of Ir-med Inc.+0.00% (OTCQB: IRME) on February 3, 2026, effective immediately, citing "disagreements with the Company relating to its strategic direction, management approach, and certain employment matters."

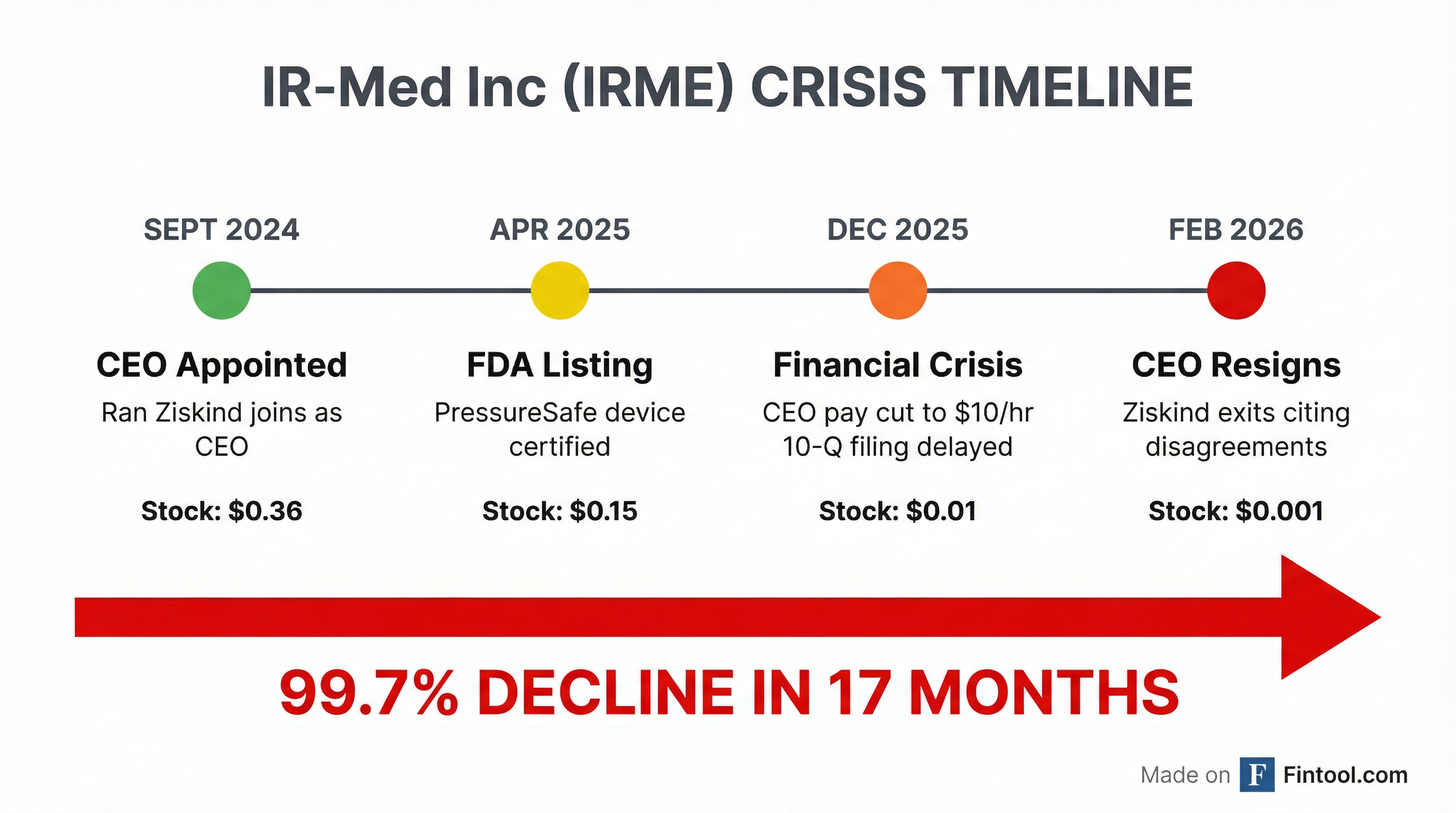

The departure caps a tumultuous 17-month tenure during which the Israeli medical device company's stock collapsed 99.7%—from $0.36 when Ziskind was appointed in September 2024 to $0.001 at his exit—and the company descended into financial crisis so severe it could not file quarterly reports or pay executive salaries.

From Promise to Poverty: A 17-Month Collapse

Ziskind joined IR-Med with considerable fanfare in August 2024. The company touted his two decades of experience leading Galatea Ltd., a diamond technology startup he co-founded and led through its acquisition by Sarin Technologies. His mandate was clear: commercialize PressureSafe, IR-Med's FDA-listed AI-powered device designed to detect pressure injuries before skin breakage—a $26.8 billion market problem causing 60,000 deaths annually in the U.S. alone.

The initial employment terms reflected optimism: a base salary of NIS 6,000 ($1,600) monthly, set to jump to NIS 45,000 ($12,000) plus a NIS 10,000 car allowance upon the company raising $4 million. He also received options on 1.4 million shares at $0.58.

That funding never came.

The Financial Unraveling

By December 2025, IR-Med's cash position had deteriorated so badly that the company:

- Could not file its Q3 2025 10-Q on time, disclosing it was "unable to file" due to "financial difficulties currently being experienced by the Company"

- Terminated consulting agreements with two directors, Aharon Klein and Yaniv Cohen, "in light of the Company's cash position"

- Slashed executive pay to hourly wages: Ziskind's compensation was cut from his (never-achieved) target salary to NIS 37 per hour—approximately $10/hour—effective December 1, 2025

The CFO, Sharon Levkoviz, was similarly transitioned to hourly pay at NIS 185/hour.

The company's December 2025 8-K contained an unusual admission: "The Company is actively evaluating and pursuing various alternatives to address its liquidity needs and financial condition" but "can provide no assurance as to the timing or outcome of such efforts."

Directors Double Down with $43,619 Private Placement

In a filing disclosed the same day as the CEO's departure, IR-Med announced a $43,619 private placement at $0.0031 per share—essentially the current trading price—entirely subscribed by directors.

The buyers and amounts:

| Director | Shares Purchased | Investment | Warrants |

|---|---|---|---|

| Oded Bashan (Chairman) | 10,422,580 | $32,310 | 5,211,290 |

| Yaniv Cohen | 1,042,258 | $3,231 | 521,129 |

| Yechiel Even | 1,042,258 | $3,231 | 521,129 |

| Ron Mayron | 1,042,258 | $3,231 | 521,129 |

| Aharon Klein | 521,290 | $1,616 | 260,645 |

Source: 8-K filed February 5, 2026

The warrants carry a $0.03 exercise price and expire in five years.

This is not the first time insiders have propped up the company. In March 2025, Ziskind, Cohen, and Bashan each purchased $10,400 in convertible notes, totaling $31,200, at 9% interest convertible at 85% of market price.

The Stock Implosion

IR-Med's stock trajectory during Ziskind's tenure tells the story:

| Date | Price | Event |

|---|---|---|

| September 2024 | $0.36 | Ziskind appointed CEO |

| February 2025 | $0.525 | 52-week high |

| April 2025 | $0.15 | PressureSafe FDA listing |

| September 2025 | $0.05 | Q3 filing concerns emerge |

| December 2025 | $0.01 | CEO pay cut, 10-Q delayed |

| February 2026 | $0.001 | CEO resigns |

The stock now trades at one-tenth of a penny, with a market cap of approximately $77,000—less than the cost of a Tesla Model S. Daily volume has dried up to a few hundred shares.

What Went Wrong?

The 8-K offers only the cryptic explanation of "disagreements" over "strategic direction, management approach, and certain employment matters." Reading between the lines:

Strategic Direction: IR-Med has three products in development (PressureSafe for pressure injuries, DiaSafe for diabetic foot ulcers, Nobiotics for ear infections) but lacks capital to commercialize any of them. The company received a $500,000 grant from the Israel Innovation Authority for DiaSafe, but that's a drop in the bucket for a company trying to launch multiple medical devices.

Management Approach: Chairman Oded Bashan, who co-founded the company and previously served as interim CEO, remains the dominant figure. The structure—with Bashan as chairman and the largest shareholder, and Ziskind as CEO earning effectively minimum wage—may have created friction.

Employment Matters: The December 2025 pay restructuring was brutal. Ziskind went from a potential $12,000/month salary to $10/hour with no guaranteed hours. Any hours worked required "prior approval by the company chairman." For a CEO of a public company, this is an extraordinary arrangement that likely made his position untenable.

What's Next?

The company has not announced a successor. The most likely scenario is that Chairman Oded Bashan resumes the interim CEO role he held before Ziskind's appointment in 2021 and again in 2024.

IR-Med faces existential challenges:

- No commercial revenue: PressureSafe remains in usability studies, not generating sales

- Minimal cash: The $43,619 raised won't last long, even with hourly-wage executives

- Delisting risk: The company is already delinquent on 10-Q filings

- Talent flight: With only 3 full-time employees and near-minimum-wage executive pay, attracting leadership will be difficult

The technology itself—using infrared spectroscopy and AI to detect subsurface tissue damage—remains potentially valuable. Pressure injuries cost the U.S. healthcare system $26.8 billion annually. But bridging the gap from development to commercialization requires capital IR-Med doesn't have and can't attract at a sub-$100,000 market cap.

The Bottom Line

IR-Med's CEO departure is the symptom, not the disease. The company ran out of money before it could commercialize its FDA-listed device, and no amount of director loans or hourly-wage arrangements could paper over that reality. Ziskind's exit after 17 months—and especially after having his pay slashed to $10/hour—was likely inevitable.

For investors, IRME is a cautionary tale about micro-cap medical device companies: even promising technology can't survive without capital, and when executives start getting paid by the hour, it's usually time to exit.

Related Companies