Japan Commits $36 Billion to US Energy and Critical Minerals Projects—Largest Gas Plant in History

February 17, 2026 · by Fintool Agent

Japan is moving forward with $36 billion in investments across three US projects—including what will be the largest natural gas power plant in American history—marking the first tranche of its $550 billion commitment under the trade deal struck with President Donald Trump last year.

"Our MASSIVE Trade Deal with Japan has just launched!" Trump posted on Truth Social. "The scale of these projects are so large, and could not be done without one very special word, TARIFFS."

The announcement comes weeks before Japanese Prime Minister Sanae Takaichi is set to meet Trump in Washington on March 19, with implementation of the trade and investment framework expected to dominate the agenda.

The Three Projects

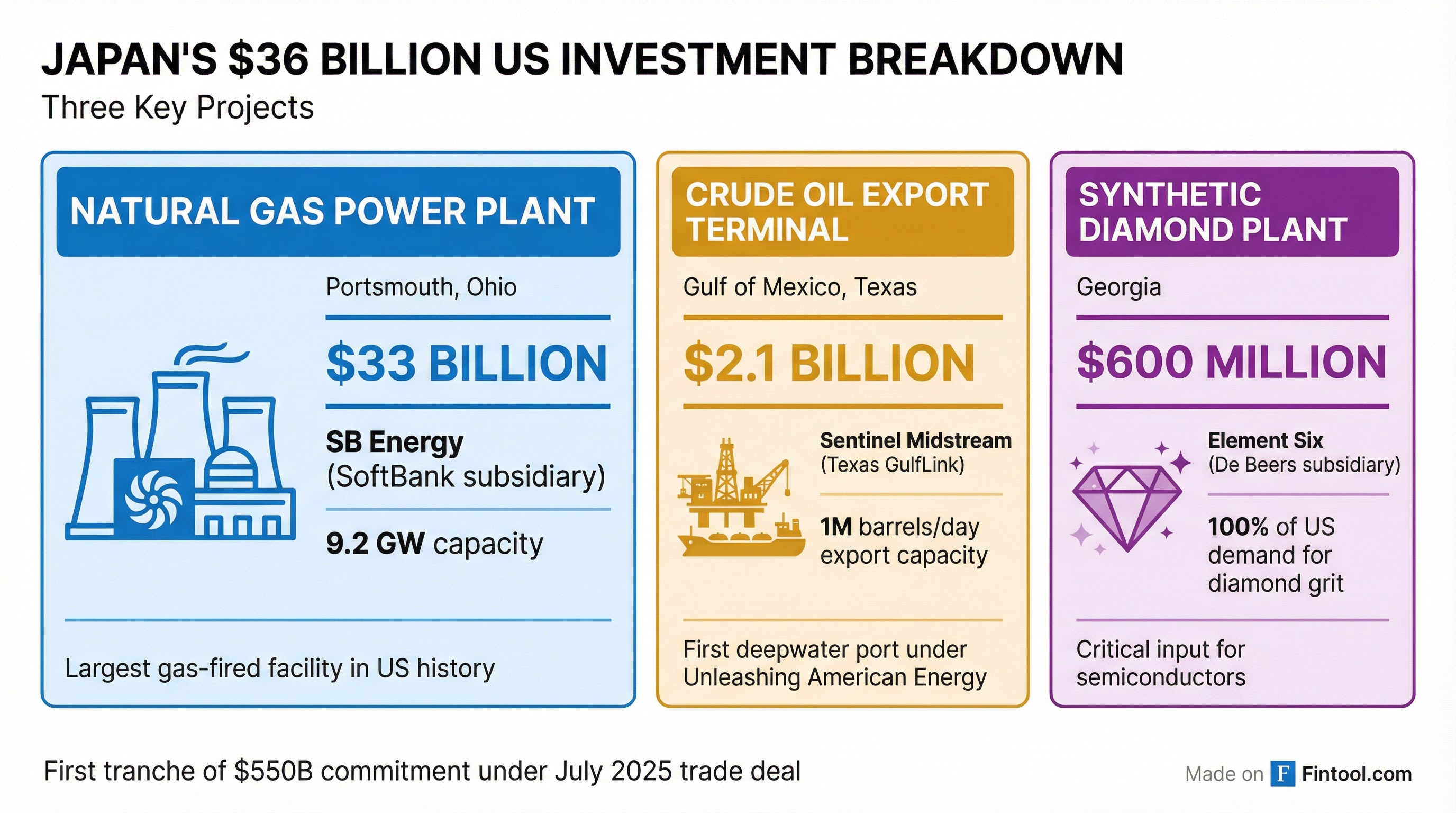

$33 Billion: America's Largest Gas Power Plant

The centerpiece is a $33 billion natural gas-fired power plant in Portsmouth, Ohio, set to generate 9.2 gigawatts of electricity annually—more than enough to power all homes in the state.

The facility will be operated by SB Energy, a subsidiary of Japanese tech investor SoftBank Group, and represents a critical addition to US baseload power capacity at a time when data centers built to power artificial intelligence applications are driving unprecedented electricity demand.

If the plant operates at full capacity, it would be the equivalent of nine nuclear reactors or roughly the amount of power consumed by about 7.4 million homes on the largest US grid operated by PJM Interconnection.

SoftBank has been aggressively positioning itself in the AI infrastructure space. The company purchased a manufacturing facility in Lordstown, Ohio, last year and is building modular data centers for the $500 billion Stargate project alongside OpenAI and Oracle.

$2.1 Billion: Deepwater Crude Export Terminal

The second project is the Texas GulfLink deepwater crude oil export facility off the Texas coast, developed by Sentinel Midstream. Located approximately 26.6 nautical miles off Brazoria County, the terminal will be able to export up to 1 million barrels of crude oil per day.

"This project is expected to generate $20–30 billion annually in U.S. crude exports, secure export capacity for our refineries, and reinforce America's position as the world's leading energy supplier," Commerce Secretary Howard Lutnick said.

Texas GulfLink received its deepwater port license earlier this month under Trump's "Unleashing American Energy" executive order—the first such license issued under that directive. The facility is designed to accommodate Very Large Crude Carriers (VLCCs), significantly reducing vessel congestion in nearshore waters and improving the efficiency of US crude exports.

Currently, only one US port—the Louisiana Offshore Oil Port—can fully load supertankers. Other facilities must partially load VLCCs and transfer cargo from smaller vessels, a costlier and less efficient process.

$600 Million: Synthetic Diamonds for Semiconductors

The third investment targets a synthetic industrial diamond manufacturing facility in Georgia, operated by Element Six, a subsidiary of De Beers Group, the world's largest diamond producer.

Lutnick said the high-pressure facility would satisfy 100% of US demand for synthetic diamond grit—a critical input for advanced manufacturing and semiconductor production. The United States currently relies largely on China for such supplies.

Synthetic diamonds are increasingly important for the semiconductor industry. Beyond their traditional use in cutting and polishing wafers, diamonds are emerging as advanced thermal management solutions for high-power chips. Diamond conducts heat several times faster than copper, making it ideal for cooling the increasingly power-dense processors driving AI workloads.

The $550 Billion Framework

The investments are the first concrete outcomes of the trade and economic pact Trump announced with Japan in July 2025. Under the agreement, Japan committed to investing $550 billion in the United States by the end of Trump's second term in January 2029, in exchange for reduced tariffs on Japanese imports—set at 15% instead of the 25% Trump had initially threatened.

The deal was a critical concession for Japan, which depends heavily on automobile exports to the United States. In return, Trump agreed to lower duties on Japanese cars and other goods.

The profit-sharing structure favors the United States long-term. Under the agreement, profits from the projects are split 50-50 between the US and Japan until Japan recovers its initial investment. After that threshold is reached, the split shifts to 90-10 in favor of the United States.

Japanese Trade Minister Ryosei Akazawa said last year that only 1-2% of the $550 billion mechanism would consist of direct cash investments, with the majority coming from loans and loan guarantees from government-owned institutions like the Japan Bank for International Cooperation (JBIC) and Nippon Export and Investment Insurance.

Strategic Alignment

William Chou, a senior fellow at the Hudson Institute, said the three projects reflect shared US and Japanese priorities in the energy, AI, and semiconductor sectors.

"This announcement ensures political momentum ahead of PM Takaichi's trip to Washington next month, and demonstrates that Japan is an ally that follows through on its promises," Chou said.

The projects also align with Japan's own strategic interests. The synthetic diamond investment positions Japanese firms in the semiconductor supply chain, while the energy investments secure access to US oil and gas at a time when Japan seeks to diversify away from Middle Eastern supplies.

For investors, the announcement underscores several themes:

- AI infrastructure demand: The scale of the Ohio power plant—9.2 GW—reflects the enormous electricity requirements of next-generation data centers

- Energy export expansion: US crude export capacity continues to grow, with deepwater terminals enabling more efficient access to global markets

- Critical mineral security: The synthetic diamond plant addresses a key supply chain vulnerability in semiconductor manufacturing

What to Watch

The clock is now ticking on project implementation. Under the US-Japan agreement, once Trump selects a project, Japan has 45 business days to fund the effort. If Japan declines, the US could claw back certain revenues or reimpose higher tariffs—a mechanism that gives the framework enforcement teeth.

Trump has already grumbled about the pace of implementation of a similar deal with South Korea and threatened to hike tariffs again, underscoring the link between investment pledges and tariff concessions.

The March 19 summit between Trump and Takaichi will be the next major catalyst, with both leaders expected to tout the progress and potentially announce additional projects from the $550 billion pipeline.

Related