JLR Posts £310M Loss After Cyberattack Halts Production for Five Weeks

February 5, 2026 · by Fintool Agent

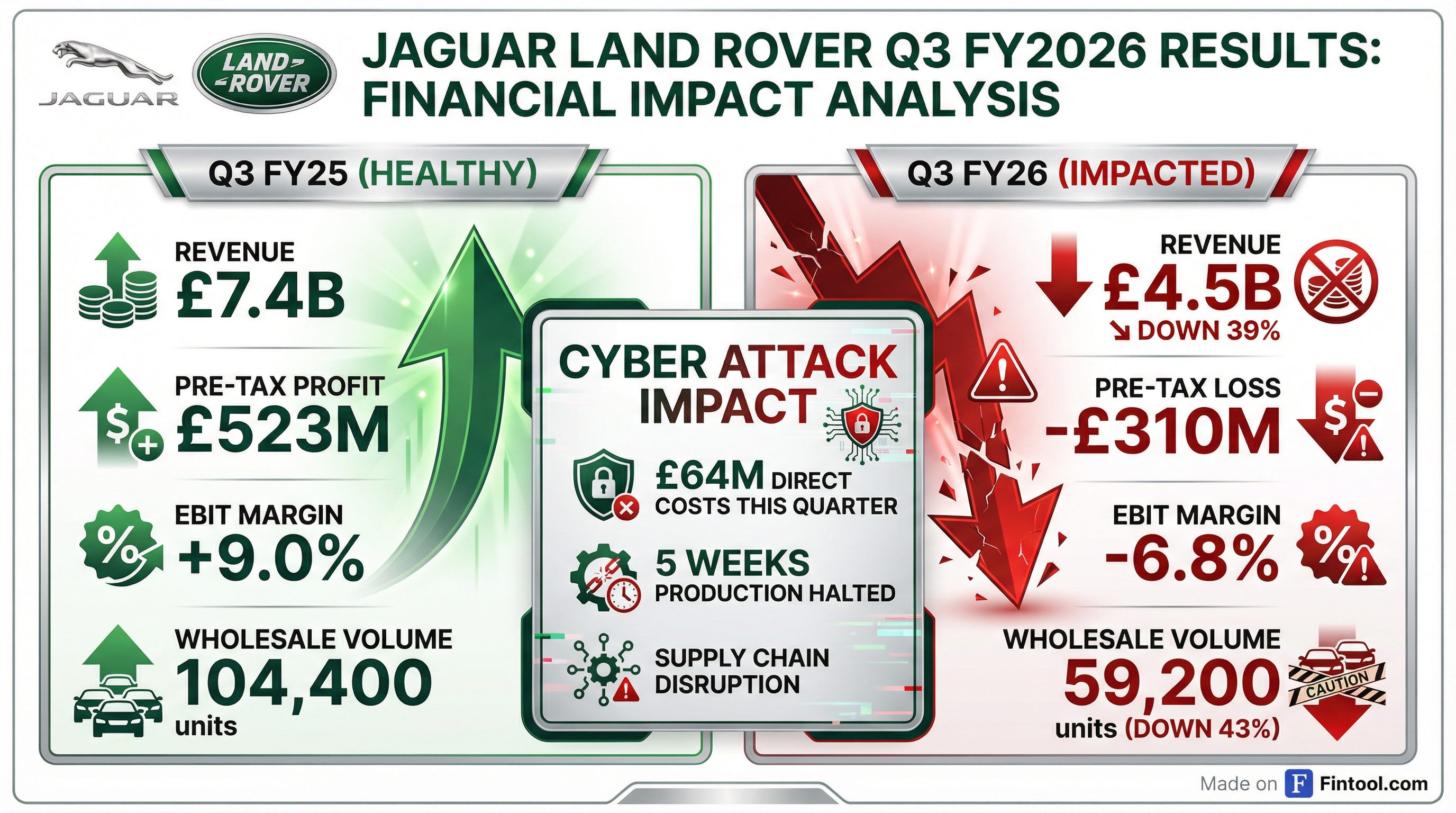

Jaguar Land Rover reported a pre-tax loss of £310 million for its fiscal third quarter, a stark reversal from the £523 million profit recorded a year earlier, as the full financial toll of September's cyberattack became clear.

The attack—described by JLR's CFO as "like nothing else I've experienced"—forced Britain's largest automaker to halt production for five weeks, wiped out 43% of quarterly wholesale volumes, and triggered a £1.5 billion government loan guarantee to stabilize the supply chain.

The Numbers Tell the Story

JLR's Q3 revenue plunged 39% year-over-year to £4.5 billion, with EBIT margins collapsing from positive 9% to negative 6.8%. Parent company Tata Motors Passenger Vehicles swung to a consolidated net loss of Rs 3,486 crore ($386 million), down from a profit of Rs 5,485 crore ($608 million) the prior year.

| Metric | Q3 FY25 | Q3 FY26 | Change |

|---|---|---|---|

| Revenue | £7.4B | £4.5B | -39% |

| Pre-tax Profit/(Loss) | £523M | (£310M) | NM |

| EBIT Margin | +9.0% | -6.8% | -15.8pp |

| Wholesale Volume | 104,400 | 59,200 | -43% |

| Retail Volume | 106,300 | 79,600 | -25% |

Source: JLR Q3 FY26 results

The damage extended across all regions: North America volumes crashed 64%, Europe fell 48%, and China dropped 46%. Only the UK showed relative resilience with a modest 0.9% decline in wholesale volumes.

Five Weeks That Cost Billions

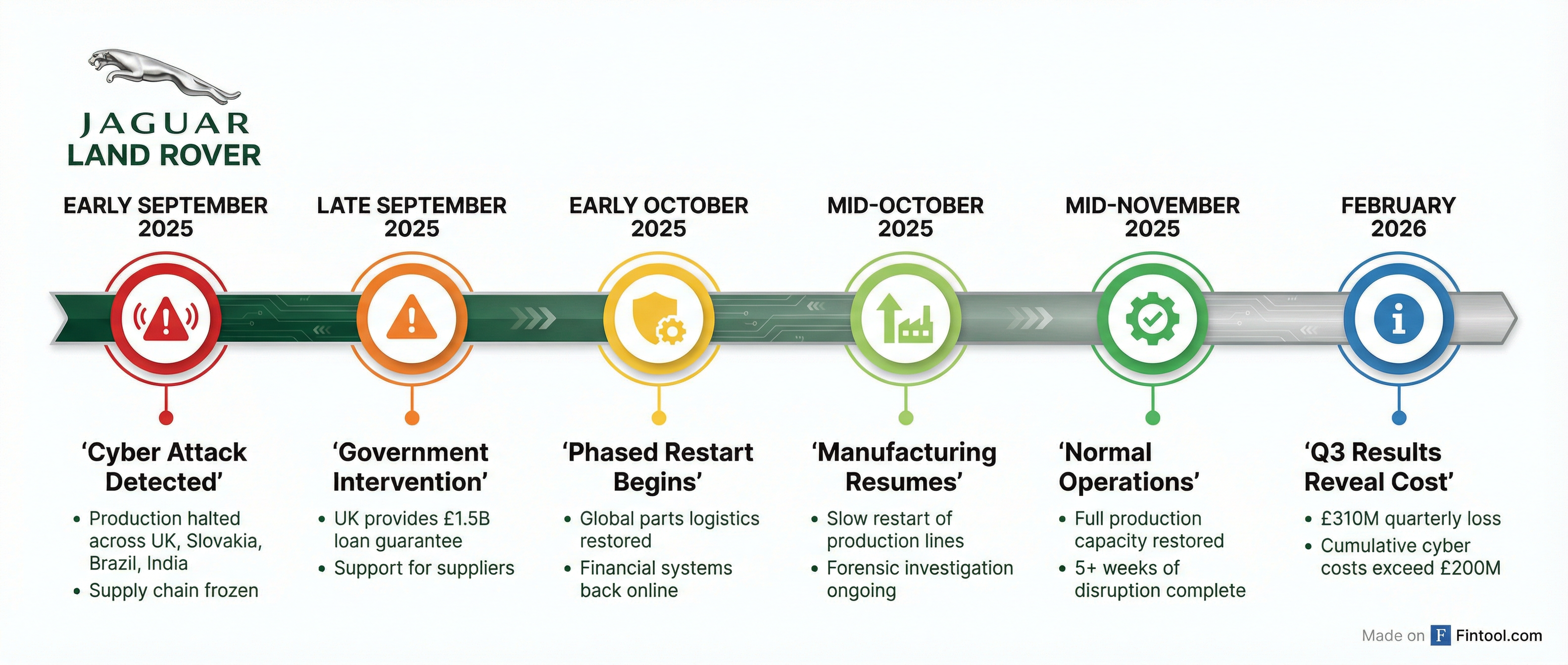

The cyberattack struck in early September 2025, forcing JLR to immediately halt production across its facilities in the UK, Slovakia, Brazil, and India. The company initiated a "controlled shutdown" while conducting a forensic investigation to ensure operational security before restarting.

The ripple effects were immediate and severe:

- £50 million per week in estimated losses during the production halt

- $2.5 billion impact on the broader UK economy from supply chain disruption

- £1.5 billion government loan guarantee to keep suppliers afloat

Production resumed in a phased manner starting in early October, with JLR prioritizing client, retailer, and supplier systems. However, normal production levels weren't restored until mid-November—meaning the October-December quarter bore the full brunt of the disruption.

Cumulative Toll Exceeds £200 Million

JLR has now disclosed direct cyber attack costs across two quarters:

| Quarter | Direct Cyber Costs | Revenue Impact |

|---|---|---|

| Q2 FY26 (Jul-Sep) | £178M ($228.5M) | -24% YoY |

| Q3 FY26 (Oct-Dec) | £64M | -39% YoY |

| Total | £242M+ | — |

*Sources: Reuters, company filings *

The true cost likely exceeds these figures when factoring in lost sales, expedited shipping costs, overtime to catch up, and long-term brand damage. The Wall Street Journal called it "likely the most costly of a series of cyberattacks" targeting UK businesses in 2025.

Management Maintains Full-Year Guidance

Despite the challenging quarter, CEO P.B. Balaji struck an optimistic tone: "While the external environment remains volatile, we expect performance to improve significantly in the fourth quarter and we have clear plans to manage global challenges."

JLR maintained its full-year guidance:

- EBIT Margin: 0% to 2% (lowered twice in 2025 due to US tariffs and the cyberattack)

- Free Cash Outflow: £2.2 billion to £2.5 billion

- Investment Spending: £18 billion over five years from FY24

The company is banking on several catalysts to drive recovery:

- Range Rover Electric launch in 2026

- New Jaguar unveiling as part of brand transformation

- Strong model mix with Range Rover, Range Rover Sport, and Defender comprising 74% of volumes

- Normalized production providing full quarter of output in Q4

What Investors Are Watching

The JLR cyberattack represents a stark case study in operational risk cascading into financial catastrophe. For investors, several questions remain:

Near-term recovery: Can JLR fully recover lost production and deliver on Q4 expectations? Order books for Range Rover and Defender remain strong, but China's weakening demand and U.S. tariffs add headwinds.

Cybersecurity investments: JLR has not disclosed specific plans to harden its systems. Given the scale of this breach, investors should expect increased IT and security spending.

Insurance recovery: The company has not disclosed whether cyber insurance will cover any portion of the losses. Given the magnitude, this could be material.

Parent company impact: JLR accounts for roughly 80% of Tata Motors Passenger Vehicles' revenue. The subsidiary's ability to recover is critical for the parent's overall valuation.

The Bigger Picture

This attack underscores the growing threat that cyber incidents pose to capital-intensive manufacturers. JLR's five-week shutdown demonstrated how quickly digital vulnerabilities can translate into shuttered factories, stranded suppliers, and evaporating shareholder value.

For a company already navigating the complex transition to electric vehicles, the timing could not have been worse. But with production now normalized and premium demand holding steady, JLR has a path back to profitability—if it can execute flawlessly in the quarters ahead.

Related: