Lands' End Sells Brand IP to WHP Global for $300M, Stock Soars 34% as Tender Offer Prices Shares at 220% Premium

January 26, 2026 · by Fintool Agent

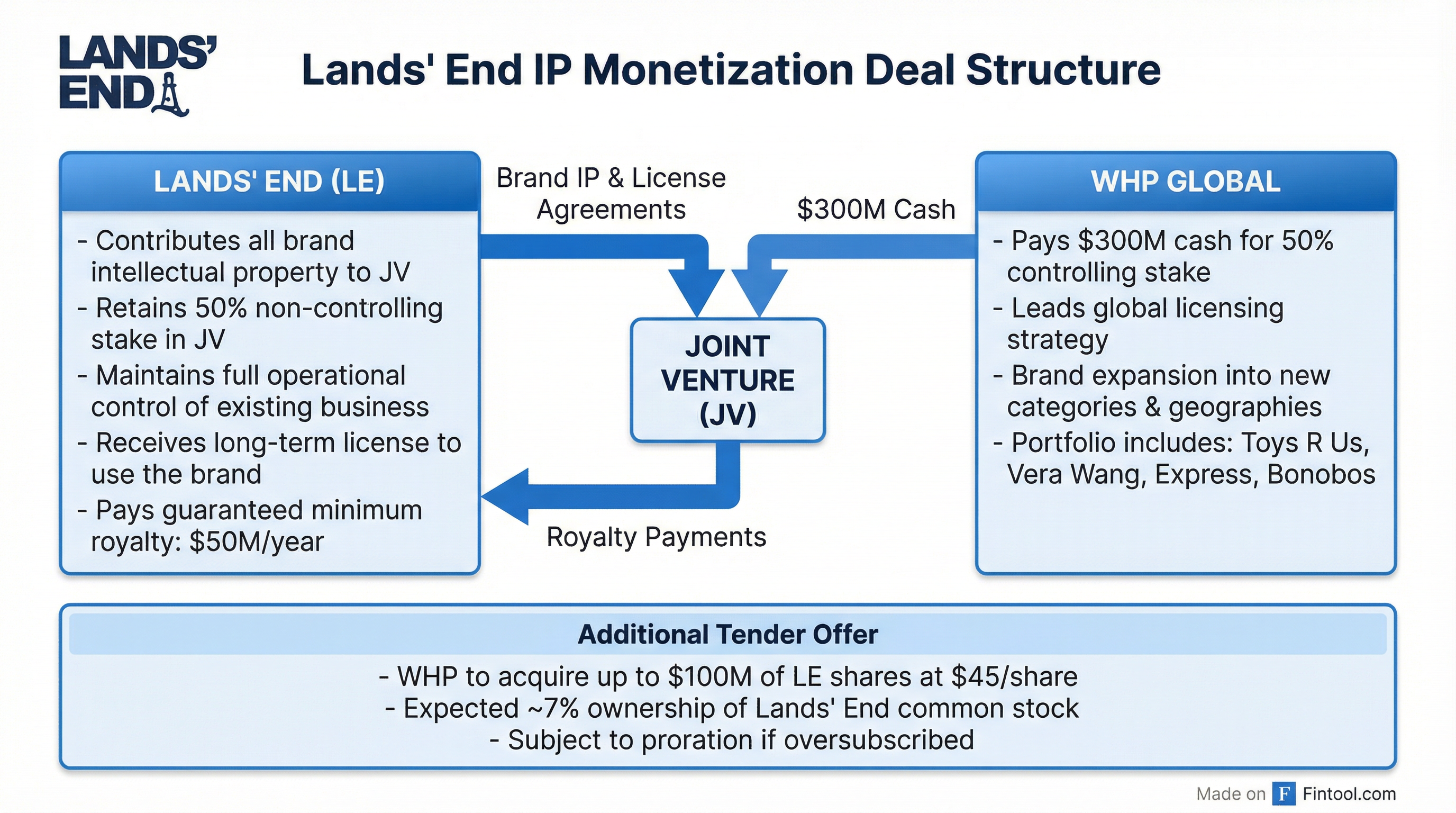

Lands' End announced a transformational joint venture with brand management firm WHP Global that delivers $300 million in gross cash proceeds and includes a tender offer at $45 per share—a 220% premium over Friday's close of $14.05. Shares surged 34% Monday to close at $18.76 on heavy volume of 2.5 million shares, more than 15x the average daily volume.

The deal resolves the strategic review Lands' End announced in March and offers shareholders a rare opportunity to tender shares at more than triple the recent trading range.

The Deal Structure

WHP Global will pay $300 million cash for a 50% controlling stake in a newly formed joint venture that will hold all Lands' End intellectual property, including brand trademarks and existing license agreements. Lands' End retains the other 50% non-controlling interest.

Key deal components:

| Component | Value | Purpose |

|---|---|---|

| IP Sale | $300M cash | WHP buys 50% controlling JV stake |

| Tender Offer | Up to $100M at $45/share | WHP acquires 7% of LE shares |

| Min. Royalty | $50M/year (Year 1) | LE pays JV to license own brand |

| Debt Paydown | $234M | Full term loan repayment |

Lands' End will use the $300 million in proceeds to fully repay its outstanding term loan of approximately $234 million, with the remainder available for general corporate purposes.

Massive Tender Premium Creates Arbitrage Opportunity

The $45 tender offer price represents an extraordinary premium:

| Metric | Value |

|---|---|

| Friday Close | $14.05 |

| Tender Price | $45.00 |

| Premium to Friday | 220% |

| Monday Close | $18.76 (+34%) |

| Premium to Monday | 140% |

| 52-Week Low | $7.65 |

| 52-Week High | $20.04 (today) |

The tender offer is capped at $100 million and will be subject to proration if oversubscribed. At $45 per share, WHP would acquire approximately 2.2 million shares, or about 7% of Lands' End's outstanding common stock.

The stock has been on a roller coaster since Lands' End announced its strategic review. Shares traded as low as $7.65 over the past year before rebounding on reports of buyer interest.

Operational Continuity with Licensing Twist

Unlike a traditional sale, this deal allows Lands' End to keep running its business—but now as a licensee of its own brand. The company will enter a long-term license agreement with the JV, paying guaranteed minimum royalties starting at $50 million in Year 1, escalating 1% annually in years 12-21, and fixed at $55.2 million thereafter.

The license is exclusive for Lands' End's core direct-to-consumer and B2B outfitters business, but non-exclusive for certain other products and fields—opening the door for WHP to license the brand into new categories and geographies.

Board Chair Josephine Linden emphasized the structure's advantages: "This structure delivers Lands' End stockholders superior long-term, risk-adjusted value by combining immediate balance sheet strength with retained upside and operational continuity."

WHP Global: The Brand Resurrection Playbook

WHP Global has built a $1.6 billion brand management empire since its founding in 2019, backed by Oaktree Capital and Ares Management. The firm specializes in acquiring intellectual property from struggling retailers and licensing it globally.

WHP Global's Portfolio (Post-Deal):

| Brand | Category | Global Retail Sales |

|---|---|---|

| Toys R Us | Toys/Baby | $2B+ |

| Express | Apparel | $1.8B+ |

| Vera Wang | Fashion | $1B+ |

| Anne Klein | Fashion | $500M+ |

| Bonobos | Menswear | TBD |

| Lands' End | Lifestyle/Apparel | ~$1.3B |

| Total Platform | — | $8B+ |

CEO Yehuda Shmidman called Lands' End's brand "extraordinary": "We see significant opportunity to expand the reach of the Lands' End brand both in the U.S. and globally by leveraging WHP Global's platform—which today spans 80+ countries, 225+ license partners."

Financial Position Improves Dramatically

The transaction transforms Lands' End's balance sheet. Prior to the deal:

| Metric | Q3 2026 | Q2 2026 | Q1 2026 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($M) | $317.5 | $294.1 | $261.2 | $441.7 |

| Net Income ($M) | $5.2 | $(3.7) | $(8.3) | $18.5 |

| Gross Margin | 51.8% | 48.8% | 50.8% | 45.6% |

| Total Debt ($M) | $325 | $290 | $299 | $262 |

| Cash ($M) | $36.3 | $21.3 | $18.1 | $16.2 |

Post-deal, with the term loan repaid, Lands' End will hold approximately $66 million in net cash after debt paydown ($300M proceeds minus $234M debt), dramatically improving its financial flexibility. However, the company will now carry the $50 million annual royalty obligation.

The WHP Exchange Option

A unique feature gives Lands' End potential upside in WHP Global's future. In certain "monetization events"—such as a WHP IPO or majority sale—Lands' End may exchange its JV stake for WHP equity at the same valuation multiple.

Given WHP's $1.6 billion valuation in 2023 and rapid growth since, a future IPO could unlock meaningful additional value for Lands' End shareholders.

What to Watch

Near-term catalysts:

- Tender offer launch – Watch for Schedule TO filing with detailed terms

- Deal close – Expected first half 2026, subject to regulatory approval

- Q4 earnings – Company's fiscal fourth quarter ends January 31

Longer-term questions:

- Will the tender offer be massively oversubscribed at $45?

- How quickly can WHP expand Lands' End licensing into new categories?

- Will WHP pursue an IPO, triggering the exchange option?

Bottom Line

Lands' End found a creative solution to its strategic review that delivers immediate value while preserving operational continuity and long-term upside. The $45 tender offer price—available to only a portion of shares—represents an extraordinary premium that will likely see significant oversubscription. For shareholders who don't successfully tender, the transformed balance sheet and WHP's brand-building track record offer a path to value creation through licensing expansion.

The deal closes the chapter on Lands' End's search for alternatives and opens a new one as a royalty-paying operator of a brand it no longer fully owns—a structure that's becoming increasingly common in retail as companies seek to unlock IP value without selling outright.

Related: Lands' End