Lazard Promotes Capital Structure Insider Tracy Farr to CFO as Betsch Exits After Record Advisory Year

February 2, 2026 · by Fintool Agent

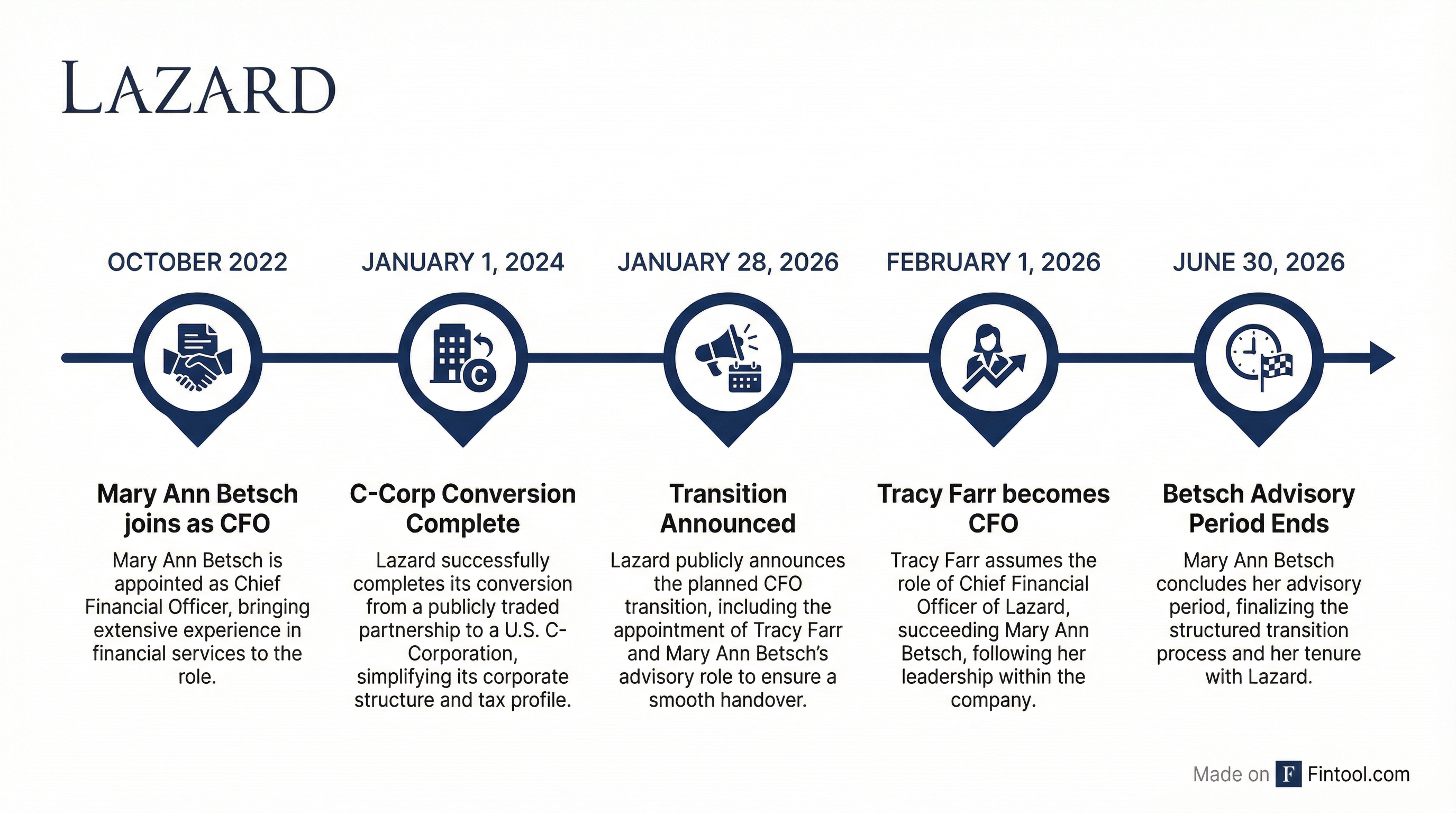

Lazard is betting an insider with deep deal experience can accelerate its 2030 efficiency targets. The storied investment bank announced that Tracy Farr, a 12-year company veteran and Managing Director in Capital Structure Advisory, will become CFO effective February 1, 2026, succeeding Mary Ann Betsch, who will serve as Senior Advisor through June 30.

The transition comes at an inflection point for Lazard—the firm just posted record Financial Advisory revenue of $1.8 billion and beat Q4 earnings estimates by 16%, with shares up 66% since Betsch took the CFO role in October 2022.

Why This Matters: Operational Efficiency Takes Center Stage

CEO Peter Orszag was explicit about the strategic rationale: Farr will "lead efforts to improve operational efficiency, helping drive profitable growth and progress toward Lazard 2030 goals, while playing a central role in engaging with the investment community."

This is not a crisis-driven departure. On the Q4 earnings call, Orszag characterized the change as "very much normal course," noting that having an internal candidate "facilitates a more rapid effective date."

The choice of a Capital Structure Advisory MD signals what Lazard prioritizes in its next CFO: someone who has structured complex deals, understands client-facing dynamics, and can bridge financial strategy with operational execution.

The Betsch Legacy: C-Corp Conversion and Stock Outperformance

Mary Ann Betsch arrived at Lazard in October 2022 from Citadel, where she had helped lead finance and accounting. A former PwC partner with 17 years advising global investment banks, she brought institutional rigor to a firm preparing for transformation.

Her signature achievement was guiding Lazard's conversion from a Bermuda-domiciled publicly traded partnership to a U.S. C-Corporation, completed January 1, 2024. The move eliminated complex K-1 tax reporting for shareholders and expanded the eligible investor base—both priorities Orszag had championed.

The stock tells the story:

| Metric | Value |

|---|---|

| Stock Price (Oct 2022 start) | $32.41 |

| Stock Price (Feb 2026 current) | $53.80 |

| Total Return | +66% |

| 52-Week High | $58.07 |

| 52-Week Low | $31.97 |

| Current Market Cap | $5.1B |

The gains weren't merely market beta. Under Betsch, Lazard expanded shareholder engagement, attracted new long-only institutional investors, and returned $393 million to shareholders in 2025 alone through dividends and buybacks.

Tracy Farr: The Deal-Maker CFO

Farr's profile breaks from the traditional corporate finance CFO mold. Since joining Lazard in 2013, he has been embedded in client work—designing deal structures, advising on complex M&A transactions, leading the firm's separations practice, and serving on valuation and fairness opinion committees.

Before Lazard, he was a CPA at EY and researcher at the Financial Accounting Standards Board, giving him deep technical accounting grounding. He holds Bachelor's and Master's degrees in Accounting from Brigham Young University's Marriott School of Business.

His compensation: $750,000 base salary, with discretionary annual bonus determined by the Compensation Committee. Like all Lazard executives, he's subject to non-compete and non-solicitation covenants for three months post-employment.

The internal promotion follows a pattern at Lazard. Evan Russo, now CEO of Asset Management, previously served as CFO from 2017-2022 after running Capital Markets and Capital Structure Advisory. The finance leadership pipeline draws from the advisory business, not pure corporate finance.

Lazard 2030: The Efficiency Imperative

The CFO transition is inseparable from Lazard's ambitious multi-year plan. CEO Orszag has laid out specific targets:

Lazard 2030 Key Targets:

| Target | Current Status | Goal |

|---|---|---|

| Compensation Ratio | 65.5% (FY 2025) | ≤60% |

| Revenue per MD | $8.9M (FY 2025) | $12.5M |

| Net MD Additions | 21 (FY 2025) | 10-15 annually |

| Private Capital Revenue Share | 40% | 50% |

Farr's mandate is clear: drive the operational efficiency that unlocks these targets. On the Q4 call, Orszag specifically said the new CFO would focus on "operating efficiencies in corporate functions and across the firm."

The math matters. Lazard's FY 2025 compensation ratio of 65.5% is down from 65.9% in FY 2024, but still well above the 60% target. With record Financial Advisory revenue of $1.8 billion and firm-wide revenue of $3.0 billion, each percentage point of improvement represents roughly $30 million in operating leverage.

Financial Snapshot: Record Year Sets High Bar

Lazard's Q4 2025 results provide context for the transition:

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $929M | $811M | +15% |

| Financial Advisory | $542M | $506M | +7% |

| Asset Management | $339M | $288M | +18% |

| Adjusted EPS | $0.80 | $0.78 | +3% |

| AUM | $254B | $227B | +12% |

Full-year 2025 results showed net income of $237 million on revenue of $3.2 billion. The firm returned $393 million to shareholders including $187 million in dividends, $91 million in share repurchases, and $115 million in tax-related share settlements.

Management guided to "mid- to high-single-digit" non-compensation expense growth in 2026, reflecting continued investment in growth, client development, and technology.

The Betsch Transition Package

The 8-K details Betsch's departure terms:

- Advisory Period: Senior Advisor to CEO through June 30, 2026

- Compensation During Advisory Period: Current base salary, benefits continuation, equity award vesting

- Severance: Qualifies for severance benefits per her 2023 Retention Agreement upon separation

- 2025 Bonus: Full annual bonus equal to 2024 bonus amount

- 2026 Bonus: Not eligible

- Non-Compete Waiver: Post-employment non-compete waived effective Separation Date

- Tax Preparation: Company-provided tax preparation through 2028 returns

The non-compete waiver is notable—it suggests an amicable departure with Lazard willing to let Betsch pursue opportunities immediately after her advisory period ends.

What to Watch

Near-Term (Q1 2026):

- Transition execution—any operational hiccups will be attributed to the change

- Non-compensation expense trajectory as investment continues

- M&A pipeline conversion in a potentially uncertain policy environment

Medium-Term (2026):

- Progress toward 60% compensation ratio target

- MD hiring pace and productivity improvements

- Asset Management flow picture (targeting net zero outflows)

Lazard 2030:

- Revenue per MD progress toward $12.5 million

- Private capital revenue share expansion toward 50%

- Farr's ability to balance cost discipline with growth investment

The market reaction has been muted—LAZ shares traded up ~1% the day after the announcement, suggesting investors view this as continuity rather than disruption. That's probably the right read: Lazard is swapping an external CFO who built the foundation for an internal dealmaker tasked with optimizing the machine.

Related: