LGL Group Taps Former Navy SEAL Jason Lamb as CEO in Defense-Focused Pivot

January 7, 2026 · by Fintool Agent

The LGL Group (NYSE American: LGL) is installing a former Navy SEAL officer with deep defense technology expertise as its new Chief Executive Officer, a move that signals the $32 million micro-cap holding company's pivot toward national security opportunities at a time of accelerating defense spending.

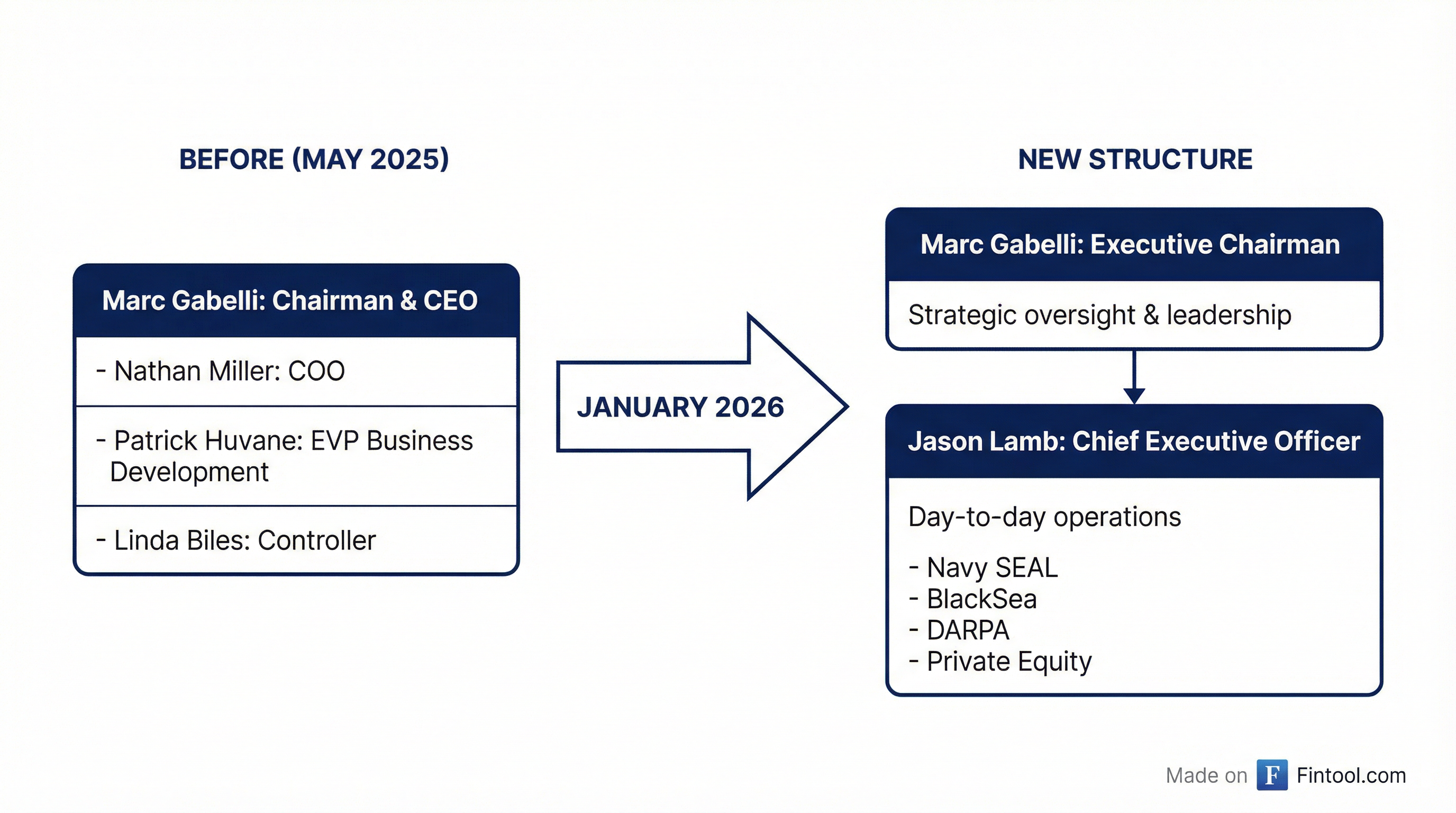

Jason Lamb, who brings 20+ years of leadership across special operations, intelligence, and private equity investing, assumed the CEO role on January 5, 2026. Marc Gabelli, who has served as CEO since May 2025, transitions to Executive Chairman, maintaining strategic oversight while ceding day-to-day operations.

The leadership change coincides with the completion of a warrant exercise that generated approximately $5 million in proceeds and expanded shares outstanding by nearly 18% to 6.4 million shares—providing fresh capital for the company's growth initiatives.

A Strategic Bet on Defense Tech

Lamb's appointment represents a calculated bet by the Gabelli-controlled holding company on the defense sector's growth trajectory. In his first public statement as CEO, Lamb signaled aggressive ambitions:

"This is an unprecedented period of growth in national defense, with small, entrepreneurial new entrants positioned to take share and redefine the historical market. Our strength in radio frequency designs sets the foundation for opportunities to come."

The statement positions LGL's Precise Time and Frequency (PTF) subsidiary—a manufacturer of precision electronic instruments and frequency control products—as a potential beneficiary of increased defense procurement.

From SEAL Team to C-Suite

Lamb's trajectory from special operations to corporate leadership follows an increasingly common path in defense technology:

| Experience | Role/Achievement |

|---|---|

| Navy SEAL Officer | 20+ years special operations and intelligence |

| Hard Yards (Founder) | Defense consulting firm advising DARPA, USSOCOM, Army Futures Command |

| BlackSea Technologies | Chief Strategy Officer following Hard Yards acquisition |

| LGL Systems Acquisition | Special advisor to Gabelli-led defense SPAC |

| Teton Advisors | Current board member |

His academic credentials are equally extensive: MBA from UVA Darden, MS in Information Technology Management from UVA, MA in National Security and Strategic Studies from Naval War College, and BS from the U.S. Naval Academy.

Lamb's connection to LGL predates this appointment—he served as a special advisor to LGL Systems Acquisition Corporation, a Gabelli-led SPAC that merged with IronNet Cybersecurity in 2021. That network connection facilitated his path to the CEO role.

The Gabelli Factor

Marc Gabelli remains the dominant force at LGL Group. As Executive Chairman, he retains his board seat and strategic oversight role while his family's aggregate stake exceeds 50% of shares outstanding.

The transition represents Gabelli's third leadership structure adjustment at LGL in under two years:

- April 2025: Timothy Foufas resigned as Co-CEO

- May 2025: Marc Gabelli assumed sole CEO role

- January 2026: Jason Lamb becomes CEO, Gabelli to Executive Chairman

This pattern suggests a deliberate search for operational leadership while maintaining family control—a structure common in Gabelli-controlled entities.

Financial Snapshot

LGL Group operates two segments: Electronic Instruments (PTF) and Merchant Investment (Lynch Capital International). The company's recent financial performance has been modest but stable:

| Metric | Q3 2025 | Q3 2024 | Change |

|---|---|---|---|

| Total Revenue | $1.11M | $1.18M | -5.9% |

| Net Sales (Electronic Instruments) | $661K | $650K | +1.7% |

| Net Investment Income | $442K | $531K | -16.8% |

| Net Income | $772K | $72K | +972%* |

| EPS (Diluted) | $0.14 | $0.01 | +1,300%* |

*Net income spike driven by tax benefit from reversed uncertain tax position

The company holds $41.6 million in cash and equivalents against minimal debt, providing significant financial flexibility relative to its market cap.

Order backlog has improved substantially, rising 131% from $336K at year-end 2024 to $776K as of September 30, 2025.

Stock Performance

LGL shares have been on a downward trajectory since peaking at $9.74 in June 2025, declining approximately 40% to current levels around $5.70. The stock is down 7.5% year-to-date.

Trading volume remains extremely thin—averaging under 10,000 shares daily—making the stock illiquid and subject to significant price swings on minimal trading activity.

What This Means for Investors

Bull Case: Lamb's defense connections and operational expertise could unlock government contracts and strategic partnerships that transform LGL's Electronic Instruments business. The ~$5M warrant proceeds and strong cash position provide runway for growth initiatives. Rising defense budgets create a favorable macro backdrop.

Bear Case: At $32M market cap with under 10,000 daily volume, LGL remains a highly illiquid micro-cap. The company's core manufacturing business generates only ~$2M annual revenue. Success depends on executing a strategy shift that has yet to be articulated in detail.

Watch For: Concrete announcements on defense contracts, potential acquisitions using the newly raised capital, and any disclosure of compensation arrangements for the new CEO (not yet finalized per the 8-K).

Related: LGL Group Company Profile