LVMH Exits Hong Kong Travel Retail, Sells DFS to China's State-Owned Giant for $395M

January 19, 2026 · by Fintool Agent

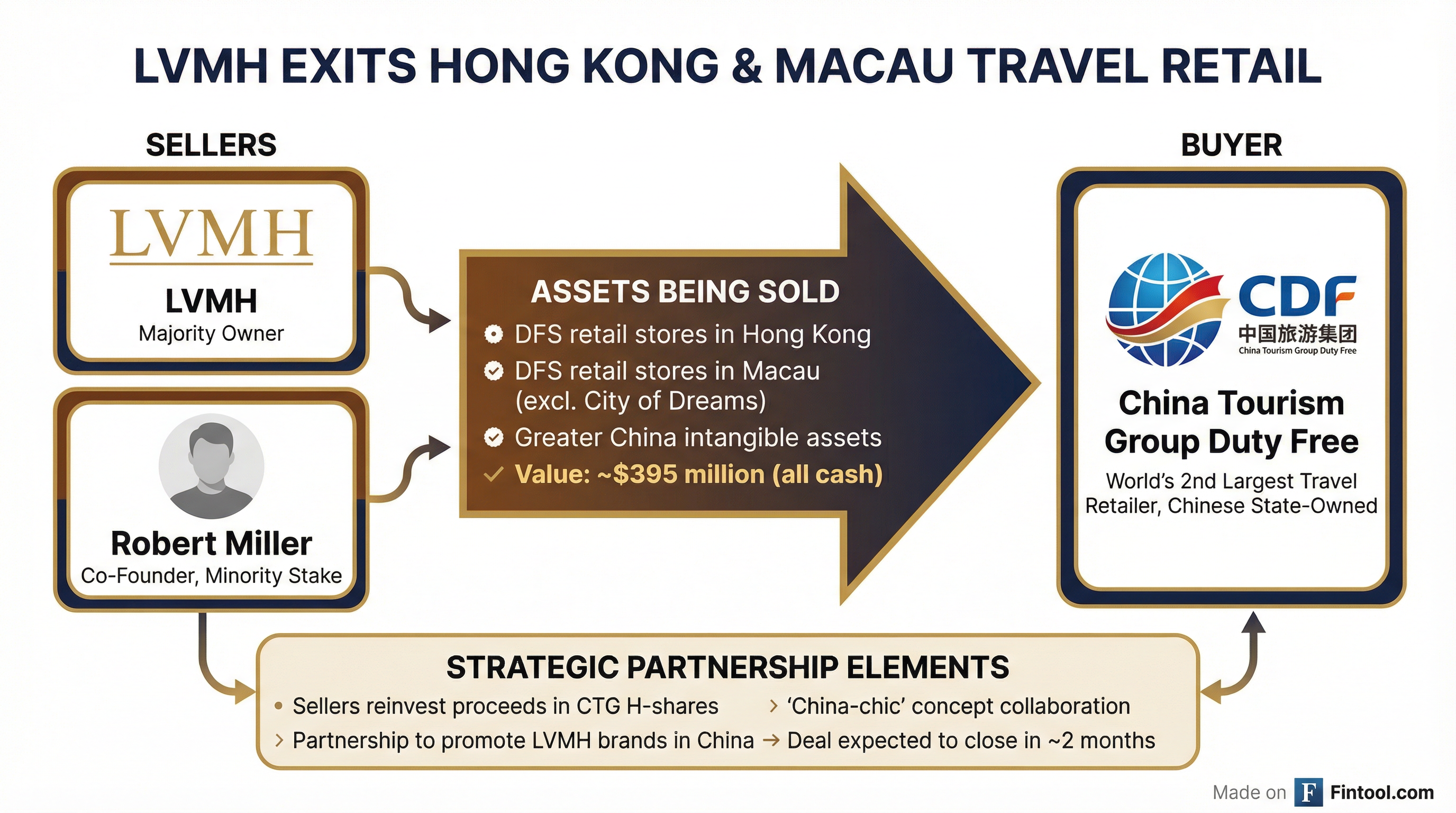

LVMH Moët Hennessy Louis Vuitton-0.37%, the world's largest luxury group, is selling its iconic DFS travel retail operations in Hong Kong and Macau to China Tourism Group Duty Free (CTG) for approximately $395 million—marking the end of a three-decade chapter that once made DFS synonymous with Asian luxury shopping.

The sale price represents a fraction of the roughly $2.5 billion LVMH paid to acquire a majority stake in DFS back in 1996 , underscoring just how thoroughly the Hong Kong travel retail landscape has transformed since the 2019 protests and COVID-19 pandemic.

The Deal Structure

Under the definitive agreement announced Monday, CTG Duty Free will acquire DFS's retail stores in Hong Kong and Macau (excluding the City of Dreams location in Macau), along with intangible assets across Greater China.

The sellers include both LVMH and Robert Miller, the DFS co-founder who retained a significant minority stake when LVMH purchased the company nearly 30 years ago.

The transaction is structured as an all-cash deal, though both sellers will reinvest a portion of the proceeds into a capital increase at CTG Duty Free through H-shares (mainland Chinese company shares listed in Hong Kong).

A memorandum of understanding also establishes a strategic partnership to promote LVMH brands and the "China-chic" concept internationally—a signal that while LVMH is exiting travel retail operations, it intends to maintain brand presence through its new state-owned partner.

"This transaction underscores our confidence in the long-term potential of the Chinese market," said Michael Schriver, President of LVMH for North Asia.

The deal is expected to close within approximately two months.

A State-Owned Giant Takes Over

The buyer, China Tourism Group Duty Free-0.13%, is China's largest travel retailer and the world's second-largest by revenue, generating CNY 56.5 billion ($7.8 billion) in 2024. The company is approximately 50.3% owned by China Tourism Group, a state-owned enterprise that reports directly to China's State-owned Assets Supervision and Administration Commission.

CTG operates nearly 200 stores spanning over 30 provinces in China, with a dominant position in Hainan island's lucrative offshore duty-free market. The acquisition of DFS's iconic Hong Kong and Macau locations gives CTG prime real estate in markets where it previously had limited presence.

The deal represents a broader shift in Asian travel retail—from Western luxury operators to Chinese state-backed giants—as Beijing encourages domestic consumption and keeps more luxury spending within China's economic orbit.

Years of Struggle Led to This Moment

DFS's troubles began long before this sale was announced. The 2019 Hong Kong protests dealt the first blow, with LVMH reporting a 40% drop in Hong Kong sales in August and September of that year.

Then came COVID-19, which devastated global travel retail for years. Even as international travel recovered, DFS's business activity remained stubbornly below pre-pandemic 2019 levels, LVMH repeatedly acknowledged in earnings reports.

By 2024, leadership turnover signaled deeper trouble. CEO Benjamin Vuchot stepped down "to pursue other professional interests," with Ed Brennan—who had led DFS before the pandemic—returning to helm the struggling retailer.

Throughout 2025, DFS accelerated store closures:

- Venice: The T Galleria at the historic Fondaco dei Tedeschi closed

- Australia/New Zealand: Complete exit from Oceania, shuttering Sydney, Auckland, and Queenstown stores

- Saipan: Operations wound down

LVMH explicitly stated its strategy was to "streamline DFS operations and maintain tight control over resource allocation" in response to challenging conditions.

While Q3 2025 showed "improved trends" with better traffic in Hong Kong, Macau, and the Okinawa Galleria in Japan, the overall trajectory was clear—DFS would never return to its former glory, and Greater China had become more trouble than it was worth.

Market Reaction

LVMH shares fell nearly 4.8% in Paris trading Monday, though the decline was largely attributed to broader concerns about Trump administration tariff threats against Europe over the Greenland dispute rather than the DFS sale specifically.

For a company of LVMH's scale—with roughly €80 billion in annual revenue—the $395 million sale is financially immaterial. The significance is strategic: LVMH is acknowledging that operating travel retail stores in Greater China no longer fits its business model.

Sephora, the other major component of LVMH's Selective Retailing division, continues to drive growth with double-digit sales increases in many markets, making the DFS underperformance even more stark by comparison.

What Remains of DFS

The sale doesn't mean DFS Group disappears entirely. The company retains operations in:

- Japan: Including the strong-performing Okinawa Galleria

- Hawaii: A core legacy market

- Airports worldwide: Various airport locations continue operations

But the Greater China exit removes what was once DFS's crown jewel—the Hong Kong and Macau stores that built the company's reputation as Asia's premier luxury destination retailer.

The Broader Signal

This transaction marks more than just a real estate deal. It represents the culmination of forces that have reshaped luxury retail in Asia:

Chinese consumer behavior has shifted. Mainland Chinese shoppers once flocked to Hong Kong for tax-free luxury goods. Now, Hainan's duty-free shopping draws that traffic domestically, while Shanghai and Beijing offer comparable luxury experiences.

State capital is ascendant. CTG's state backing gives it advantages in a market increasingly shaped by Chinese government priorities. A Western operator like LVMH faces structural disadvantages it simply didn't face in 1996.

Travel retail economics have changed. The pandemic accelerated shifts in how and where consumers shop for luxury goods, with e-commerce and domestic retail gaining share at the expense of travel retail.

For LVMH, the strategic partnership component of the deal—promoting its brands through CTG—may prove more valuable than operating stores directly ever could in the current environment.

Related: LVMH-0.37% · China Tourism Group Duty Free-0.13%