Marvell Closes $3.25 Billion Celestial AI Acquisition, Positioning for Optical Interconnect Dominance

February 2, 2026 · by Fintool Agent

Marvell Technology completed its $3.25 billion acquisition of Celestial AI today, gaining breakthrough photonic fabric technology that could reshape how AI data centers connect processors, memory, and switches. The deal, first announced in December 2025, positions Marvell as the industry's most comprehensive provider of AI connectivity solutions—from custom silicon to optical interconnects.

Shares of Marvell traded down 3% to $78.92 amid broader market weakness, though the company's shares remain up significantly from sub-$50 levels seen in early 2025.

The Strategic Rationale: Why Optics Now

AI infrastructure is approaching a critical inflection point. Next-generation accelerated systems are evolving from single-rack configurations into multi-rack scale-up fabrics connecting hundreds of XPUs with high-bandwidth, ultra-low-latency connections. Copper-based interconnects—the workhorses of today's data centers—are hitting fundamental limits in reach and bandwidth.

"As bandwidth and reach continue to increase, every connection point in the data center must move from copper to optical," Marvell stated in its filing. "For rack-to-rack scale-out and data-center to data-center connections this transition has already taken place. The next inflection point is within the rack, within the system, and even within a package."

Celestial AI's Photonic Fabric technology was purpose-built for this transition. Its first-generation product delivers an unprecedented 16 terabits per second of bandwidth in a single chiplet—10x the capacity of today's state-of-the-art 1.6T ports used in scale-out applications. The technology also delivers more than 2x the power efficiency of copper interconnects.

Deal Structure: Cash, Stock, and Performance Incentives

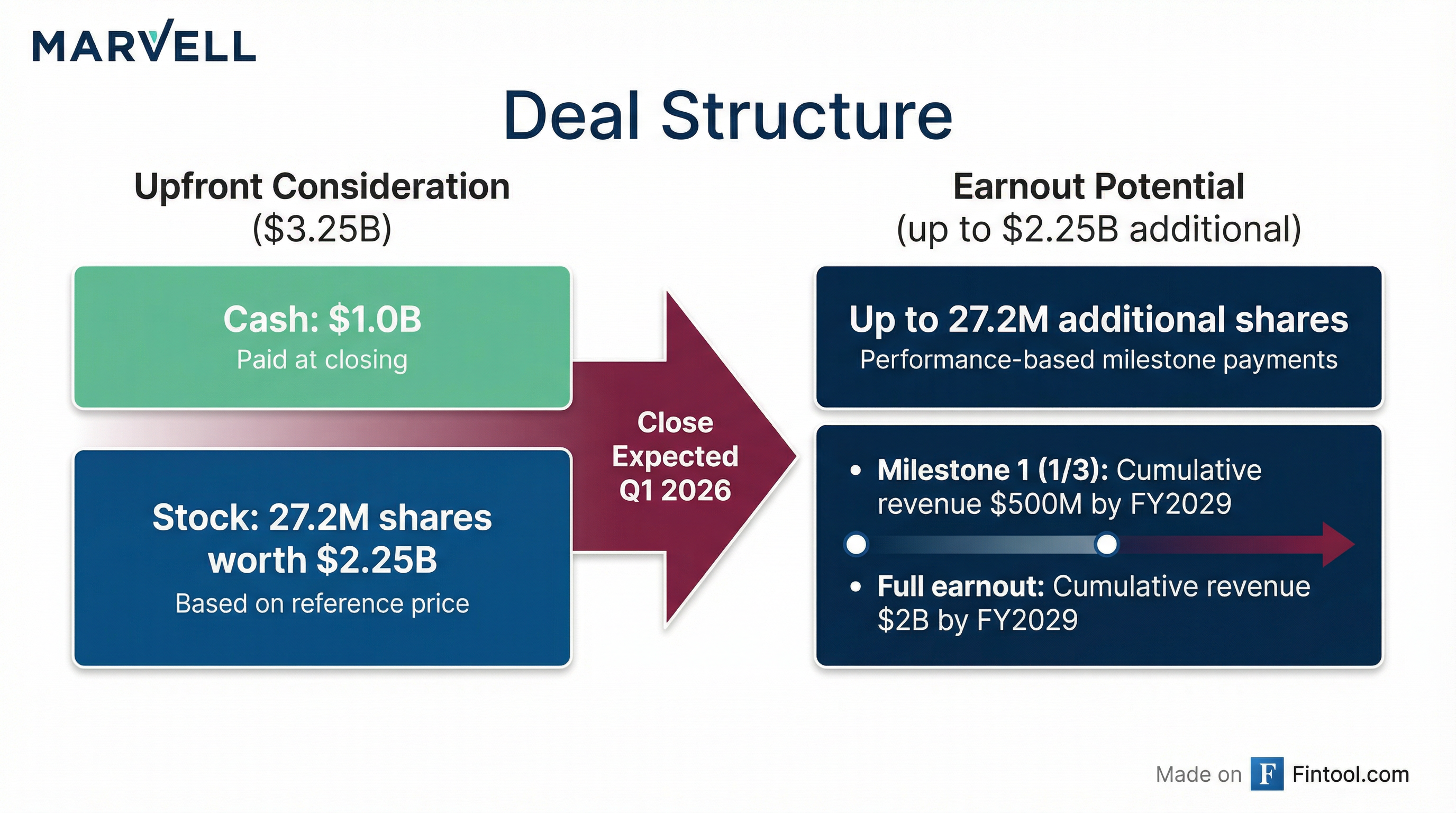

The acquisition structure aligns both parties around aggressive growth targets:

| Component | Value | Details |

|---|---|---|

| Cash | $1.0 billion | Paid at closing |

| Stock (Upfront) | Based on 10-day VWAP prior to signing | |

| Total Upfront | ~$3.25 billion | |

| Earnout (Milestone 1) | 9.1M shares | Triggered at $500M cumulative revenue by FY2029 |

| Earnout (Full) | Up to 27.2M shares | Triggered at $2.0B cumulative revenue by FY2029 |

| Maximum Total | ~$5.5 billion | If all milestones achieved |

Marvell is funding the acquisition through stock and cash on hand, with no additional debt required. The company ended its most recent quarter with $2.7 billion in cash and equivalents.

Financial Outlook: From Zero to $1 Billion

Marvell provided unusually specific revenue guidance for Celestial AI during its Q3 2026 earnings call in December:

| Period | Revenue Milestone |

|---|---|

| H2 FY2028 | Meaningful revenue begins |

| Q4 FY2028 | $500M annualized run rate |

| Q4 FY2029 | $1B annualized run rate |

CFO Willem Meintjes noted that Celestial AI will add approximately $50 million in annual operating expenses post-closing. The acquisition is expected to become accretive to non-GAAP earnings once meaningful revenue begins in H2 FY2028.

"We see even greater potential for Celestial AI's photonic fabric to transform the scale-up interconnect market" than Marvell's previous transformative acquisition of Inphi, CEO Matt Murphy said on the earnings call.

AWS Endorsement and Warrant Extension

The deal carries a powerful endorsement from Amazon Web Services. AWS VP Dave Brown stated: "At AWS, we aim to be at the forefront of major technology inflections, and we believe optical interconnects will play an important role in the future of AI infrastructure. Celestial AI has made impressive progress, and we expect their combination with a large-scale semiconductor company like Marvell will help further accelerate optical scale-up innovation for next-generation AI deployments."

Notably, Marvell filed a separate 8-K revealing a warrant granted to Amazon, extending the companies' existing strategic relationship to include photonic fabric products. This follows a warrant agreement announced just one year ago covering AI custom products and networking products.

"Think of this as just adding another swim lane of photonic fabric products to the mix," Murphy explained. "All in, the potential of each of these is quite significant."

The Technology Edge: Thermal Stability

Celestial AI's competitive moat extends beyond raw bandwidth. A key differentiator is thermal stability, enabling the technology to operate reliably in extreme thermal environments created by multi-kilowatt XPUs and switches.

This allows the photonics to be co-packaged vertically with high-power chips in a 3D package—making photonic connections directly into the XPU rather than from the die edge. The approach frees up valuable "die edge beachfront" that can be repurposed to increase HBM capacity within XPU packages.

"Celestial AI's approach results in a more compact and integrated solution, while freeing up highly valuable die edge beachfront, which can be repurposed to significantly increase the amount of HBM within the XPU package," the company explained.

TAM Expansion: A $10+ Billion Opportunity

The acquisition opens a substantial new addressable market for Marvell. Industry analysts forecast the merchant portion of the scale-up switch market to approach $6 billion in revenue by 2030. For interconnects, Marvell sees dollar content of similar magnitude—and because optical interconnects attach to both the XPU and the switch, the opportunity effectively doubles.

"Industry analysts are forecasting the merchant portion of the scale-up switch market to approach $6 billion in revenue in 2030. On the interconnect side, we are seeing the dollar content for optics of the same magnitude as a scale-up switch. As the optical interconnect attaches to both the XPU and the switch, the opportunity actually doubles, meaning over $10 billion," Murphy said.

Integration Playbook: Following the Inphi Blueprint

Marvell has a strong track record of successful semiconductor acquisitions. Since 2019, the company has divested its Wi-Fi business and acquired Avera, Aquantia, Inphi, and Innovium—each of which Murphy called "an absolute home run."

The company plans to apply the same integration blueprint to Celestial AI:

- Celestial AI's CEO, founders, and key executives will assume leadership roles at Marvell

- The technology teams will combine with Marvell's existing silicon photonics organization (which came from Inphi and pioneered 400G/800G ZR technology)

- Celestial AI will be part of Marvell's Data Center Group, strengthening end-to-end connectivity capabilities

What's Next: The Path to Production

Celestial AI has already secured a design win with a major hyperscaler for next-generation scale-up architecture. The photonic fabric chiplets will be co-packaged with both custom XPUs and scale-up switches.

"This is expected to be the industry's first large-scale commercial deployment of optical interconnects for scale-up connectivity," Marvell stated.

Beyond scale-up networks, the photonic fabric platform enables additional applications over time, including pooled memory appliances and optical replacements for traditional electrical die-to-die connections in multi-die packages.

The Bottom Line

Marvell's acquisition of Celestial AI marks a pivotal moment in AI infrastructure evolution. As data centers transition from copper to optical connectivity at every level—from package to rack to data center—Marvell is positioning itself as the one-stop shop for next-generation AI connectivity.

The aggressive earnout structure and AWS warrant extension suggest both parties see substantial upside. If Celestial AI hits its $1 billion revenue target by FY2029, the deal will be remembered as another "home run" in Marvell's M&A playbook. If it exceeds $2 billion in cumulative revenue, Celestial AI's shareholders could receive up to $5.5 billion in total value.

For investors, the key question is whether optical interconnect adoption will accelerate as fast as Marvell projects. The technology advantages are clear; the execution risk lies in ramping manufacturing at scale while maintaining the thermal stability and power efficiency that make the technology compelling.

Related: