Mattel CEO Drops $1 Million on Stock Day After 28% Crash

February 17, 2026 · by Fintool Agent

Mattel CEO Ynon Kreiz put $1 million of his own money into the toy maker's battered stock on February 12—one day after shares suffered their sharpest single-day decline this century.

Kreiz purchased 65,000 shares at $15.53, bringing his direct ownership to 1.79 million shares. The open-market buy came as MAT traded near $15.85, down 28% from $21.54 just 48 hours earlier.

What Triggered the Crash

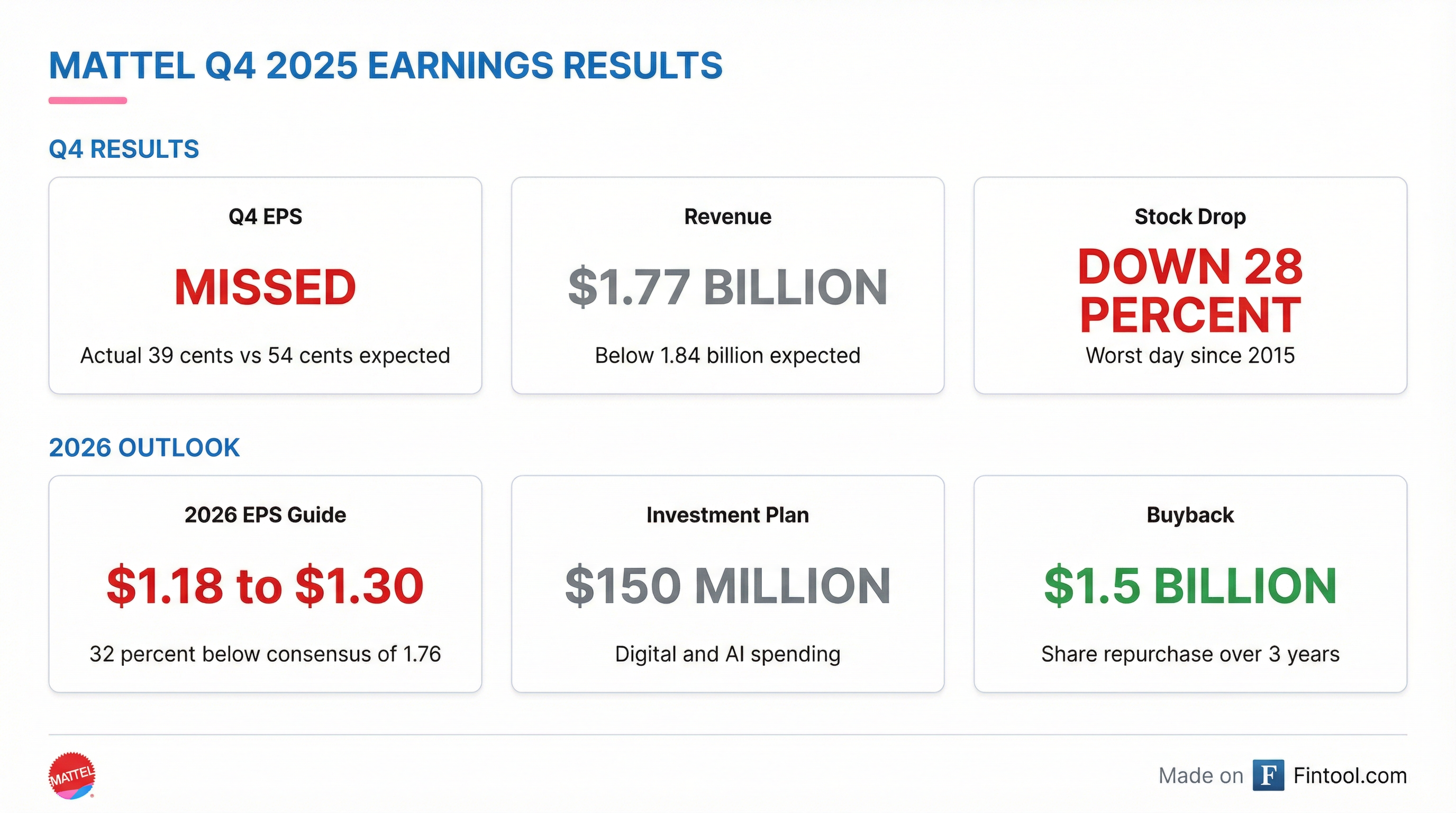

The carnage started after Mattel reported Q4 2025 results on February 10. The numbers disappointed across the board:

- Q4 EPS of $0.39 vs. $0.54 expected—a 14% miss

- Revenue of $1.77 billion vs. $1.84 billion expected

- 2026 EPS guidance of $1.18-$1.30 vs. $1.76 consensus—32% below Street expectations

Management attributed the miss to December U.S. sales coming in "less than anticipated" as retailers managed inventory more conservatively than expected.

But the real shock was the 2026 outlook. Mattel guided to lower year-over-year earnings despite expecting 3-6% revenue growth. The culprit: $150 million in strategic investments across digital games, AI, and data infrastructure.

The Signal in Kreiz's Buy

When a CEO buys shares with personal money immediately after a crash, it sends a clear message: management believes the market overreacted.

Kreiz has been through turnarounds before. Since taking over in 2018, he's transformed Mattel from a struggling toy maker into a multi-platform entertainment company. The Barbie movie grossed $1.4 billion, and the company has two more theatrical releases in 2026—Masters of the Universe in June and Matchbox in October.

On the earnings call, Kreiz framed the strategic investments as "highly accretive" moves that will "accelerate growth in top and bottom lines in 2027 and beyond." He noted the investments are "flexible" and "in line with our capital light strategy"—meaning they can be scaled up or down based on results.

The company also announced a new $1.5 billion share buyback program, extending its track record of returning capital. Mattel has already repurchased $1.2 billion in shares over the past three years, reducing share count by 18%.

The Bull Case

Mattel's core brands remain strong. Hot Wheels just posted its eighth consecutive record year. UNO achieved ten consecutive quarters of growth. The newly launched Mattel Brick Shop is gaining traction in building sets—a category long dominated by LEGO.

The $150 million investment includes acquiring full ownership of Mattel163, a mobile gaming studio with 20 million monthly active users and 550 million downloads. Management expects the acquisition to be "immediately accretive" both strategically and financially.

At current levels around $16.50, MAT trades at roughly 12-13x forward earnings guidance—cheap if management delivers on its 2027 promise of double-digit operating income growth.

The Bear Case

Barbie remains under pressure. The franchise declined for the full year after the movie bump faded, hurt by "softer overall category trends and headwinds from non-core segments such as Mini Barbieland." Management doesn't expect Barbie to return to growth until 2027.

The Fisher-Price segment continues to struggle, with infant, toddler, and preschool products down 18% for the year. Management acknowledged they're "actively assessing" the category's strategy.

And the near-term headwinds are real. Q1 2026 revenue is expected to decline low-single-digits due to continued shifts in retailer ordering patterns. Gross margins face pressure from inflation and promotional activity.

What to Watch

Masters of the Universe (June 5): Management described the film as "very toyetic" based on director's cut screenings. A strong box office could reignite momentum in action figures.

Digital games self-publishing: Two mobile game launches planned for 2026, with soft launch in the first half. Management said testing has been "very positive."

Q1 2026 earnings: Will December's weakness carry into the new year, or has the reset already happened?

The CEO just bet $1 million that this story has a better ending than the market expects. Whether he's right depends on whether Mattel can execute its entertainment pivot while managing a promotional retail environment and category-specific headwinds in its largest franchises.

Related: