McGrath RentCorp CEO Joe Hanna Retires After 9 Years, Hands Reins to COO Phil Hawkins

February 05, 2026 · by Fintool Agent

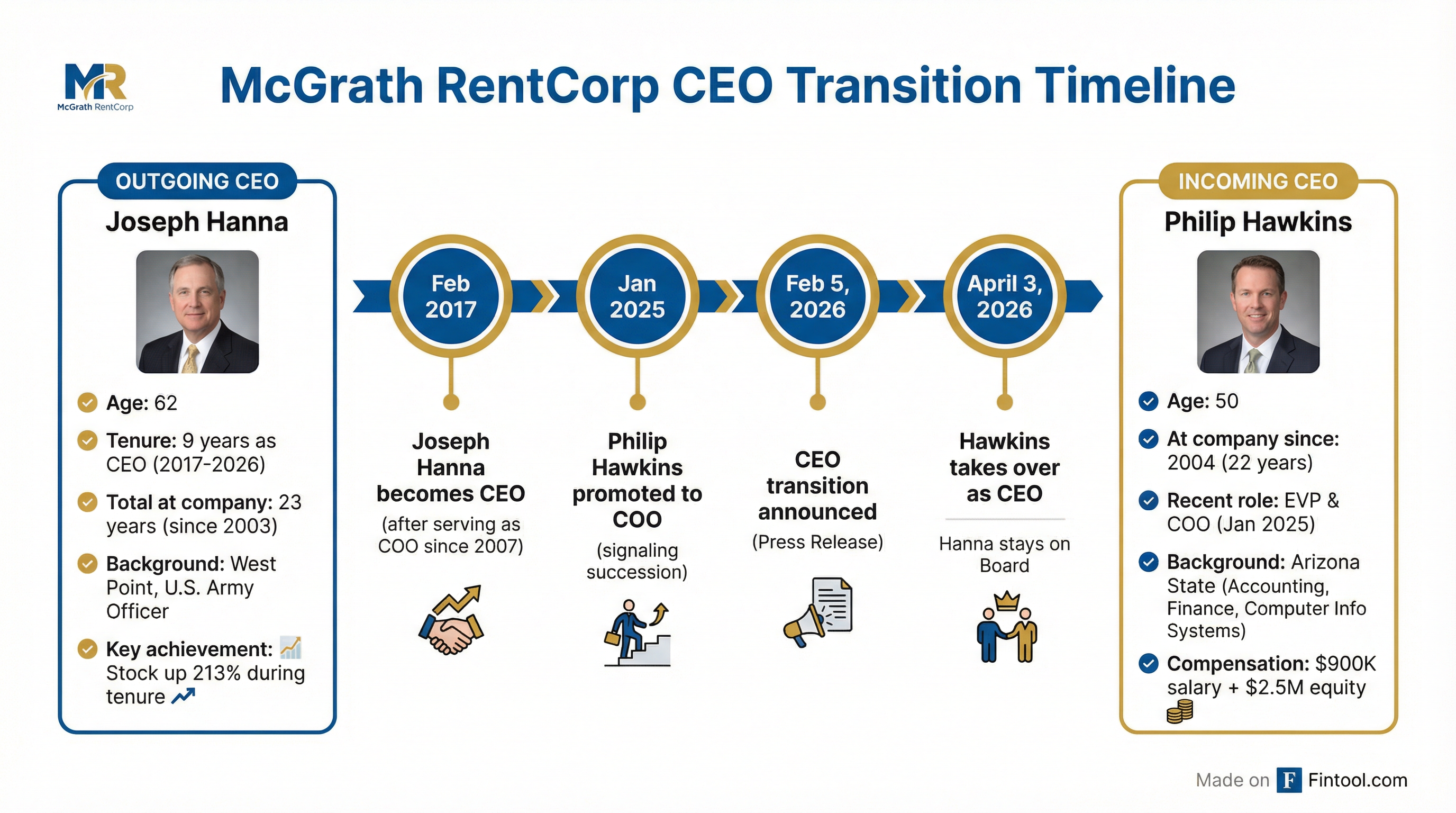

Mcgrath Rentcorp (NASDAQ: MGRC), the $2.9 billion modular building and equipment rental company, announced today that President and CEO Joseph F. Hanna will retire on April 3, 2026, handing leadership to 22-year company veteran Philip B. Hawkins .

The transition caps a nine-year run for Hanna that saw McGrath's stock nearly triple, revenue almost double, and the company survive a blocked $3.8 billion acquisition—walking away with a $180 million termination fee. Hanna will remain on the Board of Directors.

Shares slipped 0.5% to $120.20 on the news, a muted reaction reflecting what the Board characterized as a "natural progression" following a "thoughtful succession plan" .

The Transition Details

Hawkins, 50, currently serves as Executive Vice President and Chief Operating Officer—a role he was promoted to just 13 months ago in what now appears to have been clear succession planning .

| Detail | Joseph Hanna (Outgoing) | Philip Hawkins (Incoming) |

|---|---|---|

| Age | 62 | 50 |

| Years at McGrath | 23 (since 2003) | 22 (since 2004) |

| Previous Role | President & CEO (Feb 2017) | EVP & COO (Jan 2025) |

| Education | West Point (Electrical Engineering) | Arizona State (Accounting, Finance, CIS) |

| Background | U.S. Army Officer, SMC Corporation | Dell Financial Services, CIT Technologies |

Hawkins's compensation package as CEO includes :

- Base salary: $700,000

- Target bonus: 100% of salary (75% company metrics, 25% individual)

- Equity grant: $2.5 million (50% RSUs, 50% PSUs)

Hanna's Legacy: A Stock That Tripled

Joe Hanna took over as CEO in February 2017 after serving as COO since 2007. During his nine-year tenure:

| Metric | Feb 2017 | FY 2024 | Change |

|---|---|---|---|

| Revenue | $459M | $901M | +96% |

| EBITDA | $105M | $254M | +142% |

| Stock Price | $38.43 | $120.20 | +213% |

| Total Equity | $524M | $1.12B | +114% |

| Total Debt | $303M | $603M | +99% |

The company maintained its streak of 34 consecutive years of dividend increases—a rare distinction among publicly traded companies .

The WillScot Episode

Perhaps the most dramatic chapter of Hanna's tenure came in 2024 when Willscot Holdings (NASDAQ: WSC) announced a $3.8 billion cash-and-stock deal to acquire McGrath in January 2024 .

The deal offered McGrath shareholders $123 per share—a significant premium. But the FTC blocked the combination, finding the two largest modular and portable storage rental companies nationally couldn't merge without harming competition .

In September 2024, both parties mutually terminated the merger. McGrath collected a $180 million termination fee and promptly expanded its share repurchase authorization to 2 million shares .

Why Now? An Orderly Handoff

The announcement shows no signs of distress or pressure. Rather, the timing suggests careful planning:

-

COO appointment (Jan 2025): Hawkins was elevated to COO just over a year ago, giving him time to expand his oversight across all operations .

-

Strong operational momentum: In the most recent quarter, McGrath reported rental operations growth of 5% and adjusted EBITDA growth of 3% despite uncertain macro conditions .

-

Active M&A pipeline: The company closed two tuck-in acquisitions in Q2 2025 and maintains a "robust" deal pipeline .

-

Insider selling normalized: CEO Hanna's recent insider transactions were routine RSU exercises and tax-related sales, not unusual liquidation. He sold ~22,825 shares at prices between $108-128 in 2025, still retaining 153,637 shares worth approximately $18.5 million.

Chairman Brad Shuster framed it as legacy preservation: "The McGrath Board has invested considerable time developing a thoughtful succession plan. This is a natural progression in our company's history" .

Hawkins: The 22-Year Company Man

Philip Hawkins joined McGrath in 2004 through the acquisition of TRS (an electronics equipment rental division of CIT Technologies), where he was a Senior Business Analyst .

Career progression at McGrath:

| Period | Role |

|---|---|

| 2004-2007 | Manager, Corporate Financial Planning & Analysis |

| 2007-2011 | VP & Division Manager, TRS-RenTelco |

| 2011-2021 | VP & Division Manager, Mobile Modular |

| 2022-2025 | SVP & Division Manager, Mobile Modular (added Enviroplex, Kitchens to Go) |

| Jan 2025-Present | EVP & COO |

| April 2026 | President & CEO (effective) |

Hawkins led Mobile Modular, McGrath's largest and most strategic business unit, through its expansion as a "modular solutions provider"—a strategic pivot emphasized repeatedly in recent earnings calls .

"McGrath is an industry leader and is stronger than ever. We have a broad array of market opportunities ahead of us, and we're well positioned to continue to pursue them and grow the company," Hawkins said in the announcement .

Analyst Estimates and What's Next

Wall Street expects continued growth under new leadership:

| Metric | FY 2025E | FY 2026E | FY 2027E |

|---|---|---|---|

| Revenue | $942M | $982M | $1.03B |

| EPS | $6.07 | $6.60 | $7.33 |

| EBITDA | $353M | $373M | $398M |

Values retrieved from S&P Global

At current prices (~$120), the stock trades at:

- 19.8x FY25E EPS and 18.2x FY26E EPS

- ~1.0x FY25E revenue

- ~8.4x FY25E EBITDA

Key Catalysts to Watch

-

Q4 2025 Earnings Call (Feb 25, 2026): Both Hanna and Hawkins will participate alongside CFO Keith Pratt—an opportunity to hear the strategic vision articulated jointly .

-

April 3, 2026 Transition Date: Official handoff .

-

M&A Activity: The company has emphasized an active acquisition pipeline, with tuck-in deals expected .

-

Tariff and Macro Exposure: Management has noted limited tariff exposure but flagged potential project delays from economic uncertainty .

The Bottom Line

This is a textbook succession. A nine-year CEO retires after tripling the stock, handing off to a 22-year company veteran who was groomed through the COO role. The departing CEO stays on the Board. The incoming CEO gets a competitive compensation package with meaningful performance-based equity.

McGrath RentCorp emerges from the Hanna era as a far larger, more profitable company than when he took over. Whether Hawkins can maintain the trajectory—especially as the company navigates potential construction market softness and pursues its modular solutions strategy—will be the test of the next chapter.