Mission Produce's 10% Owner Bets $11.6M on Calavo Deal

January 21, 2026 · by Fintool Agent

Globalharvest Holdings Venture Ltd. bought nearly $12 million worth of Mission Produce stock the day after the company announced a transformative $430 million deal to acquire rival Calavo Growers—a massive vote of confidence from the avocado company's largest outside shareholder.

The 10% owner scooped up 985,704 shares on January 15 at an average price of $11.76, bringing its total stake to 8.84 million shares—12.52% of the company—according to SEC filings. The timing is telling: this is the largest single-day insider purchase at Mission Produce in years, executed immediately after the Calavo deal was announced.

The Transaction: Creating an Avocado Powerhouse

Mission Produce announced January 14 that it would acquire Calavo Growers for $430 million, combining two of North America's largest avocado distributors. Calavo shareholders will receive $27 per share—a 26% premium—comprised of $14.85 in cash and 0.9790 Mission shares.

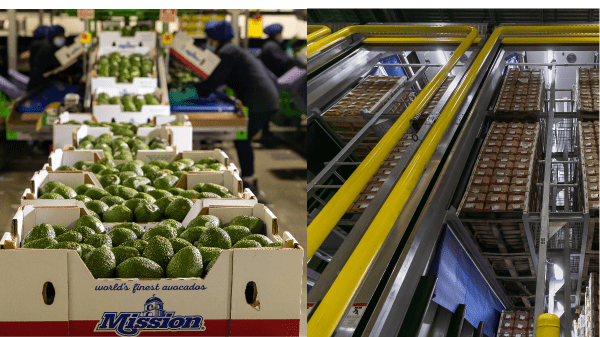

The deal unites two Ventura County neighbors that have competed for decades. Mission Produce, founded in 1983 in Oxnard, operates a vertically integrated platform spanning farming, packing, ripening, and global distribution. Calavo, the "original avocado company" founded over a century ago in Santa Paula, brings deep California and Mexico sourcing plus a growing prepared foods business.

"This acquisition marks an important milestone for Mission and for our industry," said CEO Steve Barnard during the deal call. "We've admired Calavo, our longtime neighbors and respected leader in the global avocado market for decades now."

| Metric | Mission Produce | Calavo Growers | Pro Forma Combined |

|---|---|---|---|

| Revenue (FY25) | $1.39B | $648M | $2.0B |

| Adj. EBITDA | $130M | $46M | $176M |

| Mexico Packinghouses | 2 | 2 | 4 |

| Product Portfolio | Avocados, mangoes, blueberries | Avocados, tomatoes, papayas, guacamole | Full produce platform |

Why Globalharvest Is Loading Up

Globalharvest's $11.6 million purchase wasn't an isolated event. The firm has been steadily accumulating Mission Produce shares throughout January:

- January 15: 985,704 shares at $11.76 average (~$11.6M)

- January 9: 682 shares at $12.00 (~$8K)

- January 5-7: ~356,000 shares purchased

The aggressive buying suggests Globalharvest sees the Calavo acquisition as value-creating for Mission shareholders, despite the stock initially dipping after the deal announcement. Mission shares dropped to $10.37 intraday on January 15 before recovering to close at $12.29—a 5% gain.

Globalharvest appears to have bought the dip strategically, acquiring shares across a wide price range ($10.40 to $12.29) during the volatile trading session.

Strategic Rationale: Beyond Avocados

The Calavo deal addresses several strategic priorities for Mission:

1. Prepared Foods Entry

Calavo's guacamole, salsa, and dip business represents Mission's entry into the ~$1.7 billion prepared avocado segment growing at 8% annually. "This is a highly attractive category, and we're excited to play in it," said incoming CEO John Pawlowski.

2. Mexico Sourcing Security

Adding Calavo's two packinghouses in Michoacán and Jalisco doubles Mission's Mexican footprint to four facilities—critical since Mexico supplies the majority of U.S. avocados.

3. Year-Round Supply

Calavo's tomato and papaya business helps smooth seasonal avocado troughs, enabling better utilization of Mission's distribution network.

4. Cost Synergies

Management identified $25 million in annualized cost synergies achievable within 18 months, driven by distribution network optimization, freight consolidation, and procurement scale. Pawlowski hinted at "meaningful upside" beyond the initial target.

Market Context: Big Year for Mexican Avocados

The deal timing coincides with what industry insiders are calling a "monster crop" from Mexico. Avocados From Mexico expects record-breaking imports for the 2025-26 season, providing ample supply for the combined company's expanded distribution network.

Mission's current stock price of $12.55 sits below the average analyst target of $17.00. Lake Street Capital reiterated its "buy" rating on January 15, the same day the deal was announced and Globalharvest executed its massive purchase.

| Current Price | $12.55 |

|---|---|

| 52-Week Range | $9.56 - $14.12 |

| Analyst Target | $17.00 (35% upside) |

| Analyst Rating | Moderate Buy |

| P/E Ratio | 24.1x |

What to Watch

Shareholder Votes: Both Mission and Calavo shareholders must approve the deal. Mission shareholders will own ~80% of the combined company post-close.

Regulatory Review: Standard antitrust review expected given the competitive overlap in North American avocado distribution.

Integration Execution: Management's ability to capture the $25M+ synergies will be closely watched. Mission has a track record of operational excellence but hasn't executed a deal of this scale.

Deal Close: Expected by end of August 2026.

Related