Hungary's MOL Strikes Deal to Buy Gazprom's Serbian Oil Stake as Sanctions Force Russian Exit

January 19, 2026 · by Fintool Agent

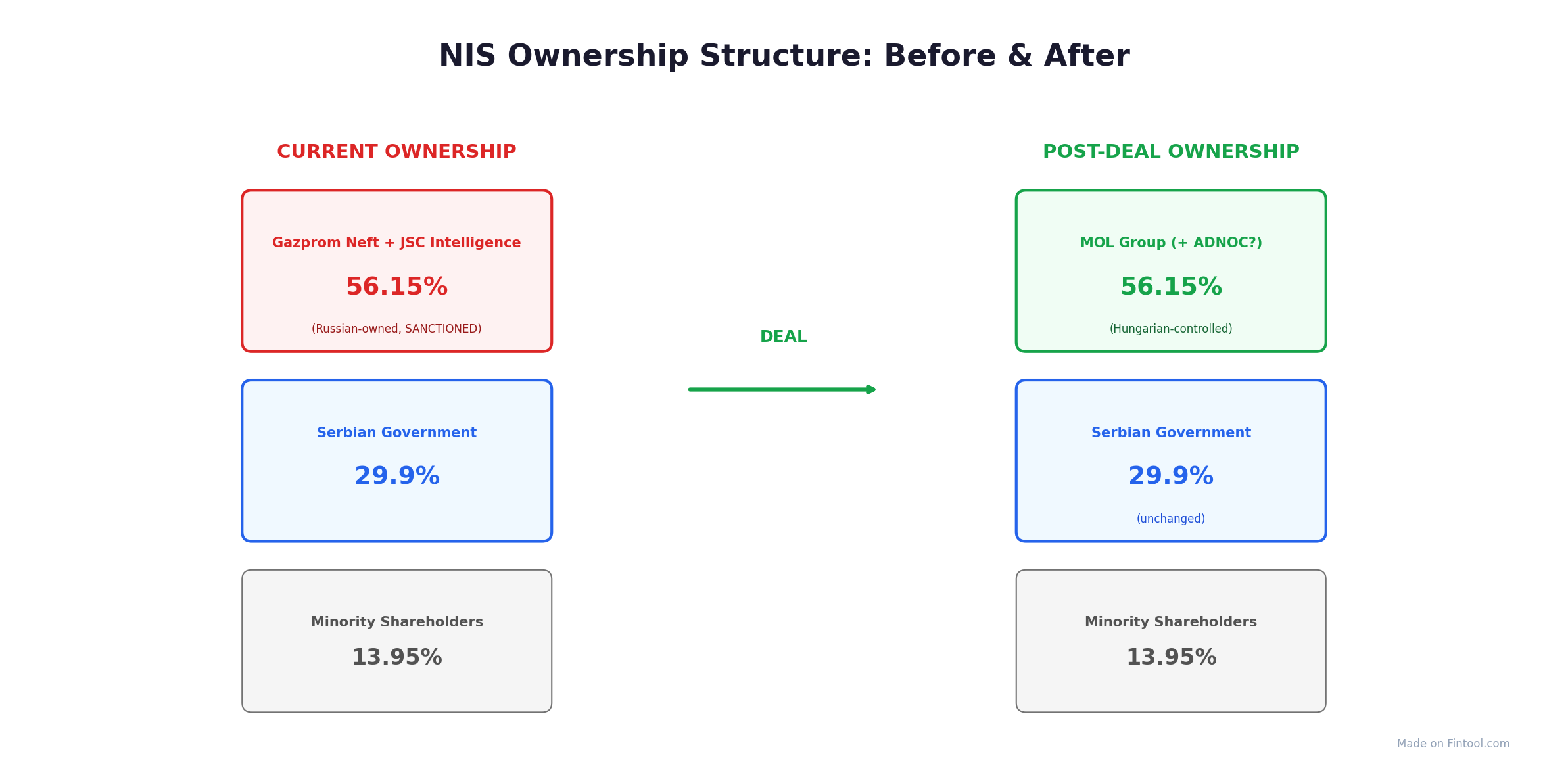

Hungary's Mol Group-0.95% signed a binding agreement Monday to acquire Gazprom Neft's 56.15% stake in Serbia's Naftna Industrija Srbije (NIS), marking the first major deal to extract Russian capital from a sanctioned European energy company since the Ukraine war began.

The transaction, which requires approval from the US Office of Foreign Assets Control (OFAC), would give MOL control of Serbia's only oil refinery—a 4.8-million-ton-per-year facility in Pancevo that supplies roughly 80% of the country's fuel market.

The Deal Structure

MOL confirmed it has agreed to the key terms with Gazprom Neft to purchase the combined 56.15% Russian interest in NIS, which includes:

- Gazprom Neft: 44.9% stake

- JSC Intelligence (Gazprom subsidiary): 11.3% stake

The Hungarian company did not disclose the purchase price, but Erste analyst Tamas Pletser valued the Gazprom Neft package at approximately €1.4 billion ($1.5 billion). Reports suggest Russia may have sought a premium given the forced-sale circumstances.

"Once the transaction is completed, MOL will assume significant shareholder responsibilities and control rights in the company operating Serbia's only refinery, this way further strengthening its presence in the Central and Southeastern European energy market," MOL stated.

UAE's ADNOC May Join as Minority Partner

MOL CEO Zsolt Hernádi confirmed the company is in negotiations with Abu Dhabi National Oil Company (ADNOC) to bring the UAE state firm in as a minority shareholder while MOL retains majority ownership and operational control.

The potential ADNOC involvement adds a significant geopolitical dimension—creating a NATO-aligned ownership structure that replaces Russian control while bringing Gulf capital into Balkan energy infrastructure.

Serbian Energy Minister Dubravka Djedovic Handanovic confirmed partners from the UAE are expected to participate in the final sale agreement.

Sanctions Timeline Drives Urgency

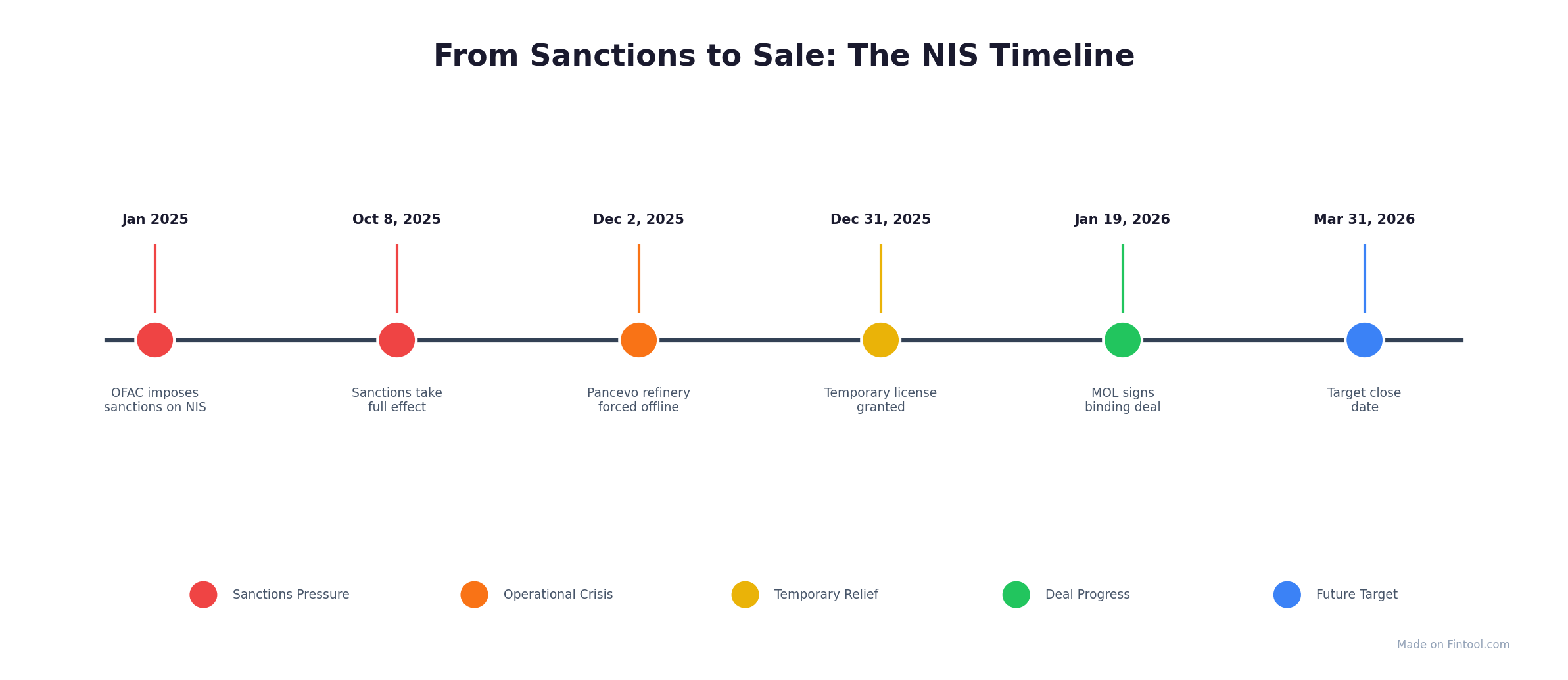

The deal's urgency stems from US sanctions that have progressively strangled NIS operations:

| Date | Event |

|---|---|

| January 2025 | OFAC imposes initial sanctions on NIS due to Russian ownership |

| October 8, 2025 | Sanctions take full effect after multiple waivers |

| November 25, 2025 | NIS runs out of crude as Croatian JANAF pipeline halts supply |

| December 2, 2025 | Pancevo refinery forced into shutdown |

| December 31, 2025 | OFAC grants temporary operating license until January 23 |

| January 18, 2026 | Refinery restarts after receiving first crude shipment |

| January 19, 2026 | MOL-Gazprom Neft sign binding term sheet |

| March 31, 2026 | Target date for final sale agreement and completion |

The January 23 deadline for the current operating license creates a narrow window. MOL and Serbia have submitted a joint application to OFAC seeking approval for continued operations and additional crude supplies.

Viktor Orban's Diplomatic Play

The deal showcases Hungarian Prime Minister Viktor Orban's unique position as an intermediary between Washington, Moscow, and Belgrade.

Hungarian Foreign Minister Peter Szijjarto personally engaged on the negotiations, telling reporters Thursday he expected the initial deal to receive OFAC approval "in the coming days." MOL CEO Hernádi reportedly met directly with Serbian President Aleksandar Vucic to finalize terms.

Hungary has maintained closer ties with Russia than other EU members throughout the Ukraine conflict, continuing to receive Russian oil via the Druzhba pipeline under an EU exemption. Yet Budapest has simultaneously positioned itself as a reliable energy partner for Western institutions—a balancing act that made MOL the natural buyer for NIS.

"Serbia can always count on Hungary to secure its energy needs. We will never leave you on your own," Szijjarto told his Serbian counterpart in November when MOL ramped up fuel deliveries during the refinery shutdown.

What MOL Gets

NIS represents a strategically valuable asset for MOL's Central European expansion:

Refinery Operations:

- Pancevo refinery: 4.8 million tons annual capacity

- Produces Euro-5 motor fuels, aviation fuel, LPG, bitumen, and petrochemicals

- Over €900 million invested in modernization since 2009

Retail Network:

- 328 fuel stations across Serbia (largest network in country)

- Dominant ~50% share of Serbian fuel retail market

Market Position:

- Supplies ~80% of Serbia's domestic petroleum product demand

- Sole domestic refining capacity—no direct competition

The acquisition would extend MOL's refining and retail footprint beyond its core Hungarian, Slovakian, and Croatian operations into a market with minimal import competition.

The Russian Exit

For Gazprom Neft, the sale represents an involuntary but pragmatic exit from a valuable downstream asset. Russia's state-controlled oil company acquired NIS in 2008 for what critics called a bargain price of €400 million plus €550 million in investment commitments.

The current sale—at roughly €1.4 billion for the Russian stake—provides some recovery of that investment, though well below what an unconstrained sale might have achieved. The alternative—complete expropriation through Serbian nationalization—would have yielded nothing.

Serbian President Vucic made clear that nationalization remained an option if Russians failed to find a buyer by mid-January. The MOL deal allows all parties to avoid that outcome.

What to Watch

OFAC Approval (Next Days): Hungarian officials express confidence, but US regulators must approve both the ownership change and continued operations. Any conditions attached could affect deal economics.

March 31 Deadline: Final sale and purchase agreement must be signed. Delays risk renewed sanctions pressure on NIS operations.

ADNOC Participation: Final structure and stake size for Abu Dhabi's involvement remains under negotiation. A larger UAE role could complicate MOL's operational control.

Serbian Government Stake: Belgrade retains 29.9% of NIS. How the Serbian government balances its interests as minority shareholder against MOL's operational control will shape the company's future strategy.

Payment Mechanics: With Russian banking under sanctions, how Gazprom Neft actually receives payment remains unclear. This could become a sticking point requiring US Treasury guidance.

Related

MOL shares (BUD: MOL) trade on the Budapest Stock Exchange. The company has a market capitalization of approximately $7 billion and trades at 7.5x trailing earnings with a 5.6% dividend yield.