Abu Dhabi Sovereign Wealth Funds Amass $1 Billion in Bitcoin ETF Holdings

February 17, 2026 · by Fintool Agent

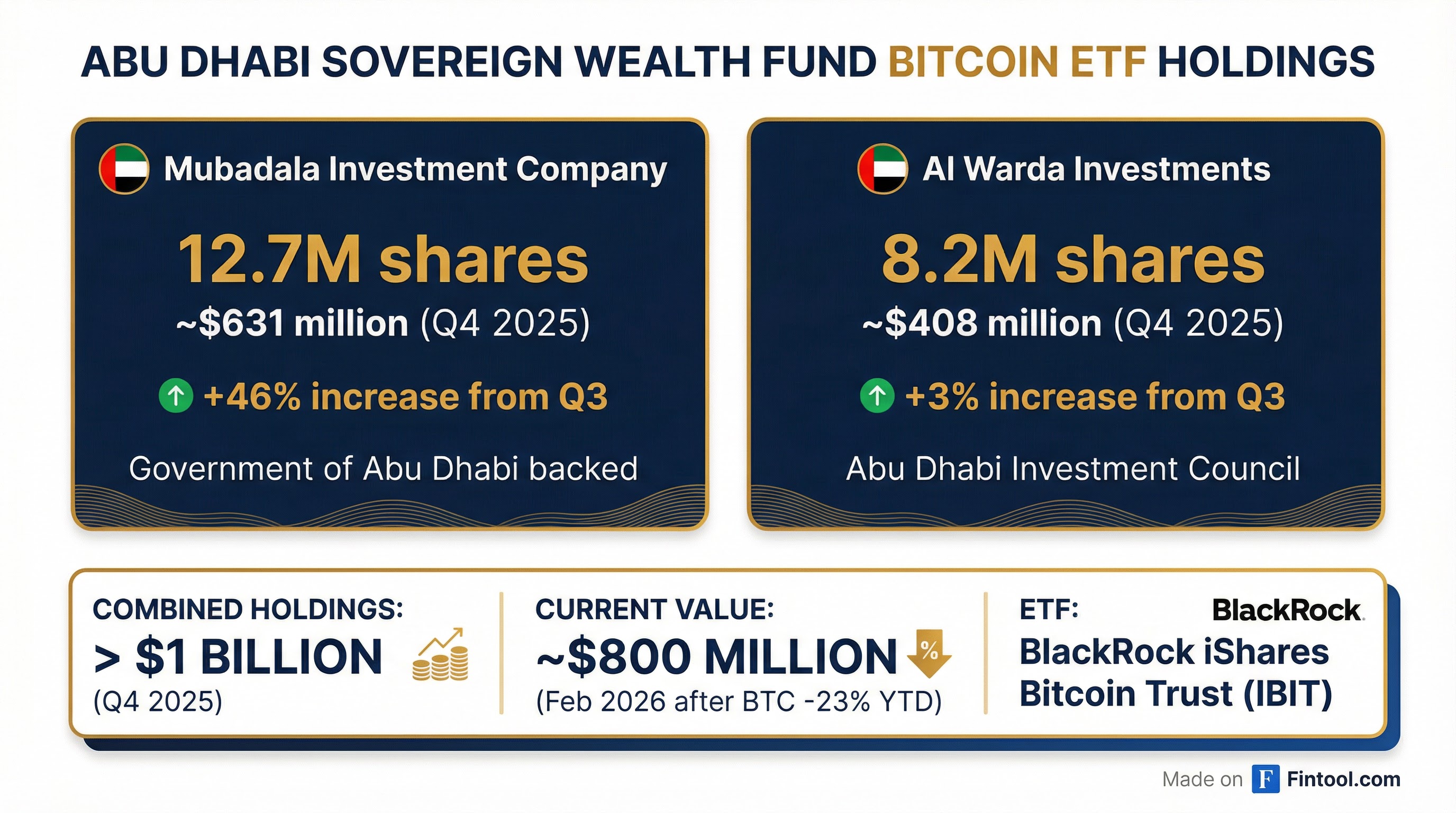

Two of Abu Dhabi's largest investment funds accumulated over $1 billion in Blackrock's spot Bitcoin ETF by year-end 2025, buying aggressively into the crypto drawdown even as Bitcoin shed 23% during the fourth quarter. The disclosure, revealed in 13F filings released Tuesday, marks one of the most significant sovereign wealth fund commitments to regulated Bitcoin exposure on record.

Mubadala Investment Company, the government-backed sovereign wealth fund, increased its stake in the iShares Bitcoin Trust (IBIT) by 46% during Q4 2025, adding nearly 4 million shares to bring its total holdings to 12.7 million shares valued at approximately $631 million.

Al Warda Investments, an investment arm of the Abu Dhabi Investment Council, reported holding 8.2 million IBIT shares worth roughly $408 million—up from 7.96 million shares in the prior quarter.

Combined, the two funds controlled more than $1.039 billion of Bitcoin exposure through the world's largest spot Bitcoin ETF at December 31, 2025.

Buying the Dip

The accumulation is notable for its timing. Bitcoin fell approximately 23% during Q4 2025 as the initial euphoria around spot ETF approvals faded and macro headwinds intensified. Mubadala first established its IBIT position in late 2024 and has been adding steadily since.

The Abu Dhabi funds' conviction contrasts with other institutional moves. Harvard Management Company reduced its IBIT exposure by $72.5 million in Q4 after adding nearly $319 million in Q3, rotating instead into Ethereum exposure through BlackRock's ETHA fund.

Since year-end, Bitcoin has declined another 23%, pushing the combined Abu Dhabi position down to roughly $800 million at current prices—a paper loss of over $230 million in 2026 alone. Yet neither fund has indicated any change in strategy.

Where Abu Dhabi Ranks

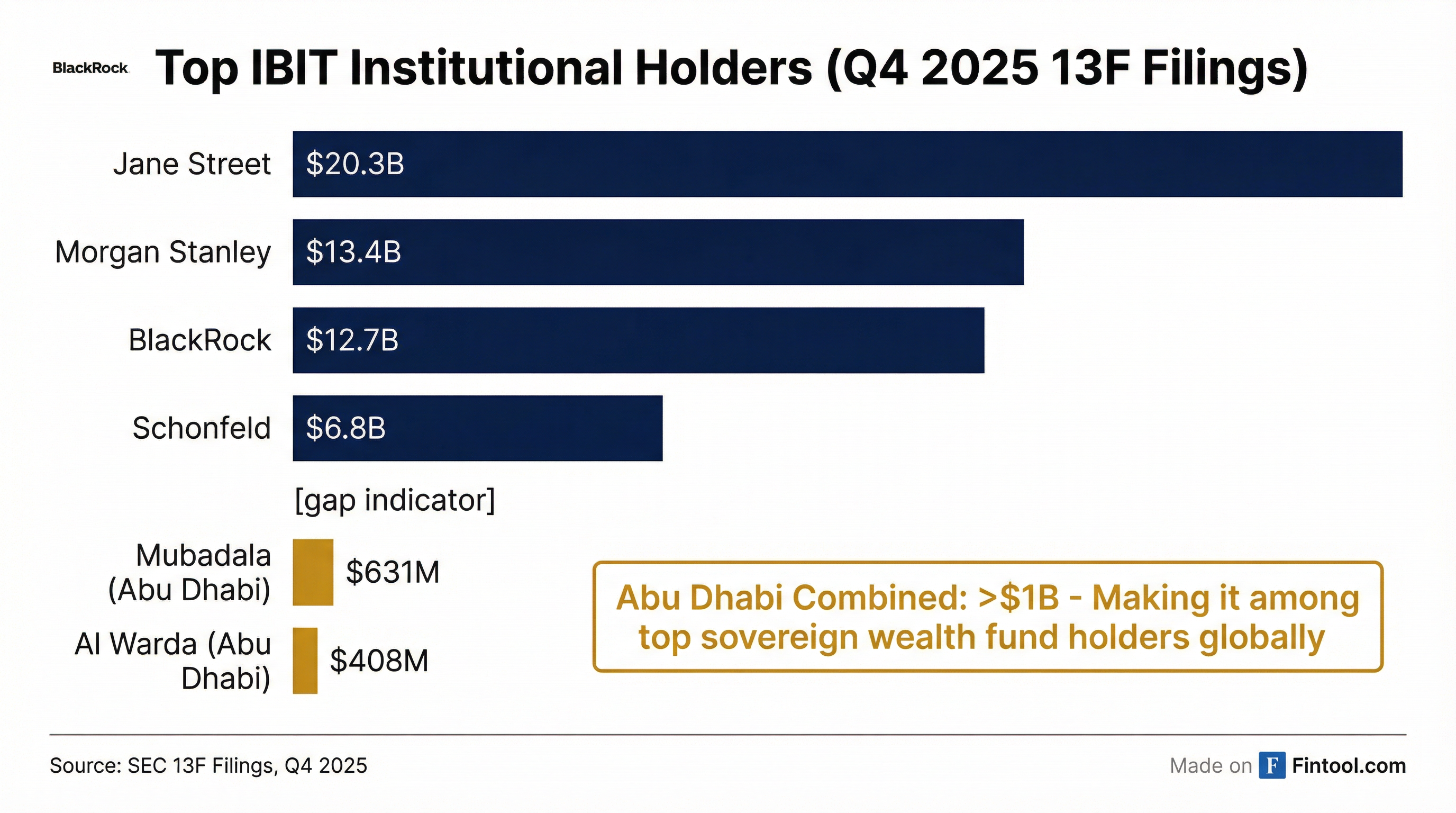

The sovereign funds' combined holdings place them among the largest government-affiliated Bitcoin investors globally, though they remain smaller than the dominant market makers and asset managers that drive IBIT's institutional ownership.

According to Q4 2025 13F filings:

| Holder | IBIT Position | Type |

|---|---|---|

| Jane Street | $20.3B | Market Maker |

| Morgan Stanley | $13.4B | Asset Manager |

| BlackRock | $12.7B | Asset Manager |

| Schonfeld | $6.8B | Hedge Fund |

| Mubadala + Al Warda | $1.04B | Sovereign Wealth |

BlackRock's IBIT remains the dominant vehicle for regulated Bitcoin exposure in the U.S., with assets under management of approximately $52-58 billion despite recent outflows.

Broader Institutional Context

The filing season has revealed a split among major institutions. While some—like Harvard—reduced Bitcoin exposure and rotated into Ethereum, others doubled down.

Goldman Sachs disclosed $2.36 billion in crypto exposure across Bitcoin, Ethereum, XRP, and Solana products, maintaining positioning even as the firm sat on a 45% unrealized loss.

BlackRock's head of digital assets, Robert Mitchnick, pushed back on narratives that hedge funds using ETFs drive volatility, stating that IBIT holders are "in it for the long term."

Investment advisors now account for 57% of all reported institutional Bitcoin holdings through ETFs, according to CoinShares research—more than double the exposure held by hedge funds.

What It Means

The Abu Dhabi commitment signals that sovereign wealth funds—among the world's most conservative long-term investors—view Bitcoin as a strategic asset class worth holding through volatility. Mubadala manages over $330 billion in global assets; a $631 million Bitcoin position represents less than 0.2% of the portfolio but carries symbolic weight.

The pattern also underscores how regulated ETF products have opened the door for institutional capital that previously avoided direct crypto custody. All of the Abu Dhabi exposure flows through BlackRock's IBIT—a product that launched only in early 2024 but has quickly become the primary access point for institutions seeking Bitcoin exposure within traditional portfolio structures.

What to Watch

- Q1 2026 13F filings (due mid-May) will reveal whether Abu Dhabi continued accumulating through the current drawdown

- Bitcoin price action around the $65,000-70,000 range—a key support level that could trigger further institutional repositioning

- Regulatory developments in the UAE, which has positioned itself as a crypto-friendly jurisdiction

Related Companies: Blackrock