Netflix Goes All-Cash in $83B Warner Bros Bid as Paramount's Deadline Expires

January 21, 2026 · by Fintool Agent

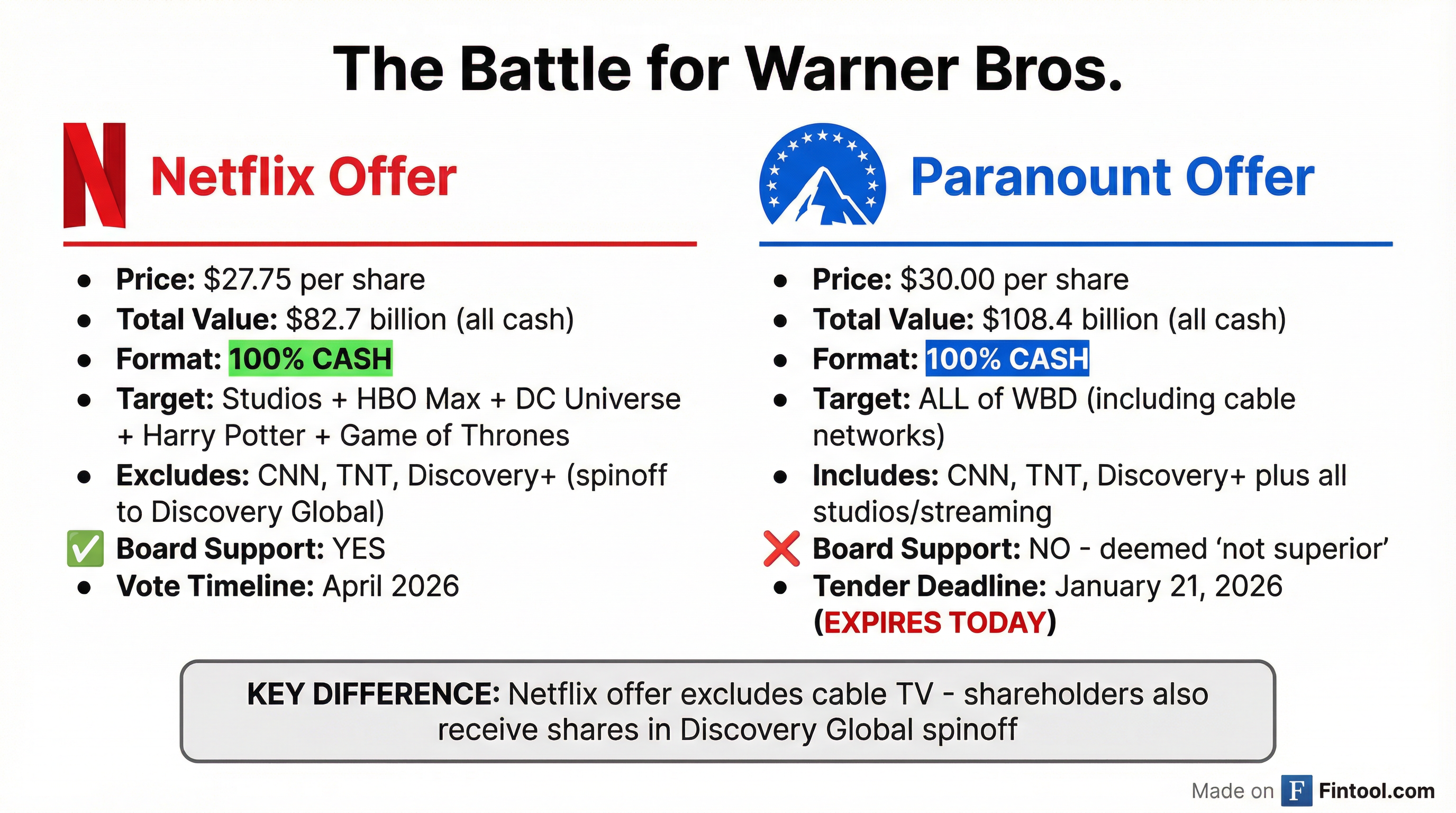

Netflix converted its $82.7 billion merger agreement for Warner Bros. Discovery's studio and streaming assets to an all-cash offer, eliminating stock-based uncertainty and accelerating the path to shareholder approval—just as Paramount Skydance's rival tender offer expires today.

The new $27.75-per-share all-cash bid replaces Netflix's earlier cash-and-stock offer of $23.25 in cash plus $4.50 in Netflix shares. The move directly addresses Paramount's argument that Netflix's falling share price—down 15% since the December 5 deal announcement—diminished the value of its original bid.

"The merger consideration is a fixed cash amount to be paid by an investment-grade company, providing stockholders with certainty of value and liquidity immediately upon closing," Warner Bros stated in Tuesday's SEC filing.

The Stakes: Hollywood's Crown Jewels

The winner controls some of entertainment's most valuable franchises:

- HBO Max — Premium streaming with 100+ million global subscribers

- Warner Bros. Studios — A century of filmed entertainment

- DC Universe — Batman, Superman, Wonder Woman franchises

- Harry Potter — One of entertainment's most valuable IP portfolios

- Game of Thrones/House of the Dragon — Prestige TV powerhouse

Netflix's deal excludes WBD's cable networks. CNN, TNT, and Discovery+ will be spun off into a separately traded entity called Discovery Global. WBD's board valued this spinoff at $1.33 to $6.86 per share, meaning shareholders could receive combined value of $29.08 to $34.61—potentially exceeding Paramount's headline $30 bid.

Paramount's Last Stand

Today marks the expiration of Paramount Skydance's $30-per-share tender offer for all of Warner Bros. Discovery—a $108.4 billion bid that WBD's board has unanimously rejected as "not superior" to Netflix's agreement.

The Ellison family, which controls Paramount through son David Ellison's CEO role and father Larry's 77.5% voting stake, pulled out all the stops. Larry Ellison personally guaranteed $40.4 billion of the equity financing—approximately 17% of his $238 billion fortune—to address the board's financing concerns.

It wasn't enough.

"Despite its multiple opportunities, Paramount Skydance continues to propose a transaction that our board unanimously concluded is not superior to the merger agreement with Netflix," Warner Bros stated after a Delaware judge rejected Paramount's attempt to expedite its lawsuit against WBD.

| Offer Comparison | Netflix | Paramount Skydance |

|---|---|---|

| Price per Share | $27.75 | $30.00 |

| Total Value | $82.7B | $108.4B |

| Format | All Cash | All Cash |

| Target Assets | Studios + HBO Max | All of WBD |

| Board Support | Yes (Unanimous) | No ("Not Superior") |

| Key Milestone | April 2026 Vote | Jan 21 Tender Expires |

"Paramount will make another appeal to shareholders. Unless Paramount raises its bid, the appeal will be window dressing," said Emarketer analyst Ross Benes.

Netflix's Q4: Strong Numbers, But Stock Slides

The deal restructuring came hours before Netflix reported fourth-quarter earnings that beat expectations—yet shares fell more than 5% in after-hours trading as investors digested the implications of the Warner Bros acquisition.

| Netflix Q4 2025 | Actual | Estimate |

|---|---|---|

| Revenue | $12.05B | $11.97B |

| EPS | $0.56 | $0.55 |

| Global Subscribers | 325M | 325M |

| Net Income | $2.42B | — |

Key highlights from the quarter:

- Ad revenue topped $1.5 billion in 2025, up 2.5x year-over-year

- Content spending set to rise 10% to approximately $20 billion in 2026

- 2026 revenue guidance of $50.7B-$51.7B (12-14% growth)

- Share buybacks paused while Warner Bros deal is pending

"We're working really hard to close the acquisition of Warner Bros. Studios and HBO, which we see as a strategic accelerant," co-CEO Ted Sarandos said on the earnings call.

What WBD Shareholders Actually Get

The Netflix deal offers WBD investors two components:

1. Cash Payment: $27.75 per share

- Immediate liquidity upon closing

- No market risk from Netflix stock volatility

- Investment-grade counterparty

2. Discovery Global Shares

- Spinoff containing CNN, TNT, Discovery+

- Board valuation: $1.33-$6.86 per share

- Will trade as separate public company

Warner Bros' advisers used three separate approaches for valuing Discovery Global. The lowest estimate of $1.33 per share assumed a single blended valuation, while the high end of $6.86 assumed the spinoff could be involved in future M&A activity.

Paramount has dismissed the cable spinoff as "effectively worthless."

Warner Bros Financial Snapshot

WBD enters this deal carrying significant debt but generating substantial EBITDA:

| WBD Financials | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $6.7B | $6.9B | $7.1B | $6.1B |

| Net Income | -$494M | -$453M | $1.6B | -$148M |

| Total Debt | $43.0B | $37.4B | $34.6B | $33.5B |

| Cash | $5.3B | $3.9B | $4.9B | $4.3B |

The company has reduced debt from $43 billion to $33.5 billion over the past year while navigating the transformation of its business model.

The Regulatory Question

Both deals face intense antitrust scrutiny. A Netflix-WBD combination would give the streamer approximately 43% of global SVOD subscribers.

Sarandos expressed confidence in clearing regulatory hurdles: "This is pro-consumer, pro-innovation, pro-worker, pro-creator and pro-growth."

The Ellisons have argued their relationship with President Donald Trump gives Paramount an easier regulatory path. Trump has publicly weighed in on the competing transactions, adding a political dimension to the deal process.

What to Watch

Today (January 21): Paramount's tender offer deadline expires. Unless Paramount raises its bid or extends the deadline, shareholders must decide whether to tender their shares.

April 2026: Expected WBD shareholder vote on Netflix deal. The all-cash structure accelerated this timeline from the previously expected spring/early summer vote.

Post-Approval: If approved, the spinoff of Discovery Global is expected to complete within six to nine months, prior to the Netflix acquisition closing.

The Bottom Line

Netflix's conversion to all-cash removes the volatility risk that gave Paramount its strongest argument. With the WBD board standing firm and Paramount's tender deadline expiring today, the path to a Netflix-controlled Warner Bros. looks increasingly clear.

"This new agreement only ramps up the pressure," said Fitch analyst. "The changes show that Netflix is serious about winning, and the accelerated shareholder vote means Paramount needs to act with urgency. Now, it is up to Paramount to provide a clearly superior offer if they want to get this done."

For WBD shareholders, the calculation is straightforward: accept Netflix's $27.75 in guaranteed cash plus Discovery Global shares valued up to $6.86, or hope Paramount sweetens its $30 bid before time runs out.

Time is now measured in hours.