Netflix Wins: WBD Board Accepts $82.7B All-Cash Deal, Paramount's Hostile Bid Fades

January 20, 2026 · by Fintool Agent

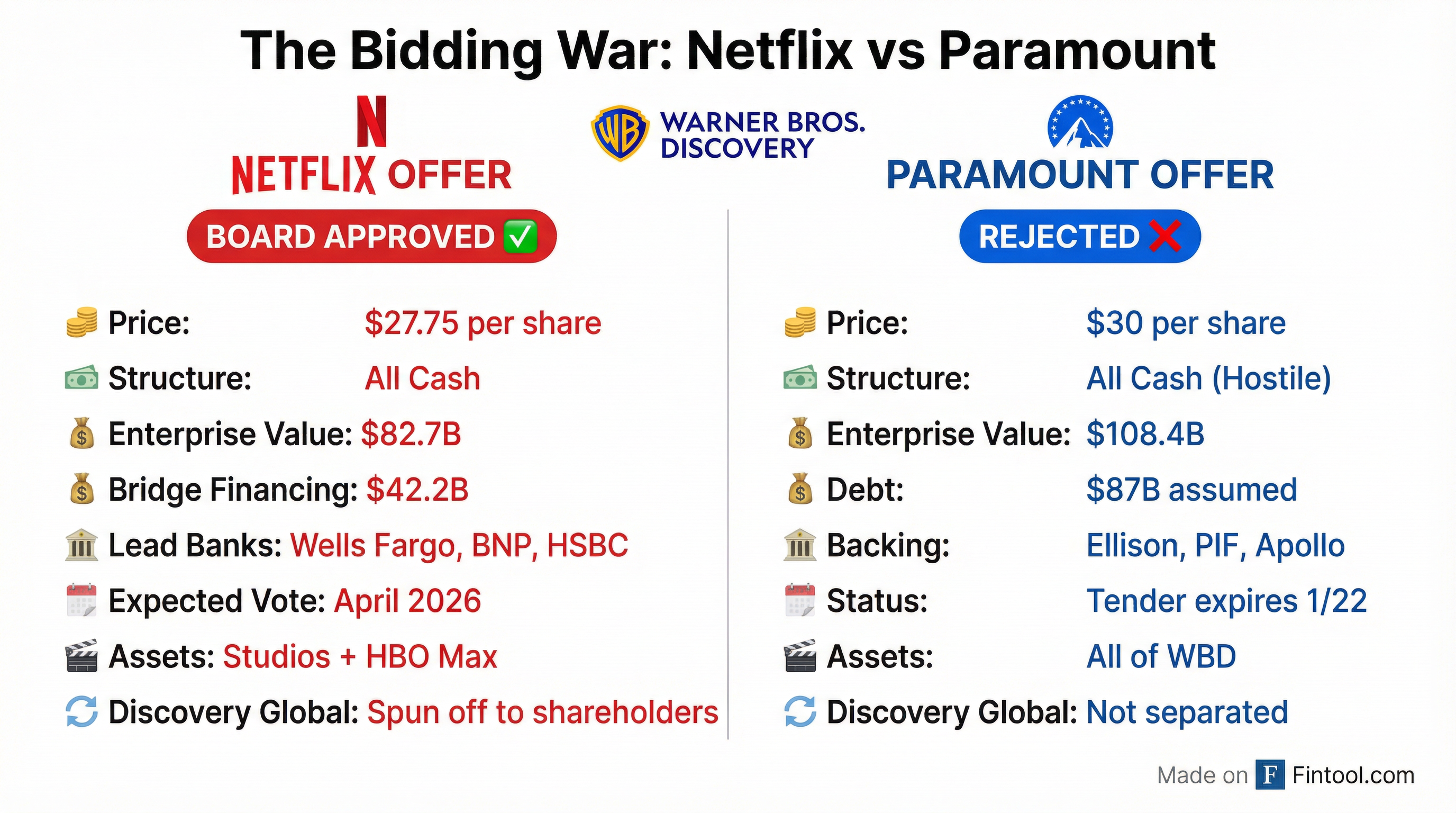

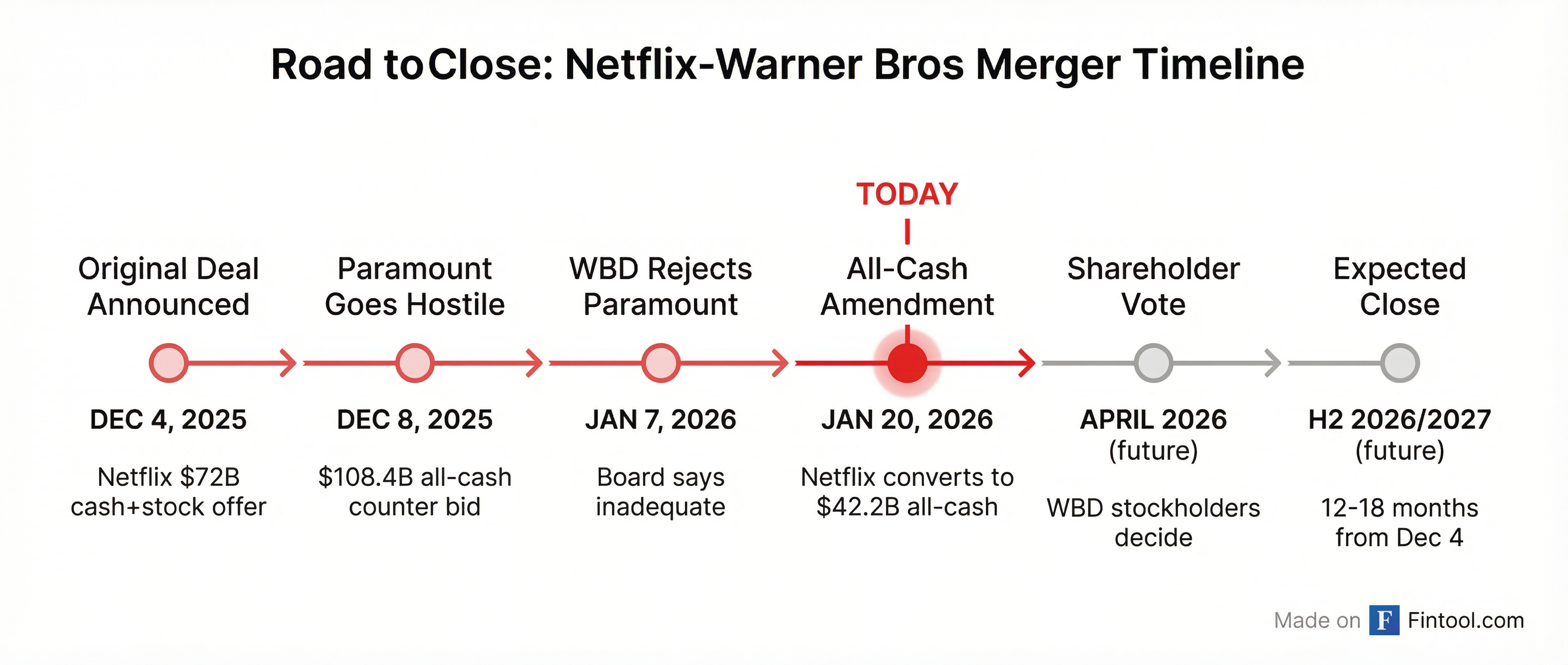

Netflix has converted its $82.7 billion Warner Bros. Discovery takeover bid to an all-cash transaction, securing unanimous board approval and dealing a decisive blow to Paramount Skydance's hostile counter-offer. The streaming giant will now pay $27.75 per share entirely in cash—eliminating the stock component that had left the deal vulnerable to market volatility—while boosting its bridge financing commitments to $42.2 billion.

The revised structure clears the path to a shareholder vote by April 2026, significantly accelerating the timeline from the previously expected spring or early summer vote.

The Deal: What Changed

Netflix's original December offer included $23.25 in cash plus $4.50 in Netflix stock, subject to a price collar of $97.91 to $119.67 per share. With Netflix shares trading at just $88—well below the collar floor—WBD shareholders faced uncertainty about the deal's ultimate value.

The all-cash amendment eliminates that risk entirely.

| Term | Original Deal (Dec 4) | Revised Deal (Jan 20) |

|---|---|---|

| Price Per Share | $27.75 ($23.25 cash + $4.50 stock) | $27.75 (100% cash) |

| Enterprise Value | $82.7B | $82.7B |

| Bridge Financing | $34.0B | $42.2B |

| Lead Banks | Wells Fargo, BNP, HSBC | Wells Fargo, BNP, HSBC |

| Shareholder Vote | Spring/Summer 2026 | April 2026 |

| CFIUS Review | Not required | Not required |

"Our revised all-cash agreement will enable an expedited timeline to a stockholder vote and provide greater financial certainty at $27.75 per share in cash, plus the value from the planned separation of Discovery Global," said Ted Sarandos, co-CEO of Netflix.

Bidding War: How Netflix Beat Paramount

The amendment comes after six weeks of hostile maneuvering from Paramount Skydance, which launched a $108.4 billion all-cash counter-bid on December 8—just four days after Netflix's original deal was announced.

Paramount's offer of $30 per share—a 139% premium to WBD's undisturbed stock price—appeared more generous on paper. But the WBD board rejected it twice, calling it "inadequate" and characterizing it as a highly leveraged buyout that posed significant execution risks.

The key differences:

Netflix's Approach:

- Acquires only the studios and HBO Max streaming business

- Discovery Global (CNN, TNT, Discovery+) spun off to WBD shareholders

- $42.2B bridge financing from investment-grade banks

- No CFIUS review required

- Board-approved, friendly transaction

Paramount's Approach:

- Sought to acquire all of WBD including cable networks

- Backed by $87B in assumed debt

- Financing consortium included Saudi PIF, Abu Dhabi's L'imad Holding, Qatar Investment Authority, and Jared Kushner's Affinity Partners

- Launched proxy fight, nominated rival board candidates

- Delaware court denied expedited lawsuit seeking deal information

"The Board unanimously determined that Paramount's latest offer remains inferior to our merger agreement with Netflix across multiple key areas," said Samuel A. Di Piazza, Jr., Chair of the WBD Board.

The Numbers: Financial Positioning

Netflix enters this deal from a position of strength. The company generated $6.7 billion in levered free cash flow in Q3 2025 alone, with cash on hand of $9.3 billion and total debt of $17.1 billion.

Netflix Recent Performance

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $10.2 | $10.5 | $11.1 | $11.5 |

| Net Income ($B) | $1.9 | $2.9 | $3.1 | $2.5 |

| Free Cash Flow ($B)* | $4.9 | $5.7 | $6.0 | $6.7 |

| Cash ($B) | $7.8 | $7.2 | $8.2 | $9.3 |

*Values retrieved from S&P Global

Warner Bros. Discovery, by contrast, continues to navigate a turnaround, with quarterly losses persisting even as the company has aggressively paid down debt—reducing total debt from $43.0 billion in Q4 2024 to $33.5 billion in Q3 2025.

WBD Recent Performance

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B)* | $6.7 | $6.9 | $7.1 | $6.1 |

| Net Income ($B) | ($0.5) | ($0.5) | $1.6 | ($0.1) |

| EBITDA ($B)* | $2.4 | $1.8 | $1.4 | $2.2 |

| Total Debt ($B) | $43.0 | $37.4 | $34.6 | $33.5 |

*Values retrieved from S&P Global

Discovery Global: The Spin-Off Wild Card

A critical—and contested—part of the deal is the value of Discovery Global, the entity that will hold WBD's cable networks (CNN, TNT Sports, Discovery Channel) after the separation.

WBD's proxy filing Tuesday valued Discovery Global at:

- Sum-of-the-parts analysis: $2.41 to $3.77 per share

- Selected transactions analysis (M&A context): $4.63 to $6.86 per share

Paramount has argued Discovery Global could be worth as little as zero—or at most $0.50 per share in an M&A scenario.

The spin-off is expected to be completed 6-9 months before the Netflix deal closes, allowing WBD shareholders to receive both the $27.75 cash payment and Discovery Global shares.

Market Reaction

Since the original deal announcement on December 4, the three stocks have diverged:

| Stock | Dec 4 Price | Current Price | Change |

|---|---|---|---|

| WBD | $12.50 | $28.57 | +129% |

| NFLX | $114 | $88.00 | -23% |

| PSKY | $18 | $11.80 | -34% |

WBD has surged on deal premium expectations, while Netflix has sold off—partly due to broader market pressure and partly due to concerns about the acquisition's impact on its balance sheet. Paramount has cratered as its hostile bid appears increasingly unlikely to succeed.

What Happens Next

Key dates and milestones:

-

January 22, 2026: Paramount's tender offer expires (likely to be extended, but fewer than 400,000 WBD shares had been tendered as of December 19)

-

Q1 2026: Discovery Global spin-off expected to begin; WBD shareholders will receive shares in the new entity

-

April 2026: WBD shareholder vote on Netflix transaction

-

H2 2026 - H1 2027: Expected deal closing (12-18 months from December 4, 2025), pending regulatory approval from DOJ and European Commission

Breakup fees remain unchanged:

- WBD pays Netflix $2.8 billion if it backs out

- Netflix pays WBD $5.8 billion if regulators block the deal

Investment Implications

For WBD shareholders, the all-cash structure removes stock price volatility risk while preserving upside through Discovery Global shares. The accelerated vote timeline also shortens the period of uncertainty.

For Netflix investors, today's earnings report (after the bell) will be closely watched for any additional commentary on synergy expectations, content strategy, and balance sheet management post-acquisition. With $42.2 billion in bridge financing to be refinanced, Netflix's debt profile will transform significantly.

For Paramount shareholders, the failed hostile bid raises questions about the company's strategic direction. Down 40% from October highs, Paramount Skydance faces an uncertain path forward.