Newmont Issues Notice of Default to Barrick Over Nevada Gold Mines, Threatening $81B Miner's Spinoff Plans

February 20, 2026 · by Fintool Agent

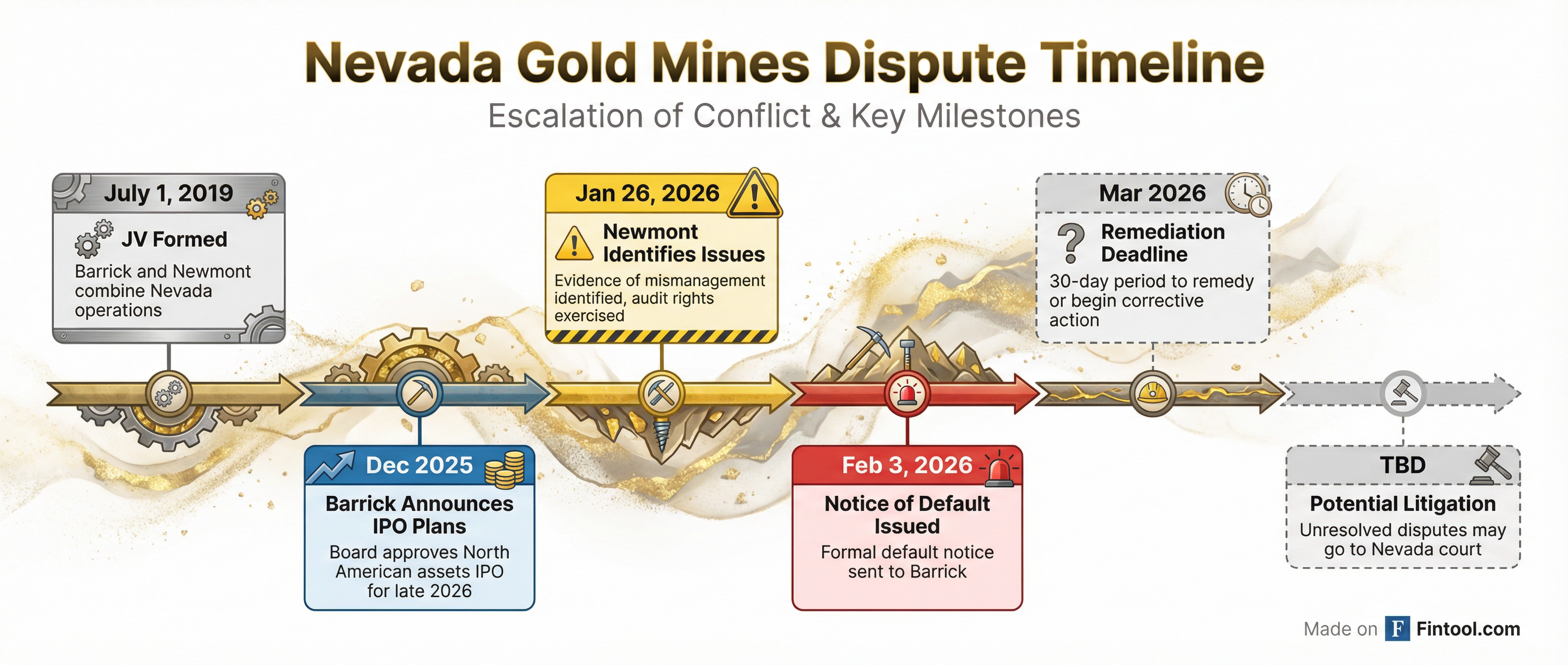

The world's two largest gold miners are feuding over one of the industry's most valuable assets. Newmont Corporation issued a formal notice of default to Barrick Mining on February 3, alleging mismanagement at their Nevada Gold Mines joint venture—a dispute that could derail Barrick's planned IPO of North American assets and reshape the gold mining landscape.

Newmont shares fell 3.7% on Thursday to $120.77 following the 10-K filing disclosure, while the company otherwise reported strong Q4 results with $22.7 billion in full-year revenue.

The Allegation: Resource Diversion

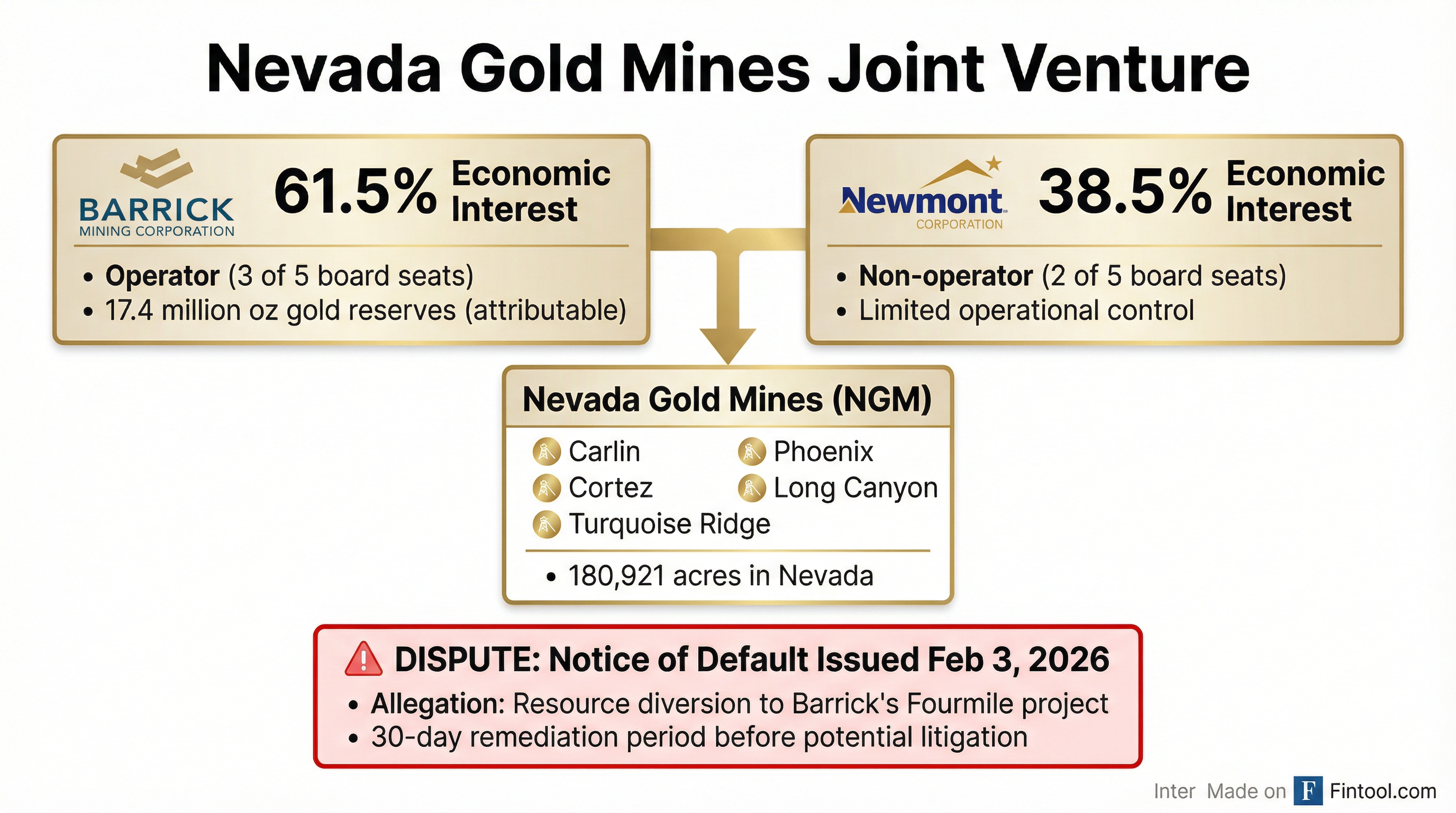

Newmont alleges Barrick diverted resources from Nevada Gold Mines (NGM) to benefit Barrick's wholly-owned Fourmile project—a high-grade gold deposit adjacent to the joint venture that Barrick has been advancing as a potential "world-class gold asset."

"On January 26, 2026, we informed Barrick and the NGM Board of Managers that we had identified evidence of mismanagement at NGM, including diversion of resources from NGM to the benefit of Barrick's wholly-owned property Fourmile and Barrick," Newmont stated in its 10-K filing.

Newmont is exercising its contractual inspection and audit rights under the 2019 joint venture agreement. The notice of default triggers a 30-day period for Barrick to remedy the issue or begin corrective action. If unresolved, the matter could proceed to litigation in Nevada courts.

The Stakes: 60% of Barrick's Value

Nevada Gold Mines is no ordinary joint venture. Formed in July 2019 when Barrick dropped a hostile takeover bid for Newmont, NGM combines five major Nevada operations—Carlin, Cortez, Turquoise Ridge, Phoenix, and Long Canyon—spanning 180,921 acres with 17.4 million attributable ounces of gold reserves.

The asset is central to Barrick's future. RBC Capital Markets analyst Josh Wolfson estimates NGM accounts for roughly 60% of Barrick's market value. Without it, investors may question the company's appeal.

Under the joint venture agreement, Barrick holds 61.5% economic interest and operates NGM, while Newmont holds 38.5%. Barrick appoints three of five board managers, giving it majority voting control on most decisions.

"Because we beneficially own less than a majority of the ownership and governance interests in NGM, we have limited control of NGM's operations, and we depend on Barrick to operate NGM," Newmont disclosed.

Barrick's Spinoff in Jeopardy

The timing couldn't be worse for Barrick. In December, the company announced plans to spin off its North American gold assets through an IPO by late 2026. The proposed "NewCo" would include Barrick's stake in NGM, the Pueblo Viejo mine in the Dominican Republic (also a JV with Newmont), and the wholly-owned Fourmile project.

"The board has decided to move forward with preparations for an initial public offering of Barrick's North American gold assets, aimed at maximizing shareholder value. We are targeting to complete the IPO by late 2026," CEO Mark Hill said on Barrick's February 5 earnings call.

Newmont's notice of default throws a wrench into those plans. Under the joint venture agreement, Newmont holds a contractual right of first refusal over moves affecting the venture—and has previously expressed interest in acquiring Barrick's Nevada assets.

Both Sides Claim Constructive Relations

Despite the escalating legal conflict, both companies struck conciliatory tones on their earnings calls.

"Our primary focus remains on working with a managing partner to improve performance of these assets and generate long-term value for Newmont shareholders," said Newmont CEO Natascha Viljoen. "Confidentiality provisions in the joint venture agreement prevent further comment on the notice of default."

When asked about discussions regarding Fourmile potentially joining the JV, Viljoen said: "Our current discussions have been predominantly around the improvement of the performance of Nevada. I think a very constructive relationship to work together to improve that performance."

Barrick disputed Newmont's claims but declined details. "While we disagree with Newmont's claims, we are limited by the terms of the joint venture agreement in what we can say," CEO Mark Hill said. "We are committed to constructive engagement and to working together with Newmont to deliver shareholder value."

Hill defended NGM's recent performance, citing the "best January we've had in 5 years" with record throughput at Carlin's processing facilities.

Financial Context: Both Miners Benefiting From Gold Surge

The dispute comes amid a golden era for both companies, with gold prices driving record results.

| Metric | Newmont (FY 2025) | Newmont (FY 2024) | Barrick (FY 2025) | Barrick (FY 2024) |

|---|---|---|---|---|

| Revenue | $22.7B | $18.7B | $17.0B* | $12.9B* |

| Net Income | $7.1B | $3.3B | $5.0B* | $2.1B* |

| EBITDA | $13.5B | $8.9B* | $9.9B* | $6.1B* |

| Cash Position | $7.6B | $3.6B | $6.7B* | $4.1B* |

*Values retrieved from S&P Global

Barrick reported record adjusted earnings per share, cash flow, and shareholder returns in 2025, repurchasing $1.5 billion of shares and increasing its dividend by 40%.

Newmont generated $10.3 billion in operating cash flow in 2025 and announced an annual dividend of $1.1 billion as part of a new capital allocation framework targeting 6 million ounces of annual gold production.

What to Watch

Remediation deadline (early March): Barrick has 30 days from February 3 to remedy the alleged default or begin corrective action. The response—and Newmont's reaction—will signal whether this heads toward resolution or litigation.

Audit findings: Newmont is exercising inspection and audit rights. What the audit reveals could strengthen or weaken Newmont's position and influence any settlement discussions.

IPO timeline: Barrick's planned late-2026 IPO of North American assets requires clarity on the JV relationship. Uncertainty could delay or derail the offering.

Fourmile development: The dispute centers on alleged resource diversion to Fourmile. How Barrick advances this "world-class" deposit while managing JV obligations will be scrutinized.

Newmont's M&A appetite: Newmont has previously expressed interest in acquiring Barrick's Nevada stake. The dispute could be a negotiating tactic—or the opening salvo in a larger strategic move.

"Any such disagreements could have a material adverse effect on our interest in NGM, the business of NGM or the portion of our growth strategy related to NGM," Newmont warned in its 10-K.