NRC Health Data Shows Customers Outperform on HCAHPS as Care Coordination Becomes Critical

January 27, 2026 · by Fintool Agent

NRC Health+0.06% revealed today that its hospital customers improved at higher rates across all 10 HCAHPS dimensions compared to the broader market between 2022 and 2024, with the company highlighting care coordination as an emerging priority area in its January 2026 webcast on patient experience optimization.

The Lincoln, Nebraska-based healthcare experience management company presented data showing that care coordination metrics now appear as top correlates in 85-90% of client reviews—a significant shift that aligns with CMS's evolving measurement framework ahead of FY 2030 regulatory changes.

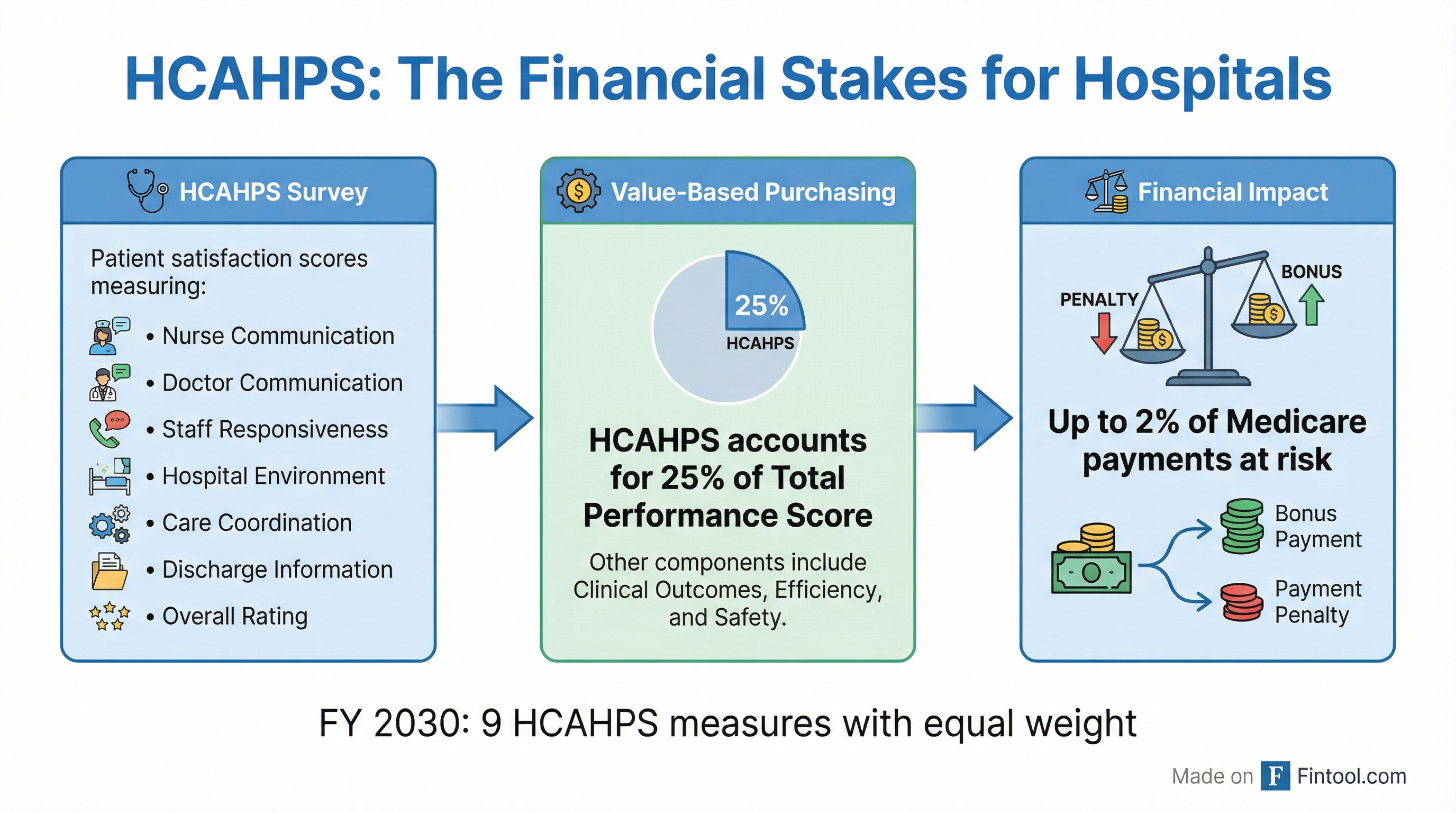

The Financial Stakes for Hospitals

HCAHPS performance directly impacts hospital reimbursement under Medicare's Value-Based Purchasing Program. Patient experience accounts for 25% of a hospital's total performance score, with up to 2% of Medicare inpatient payments at stake based on results.

"The stakes are real. Underperforming or not fully participating in HCAHPS can lead to financial loss," said Sarah Fryda during the webcast. "Hospitals that don't understand the true drivers of experience not only miss insights, they also leave substantial revenue unclaimed from the national incentive pool."

Customer Outperformance Documented

NRC Health's comparison of customer performance versus the broader market from 2022 (the lowest-scoring pandemic period) through 2024 showed consistent outperformance:

Biggest Improvement Areas for NRC Health Customers:

- Staff responsiveness

- Overall hospital rating

- Hospital quietness

"Hospitals that partnered with NRC Health improved at a higher rate across all 10 HCAHPS dimensions," Fryda noted. "The takeaway from this is that using patient feedback effectively doesn't just improve experience in the moment. It positions organizations to sustain improvement, strengthen outcomes, and capture the full financial and reputational value tied to HCAHPS."

Care Coordination Emerges as Top Correlate

Perhaps the most significant insight from the webcast was the rising importance of care coordination metrics. Jason Messerli, presenting alongside Fryda, revealed that care coordination questions now appear as top correlates for patient loyalty in 85-90% of client data reviews.

"In 2025, one of the really prevalent trends that I saw in client data was that the new metrics under care coordination were coming to the top a lot," Messerli said. "That really is telling for me because it's probably more of a self-fulfilling prophecy than anything that it's always probably been something that patients struggle with—coordinating care, understanding what all these roles do, what they're all telling me, what I need to do when I leave here. It's complex."

This aligns with CMS's regulatory trajectory. Starting in FY 2030, nine HCAHPS measures will be included in Hospital VBP with equal weight, with care coordination becoming a standalone dimension.

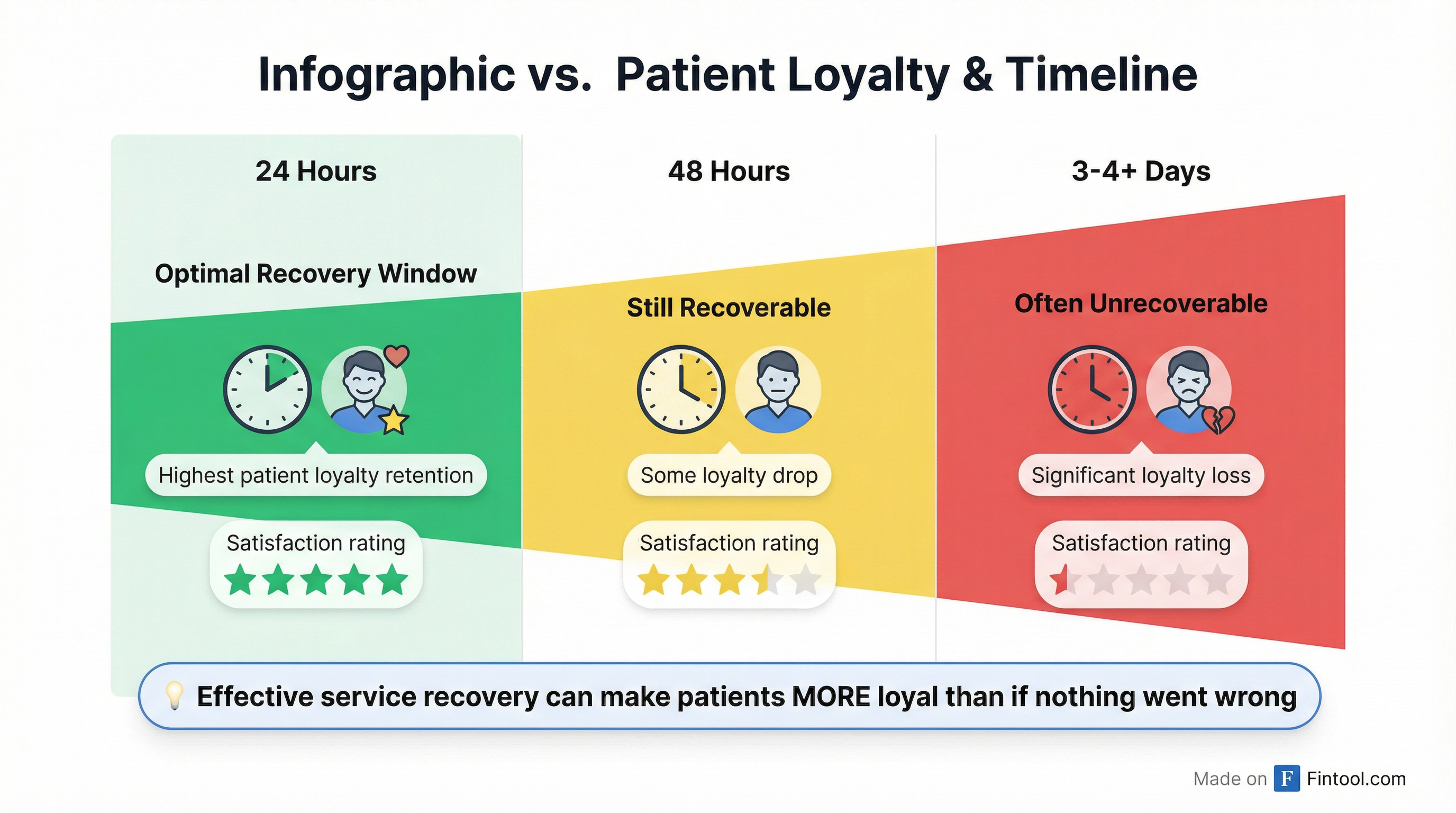

Service Recovery: The 24-48 Hour Window

NRC Health's research quantifies the importance of rapid service recovery. The data shows significant drop-offs in patient loyalty beyond the 48-hour mark, with service issues often becoming "unrecoverable" after 3-4 days.

"The data tells us if someone has an issue, we do effective service recovery, they might actually be more loyal than if they never had anything go wrong in the first place," Messerli explained. "They know should the worst happen, they are going to be taken care of."

This creates a competitive moat for NRC Health's real-time feedback platform, which enables rapid service recovery that HCAHPS-only survey methods—with longer data collection periods—cannot match.

The Demographic Challenge in HCAHPS

The webcast highlighted a significant demographic skew in HCAHPS responses that affects how hospitals can improve scores. According to NRC Health's database, 63% of all HCAHPS responses come from patients aged 65 and over.

"I've had reviews that I've done for clients recently where that number has climbed to 70%, 75%, and even one example where 80% of all feedback that client was receiving for HCAHPS came via that 65 and over age group," Messerli noted. "That's going to be a really difficult population to move the needle with. They're probably more medically complex. They have more comorbidities."

This demographic concentration underscores the value of NRC Health's contemporary feedback tools, which capture a more representative patient sample to drive improvement strategies.

CMS's 2025 addition of web-based survey administration as an HCAHPS option represents an opportunity for NRC Health to help clients reach previously underrepresented patient populations.

Stock Performance and Valuation

NRC Health shares have doubled from their 52-week low of $10.13 in April 2025, closing at $20.29 today (-2.9%). The rally reflects improving fundamentals under new CEO Trent Green, who joined from Amazon One Medical in June 2025.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $36.9 | $33.6 | $34.0 | $34.6 |

| EBITDA Margin | 30.1%* | 30.2%* | 9.8%* | 28.7%* |

| Total Recurring Contract Value ($M) | — | $134.4 | — | $141.7 |

*Values retrieved from S&P Global

Total Recurring Contract Value (TRCV) has grown for three consecutive quarters, reaching $141.7 million in Q3 2025—an 8% year-over-year increase. Management has positioned TRCV growth as a leading indicator for revenue recovery.

The company raised its quarterly dividend 33% to $0.16 per share in October 2025 and has been actively repurchasing shares, returning $28.1 million to shareholders through dividends and buybacks during 2025.

Competitive Positioning

NRC Health operates in a concentrated market. Only five organizations hold CMS-approved vendor status for all seven CAHPS survey types. The field narrows further when including both patient experience and employee engagement survey capabilities.

CEO Trent Green has emphasized two key differentiators since joining:

-

Healthcare-only focus: Unlike horizontal competitors, NRC Health is purpose-built for healthcare, understanding the unique regulatory, cultural, and operational realities of health systems.

-

In-house implementation model: The company doesn't outsource implementations or rely on impersonal support lines, instead providing dedicated teams that accelerate time-to-value.

Recent partnership wins with BJC HealthCare, Mosaic Life Care, North Mississippi Health Services, and South Shore Health demonstrate continued momentum in the competitive landscape.

What to Watch

Q4 2025 Earnings: February 3, 2026. Key metrics to monitor include TRCV growth trajectory and any commentary on FY 2026 outlook.

CMS LEAD Model: CMS confirmed the ACO REACH model will conclude at the end of 2026, with a new 10-year accountable care model called LEAD launching in 2027. NRC Health will continue as a CMS-approved survey vendor through the transition.

FY 2030 HCAHPS Changes: The regulatory shift to nine equally weighted HCAHPS dimensions, including care coordination as a standalone measure, creates an upgrade cycle opportunity as hospitals recalibrate their improvement strategies.