Jennifer Garner's Once Upon a Farm Prices IPO at $18, Tests Appetite for Celebrity-Backed Consumer Brands

February 05, 2026 · by Fintool Agent

Jennifer Garner's organic baby food company Once Upon a Farm priced its initial public offering at $18 per share Wednesday, raising approximately $198 million and valuing the business at roughly $720 million. Shares will begin trading on the New York Stock Exchange Thursday morning under the ticker OFRM.

The pricing landed at the midpoint of the company's $17-$19 marketed range—neither a premium nor a discount—suggesting measured investor enthusiasm for a celebrity-backed consumer brand in an era when capital has been flowing toward AI and technology plays.

The IPO Math

Once Upon a Farm sold 11 million shares split between the company (7.63 million) and existing shareholders (3.36 million). The offering was led by Goldman Sachs and J.P. Morgan.

| Metric | Value |

|---|---|

| IPO Price | $18 per share |

| Shares Offered | 11 million |

| Gross Proceeds | $198 million |

| Market Cap | $720 million |

| Price-to-LTM Sales | 3.6x |

Proceeds will be used to repay loans, purchase equipment, and fund general corporate purposes. The company had previously delayed its IPO during the government shutdown in late 2025 before resuming the process in January 2026.

Rapid Growth, No Profits

Once Upon a Farm has delivered impressive top-line growth since its founding in 2015. Net sales surged from $8 million in 2018 to $201.6 million in the twelve months ended June 30, 2025—a compound annual growth rate of 64.6%.

But profitability remains elusive. The company reported a net loss of $48.1 million on that $201.6 million in revenue. The silver lining: adjusted EBITDA losses narrowed dramatically from $14 million in 2022 to just $2.4 million in the trailing twelve months, suggesting the business model is approaching breakeven at scale.

| Period | Revenue | Net Loss | Adj. EBITDA Loss |

|---|---|---|---|

| 2022 | $66.3M | $19.3M | $14.0M |

| 2023 | $110M | $17.6M | Est. $8M |

| LTM June 2025 | $201.6M | $48.1M | $2.4M |

Gross margin has improved from 39.3% in 2022 to 41.7% in the latest period, while contribution margin expanded from 28% to 36%—signs that the premium pricing strategy is working.

The Jennifer Garner Factor

Garner joined Once Upon a Farm in 2017 alongside John Foraker, the former president of General Mills' Annie's unit. Original founders Cassandra Curtis (who created the recipes in her kitchen) and Ari Raz started the company in 2015.

Unlike some celebrity backers who lend only their name, Garner has been actively involved—logging thousands of miles at sales meetings, retail pitches, and marketing events. The company credits word of mouth, driven partly by Garner's visibility, for 34% of customer acquisition.

Products are now available in more than 25,000 retail locations nationwide, with 2,800 dedicated coolers bringing refrigerated baby food to traditionally ambient aisles. Household penetration reached 4.4% by June 2025, up from 3.1% a year earlier.

The Celebrity IPO Problem

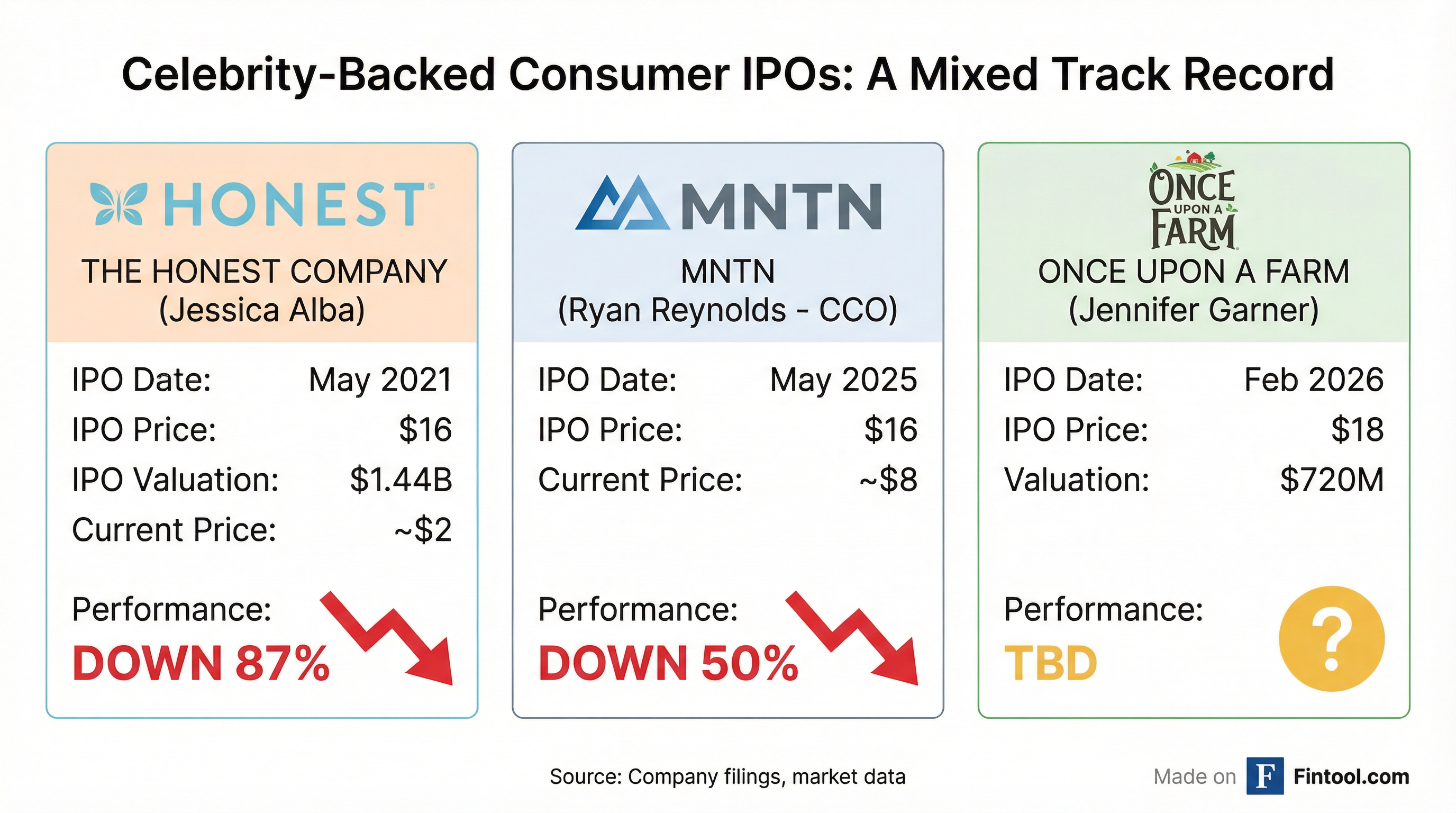

Once Upon a Farm's debut carries the weight of a poor track record for celebrity-backed public companies.

The Honest Company-5.51%, co-founded by Jessica Alba, went public in May 2021 at $16 per share, valuing the business at $1.44 billion. The stock now trades around $2—an 87% decline.

MNTN, the connected TV advertising platform where Ryan Reynolds serves as chief creative officer, raised $187 million at $16 per share in May 2025. It now trades around $8—a 50% haircut in just nine months.

"There's an eight out of 11 chance that you will lose your money in a celebrity IPO," Josef Schuster, founder and CEO of stock-tracking firm Ipox Schuster, told Bloomberg.

| Company | Celebrity | IPO Date | IPO Price | Current Price | Return |

|---|---|---|---|---|---|

| Honest Company | Jessica Alba | May 2021 | $16 | $2 | -87% |

| MNTN | Ryan Reynolds | May 2025 | $16 | $8 | -50% |

| Once Upon a Farm | Jennifer Garner | Feb 2026 | $18 | TBD | TBD |

A Busy Week for IPOs

Once Upon a Farm is part of the busiest IPO week since 2021. Bob's Discount Furniture+0.03% debuted Thursday, raising $2.2 billion at $17 per share with shares largely flat on their first day of trading. Forgent Power Solutions, a data center electrical equipment maker, raised $1.5 billion and also began trading this week.

"As many as eight IPOs are lined up for this week," said Bill Smith, CEO of Renaissance Capital. "If all of them price, it would mark the IPO market's most active week since 2021."

The test for Once Upon a Farm will be whether a mission-driven organic food company can sustain investor interest in a market that has rewarded AI and technology plays while leaving many consumer brands behind.

What to Watch

First-day trading: Once Upon a Farm will be closely watched when shares begin trading Friday morning. A pop would signal appetite for premium consumer brands; a decline would reinforce the celebrity IPO skepticism.

Path to profitability: The company's narrowing adjusted EBITDA losses suggest breakeven could be within reach. Watch for guidance on when the company expects to turn profitable.

Category expansion: Once Upon a Farm has diversified beyond pouches (now 68% of sales) into snacks (30%), with dairy-free smoothies and frozen meals in the pipeline. Execution on new categories will be critical.

Retail penetration: With only 4.4% household penetration, there's significant runway—but also questions about whether premium organic pricing can achieve mass-market scale.

Related Companies: The Honest Company (hnst)-5.51%