Oracle Bondholders Sue Over 'Blindsiding' $38 Billion AI Debt

January 14, 2026 · by Fintool Agent

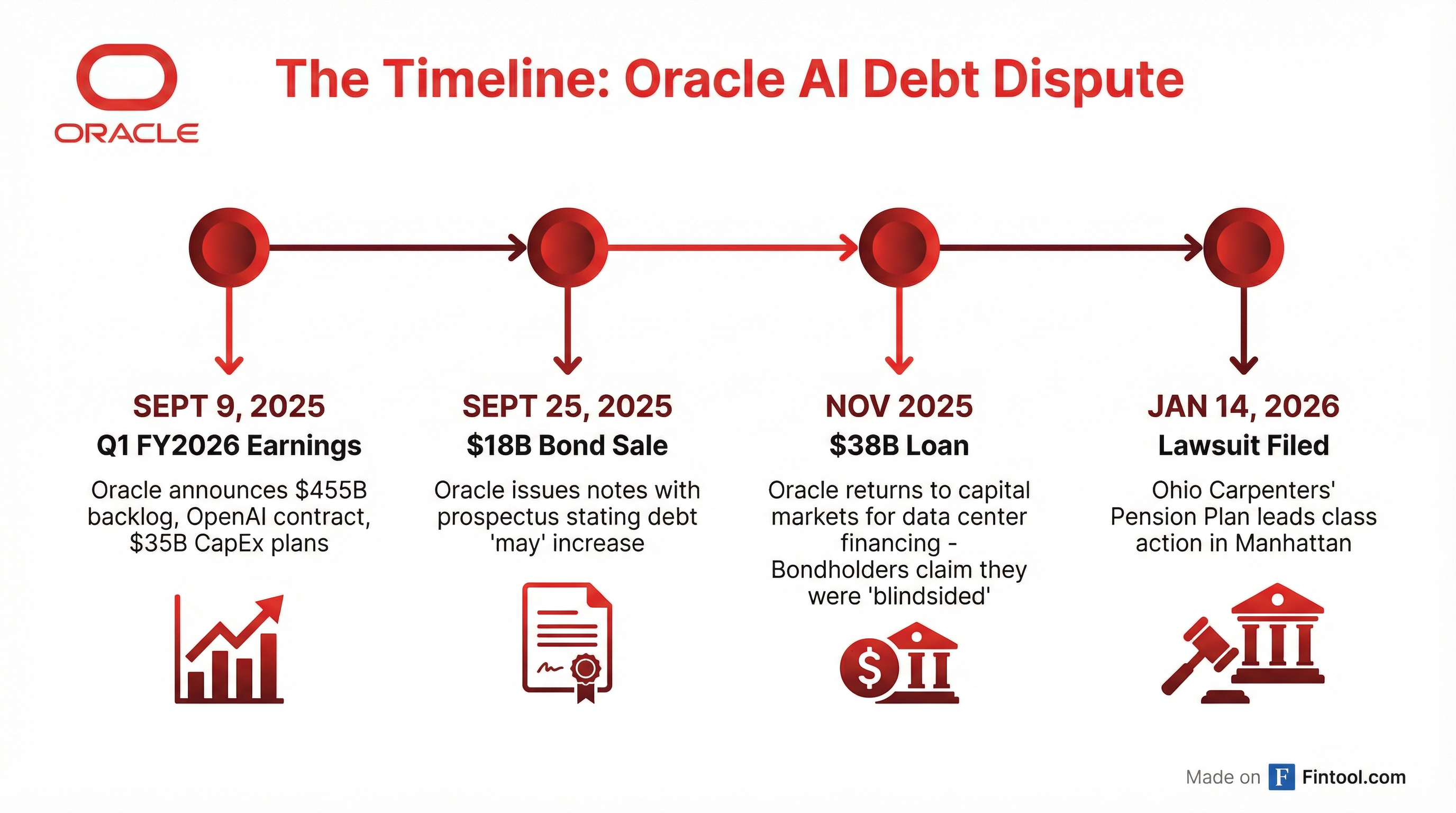

Bondholders who bought $18 billion of Oracle debt in September 2025 filed a class action lawsuit Wednesday, alleging the company concealed plans to raise $38 billion more just seven weeks later—flooding the market with additional debt and cratering the value of their bonds.

Oracle shares fell 4.3% to $193.59 on the news, extending a brutal decline that has wiped 44% off the stock since its July 2025 peak.

The lawsuit, filed in New York state court in Manhattan, names Oracle Chairman Larry Ellison, former CEO Safra Catz, Chief Accounting Officer Maria Smith, and 16 underwriting banks. The plaintiffs, led by the Ohio Carpenters' Pension Plan, seek unspecified damages under the Securities Act of 1933.

The Core Allegation: "May" vs. "Would"

The crux of the complaint centers on a single word in Oracle's September 25 bond offering documents: the prospectus stated Oracle "may" need to borrow additional funds in the future.

Bondholders argue this was false—Oracle wasn't uncertain about future borrowing; the company was already planning a massive $38 billion loan to build data centers for its $300 billion OpenAI contract.

"The bond market's reaction to Oracle's additional debt was swift and bracing," the complaint states. When the November loan was announced, bond prices fell sharply as yields and spreads widened to levels comparable with lower-rated companies.

The Debt Explosion

Oracle's balance sheet tells the story. Total debt has surged from $99.5 billion in Q2 2025 to $131.7 billion by Q2 2026—a $32.2 billion increase in just one year.

| Metric | Q2 2025 | Q4 2025 | Q2 2026 | Change |

|---|---|---|---|---|

| Total Debt | $99.5B | $109.0B | $131.7B | +$32.2B (+32%) |

| Net Debt | $88.2B | $97.7B | $112.0B | +$23.8B (+27%) |

| Net Debt / EBITDA | 3.8x | 3.4x | 3.7x | — |

| Total Assets | $148.5B | $168.4B | $205.0B | +$56.5B (+38%) |

*Values retrieved from S&P Global

The September 2025 bond issuance included notes with maturities stretching to 2065, at rates ranging from 4.45% to 6.10%. The underwriting syndicate included Goldman Sachs, JPMorgan, Citigroup, Deutsche Bank, HSBC, and Bank of America Securities—all named as defendants.

The OpenAI Contract That Changed Everything

The lawsuit traces Oracle's financing frenzy to a single catalyst: the September 2025 announcement of a $300 billion, five-year contract to supply OpenAI with computing power.

On Oracle's Q1 FY2026 earnings call—two weeks before the bond sale—CEO Safra Catz outlined the scale of investment required:

"I now expect fiscal year 2026 CapEx will be around $35 billion. As a reminder, the vast majority of our CapEx investments are for revenue-generating equipment that is going into the data centers and not for land or buildings."

Catz also revealed that remaining performance obligations (RPOs) had exploded to $455 billion, up 359% year-over-year. The OpenAI deal was described as part of Oracle's transformation into "the go-to place for AI workloads."

The Investment Case: Growth vs. Leverage

Oracle bulls point to the company's accelerating cloud infrastructure revenue—up 68% year-over-year to $4.1 billion in Q2 FY2026. The OpenAI contract alone could generate $60 billion annually once fully ramped.

But the lawsuit highlights the tension between growth and financial risk. With net debt now at 3.7x EBITDA and total debt exceeding $131 billion, Oracle is operating with leverage more typical of a private equity buyout than a technology company.*

The bond market has already rendered its verdict: Oracle debt now trades at yields and spreads comparable to speculative-grade credits, despite carrying investment-grade ratings.

| Metric | Oracle | Microsoft | Amazon |

|---|---|---|---|

| Total Debt | $131.7B | $47.0B | $58.3B |

| Debt/Equity | 432% | 31% | 73% |

| Net Debt/EBITDA | 3.7x | Net Cash | 0.8x |

*Values retrieved from S&P Global

What to Watch

Immediate catalysts:

- Court response: Oracle has not commented on the lawsuit. The company's defense will likely hinge on whether the prospectus language met legal disclosure requirements.

- Credit rating agencies: Moody's and S&P have maintained investment-grade ratings despite leverage concerns. A downgrade to junk would trigger selling from funds restricted to investment-grade holdings.

- Q3 FY2026 earnings (expected March 2026): Investors will scrutinize whether RPO-to-revenue conversion is tracking to plan and if additional financing will be required.

The bigger picture: This lawsuit isn't just about Oracle—it's a test case for how aggressively tech companies can lever up to fund AI infrastructure. With Microsoft, Amazon, and Google also racing to build out data center capacity, the outcome may shape disclosure practices across the industry.