Orion Group Holdings Acquires J.E. McAmis for $60M to Dominate West Coast Marine Construction

February 04, 2026 · by Fintool Agent

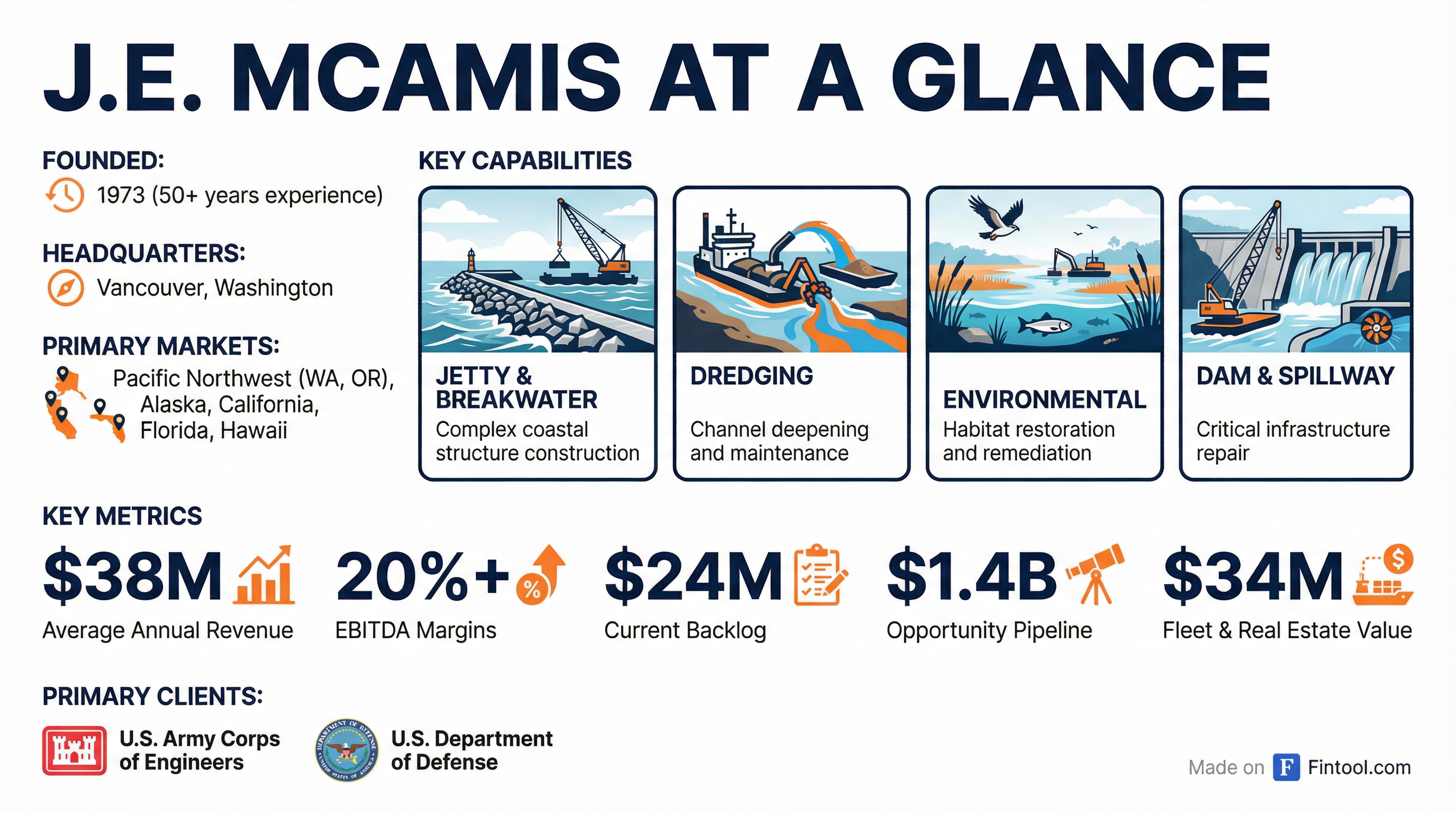

Orion Group Holdings completed its first acquisition in nearly a decade, purchasing Pacific Northwest marine contractor J.E. McAmis for $60 million in a deal that adds 20%+ EBITDA margin business and a $1.4 billion project pipeline.

The acquisition, announced this morning and discussed on a conference call hosted by CEO Travis Boone and CFO Allison Vasquez, marks a strategic pivot for the Houston-based specialty contractor as it positions for a wave of federal defense infrastructure spending in the Pacific.

The Deal

Orion is paying approximately $60 million for J.E. McAmis, Inc. and JEM Marine Leasing LLC, structured as follows:

| Component | Amount | Details |

|---|---|---|

| Cash | $46M | Funded via new credit facility |

| Promissory Note | $12M | 5-year term, 6% interest, subordinated |

| ORN Stock | $2M | 182,392 shares |

| Contingent Earnout | Up to $10M+ | Tied to backlog profitability |

Cash at closing was funded through Orion's recently refinanced $120 million credit facility, which includes a $40 million acquisition term loan and $6 million drawn on the revolver. All borrowings bear interest at SOFR + 2.75% and mature in 2030. Post-close leverage sits at approximately 1.0x EBITDA, leaving dry powder for future opportunities.

The earnout structure incentivizes the McAmis team: they receive $10 million upon reaching a minimum profit threshold on backlog projects, plus 40% of profits above that threshold and on select near-term pursuits.

What Orion Gets

McAmis brings a compelling financial profile that should be immediately accretive to Orion's consolidated results:

| Metric | McAmis | Orion Marine (Q3 2025) |

|---|---|---|

| Annual Revenue | $38M average | $135M quarterly run rate |

| EBITDA Margin | 20%+ consistently | 9.4% |

| Backlog | $24M (Dec 2025) | $607M (Q1 2025) |

| Pipeline | $1.4B | Part of $18B total |

The 20%+ margin profile is the standout. Orion's marine segment posted 9.4% adjusted EBITDA margins in Q2 2025 , meaning McAmis operates at more than double the margin rate. The company cited McAmis's specialized expertise in jetty and breakwater construction—a capability Orion previously lacked—as the key driver of these superior economics.

"They're too small to be big, and too big to be small," CFO Vasquez noted on the call, explaining why McAmis sought a strategic partner. "For them to do the things they want to do and grow into the markets they want, they needed to be attached to a larger organization."

Strategic Assets

Beyond the P&L, McAmis brings:

- Jones Act marine vessels: ABS-certified barges and specialty equipment critical for federal projects

- Pacific Northwest real estate: Facilities along the Columbia River in Washington state

- Quarry access: Secured relationships with prime stone quarries—essential for jetty construction

- Federal relationships: Deep ties to U.S. Army Corps of Engineers, comprising 80%+ of McAmis revenue

The $34 million appraised value of McAmis's fleet and real estate means Orion is effectively paying a modest premium over asset value for a business generating $8+ million in annual EBITDA.

The Strategic Rationale

This isn't just about buying earnings. Orion is positioning for what CEO Boone calls "significant marine opportunities on the horizon."

The U.S. Navy's Pacific Deterrence Initiative (PDI) is driving billions in infrastructure spending across the Pacific region, and Orion has consistently highlighted its unique ability to operate in these challenging environments. McAmis is already working on a project in the Pacific with its fleet, giving Orion immediate capability in this theater.

"There are very few marine contractors that have the skill, experience and the logistical capacity to work in the Pacific as we do," Boone stated in the company's Q4 2024 earnings call.

The acquisition also addresses a geographic gap. Orion's marine operations have historically concentrated in the Gulf Coast and Atlantic regions. McAmis's strength in Washington, Oregon, Alaska, California, Florida, and Hawaii fills out the national footprint.

McAmis Track Record

Founded in 1973, J.E. McAmis has built a reputation as the go-to contractor for complex jetty projects in harsh conditions.

Signature projects include:

- Columbia River South Jetty: A $170 million rehabilitation completed over five seasons, involving 450,000+ tons of jetty stone (individual stones up to 40 tons). Completed without a lost-time incident.

- Columbia River Deepening: Removed nearly 3 million cubic yards of material to accommodate larger bulk cargo vessels at a critical U.S. export corridor.

- Bonneville Dam Erosion Repair: Underwater work at depths up to 70 feet while maintaining power generation and protecting fish habitat.

- Cape Canaveral North Jetty: Storm resilience project with 13,000+ tons of granite armor stone placed using ABS-certified floating equipment.

The McAmis leadership team—John McAmis Jr. and Scott Vandegrift—will join Orion's executive ranks, with equity ownership and earnouts designed to retain their engagement.

Market Reaction

ORN shares opened at $13.30—up 1% from Monday's close of $13.15—before retreating to trade down 4.1% at $12.61 as of mid-morning. The pullback comes despite the stock hitting a new 52-week high of $13.63 intraday.

The stock has nearly tripled from its 52-week low of $4.64, reflecting the company's operational turnaround over the past two years. Since launching its strategic plan in early 2024:

| Metric | FY 2022 | FY 2024 | Change |

|---|---|---|---|

| Revenue | $748M* | $796M* | +6% |

| EBITDA | $11M* | $31M* | +184% |

| EBITDA Margin | 1.5%* | 3.9%* | +240 bps |

| Backlog | N/A | $729M | — |

*Values retrieved from S&P Global

The Q3 2025 results continued the momentum, with revenue of $225 million and net income of $3.3 million* versus a loss position in prior years.

What to Watch

Near-term catalysts:

- Q4 2025 earnings (next month): Management will provide consolidated 2026 guidance inclusive of McAmis

- Backlog growth: The combined $1.4B McAmis pipeline plus Orion's $18B opportunity set

- Integration execution: Low overhead at McAmis limits cost synergies, but revenue synergies from expanded geographic reach are the play

Key risks:

- Federal spending uncertainty: McAmis's 80%+ Army Corps exposure creates concentration risk if defense budgets shift

- Project execution: Complex marine projects carry inherent execution risk

- Integration: First acquisition since 2017—execution track record is unproven under current management

Analysts appear sanguine. TipRanks notes a Hold rating with a $13.50 price target, suggesting limited near-term upside but validation of the strategic direction.

The Bottom Line

Orion paid roughly 7.5x EBITDA for a business with 20%+ margins, strategic assets valued at $34 million, and a $1.4 billion pipeline of federal projects. The deal immediately improves Orion's margin profile while positioning the company for the coming wave of Pacific defense infrastructure spending.

For a $500 million market cap company that has executed a meaningful turnaround over the past two years, this looks like disciplined capital allocation. The test will be whether management can successfully integrate its first deal in nearly a decade and convert McAmis's pipeline into booked backlog.

Related: