Paramount Sues Warner Bros., Launches Proxy Fight in $108B Battle With Netflix

January 12, 2026 · by Fintool Agent

David Ellison is done asking nicely. After three board rejections in five weeks, Paramount Skydance sued Warner Bros. Discovery in Delaware Chancery Court Monday morning, demanding disclosure of financial details around WBD's pending $82.7 billion deal with Netflix—and announced plans to take its fight directly to shareholders through a proxy battle.

WBD shares dipped 0.6% to $28.37 on the news, trading above Netflix's $27.75 offer but below Paramount's $30 all-cash bid. The stock has more than doubled from its pre-announcement price of $12.54, reflecting the premium shareholders have already captured from this bidding war.

"Unless the WBD board of directors decides to exercise its right to engage with us under the Netflix merger agreement, this will likely come down to your vote at a shareholder meeting," Ellison wrote in a letter to WBD shareholders. "We are committed to seeing our tender offer through."

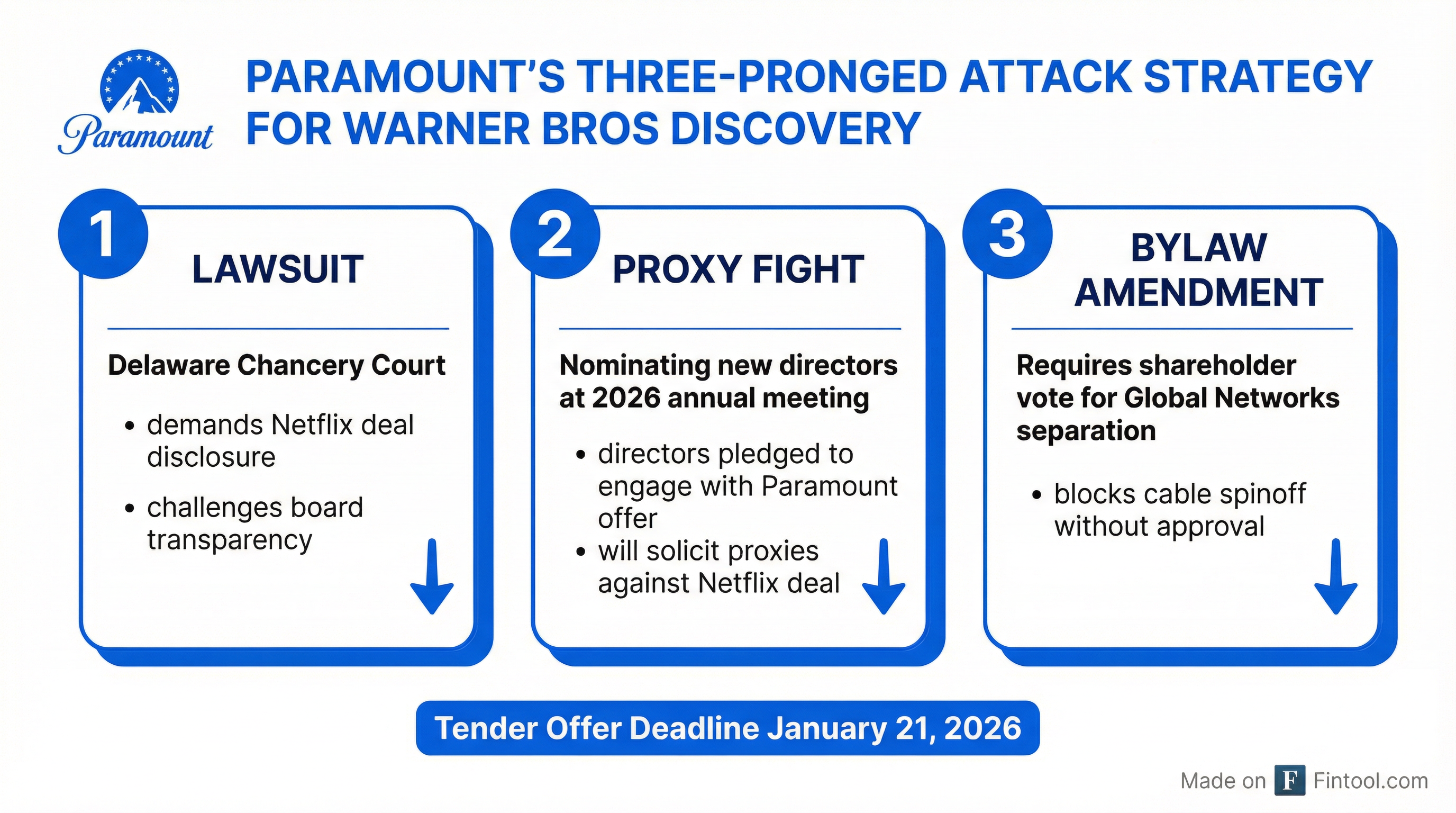

The Three-Pronged Attack

Paramount's escalation Monday represents its most aggressive move yet in the four-month battle for Warner Bros.

1. Delaware Lawsuit: The complaint asks the court to compel WBD to disclose how it valued the Netflix transaction, the Global Networks spinoff equity, and the debt transfer mechanism. Paramount argues Delaware law requires this information for shareholders to make an informed investment decision.

2. Proxy Fight: Paramount will nominate a slate of directors at WBD's 2026 annual meeting "who, in accordance with their fiduciary duties, will exercise WBD's right under the Netflix Agreement to engage on Paramount's offer." The advance notice window opens in approximately three weeks.

3. Bylaw Amendment: Paramount will propose requiring shareholder approval for any separation of Global Networks—the cable business Netflix doesn't want—effectively blocking the Netflix deal's spinoff structure without a shareholder vote.

If WBD calls a special meeting to vote on the Netflix deal before its annual meeting, Paramount said it will "solicit proxies against such approval."

The Math Battle

At the heart of this fight is a fundamental disagreement over what WBD shareholders are actually getting.

Paramount's calculation: $30 all-cash is simply more than Netflix's complex package of $23.25 cash plus Netflix shares "currently worth $4.11 (at Friday's close)" plus Global Networks equity that Paramount has analyzed as having "zero equity value."

WBD's counter: Accepting Paramount's offer would trigger approximately $4.7 billion in costs—including a $2.8 billion Netflix termination fee and $1.5 billion for abandoning a planned debt exchange—effectively reducing the net value. Plus, Netflix's investment-grade balance sheet (A/A3 credit rating) and $400+ billion market cap provide certainty that Paramount's near-junk rating and 6.8x leverage structure cannot.

| Metric | Paramount | Netflix |

|---|---|---|

| Price Per Share | $30.00 (all cash) | $27.75 (cash + stock + spinoff) |

| Enterprise Value | $108.4B | $82.7B |

| Assets Acquired | All WBD assets | Studios, HBO Max (excl. cable) |

| Acquirer Credit Rating | Ba1/BB (near-junk) | A/A3 (investment grade) |

| Pro Forma Leverage | 6.8x Debt/EBITDA | Not disclosed |

| Market Cap | $13B | $400B |

Source: Company filings

What WBD's Board Says

The board has been unequivocal. In three separate rejections, it has characterized Paramount's offer as inferior "across numerous key areas."

"The extraordinary amount of debt financing, as well as other terms of the PSKY offer, heighten the risk of failure to close, particularly when compared to the certainty of the Netflix merger," the board wrote January 7. "PSKY is a company with a $14 billion market capitalization attempting an acquisition requiring $94.65 billion of debt and equity financing, nearly seven times its total market capitalization."

The board also highlighted a sobering precedent: "The transaction PSKY is proposing is in effect a leveraged buyout. In fact, it would be the largest LBO in history."

If Paramount's offer fails to close, WBD shareholders would be left with shares in a business restricted from pursuing key initiatives for up to 18 months, with only $1.1 billion net termination fee as compensation—"an unacceptably low 1.4% of the transaction equity value."

The Stock Price Story

WBD's stock tells the tale of this bidding war:

| Date | Event | Price | Change from Pre-Deal |

|---|---|---|---|

| Sept 10, 2025 | Pre-announcement | $12.54 | — |

| Dec 5, 2025 | Netflix deal announced | $26.08 | +108% |

| Dec 8, 2025 | Paramount hostile bid | $27.23 | +117% |

| Dec 17, 2025 | First board rejection | $28.21 | +125% |

| Dec 22, 2025 | Ellison $40B guarantee | $28.75 | +129% |

| Dec 30, 2025 | Second rejection | $28.91 | +131% |

| Jan 7, 2026 | Third rejection | $28.59 | +128% |

| Jan 12, 2026 | Lawsuit filed | $28.37 | +126% |

Notably, WBD trades above Netflix's $27.75 offer but below Paramount's $30.00—suggesting markets see meaningful probability of the Netflix deal closing, while pricing in some chance Paramount prevails.

What Comes Next

Paramount's tender offer expires January 21, 2026—nine days from now. But the company can extend it, and the proxy fight strategy suggests this battle is far from over.

Key dates ahead:

- January 21, 2026: Paramount tender offer expires (unless extended)

- ~Early February 2026: Advance notice window opens for WBD annual meeting

- Q2-Q3 2026: Expected WBD 2026 annual meeting

- 12-18 months: Expected regulatory timeline for either deal

"We do not undertake any of these actions lightly," Ellison wrote. "Make no mistake, our goal remains to have constructive discussions with WBD's Board to reach an agreement that is in the best interests of WBD shareholders."

The irony isn't lost on anyone: the night before Paramount filed its lawsuit, WBD CEO David Zaslav and Netflix co-CEO Ted Sarandos were seen warmly interacting at the Golden Globes—an awards show broadcast on Paramount's CBS network.

The Bottom Line

Paramount's three-pronged attack puts the fate of this $100+ billion Hollywood battle squarely in the hands of WBD shareholders. The lawsuit seeks transparency; the proxy fight seeks control; the bylaw amendment seeks a vote.

David Ellison, backed by his father Larry's $40 billion personal guarantee, is betting that WBD shareholders will prefer his $30 cash over the board's preferred Netflix deal when given the full picture—and a direct vote.

For WBD shareholders, the choice remains: $30 now from a near-junk-rated acquirer taking on historic leverage, or $27.75 (in cash, stock, and a cable spinoff) from an investment-grade streaming giant with $400 billion behind it.

The board has chosen Netflix—three times. Now Paramount is asking shareholders to overrule them.