Planet Labs Signs 9-Figure Swedish Military Deal as Stock Hits 52-Week High

January 12, 2026 · by Fintool Agent

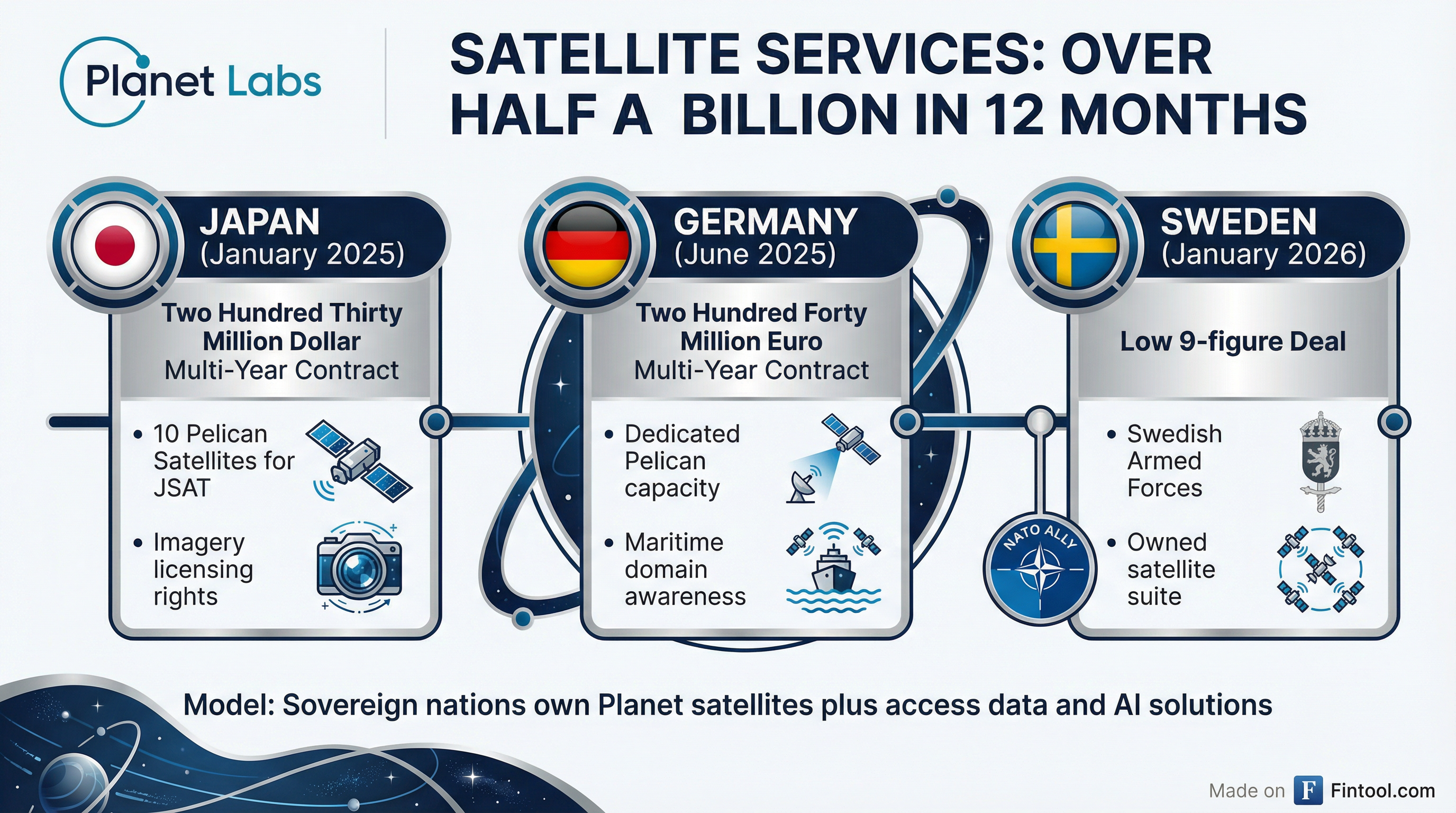

Planet Labs stock surged 11.6% to $25.36 on Monday after the satellite imagery company announced its third major government satellite services contract in twelve months—a multi-year, low 9-figure deal with the Swedish Armed Forces.

The agreement gives Sweden ownership of a dedicated suite of Planet's high-resolution Pelican satellites, along with access to data and AI-enabled intelligence solutions for peace and security operations. The contract marks another validation of Planet's "satellite-as-a-service" model, where sovereign nations purchase dedicated space capabilities without the prohibitive costs of building standalone systems.

"Europe needs its own eyes, and Sweden is leading the way by rapidly securing its own, comprehensive space capability—helping achieve its own security objectives and assisting regional allies, like Ukraine, with timely, critical information," said Will Marshall, Planet CEO and co-founder.

Half a Billion in Twelve Months

The Sweden contract caps a transformative year for Planet's satellite services business. In the past twelve months, the company has signed over $500 million in multi-year government agreements:

| Contract | Value | Customer | Key Terms |

|---|---|---|---|

| January 2025 | $230M | SKY Perfect JSAT (Japan) | 10 Pelican satellites built and operated for JSAT, with imagery licensing rights |

| June 2025 | €240M ($260M) | German Government | Dedicated Pelican capacity, maritime domain awareness |

| January 2026 | Low 9-figures | Swedish Armed Forces | Owned satellite suite, data access, AI solutions |

Revenue from the Sweden deal will be recognized over several years and does not change Planet's previously issued Q4 FY2026 guidance.

The Sovereign Space Imperative

The surge in government satellite services demand reflects a fundamental shift in how allied nations approach space-based intelligence. Rather than building costly proprietary systems, countries are increasingly purchasing turnkey solutions from companies with scaled production capabilities.

Planet operates the largest fleet of Earth observation satellites—over 200 spacecraft across three constellations (SuperDove, Tanager, and Pelican). The company's agile aerospace approach enables rapid deployment and iteration, with multiple Pelican launches scheduled for the coming year.

The timing aligns with heightened global security concerns. NATO allies, in particular, are seeking independent surveillance capabilities to monitor strategic threats and support regional partners. Sweden's explicit mention of Ukraine in the announcement underscores how geopolitical tensions are driving demand for sovereign space infrastructure.

Financial Trajectory Accelerates

Planet's satellite services wins are fueling a broader business transformation. The company's most recent quarter showed continued momentum:

| Metric | Q3 2025 | Q3 2026 | YoY Change |

|---|---|---|---|

| Revenue | $61.3M | $81.3M | +33% |

| Gross Profit | $37.5M | $46.6M | +24% |

| Cash from Operations | $4.1M | $28.6M | +602% |

Defense and intelligence revenue accelerated to approximately 41% year-over-year growth in the most recent quarter, driven by both core data solutions and satellite services contracts.

The company's backlog stood at $736.1 million at the end of Q2 FY2026—up 245% year-over-year—providing strong visibility into revenue over the next 12-24 months.

What's Next

Planet's pipeline continues to mature, with management signaling aggressive pursuit of additional satellite services opportunities. The company now expects to be free cash flow positive for the full fiscal year—over a year ahead of its prior target.

Key catalysts to watch:

- Additional satellite services wins: Management noted strong demand signals and a maturing pipeline

- Pelican constellation expansion: Multiple launches scheduled for the coming year, with production line fully ramped

- Q4 FY2026 earnings: Expected in March, will provide updated guidance incorporating Sweden revenue

The Sweden deal positions Planet at the intersection of three powerful trends: the global AI transformation (which drives demand for Earth observation data), the space commercialization wave, and the post-Ukraine geopolitical realignment pushing allies toward sovereign capabilities.

For investors, the question is whether the current valuation—now approaching $8 billion market cap—adequately prices in the satellite services opportunity or if there's further upside as the model scales.