ClassPass Owner Playlist Merges With EGYM in $7.5B Fitness Tech Mega-Deal

January 15, 2026 · by Fintool Agent

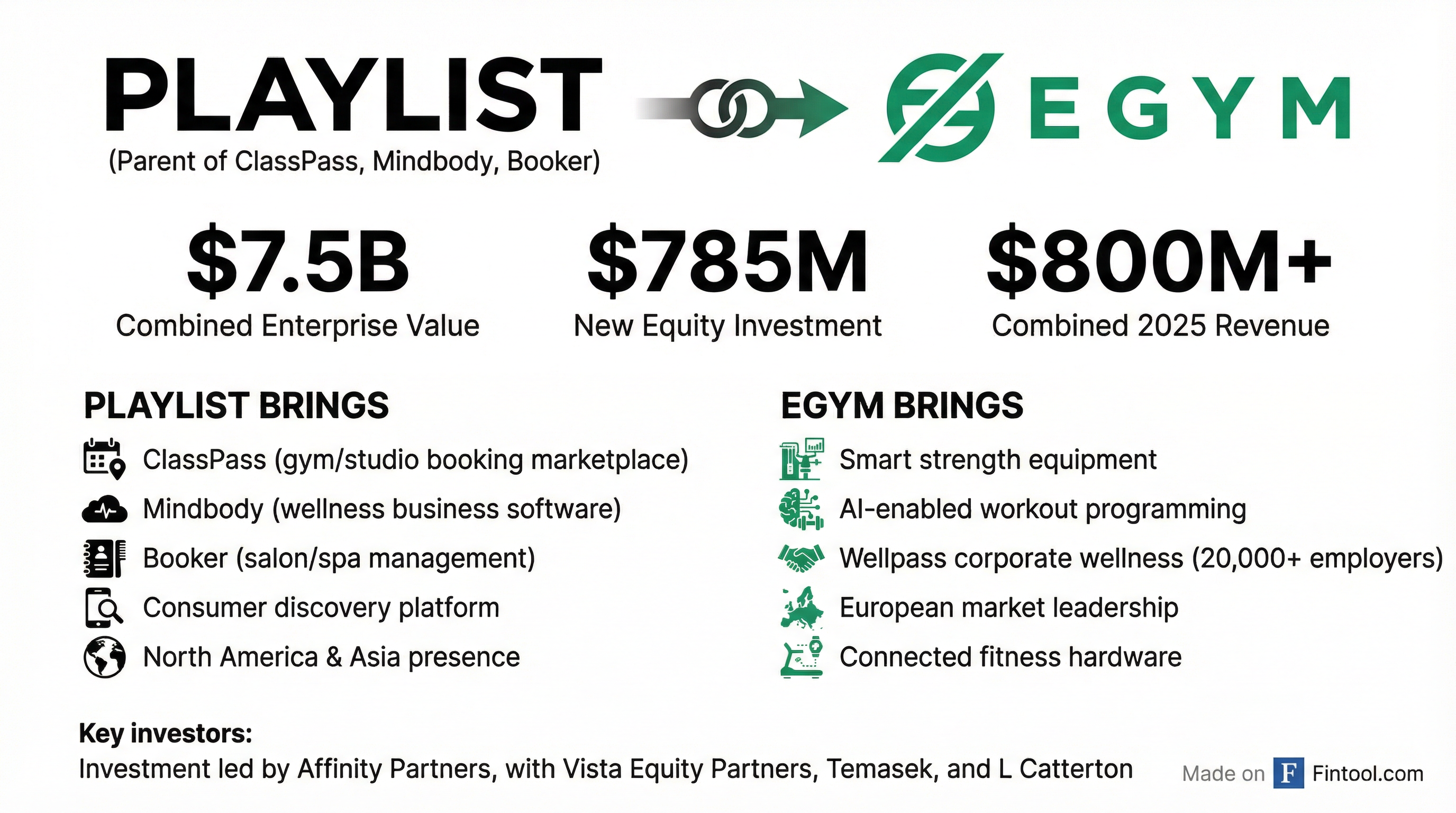

The fitness technology industry just got its defining consolidation. Playlist, the parent company of ClassPass, Mindbody, and Booker, announced today it will merge with German fitness equipment maker EGYM in a transaction valuing the combined enterprise at $7.5 billion — creating the most comprehensive wellness technology platform ever assembled.

The deal includes $785 million in fresh equity investments led by Affinity Partners, the investment firm founded by Jared Kushner, with participation from Vista Equity Partners, Temasek, and L Catterton.

The Deal Structure

The merger brings together two complementary businesses that have each achieved unicorn status independently:

| Company | Pre-Merger Valuation | What It Brings |

|---|---|---|

| Playlist (ClassPass, Mindbody, Booker) | $2.5B (estimated) | Consumer booking platform, wellness software, 85M+ users |

| EGYM | $1.2B+ (Sept 2024) | Smart fitness equipment, AI training, 20,000+ employer wellness clients |

The combined entity generated more than $800 million in net revenue in 2025, positioning it as the dominant player in a fragmented industry.

Why This Deal Matters

The transaction addresses a fundamental challenge in fitness: technology fragmentation. Today, a gym owner might use one system for scheduling, another for payments, different equipment with incompatible software, and yet another platform for corporate wellness partnerships.

"By joining forces, Playlist and EGYM are poised for even greater impact in wellness and preventative health," said Fritz Lanman, Playlist CEO and ClassPass Founding Chairman, who will serve as Co-Founder of the combined organization.

EGYM CEO Philipp Roesch-Schlanderer, who will become Co-Chairman alongside Vista Equity Partners' Monti Saroya, framed the strategic logic: "We are uniting smart training equipment, club and studio access, management software, corporate wellness, and personalized AI training into one connected ecosystem."

The deal creates value across three constituencies:

- For Consumers: A single platform to discover, book, and track fitness experiences across 85+ countries

- For Gym Operators: Integrated software, equipment, and marketplace access to drive membership and retention

- For Employers: A comprehensive wellness benefit that connects employees to thousands of fitness facilities

The Kushner Connection

The involvement of Affinity Partners adds political intrigue to what would otherwise be a straightforward tech consolidation. Kushner's firm, which received a controversial $2 billion commitment from Saudi Arabia's Public Investment Fund in 2022, is leading the equity investment.

Affinity Partners has previously faced scrutiny over its fee structure and returns. A 2024 Senate investigation found the firm had collected over $157 million in management fees from foreign investors while generating no profits.

The Playlist-EGYM deal represents a more conventional private equity play — backing a profitable, growing business with clear synergies — though Kushner's role as lead investor will likely draw continued attention.

The Road to Consolidation

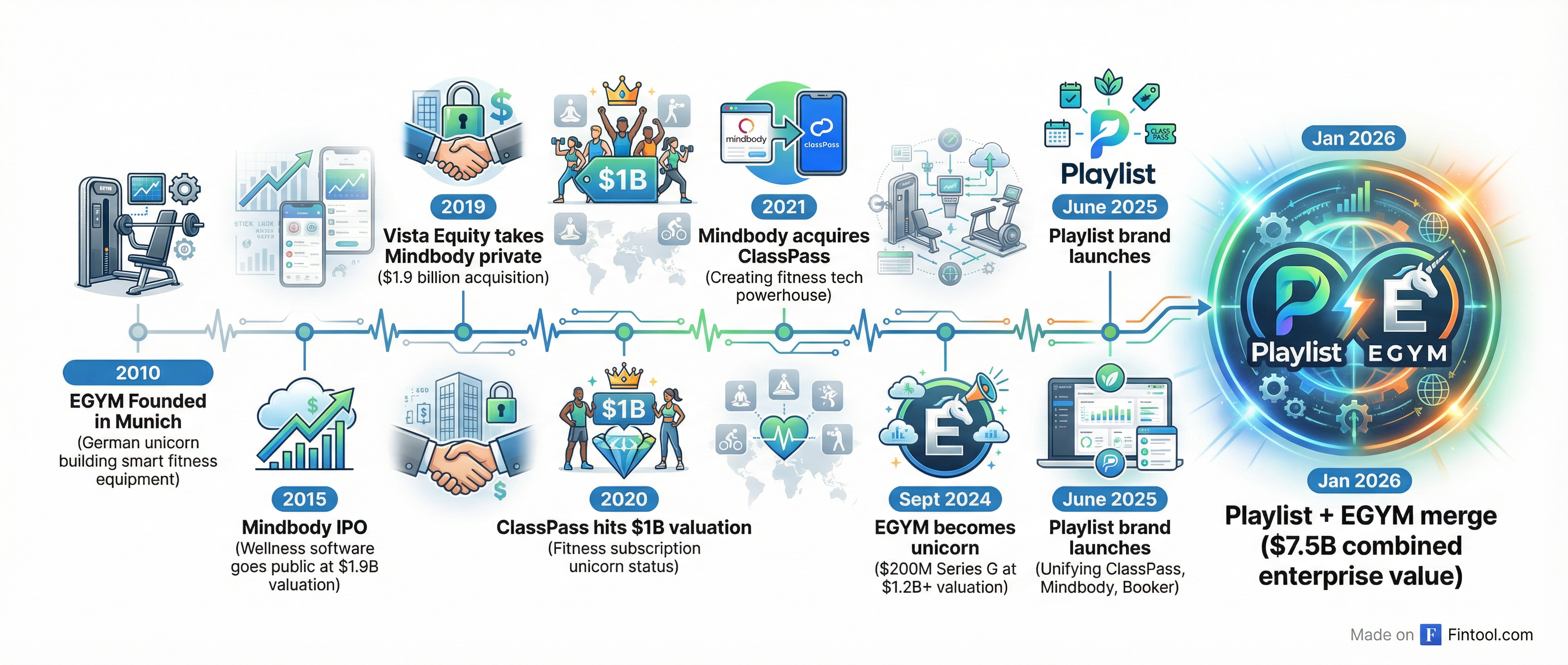

This merger caps years of industry consolidation:

- 2019: Vista Equity Partners takes Mindbody private for $1.9 billion

- 2020: ClassPass achieves $1 billion valuation in January funding round

- 2021: Mindbody acquires ClassPass, with Sixth Street investing $500 million

- 2024: EGYM raises $200 million at $1.2 billion+ valuation from L Catterton and Meritech

- June 2025: Mindbody-ClassPass rebrands as Playlist

- January 2026: Playlist and EGYM announce merger

The timing shelves earlier IPO ambitions. In 2024, the combined Mindbody-ClassPass had floated plans to go public within 12-18 months.

What Each Side Brings

Playlist's Consumer Empire

Playlist's brands have become synonymous with fitness discovery:

- ClassPass: The leading fitness marketplace, allowing users to book classes at 30,000+ studios and gyms across 85 countries with a credit-based subscription model

- Mindbody: SaaS platform powering 60,000+ fitness, beauty, and wellness businesses with scheduling, payments, and marketing tools

- Booker: Specialized software for salons and spas

The platform benefits from powerful network effects: as more consumers join ClassPass, studios get more bookings; as more studios join, consumers have more options.

EGYM's Hardware-Software Stack

EGYM takes a different approach — vertically integrated connected fitness:

- Smart Strength Equipment: Machines that automatically adjust resistance and track performance

- EGYM Genius: AI-powered platform that makes entire gym floors "smart" by connecting any equipment

- Wellpass: Corporate wellness network partnering with 20,000+ employers to provide employee fitness benefits

Founded in Munich in 2010 by Philipp Roesch-Schlanderer and Florian Sauter (both Technical University of Munich graduates), EGYM has raised over $580 million to date.

The Wellness Spending Tailwind

The deal capitalizes on secular growth in wellness spending. According to McKinsey, Americans spend over $500 billion annually on wellness, growing 4-5% per year. Gen Z and millennials drive more than 41% of this spending.

Corporate wellness represents a particularly attractive segment. Employers increasingly view fitness benefits as essential for talent retention and healthcare cost management — a thesis EGYM's Wellpass has proven at scale.

What to Watch

Integration Risk: Combining consumer-facing booking platforms with B2B equipment and corporate wellness represents operational complexity. Management will need to demonstrate that synergies justify the premium.

AI Execution: Both companies tout AI capabilities — Playlist for discovery and recommendations, EGYM for personalized training. The combined platform's ability to leverage data across the full fitness journey will be key.

Geographic Expansion: EGYM brings strong European presence; Playlist dominates North America and Asia. Cross-selling Wellpass to Playlist's existing corporate relationships offers clear upside.

Capital Structure: With $785 million in fresh equity and deep-pocketed sponsors (Vista, Temasek, L Catterton), the company has firepower for continued M&A or an eventual IPO.

The deal is expected to close in the first half of 2026, subject to regulatory approvals.

Related