Quantum Taps Turnaround Specialist as CFO After 8 Months Without Permanent Finance Chief

February 2, 2026 · by Fintool Agent

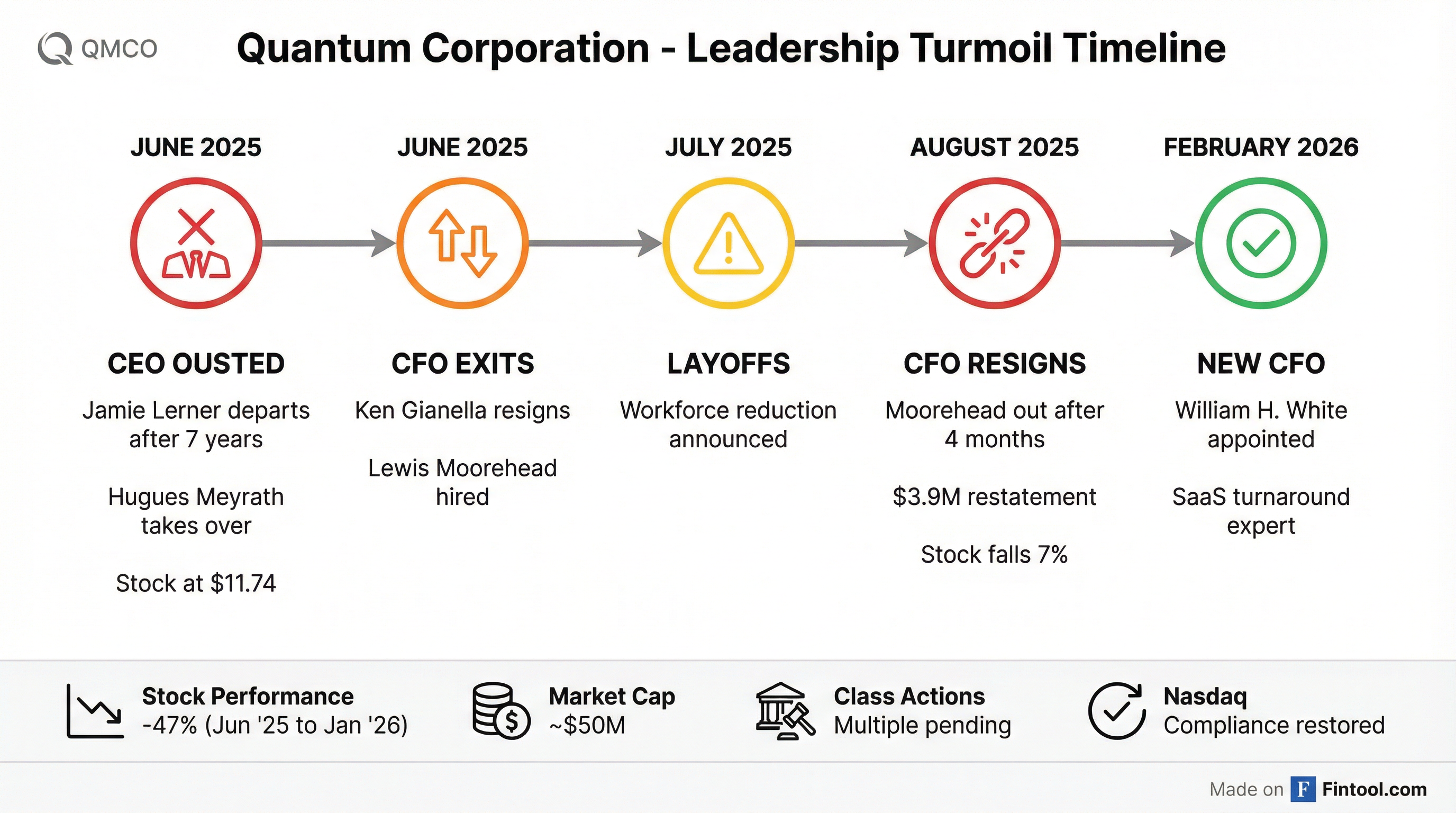

Quantum Corporation (NASDAQ: QMCO) named William H. White as Chief Financial Officer effective immediately, ending an eight-month search that followed two CFO departures and a sweeping management overhaul that has seen the stock lose nearly half its value.

White, 44, most recently served as CFO and Head of Revenue Operations at Emotive, a venture-backed SaaS company, where he led a three-year financial and operational turnaround that improved EBITDA by more than $30 million and culminated in a successful strategic exit. His appointment signals that CEO Hugues Meyrath—himself installed just eight months ago amid a boardroom shakeup—is betting that operational discipline and systems expertise can stabilize a company battered by accounting missteps, leadership churn, and securities litigation.

"Will brings an exceptional combination of financial discipline, operational leadership, and strategic vision to help drive Quantum's execution at this stage of our journey," said Meyrath.

A Company in Crisis Mode

The CFO appointment caps a turbulent eight months that fundamentally reshaped Quantum's leadership and tested investor patience.

June 2025 marked the beginning of the upheaval when CEO Jamie Lerner—who had led the company since 2018—resigned and was replaced by board member Hugues Meyrath. The same announcement revealed the departure of CFO Ken Gianella and Chief Administrative Officer Brian Cabrera. The company framed the changes as supporting "efforts to transform Quantum's ability to deliver consistent profitability and growth."

Lewis Moorehead was hired as the new CFO—only to resign four months later in August 2025 amid an accounting review that led to a $3.9 million revenue restatement for fiscal Q3 2025. The company said there was "no indication of fraud or other intentional misconduct" but the damage was done.

Shares fell 7% on the CFO resignation news, and the stock has continued to slide. From $11.74 on the day of the CEO change in June 2025, QMCO now trades around $6.20—a 47% decline that has wiped out roughly $40 million in market value.

The company also received Nasdaq delisting warnings for delayed filings and faces multiple securities fraud class action lawsuits covering the period from November 2024 through August 2025.

Why White?

White's background suggests Meyrath is prioritizing operational transformation over capital markets polish. Prior to Emotive, White served as Managing Partner at Goldblum Lentz & Co., where he advised on mergers, acquisitions, and capital transactions. He has led "numerous enterprise system transformations, accelerating close cycles and improving financial transparency for executive teams and institutional investors."

At Emotive, he wasn't just a traditional CFO—he also ran Revenue Operations, giving him a ground-level view of how financial decisions translate into sales execution.

"Quantum has a unique opportunity to lead in managing data across its entire lifecycle, especially as organizations are looking to retain all data to leverage AI," White said in his first public statement. "I look forward to working together with Hugues and the leadership team to strengthen execution, enhance financial performance, and support the company's long-term growth strategy."

Compensation Package

White's pay package is structured to align his interests with shareholders while providing competitive base compensation :

| Component | Amount | Details |

|---|---|---|

| Base Salary | $375,000 | Annual, subject to withholdings |

| Target Bonus | 50% of salary | Based on company and individual performance |

| RSUs | 25,000 units | Vesting in 3 equal annual installments |

| PSUs | 25,000 units | Performance-based metrics set by board committee |

| Severance (non-CoC) | 6 months salary | Plus 6 months COBRA |

| Severance (CoC) | 12 months salary + bonus | Plus full equity acceleration |

The equity grants are being made under Quantum's 2021 Inducement Plan and are expected to be effective March 2, 2026.

Recent Financial Performance

Despite the turmoil, Quantum delivered a revenue beat in its preliminary Q3 fiscal 2026 results announced in January. The company reported approximately $72.7 million in revenue, above the high end of guidance of $69 million ($67 million ± $2 million).

| Metric | Q3 FY26 Preliminary |

|---|---|

| Revenue | $72.7M (beat guidance) |

| GAAP Gross Margin | 38% |

| GAAP Operating Expenses | $28.1M |

| Non-GAAP Adjusted OpEx | $26.9M |

The company expects to report full results by mid-February 2026.

What to Watch

Near-term catalysts:

- Full Q3 FY2026 earnings release (expected mid-February)

- First earnings call with White participating

- Progress on Nasdaq compliance requirements

- Updates on securities litigation

Key questions for investors:

- Can White accelerate the close cycle and restore confidence in financial reporting?

- Will the operational improvements at Emotive translate to a hardware/software company?

- How quickly can the new CFO stabilize investor relations after months of turmoil?

- What's the path to resolving the pending class action lawsuits?

The Bottom Line

Quantum's hiring of White represents a bet that operational turnaround expertise can translate from venture-backed SaaS to public-company data storage. At a $50 million market cap and 47% off its June highs, the stock prices in substantial execution risk—but also offers leverage if the new management team can deliver.

The company has stabilized enough to beat revenue guidance last quarter, but the CFO seat had been empty for eight months and the shadow of accounting issues, delisting warnings, and class action lawsuits continues to loom. White's track record of improving EBITDA by $30+ million at Emotive is encouraging, but transforming a 40-year-old hardware company with declining hyperscaler sales is a different challenge than turning around a venture-backed software startup.

Investors should watch closely for White's first earnings call appearance and any updates on the company's internal control remediation efforts.

Related: