Rio Tinto Walks Away From $260 Billion Glencore Mega-Merger

February 5, 2026 · by Fintool Agent

Rio Tinto walked away from talks to acquire Glencore at the stroke of the UK Takeover Panel's deadline Thursday, scuttling what would have been the largest deal in mining history and the third failed attempt in 12 years to combine the global commodities giants.

Glencore shares plunged as much as 10.8% before closing down 7% at 467 pence, while Rio Tinto fell 2.6% to 6,820 pence in London trading.

The Deal That Wasn't

The proposed all-share merger, first disclosed on January 8, would have created a mining behemoth with combined market value exceeding $260 billion—larger than BHP, the current industry leader. The combined entity would have dominated global production of iron ore, copper, cobalt, and zinc, with unrivaled exposure to the energy transition metals driving data center construction and electric vehicle adoption.

Rio Tinto's filing was terse: the company "is no longer considering a possible merger or other business combination with Glencore" after determining "it could not reach an agreement that would deliver value to its shareholders."

Glencore's response was considerably more pointed. The Swiss-based trader said the proposed terms "significantly undervalued Glencore's underlying relative value contribution to the combined group," particularly its copper business and growth pipeline. The deal structure would have given Rio Tinto both the chairman and CEO positions—a governance arrangement Glencore's board found unacceptable for a transaction lacking a control premium.

HSBC analysts had estimated Glencore shareholders would need approximately 38% of a combined company to reflect fair value, implying a takeover premium of roughly 30% over undisturbed share prices.

A Decade of Failed Attempts

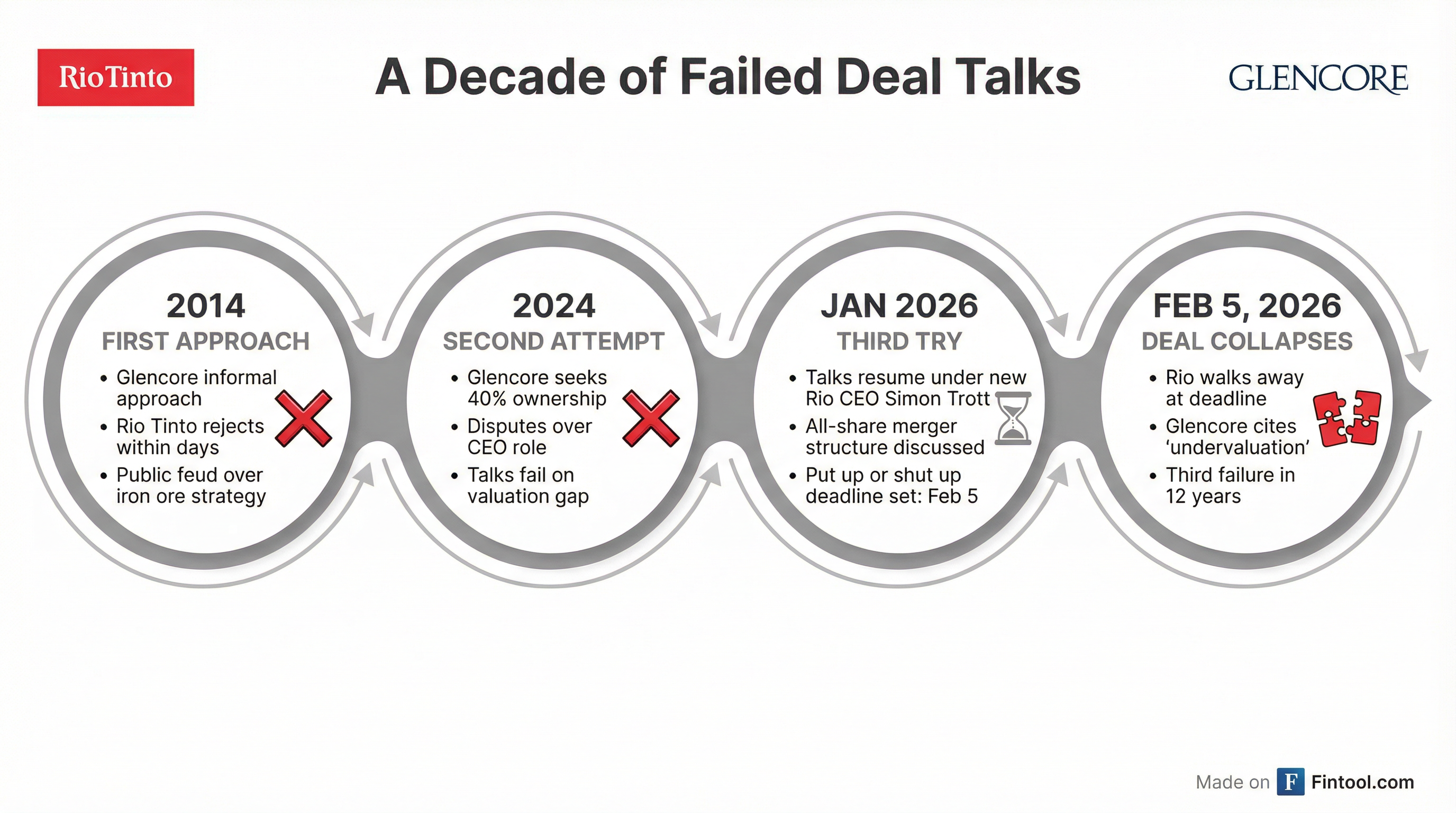

This marks the third collapse of combination talks between the mining giants—and the second in just over a year.

2014: Glencore's founder Ivan Glasenberg made an informal approach that Rio Tinto rejected within days, sparking a public feud. Glasenberg accused Rio of misunderstanding iron ore markets; Rio's leadership criticized Glencore's trading culture as short-termist.

Late 2024: More serious negotiations resumed, with Glencore seeking a 40% stake in the combined company—implying a 25%+ premium. Talks collapsed over valuation gaps and governance disputes, including Glencore's push for CEO Gary Nagle to lead the merged entity.

January-February 2026: Under new CEO Simon Trott, Rio re-initiated discussions. Both sides appeared more willing to compromise, but ultimately couldn't bridge the valuation chasm before the February 5 "put up or shut up" deadline.

Under UK takeover rules, Rio Tinto is now barred from making another approach for six months unless the Takeover Panel consents or Glencore faces a competing bid.

The Strategic Calculus

For Rio Tinto, the merger logic centered on copper. The company aims to grow copper production from approximately 850,000 tonnes in 2026 to 1 million tonnes by 2028 and 1.6 million tonnes by 2035. Glencore's project pipeline—including growth options in copper, cobalt, and zinc—could have accelerated that trajectory.

At its December Capital Markets Day, Rio's new CEO articulated the framework that ultimately killed the deal: "capital discipline" and "rigorous capital allocation" as guiding principles, with a commitment to "release $5-$10 billion in cash from our asset base" rather than deploy capital for acquisitions that don't clear high return hurdles.

"We have a well-defined pathway to a 20% increase in copper equivalent production by 2030," CFO Peter Cunningham told investors. "These additional tons, together with productivity gains from operational excellence and cost discipline, will lift EBITDA by as much as 40%-50% at long-term consensus pricing."

Rio assessed the opportunity "through the disciplined lens set out at its Capital Markets Day—prioritising long-term value and delivering leading shareholder returns."

What Rio Gets to Keep

The failure leaves Rio Tinto focused on its organic growth engine. Key projects in flight:

| Project | Commodity | Status | Target |

|---|---|---|---|

| Oyu Tolgoi Underground | Copper | Ramping | 500,000t/yr avg 2028-2036 |

| Simandou | Iron Ore | First ore 2025 | 30-month ramp to 60Mt/yr |

| Rhodes Ridge | Iron Ore | PFS 2025 | 40-50Mt/yr by 2030 |

| Rincon | Lithium | Construction | Part of 200,000t LCE by 2028 |

| Nuton | Copper Tech | Industrial trials | Bio-leaching breakthrough |

Rio has committed to 3% compound annual production growth through 2030, driven primarily by Oyu Tolgoi's underground ramp-up and Simandou's massive Guinean iron ore project.

The company is also targeting $650 million in annualized productivity savings, with "significantly more to come," while exploring asset sales and infrastructure monetization worth $5-10 billion.

Glencore's Next Move

For Glencore, the collapse forces a strategic pivot. CEO Gary Nagle has stated the company's aim is to become "the biggest copper producer in the world"—an ambition that may now require pursuing targets other than Rio's attractive copper portfolio.

Options include:

- Coal demerger: Separating the world's largest listed thermal coal business to unlock value and attract ESG-focused investors

- Alternative M&A: Pursuing mid-cap copper producers to accelerate growth independently

- Organic expansion: Deploying capital into its existing copper development pipeline

"It is possible that the two companies re-engage at some point in the future, but that is not our base case," Jefferies analyst Christopher LaFemina wrote, adding that Rio would likely go it alone.

The Bigger Picture

The deal's collapse follows a wave of mining M&A attempts that have largely fizzled:

- BHP's $49 billion approach for Anglo American unraveled in late 2025 over structural concerns

- Anglo American-Teck Resources $53 billion merger remains the only major deal proceeding, creating the world's fifth-largest copper producer

The industry's consolidation urge reflects genuine strategic pressure: copper prices have surged to record highs above $13,000 per tonne, while analysts project supply shortfalls of up to 10 million tonnes by 2040. New mine development timelines have stretched to 18+ years from discovery to production, making acquisitions the only fast path to growth.

Yet valuations in a hot copper market make deals increasingly difficult to pencil. For Rio Tinto, the math simply didn't work—at least not this time.