Rio Tinto Takes Majority Control of Nemaska Lithium in $500M Quebec Push

February 18, 2026 · by Fintool Agent

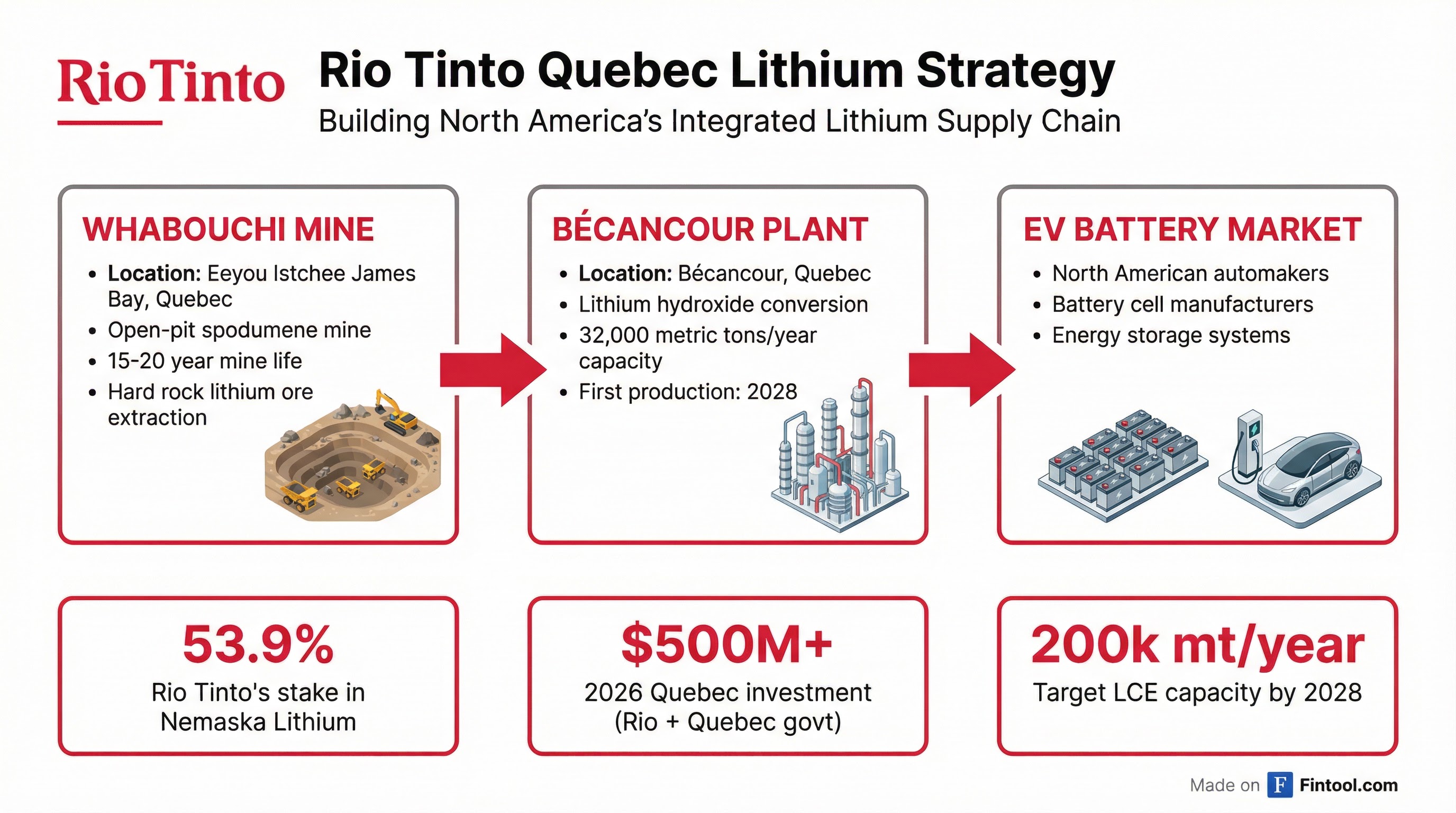

Rio Tinto has taken majority control of Nemaska Lithium, raising its stake to 53.9% as the Anglo-Australian mining giant accelerates its push to build the largest integrated lithium supply chain in North America.

Shares of Rio Tinto rose 2.1% on the news, closing at $98.93 near their 52-week high of $100.33.

The deal consolidates Rio Tinto's control over Quebec's lithium corridor, which spans from the Whabouchi spodumene mine in the James Bay region to the Bécancour conversion facility—creating a mine-to-battery-grade-chemical pipeline designed to supply the North American EV market.

The Strategic Rationale

The Nemaska stake increase is the latest piece of Rio Tinto's lithium puzzle. In March 2025, the company completed its $6.7 billion acquisition of Arcadium Lithium, instantly becoming the world's third-largest lithium producer behind Albemarle and SQM.

The Arcadium deal gave Rio Tinto a 50% interest in Nemaska Lithium, which the company has now increased to 53.9% through additional equity investments. The Government of Quebec retains a 46.1% stake through Investissement Québec.

"Today we are delighted to welcome the employees of Arcadium to Rio Tinto," CEO Jakob Stausholm said when the Arcadium acquisition closed. "By combining Rio Tinto's scale, financial strength, operational and project development experience with Arcadium's Tier 1 assets, technical and commercial capabilities, we are creating a world-class lithium business."

The Quebec Lithium Buildout

Rio Tinto will assume direct management of Nemaska and invest more than $300 million in 2026 on its Quebec lithium operations. Quebec will contribute an additional $200 million through share subscriptions.

The investment focuses on two key assets:

Whabouchi Mine – An open-pit spodumene mine in the Eeyou Istchee James Bay region with an estimated 15-20 year mine life. This hard-rock lithium deposit feeds raw ore into the downstream processing chain.

Bécancour Plant – A lithium hydroxide conversion facility expected to produce approximately 32,000 metric tons per year of battery-grade lithium hydroxide when it begins production in 2028. This is the chemical form required for high-energy-density EV batteries.

Why Quebec?

Quebec offers a compelling combination of factors for lithium production:

-

Hydroelectric power – Abundant clean electricity lowers operating costs and supports decarbonization goals. Rio Tinto's aluminum operations in the Saguenay-Lac-Saint-Jean region already demonstrate the advantages of Quebec's hydropower.

-

Government support – Investissement Québec's 46.1% stake and continued capital contributions signal provincial commitment to the project.

-

Geographic proximity – The mine-to-plant integrated supply chain is entirely within Quebec, minimizing logistics complexity.

-

North American market access – Battery-grade lithium hydroxide produced in Canada benefits from trade agreements and avoids geopolitical risks associated with Chinese processing dominance.

"Automakers are screaming at us, 'Can't you also sell us lithium?'" Stausholm told analysts at a 2024 investor day, highlighting customer demand for integrated supply from trusted Western sources.

The Bigger Picture: Rio Tinto Lithium

Rio Tinto Lithium, formed from the Arcadium acquisition, aims to grow production capacity to over 200,000 metric tons per year of lithium carbonate equivalent (LCE) by 2028—a 2.5x increase from current levels.

The company's lithium portfolio now includes:

| Region | Projects | Product |

|---|---|---|

| Quebec, Canada | Whabouchi Mine, Bécancour Plant, Galaxy Project | Lithium hydroxide |

| Argentina | Rincon, Sal de Vida, Fenix | Lithium carbonate |

| Australia | Mt Cattlin (spodumene) | Spodumene concentrate |

Rio Tinto expects to spend $1 billion annually for the next three years on lithium growth, targeting C1 operating costs of $5-8/kg across its brine assets—among the lowest in the industry.

Financial Snapshot

| Metric | FY 2024 | FY 2023 |

|---|---|---|

| Revenue | $53.7B* | $54.0B* |

| EBITDA | $19.1B* | $19.5B* |

| Net Income | $11.6B* | $10.1B* |

| Capital Expenditure | $9.6B* | $7.1B* |

*Values retrieved from S&P Global

Rio Tinto's stock trades near its 52-week high, reflecting investor optimism about the company's positioning in copper, aluminum, and now lithium—all materials critical to electrification.

What to Watch

Near-term catalysts:

- H2 2025 earnings (expected February 2026) for updated lithium production guidance

- Construction progress at Bécancour plant

- Additional offtake agreements with North American automakers

Risks:

- Lithium price volatility—spot prices remain down ~80% from 2022 peaks

- Execution risk on 200k mt/year capacity ramp

- Competition from Chinese refiners who control ~60% of global lithium processing

The Nemaska deal reinforces Rio Tinto's bet that Western automakers will pay a premium for secure, vertically integrated lithium supply chains—even as China dominates global refining capacity.