Ryan Cohen Doubles Down on GameStop With $21.4M in Back-to-Back Purchases

January 24, 2026 · by Fintool Agent

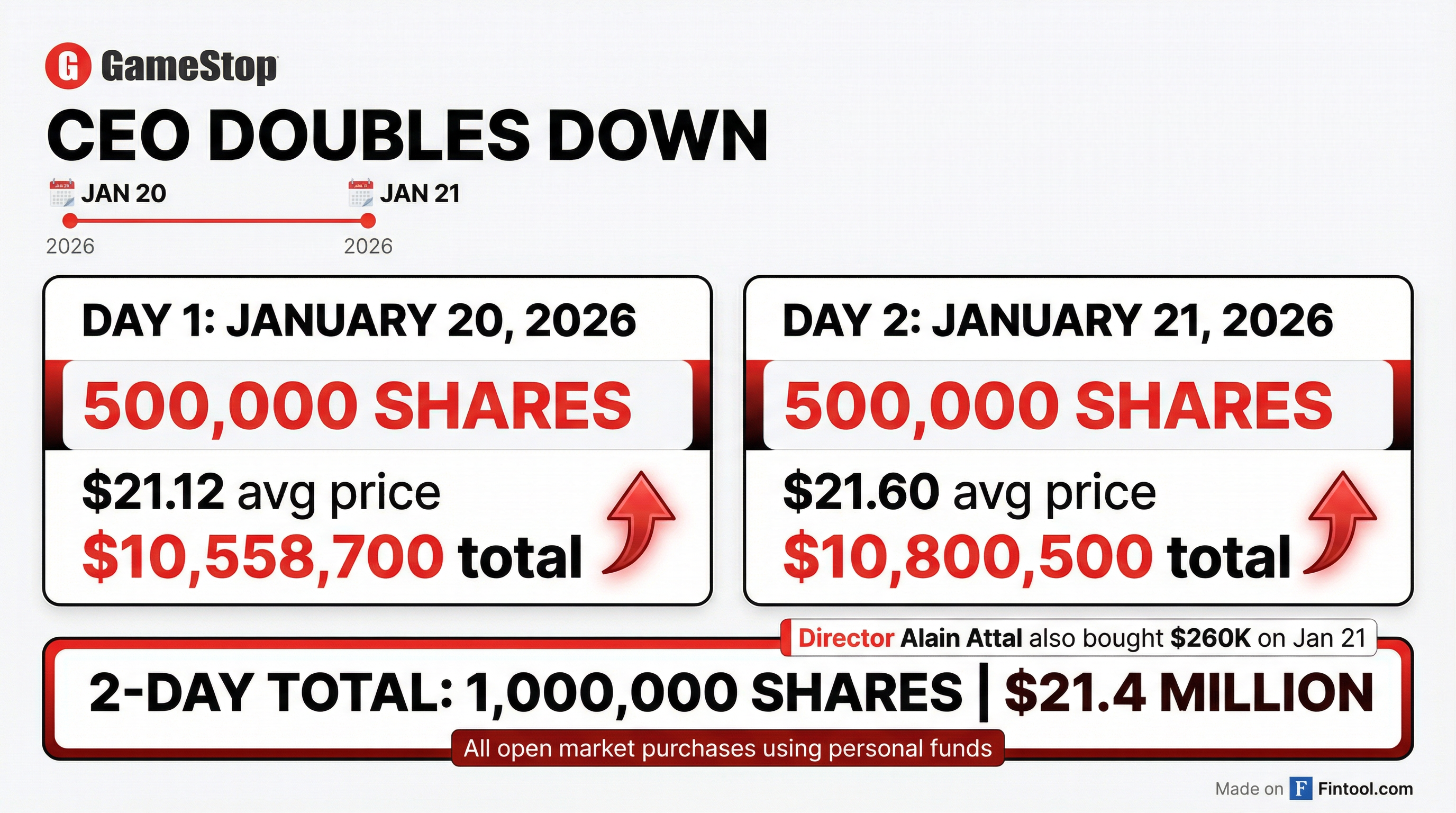

Gamestop CEO Ryan Cohen followed up his Monday stock purchase with an even larger buy on Tuesday, acquiring another 500,000 shares for $10.8 million and bringing his two-day total to $21.4 million in open market purchases using personal funds.

The back-to-back buying spree—Cohen's largest personal investment in the company since becoming CEO—pushed GME shares up 7% for the week and signals extraordinary confidence from the executive who has staked his reputation on transforming the video game retailer.

Cohen's Purchases: Day by Day

According to SEC filings, Cohen executed identical 500,000-share purchases on consecutive days:

| Date | Shares | Avg Price | Total Value |

|---|---|---|---|

| January 20, 2026 | 500,000 | $21.12 | $10,558,700 |

| January 21, 2026 | 500,000 | $21.60 | $10,800,500 |

| Total | 1,000,000 | $21.36 | $21,359,200 |

Cohen now owns 42.08 million shares—9.3% of GameStop's outstanding stock—up from 9.2% before the purchases. His directly owned shares represent a total investment of approximately $128 million, excluding brokerage commissions.

Director Alain Attal joined in, purchasing 12,000 shares on January 21 at $21.63 for approximately $260,000—creating a cluster of insider buying that often signals management conviction about the company's prospects.

Market Reaction: Stock Rallies Into Short Squeeze Territory

GME shares surged following the insider buying disclosure:

| Metric | Value |

|---|---|

| Current Price | $22.99 |

| Week-to-Date Return | +10.1% |

| Market Cap | $10.3B |

| 52-Week Range | $19.93 - $35.81 |

The rally has implications for GameStop's substantial short interest. As of December 31, 2025, 65.8 million shares were sold short—representing approximately 14.7% of shares outstanding with 13 days to cover based on average daily volume. This positions GME among the most heavily shorted stocks in the market.

Why Now? The $100 Billion Performance Award

Cohen's aggressive buying comes two weeks after GameStop's board granted him a 100% performance-based stock option award covering 171.5 million shares at a $20.66 strike price.

The award only vests if GameStop achieves both market capitalization and profitability milestones:

| Tranche | Market Cap Target | Cumulative EBITDA Target |

|---|---|---|

| 1 (10%) | $20 billion | $2.0 billion |

| 5 (10%) | $60 billion | $6.0 billion |

| 9 (15%) | $100 billion | $10.0 billion |

If GameStop reaches a $100 billion market cap and $10 billion in cumulative EBITDA, Cohen's options could be worth over $35 billion. By purchasing shares with personal funds at current prices, Cohen is demonstrating conviction that he can hit these ambitious targets.

In the SEC filing, Cohen made a pointed statement about executive accountability: "It is essential for any public company CEO to purchase shares with personal funds to strengthen alignment with stockholders. Any CEO who fails to do so should be fired."

GameStop's Financial Position: $8.8 Billion Cash Pile

Cohen's confidence is backed by a fortress balance sheet. GameStop reported Q3 fiscal 2026 results in December showing:

| Metric | Q3 FY26 | YoY Change |

|---|---|---|

| Net Sales | $821M | -4.6% |

| Net Income | $77.1M | +343% |

| EPS (Basic) | $0.17 | +325% |

| Gross Margin | 33.3% | +340 bps |

| Cash & Equivalents | $7.84B | +71% |

| Marketable Securities | $987M | +2,909% |

| Bitcoin Holdings | $519M | New |

The company has $8.83 billion in cash and investments—roughly 86% of its current market cap—plus $519 million in Bitcoin. Operating expenses have been slashed 21.5% year-over-year, driving the swing to profitability.

GameStop also raised $4.2 billion through convertible debt offerings in 2025, providing substantial firepower for potential acquisitions or strategic initiatives.

The Transformation Scorecard

Since Cohen joined the board in January 2021, GameStop has undergone significant changes:

- Market Cap: From $1.3B to $10.3B (+692%)

- SG&A Expenses: From $1.7B to $951M (-44%)

- Profitability: From $(381M) net loss to $422M trailing net income

- Cash Position: From minimal to $8.8B war chest

- Bitcoin Treasury: Acquired 4,710 BTC valued at $519M

The question is whether Cohen can convert this financial stability into the revenue growth needed to hit his $100 billion market cap target—roughly 10x the current valuation.

What to Watch

Near-term catalysts:

- Special Meeting (March-April 2026): Shareholders vote on Cohen's $100B performance award

- Q4 FY26 Earnings (March 2026): Holiday quarter results and full-year guidance

- Nintendo Switch 2 Launch: Expected March 26, 2026—potential hardware cycle tailwind

Key risks:

- Revenue continues declining despite profitability improvements

- Meme stock volatility could spike in either direction

- Performance award dilution if approved and targets achieved

Cohen's $21.4 million bet is his clearest signal yet that he believes GameStop's transformation is just getting started. With 65.8 million shares short and 13 days to cover, the stage is set for a showdown between the CEO and skeptics betting against his vision.

Related: