Sarepta's ELEVIDYS Shows 70%+ Disease Slowing at 3 Years—Stock Surges 13% on Redemption Data

January 26, 2026 · by Fintool Agent

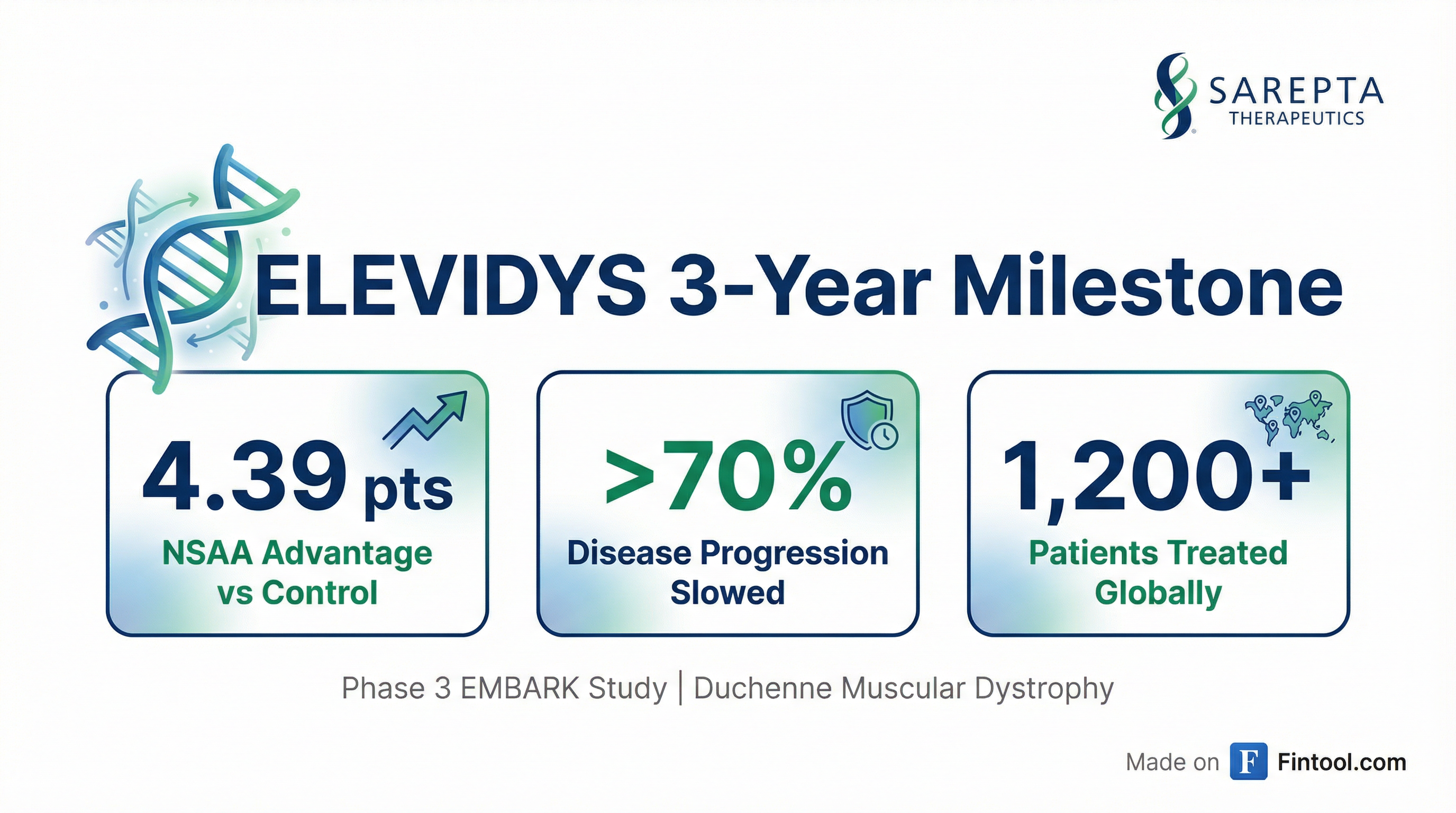

Sarepta Therapeutics stock jumped 12.6% to $23.79 Monday morning after the company released three-year data from its Phase 3 EMBARK trial showing ELEVIDYS dramatically slowed Duchenne muscular dystrophy progression—a critical vindication for the gene therapy that was nearly pulled from the market following patient deaths in 2025.

The data, presented on an investor call this morning, showed treated patients maintained motor function above their baseline three years after a single infusion, while exhibiting 70% or greater slowing of disease progression versus external controls . CEO Doug Ingram called it "the first time in history anyone has measured the disease-modifying impact of a gene therapy over a three-year period in a large, well-controlled clinical trial."

The Data: Widening Divergence From Natural History

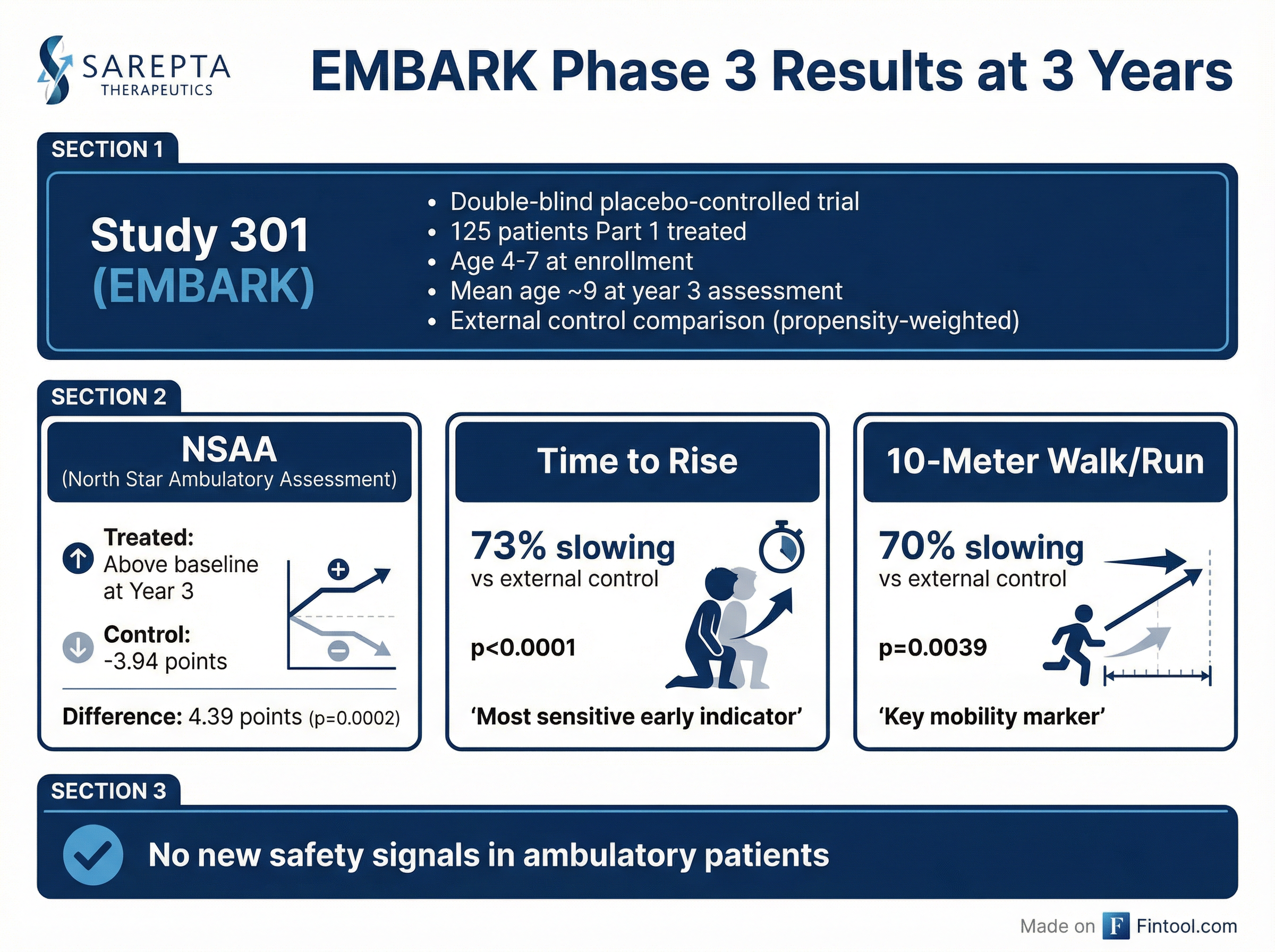

The results from EMBARK Part 1 patients demonstrate sustained and growing separation from the expected disease trajectory. On the North Star Ambulatory Assessment (NSAA)—a composite measure of motor function—treated patients showed a 4.39-point advantage over external controls at Year 3 (p=0.0002), nearly double the 2.27-point difference observed at Year 2 .

The time-based functional measures showed even more dramatic benefits:

| Endpoint | Year 3 Difference vs. Control | p-value | Disease Slowing |

|---|---|---|---|

| NSAA (points) | +4.39 | 0.0002 | N/A |

| Time to Rise (seconds) | +6.0 | <0.0001 | 73% |

| 10-Meter Walk/Run (seconds) | +2.7 | 0.0039 | 70% |

CMO Dr. James Richardson emphasized the clinical significance: "In stark contrast to the predicted trajectory, patients remain above their baseline three years following treatment. Disease progression, as measured either by the time to arise or 10-meter walk run, is being slowed by approximately 70%."

Context: A Dramatic Redemption Story

Today's data represents a potential turning point for Sarepta after a catastrophic 2025. The company's shares collapsed from a 52-week high of $127.89 to a low of $11.93 following a series of patient deaths and regulatory actions:

June 2025: Reports emerged of two fatal cases of acute liver failure in non-ambulatory pediatric patients treated with ELEVIDYS .

July 18, 2025: The FDA requested Sarepta suspend distribution and placed clinical trials on hold following a third death—though Sarepta initially refused .

July 28, 2025: The FDA reversed course after determining one death was "unlikely to be related" to the therapy, allowing ambulatory patient sales to resume .

Late 2025: The FDA approved a revised label adding a boxed warning and restricting the indication to ambulatory patients ages 4 and older only .

Ingram acknowledged the challenges on today's call: "Given some of the challenges of 2025 and the obvious requirement that we spend a lot of our time talking through the safety... there's a real need in the community to fully understand this therapy with respect both to safety and to the benefits."

Clinical Perspective: "Changing What Was Known"

Dr. Crystal Proud, Director of Neuromuscular Medicine at Children's Hospital of the King's Daughters and a study investigator, provided an independent clinical perspective on the results:

"The results demonstrate that ELEVIDYS really is changing what was known to be the natural history for these boys with Duchenne muscular dystrophy... The distinction from my untreated patients is quite clear."

She noted the practical implications: "Once a child hits a 10-meter walk time of 10 seconds or greater, they are expected to be in a wheelchair and non-ambulatory within the next couple of years. These are things that really help to facilitate my conversations with families... We're changing expectations now based on these results."

Safety Profile: No New Signals in Ambulatory Patients

Critically for investor confidence, the Year 3 data showed no new treatment-related serious adverse events in the ambulatory population . This is consistent with Sarepta's position that the fatal outcomes were concentrated in non-ambulatory patients, who are now excluded from the approved indication.

Dr. Richardson noted that only 2 patients in the treated arm lost ambulation over 3 years, "roughly about half the number that lost ambulation in the external control."

The company is also exploring the addition of sirolimus to treatment protocols for potentially higher-risk patients. Dr. Proud commented that "we'd like to try to mitigate risk as best we can... we'll have to do is really look towards the data to be able to inform us most comprehensively."

Financial Context: Revenue Volatility, Path to Profitability

Sarepta's financials reflect the turbulent 2025:

| Metric | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|

| Revenue ($M) | $413.5* | $362.9 | $467.2 | $658.4 | $744.9 | $611.1 | $399.4 |

| Net Income ($M) | $36.1 | $6.5 | $33.6 | $159.0 | $(447.5)* | $196.9 | $(179.9)* |

*Values retrieved from S&P Global

The company maintains approximately $613 million in cash as of Q3 2025 against $1.26 billion in total debt. Ambulatory patients represent 70-85% of the ELEVIDYS market, which management says is sufficient to sustain profitability .

Forward Estimates:

| Metric | Q4 2025E | Q1 2026E | Q2 2026E | Q3 2026E |

|---|---|---|---|---|

| Revenue ($M) | $387.5* | $374.3* | $380.3* | $393.0* |

| EPS | $(1.27)* | $0.35* | $0.56* | $0.72* |

*Consensus estimates from S&P Global. EPS expected to turn positive in 2026.

Strategic Outlook: Education, Pipeline, and Commercial Push

Management outlined plans to "rebalance" the narrative around ELEVIDYS in 2026. The company is doubling its sales force and planning "much more robust and well-balanced promotional activity" to emphasize efficacy alongside safety .

Beyond ELEVIDYS, Sarepta expects data readouts for siRNA therapies targeting myotonic dystrophy type 1 (DM1) and facioscapulohumeral muscular dystrophy (FSHD) "right around the very late first quarter of this year."

When asked about the potential for a label update to include the 3-year data, Ingram noted: "These top-line results are hot off the press. And so we haven't made any decisions... these results are very consistent with the labeled indication that we have, which is a traditional approval for all ambulatory patients four years and above."

What to Watch

- Q4 2025 earnings: Expected in coming weeks; will show full impact of the sales pause and recovery

- DM1/FSHD data: siRNA program readouts expected late Q1 2026

- Label discussions: Potential FDA engagement on incorporating 3-year efficacy data

- Commercial trajectory: Whether today's data can sustainably rebuild prescriber confidence

- EXPEDITION study: Long-term follow-up data will continue beyond Year 3

The analyst consensus price target of $20.83 now sits below today's trading price of $23.79, suggesting the market is repricing optimism following this data. Several analysts, including Wells Fargo, maintain targets near $50, implying significant additional upside if Sarepta can sustain its commercial recovery.