Schwab Posts Record Q4 as Client Assets Near $12 Trillion, CEO Open to Prediction Markets

January 21, 2026 · by Fintool Agent

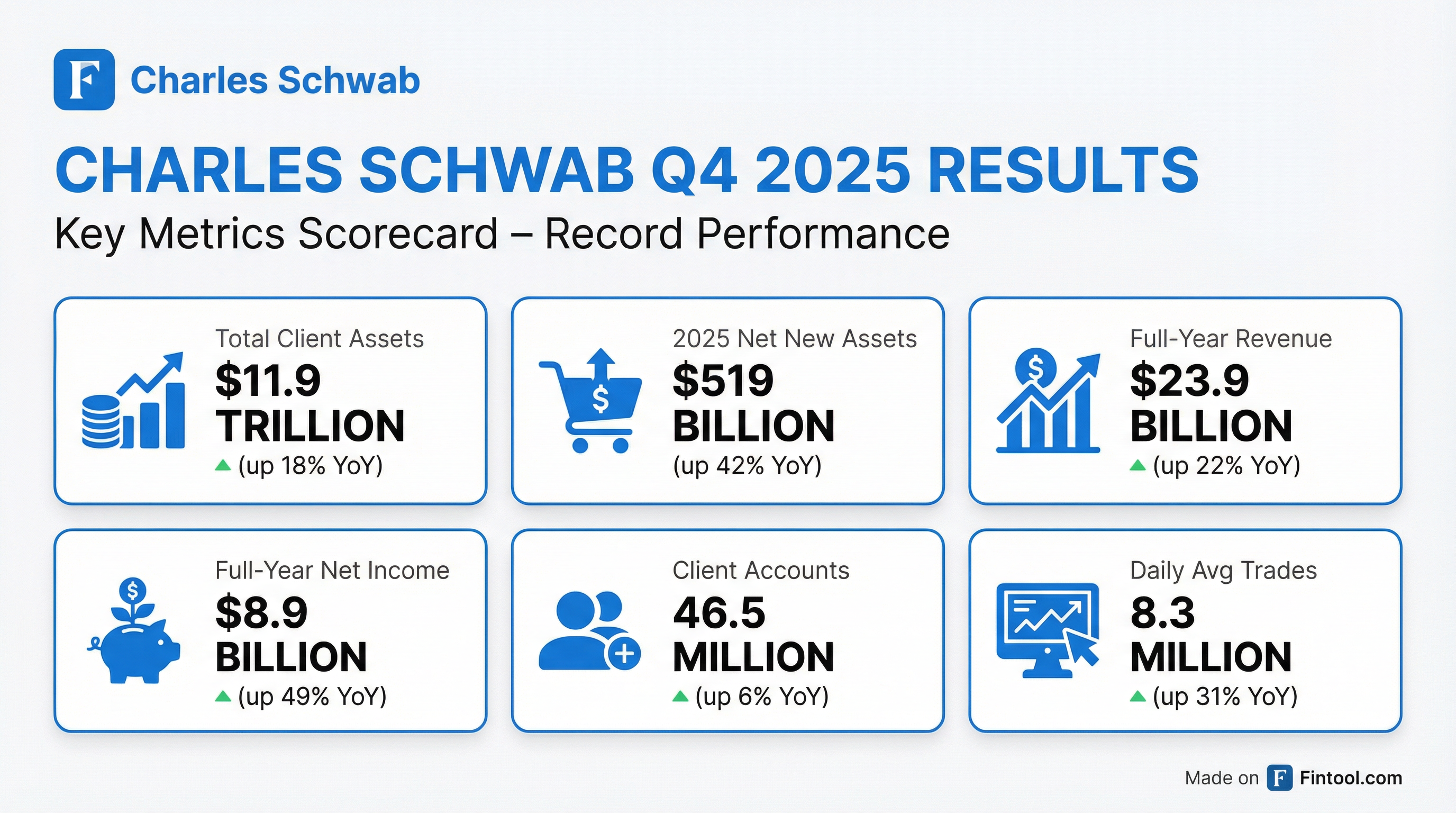

Charles Schwab delivered record fourth-quarter and full-year 2025 results on Tuesday, with client assets surging to $11.90 trillion and net income jumping 49% to $8.85 billion—yet shares slipped 3% in early trading as revenue narrowly missed Wall Street estimates.

The brokerage giant reported adjusted Q4 EPS of $1.39, up 38% year-over-year and one cent ahead of the $1.38 consensus, while quarterly revenue rose 19% to a record $6.34 billion—just shy of the $6.37 billion analysts expected.

In a Bloomberg interview following the results, CEO Rick Wurster said the firm is "absolutely open" to adding event-based prediction markets to its platform, joining the growing chorus of financial institutions exploring the rapidly evolving space dominated by Kalshi and Polymarket.

Record Growth on All Fronts

Schwab's results underscored the firm's ability to attract and retain assets even as competition intensifies across wealth management. Total client accounts grew 6% year-over-year to 46.5 million, while active brokerage accounts reached 38.5 million.

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Net Revenue | $6.34B | $5.33B | +19% |

| Net Income (GAAP) | $2.46B | $1.84B | +34% |

| Adjusted EPS | $1.39 | $1.01 | +38% |

| Net Interest Revenue | $3.17B | $2.53B | +25% |

| Trading Revenue | $1.07B | $873M | +22% |

| Daily Avg Trades | 8.3M | 6.3M | +31% |

The firm's diversified revenue model fired on all cylinders: net interest revenue expanded 25% as the net interest margin widened 57 basis points to 2.90%, asset management fees grew 15% to $1.73 billion, and trading revenue jumped 22% on the back of 8.3 million daily average trades.

"Schwab delivered growth on all fronts in 2025," President and CEO Rick Wurster said in the earnings release. "Clients are conducting more of their financial lives at Schwab, with record engagement across wealth management, trading, and banking."

Client Asset Surge

The headline number: $11.90 trillion in client assets at year-end, up 18% from $10.10 trillion a year earlier. Core net new assets totaled $163.9 billion in Q4 alone—a record quarterly haul—bringing the full-year tally to $519 billion, up 42% from 2024 and representing a 5.1% organic growth rate.

| Client Metrics | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Total Client Assets | $11.90T | $10.10T | +18% |

| Net New Assets (Q4) | $163.9B | $108.4B | +51% |

| New Brokerage Accounts | 1.27M | 1.12M | +13% |

| Margin Loan Balances | $112.3B | $83.8B | +34% |

| Bank Loan Balances | $58.0B | $45.2B | +28% |

The growth was broad-based across both retail and advisor channels. Investor Services client assets rose 17% to $6.71 trillion, while Advisor Services—which serves registered investment advisors—grew 19% to $5.20 trillion.

Net inflows into Schwab's Managed Investing solutions surged 36% for the full year and 50% in Q4 versus the prior-year quarter, signaling deepening client relationships beyond self-directed trading.

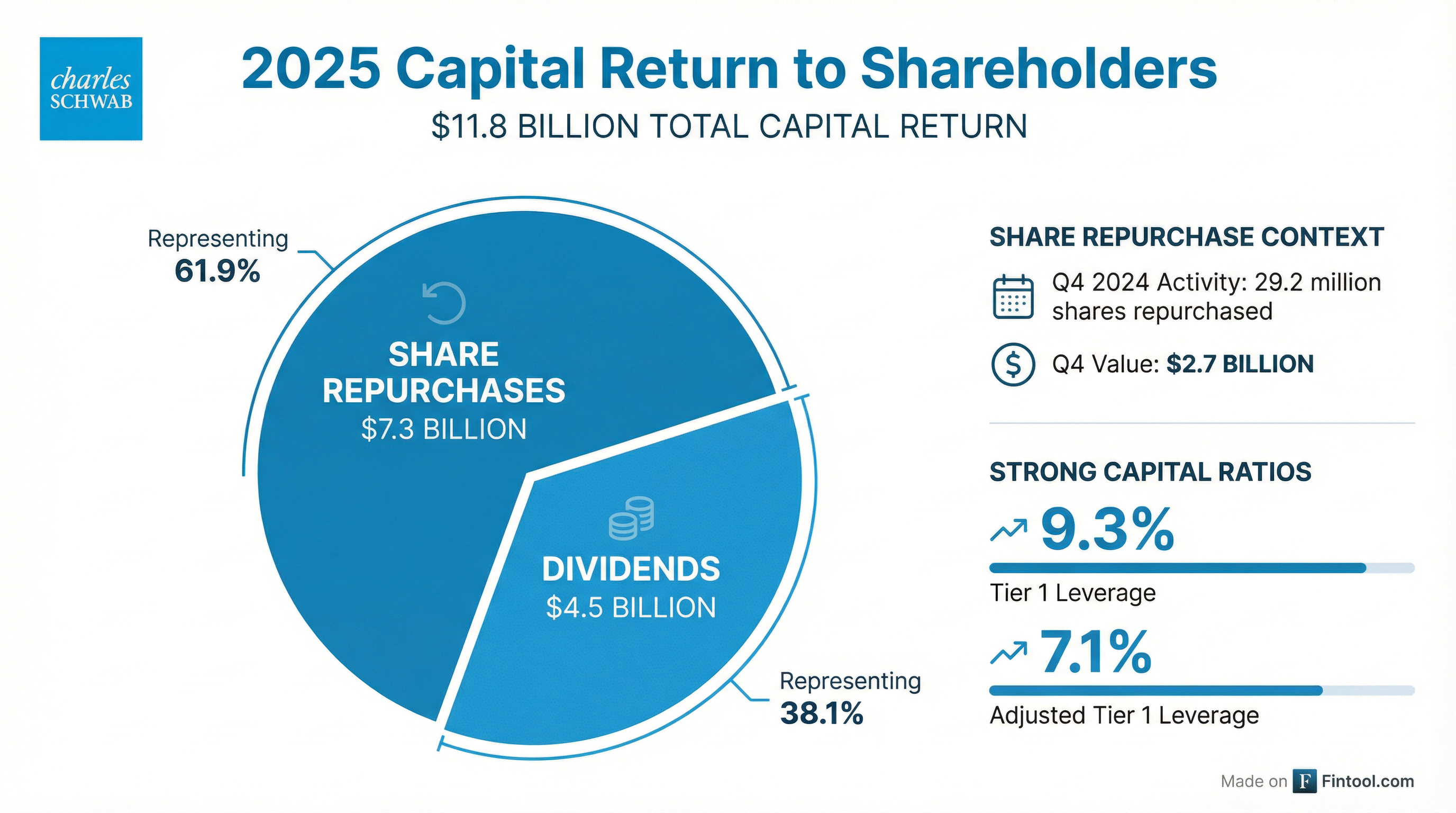

Massive Capital Return

Schwab returned $11.8 billion to shareholders in 2025 across all forms, including $7.3 billion in share repurchases. In Q4 alone, the firm bought back 29.2 million shares for $2.7 billion.

CFO Mike Verdeschi highlighted the firm's capital flexibility: "Our capital ratios remained strong while enhancing our balance sheet flexibility to meet the needs of clients in different environments." Preliminary Tier 1 Leverage stood at 9.3%, with adjusted Tier 1 Leverage at 7.1%.

CEO Signals Openness to Prediction Markets

In a Bloomberg Television interview, Wurster addressed the prediction market phenomenon, saying Schwab is "absolutely open" to the category—but with caveats.

"We've been innovating at a very fast rate," Wurster said, while noting that traditional financial instruments already offer exposure to economic outcomes. "If you want to take a position on the employment report or the inflation report, there are countless ways to do that... in the bond market, in the futures market, through options."

The comments come as regulated prediction markets gain regulatory clarity and mainstream adoption. Kalshi's event contracts now trade across election outcomes, economic data, and weather events, while crypto-native Polymarket has attracted institutional interest.

Wurster drew a clear line between investing and gambling: prediction markets would only make sense "within the context of an investment portfolio," he said. The category isn't currently high on client demand lists, but the door remains open.

Stock Performance

SCHW shares have surged approximately 41% year-to-date, outpacing the broader market, though they traded down about 3% in pre-market following the slight revenue miss. The stock closed at $101.79 on January 21, near its 52-week high of $103.82.

Morningstar analyst Sean Dunlop raised his fair value estimate to $111 per share following the results, citing strong expense discipline despite slower-than-expected balance sheet growth. The firm maintains a wide moat rating on Schwab, projecting 10-year revenue CAGR of 10% and EPS CAGR of 14.4%.

Forward Outlook

Schwab's 2026 outlook hinges on several factors:

Tailwinds:

- Continued equity market appreciation driving asset-based fees

- Net interest margin expansion if rates remain elevated

- Growing penetration of wealth management solutions

- Forge Global acquisition (expected H1 2026) expanding alternative investment access

Watch items:

- Client cash allocation remains at 9.6% of assets—below the 11.4% decade average—constraining near-term balance sheet growth

- Competition from Fidelity, Vanguard, and emerging fintech platforms

- Potential Fed rate cuts impacting net interest revenue

When asked about geopolitical volatility at Davos, Wurster remained upbeat: "There's going to be geopolitical noise from time to time... The economy is on strong footing. Markets have been up three years in a row. Unless something changes, things look pretty good."

The Bottom Line

Schwab's record 2025 validates its scale advantages and diversified business model. With nearly $12 trillion in client assets, 46.5 million accounts, and margin loans at all-time highs, the firm is firing on all cylinders. The CEO's openness to prediction markets signals a willingness to adapt to evolving investor preferences—even if the category isn't yet a priority.

The modest revenue miss and pre-market decline may offer a buying opportunity for long-term investors. At current levels, the stock trades at roughly 21x forward earnings with strong organic growth momentum and ample capital return capacity.