Scotts Miracle-Gro CEO Declares Balance Sheet Repair 'Complete,' Teases Positive Q1 Results

January 26, 2026 · by Fintool Agent

Scotts Miracle-gro CEO Jim Hagedorn delivered a bullish message to shareholders at the company's 2026 Annual Meeting on Monday, declaring the lawn and garden giant's multi-year balance sheet repair effort effectively complete and teasing "all positive" news for Wednesday's Q1 earnings call.

"I envision a time in the very near future where talk of leverage each quarter becomes a thing of the past," Hagedorn said at the virtual shareholder meeting.

Shares of SMG rose 0.3% to $62.94 in midday trading, extending a rally that has lifted the stock 8.5% above its 50-day moving average.

$1.5 Billion Debt Paydown

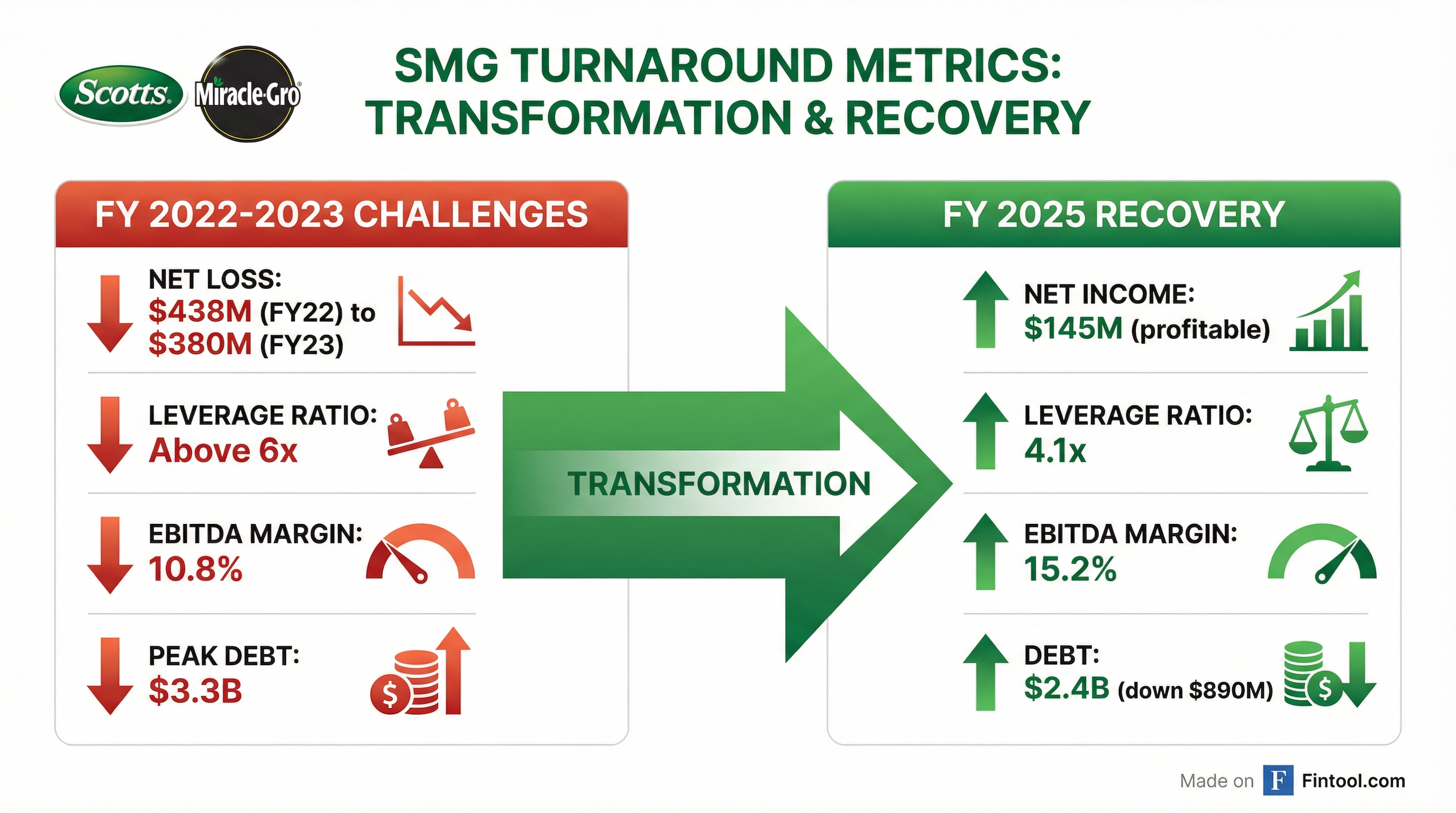

The centerpiece of Hagedorn's remarks was the company's dramatic debt reduction. Since reaching peak leverage during the post-pandemic demand normalization, Scotts Miracle-Gro has paid down over $1.5 billion in debt and expects leverage to return to "historic norms in the threes" later this fiscal year.

The company's balance sheet transformation is evident in the numbers:

| Metric | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Total Debt ($B) | $3.27* | $2.91* | $2.52* | $2.38* |

| Net Income ($M) | $(438)* | $(380) | $(35) | $145 |

| EBITDA ($M) | $525* | $384* | $445* | $518* |

| EBITDA Margin | 13.4%* | 10.8%* | 12.5%* | 15.2%* |

*Values retrieved from S&P Global

The leverage ratio stood at 4.10x as of September 30, 2025, well within the company's covenant of 5.0x under the Seventh Amended and Restated Credit Agreement signed in November 2025.

Turnaround in Focus

Hagedorn framed the company's recovery around four pillars: "significant free cash flow generation, meaningful margin improvement, solid EBITDA growth" and disciplined capital allocation.

The CEO also highlighted operational initiatives driving the margin expansion:

"From an operational perspective, we've taken cost out of the business through automation, AI, and other technologies that led to efficiencies and optimization of our supply chain. We're committed to being the lowest-cost, high-performing manufacturer."

E-commerce and digital marketing have become growth priorities. "E-commerce and the digital space are where we are driving more growth and seeing many more opportunities," Hagedorn noted.

Q1 Earnings Preview

Perhaps the most market-moving statement was Hagedorn's teaser for Wednesday's Q1 FY2026 results:

"We have an optimistic view of Fiscal 2026 and beyond, and I encourage you to listen to our first quarter earnings call on Wednesday for details. In addition to reviewing results, we'll provide an in-depth discussion as to where we're headed. And by the way, it's all positive."

Analyst expectations heading into the report call for a Q1 loss of approximately $1.00 per share on revenue of roughly $358 million—reflecting the typical seasonality of the lawn and garden business.* For the full fiscal year, consensus estimates project:

| Metric | Q1 2026 | Q2 2026 | Q3 2026 | Q4 2026 | FY 2026 |

|---|---|---|---|---|---|

| Revenue ($M) | $358* | $1,416* | $1,271* | $383* | $3,428* |

| EPS | $(1.00)* | $3.96* | $3.07* | $(1.76)* | $4.27* |

*Values retrieved from S&P Global

Wall Street maintains a "Moderate Buy" rating on SMG with an average price target of approximately $70, representing roughly 11% upside from current levels.

Shareholder Votes

All four proposals on the meeting agenda passed with strong support:

-

Director Elections: Jim Hagedorn, Edith Avilés, Rob Candelino, and Mark Kingdon were re-elected to three-year terms expiring in 2029. Each received at least 43.5 million votes.

-

Executive Compensation: The advisory "say-on-pay" vote passed with over 339 million votes in favor.

-

Auditor Ratification: Deloitte & Touche LLP was ratified as the company's independent auditor for FY2026 with over 51 million votes.

-

Long-Term Incentive Plan Amendment: Shareholders approved increasing the share pool available for equity grants with over 30 million votes.

Investment Implications

For investors, the key takeaway is that Scotts Miracle-Gro's management is signaling a transition from "turnaround mode" to "growth mode." With leverage expected to normalize this fiscal year, the company will have greater flexibility for:

- Dividend sustainability: The current $2.64 annual dividend (4.2% yield) has been maintained throughout the deleveraging process

- Capital returns: The new credit facility allows unlimited restricted payments once leverage falls below 4.0x

- Growth investments: Management has emphasized brand investment, innovation, and digital capabilities

The company refinanced its credit facilities in November 2025, extending maturities to 2030 and securing a $2 billion facility ($1.5 billion revolver, $500 million term loan).

What to Watch Wednesday

The Q1 FY2026 earnings call on January 28 at 9:00 AM ET will be critical for validating Hagedorn's optimism. Key items to monitor:

- Guidance reaffirmation or raises for FY2026

- Leverage trajectory and updated deleveraging timeline

- Spring selling season outlook heading into the peak Q2/Q3 periods

- E-commerce and digital channel momentum

- Input cost and pricing dynamics

With the CEO explicitly previewing "all positive" commentary, expectations are elevated. Any disappointment could weigh on shares, while confirmation of the turnaround narrative could catalyze a re-rating toward analyst targets.

Related: SMG Company Profile