SEC's Last Democratic Voice Exits: Crenshaw Departure Clears Path for Crypto Deregulation

January 2, 2026 · by Fintool Agent

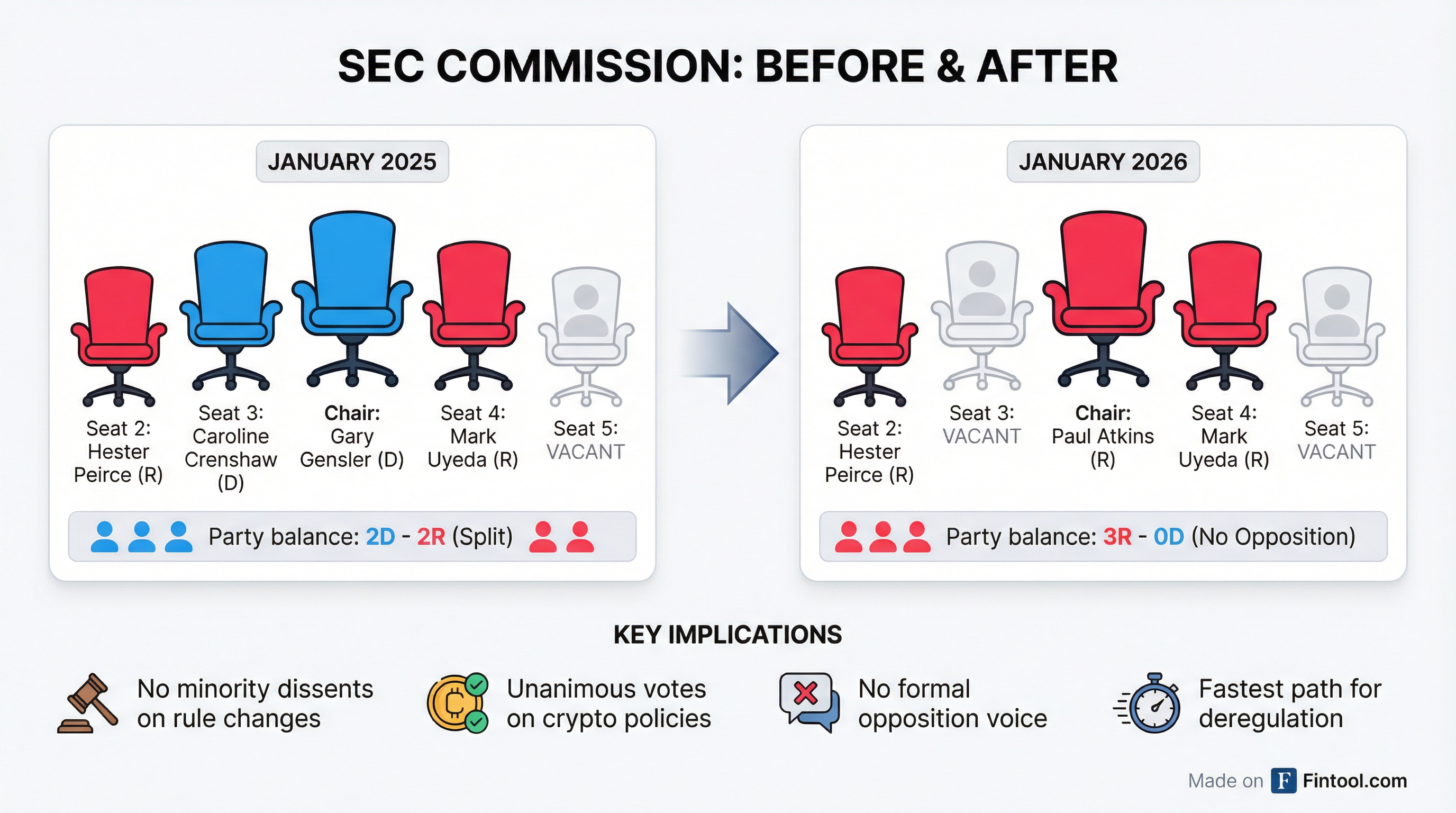

The Securities and Exchange Commission will lose its sole Democratic commissioner tomorrow, leaving the agency with a 3-0 Republican majority and no formal opposition voice for the first time in decades—just as Chairman Paul Atkins prepares to launch the most sweeping crypto deregulation in SEC history.

Caroline Crenshaw, a vocal critic of the agency's regulatory rollback who famously warned the SEC was playing "a reckless game of regulatory Jenga," departs January 3 after her 18-month term carryover expires. Her exit leaves two seats vacant on the five-member Commission, with no indication that President Trump intends to nominate Democratic replacements anytime soon.

The timing could not be more consequential. Within days, the SEC is expected to unveil its "innovation exemption"—the centerpiece of Chairman Atkins' "Project Crypto" initiative—allowing crypto firms to operate under principles-based safeguards rather than full regulatory compliance. Without Crenshaw, every vote will be unanimous. Every rule change will pass unchallenged.

The Dissenter's Final Stand

Crenshaw spent her final months at the agency issuing a stream of dissents that read like warnings for the historical record. In May, she delivered a blistering speech at "SEC Speaks," the agency's flagship conference, accusing her colleagues of systematically dismantling decades of investor protections.

"We are playing a game of regulatory Jenga," she said. "Piece by piece, we are pulling out the blocks that form the foundation of our regulatory framework, and it is only a matter of time before it all comes tumbling down."

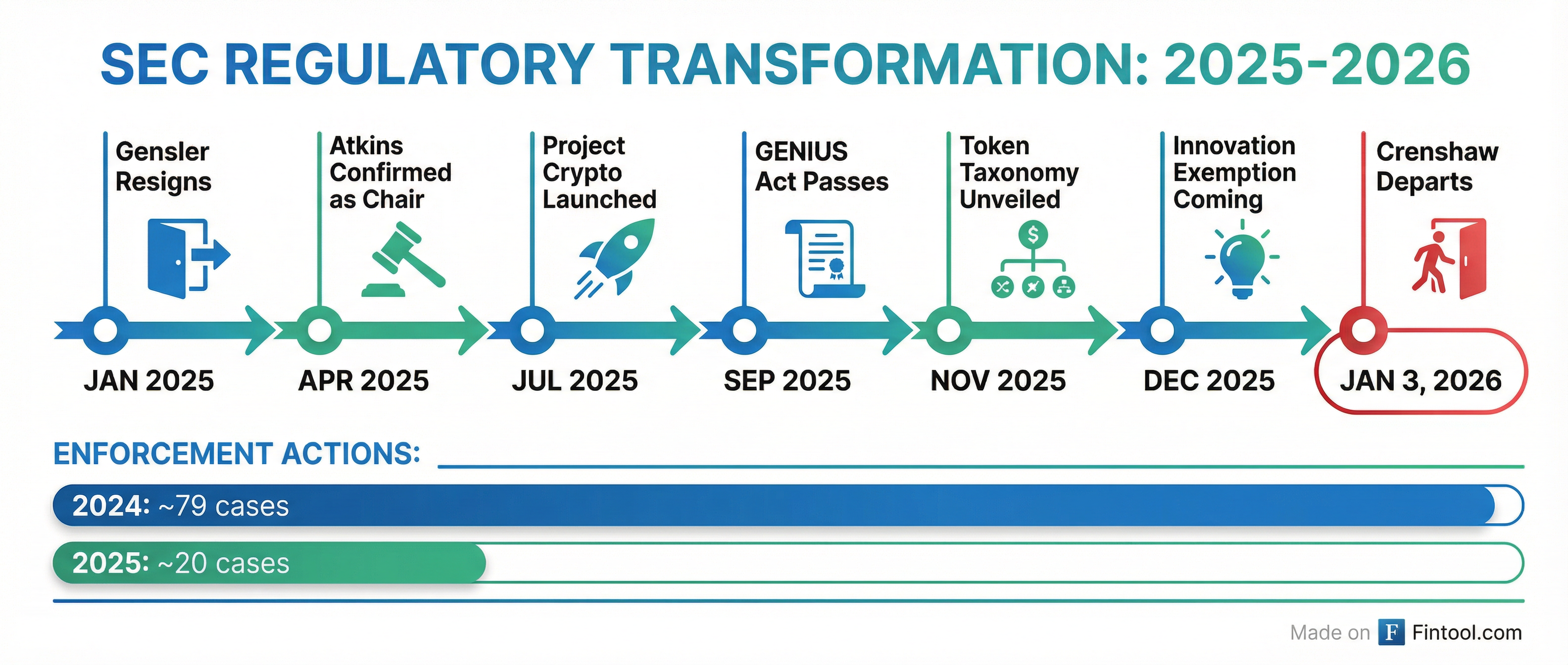

The statistics support her characterization. Under the Atkins-led SEC, enforcement actions involving earnings fraud and auditor liability have plunged to just 20 in 2025—the lowest since the Reagan administration and a fraction of the 79 cases brought in the final full year under Gary Gensler.

The agency has abandoned high-profile cases against Coinbase+13.00%, Robinhood+13.95%, Kraken, Consensys, and Ripple. In the Ripple settlement, the SEC agreed to return $75 million of a $125 million penalty it had won under the previous administration—a move Crenshaw called a "tremendous disservice to the investing public" that "undermines the court's role in interpreting our securities laws."

A Commission Transformed

The contrast with the agency Crenshaw joined in August 2020 is stark.

When she was first sworn in—ironically, by President Trump during his first term—the Commission was evenly split 2-2 between Democrats and Republicans. By statute, no more than three commissioners can belong to the same party. But with two vacancies and no Democratic nominees in the pipeline, the SEC will operate as a unified Republican body with no meaningful internal check.

The remaining commissioners—Chair Atkins, Hester Peirce, and Mark Uyeda—share a vision of dramatically scaled-back crypto enforcement and expanded industry self-regulation. Peirce, nicknamed "Crypto Mom" by digital asset enthusiasts, has long advocated for safe harbors that would allow token projects to launch without immediate SEC oversight.

Project Crypto: What's Coming

The regulatory transformation ahead is substantial. Chairman Atkins has outlined plans for:

Token Taxonomy: A formal classification system that would categorize "digital commodities," "network tokens," "digital collectibles," and "digital tools" as non-securities—potentially exempting the vast majority of existing crypto assets from SEC oversight.

Innovation Exemption: A framework allowing companies to test novel business models under principles-based safeguards rather than full compliance with existing rules. Atkins has said this could arrive "within a month"—potentially by late January.

Regulation Crypto: A comprehensive proposal establishing tailored disclosures, exemptions, and safe harbors for digital asset distributions, including token sales, airdrops, and network rewards.

Integrated Platforms: Atkins has voiced support for "superapp" platforms that would seamlessly accommodate securities, crypto assets, and nonsecurities within a single interface—a vision that would require significant regulatory coordination with the CFTC.

The building blocks are already in place. The GENIUS Act, signed in July 2025, established the first comprehensive federal framework for stablecoins, requiring 100% reserve backing and monthly public disclosures. The SEC has issued guidance allowing broker-dealers to custody crypto assets and state trust companies to act as qualified custodians for investment advisers.

Market Implications

For crypto-exposed equities, the regulatory thaw represents a significant tailwind. Coinbase+13.00% has seen the dismissal of SEC lawsuits that threatened its core business model. Robinhood+13.95% can expand crypto offerings without enforcement overhang. Bitcoin ETF sponsors like those behind GBTC+10.01% face a friendlier approval environment.

But Crenshaw's warnings about investor protection remain relevant. In her final speeches, she noted that crypto-related fraud losses increased 66% in 2025, primarily affecting individuals over 60. The FTX collapse remains recent history—and the risks she identified haven't disappeared simply because enforcement has.

The Road Ahead

With Crenshaw's departure, the SEC enters uncharted territory. The agency has operated with a partisan balance for decades—not because law requires it, but because administrations of both parties recognized the value of having a minority voice to identify risks and challenge assumptions.

That check is now gone.

Atkins has said he wants to "future-proof" his regulatory changes so "whatever happens down the road, we don't have the pendulum swinging the other way." Without Democratic commissioners to dissent, to force public debate, to create a record of objections, that task becomes significantly easier.

For crypto investors and companies, the next several months represent an unprecedented window of opportunity. For those who share Crenshaw's concerns about investor protection, it represents something else entirely.

As she said in her Brookings Institution speech last month: "Deterring misconduct is a public good. Without deterrence, there is no accountability."

The question is whether the market will provide the accountability that the regulator no longer will.

What to Watch

- Innovation Exemption: Expected within weeks—the first major policy without a Democratic dissent

- Token Taxonomy: Formal rulemaking could reclassify most crypto assets as non-securities

- CFTC Coordination: New CFTC Chair Michael Selig takes the helm as agencies divide crypto oversight

- Congressional Action: The CLARITY Act awaits Senate action; passage would codify the regulatory reset

- Fed Chair Transition: Jerome Powell's term expires May 15—a more dovish successor could amplify crypto tailwinds