SEC Drops Gemini Case: Eighth Crypto Dismissal Under Trump Administration

January 23, 2026 · by Fintool Agent

The Securities and Exchange Commission on Friday agreed to dismiss its enforcement case against Gemini Space Station+14.63%, the cryptocurrency exchange founded by billionaire twins Tyler and Cameron Winklevoss—making it the eighth crypto firm to have its lawsuit dropped since President Trump began his second term.

The dismissal comes after the Winklevoss twins emerged as Trump's fiercest allies in the digital assets world, donating over $21 million in Bitcoin to pro-Trump PACs, contributing to his inauguration, and personally lobbying the administration on key regulatory appointments.

Gemini+14.63% shares closed at $9.72 on Friday, down 3.5%—roughly 79% below their 52-week high of $45.89—as the broader crypto market continued its slide from January highs.

The Gemini Earn Saga

The SEC's case stemmed from the 2022 implosion of Gemini Earn, a lending program that promised customers yield on their crypto holdings by lending their assets to Genesis Global Capital. When Genesis collapsed in January 2023 alongside its parent company Digital Currency Group, approximately 340,000 Gemini Earn investors were left unable to access their funds.

In January 2023, the SEC charged both Genesis and Gemini with illegally selling securities to hundreds of thousands of investors through the program. Genesis eventually settled with the SEC in early 2024, agreeing to pay a $21 million penalty.

Gemini, however, fought the case. Tyler Winklevoss called the lawsuit a "manufactured parking ticket" on social media.

The SEC cited two factors in its dismissal: Gemini Earn investors received "100 percent in-kind return" of their crypto assets through the Genesis bankruptcy process between May and June 2024, and Gemini reached separate settlements with the New York State Department of Financial Services.

The Trump Administration's Crypto Retreat

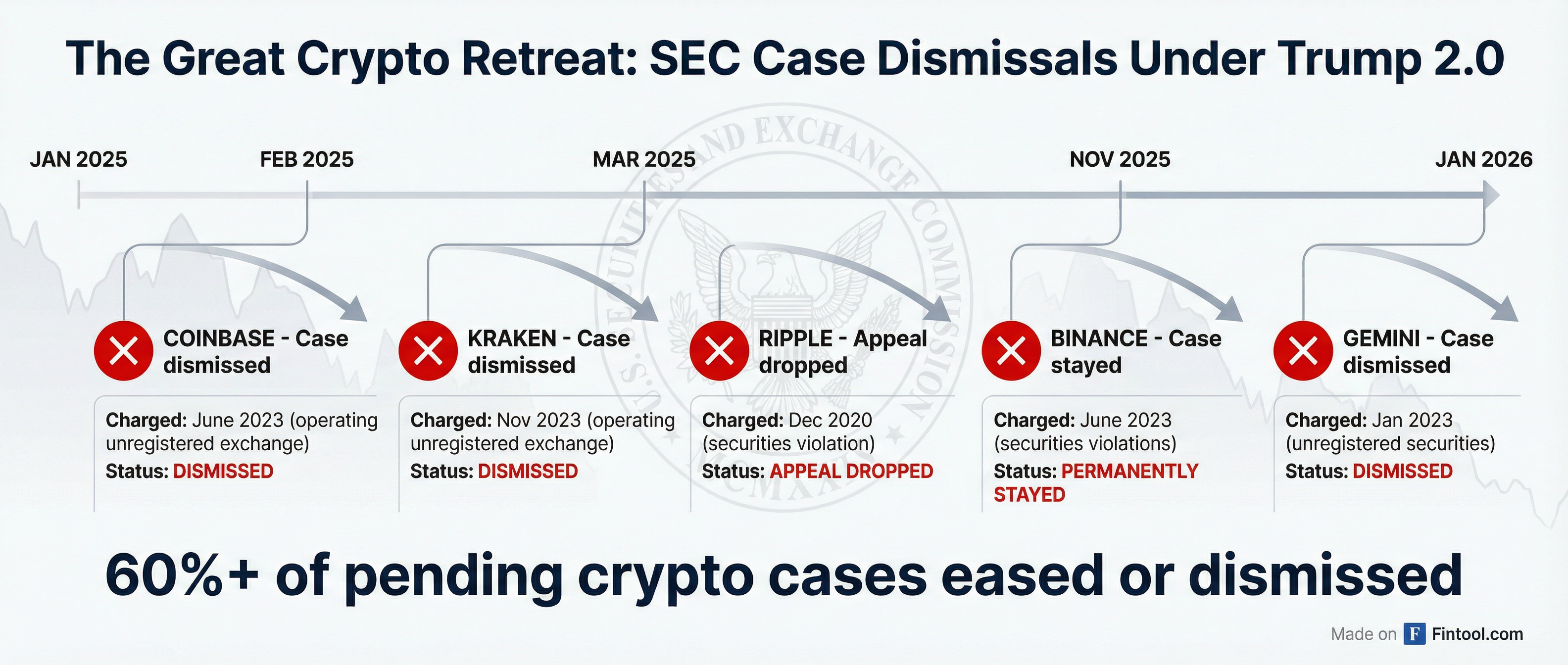

The Gemini dismissal represents the culmination of a dramatic shift in SEC crypto enforcement. According to a New York Times investigation, the agency has eased up on more than 60% of the crypto lawsuits that were pending when Trump returned to the White House in January 2025.

| Company | Original Charge Date | Dismissal/Resolution | Alleged Violation |

|---|---|---|---|

| Coinbase+13.00% | June 2023 | Feb 2025 | Operating unregistered exchange |

| Kraken | Nov 2023 | Mar 2025 | Operating unregistered exchange |

| Ripple | Dec 2020 | Mar 2025 (appeal dropped) | Securities violations |

| Binance | June 2023 | Nov 2025 (stayed) | Securities violations |

| Gemini | Jan 2023 | Jan 2026 | Unregistered securities |

Table: Major SEC crypto enforcement actions dismissed under Trump 2.0

House Financial Services Democrats have blasted the enforcement retreat. In a January 15 letter to SEC Chairman Paul Atkins, committee members wrote that the dismissals come "at a time of unprecedented lobbying and donations to President Trump and his associates by the crypto industry."

The Winklevoss-Trump Alliance

Few in crypto have cultivated closer ties to the Trump administration than the Winklevoss twins. Their political evolution from Democratic donors in 2018 to MAGA stalwarts has been swift and consequential.

Political Donations (2025):

- $21 million in Bitcoin (188.4547 BTC) to the Digital Freedom Fund PAC

- $2.6 million to House GOP campaign committees

- $1 million to MAGA Inc. super PAC

- $1.6 million+ to Senate GOP committees

Beyond donations, the twins have leveraged their relationship with Trump directly. In July 2025, they successfully lobbied the president to withdraw his nominee to lead the Commodity Futures Trading Commission, Brian Quintenz—a move that stunned the crypto industry given Quintenz's pro-crypto credentials.

At a crypto bill signing ceremony at the White House, Trump publicly praised the twins: "They've got the look, they've got the genius, got plenty of cash. It's great that you're on our side."

Market Impact

Despite the regulatory victory, Gemini's stock has struggled since its September 2025 Nasdaq debut:

| Metric | Value |

|---|---|

| Current Price | $9.72 |

| Change (Friday) | -3.5% |

| 52-Week High | $45.89 |

| 52-Week Low | $9.67 |

| Market Cap | $1.14B |

| IPO Valuation (Sept 2025) | $4.4B |

Source: Market data as of Jan 23, 2026

The stock's decline mirrors the broader crypto market pullback since late 2025, as Bitcoin has retreated from its highs above $110,000 to approximately $90,000.

For comparison, Coinbase+13.00%—which had its own SEC case dismissed in February 2025—closed Friday at $216.95, down 2.8%, with a market cap of $58.5 billion.

What's Next

The SEC's retreat from crypto enforcement has emboldened the industry but raised concerns among investor protection advocates. The agency's Crypto Task Force, formed in January 2025, is working on a "comprehensive and clear regulatory framework" for digital assets, prioritizing rulemaking over litigation.

For Gemini, the dismissal removes a major legal overhang—but the company still faces a challenging competitive environment as it seeks to compete against larger rivals like Coinbase and Kraken in the U.S. market.

The Winklevoss twins, meanwhile, continue to expand their crypto empire. They recently backed American Bitcoin, a mining company co-founded by Trump's sons, and remain fixtures at White House events.

Related: