Sigma Lithium Stock Crashes 28% After Brazil Orders Mine Shutdown Over Safety Fears

January 16, 2026 · by Fintool Agent

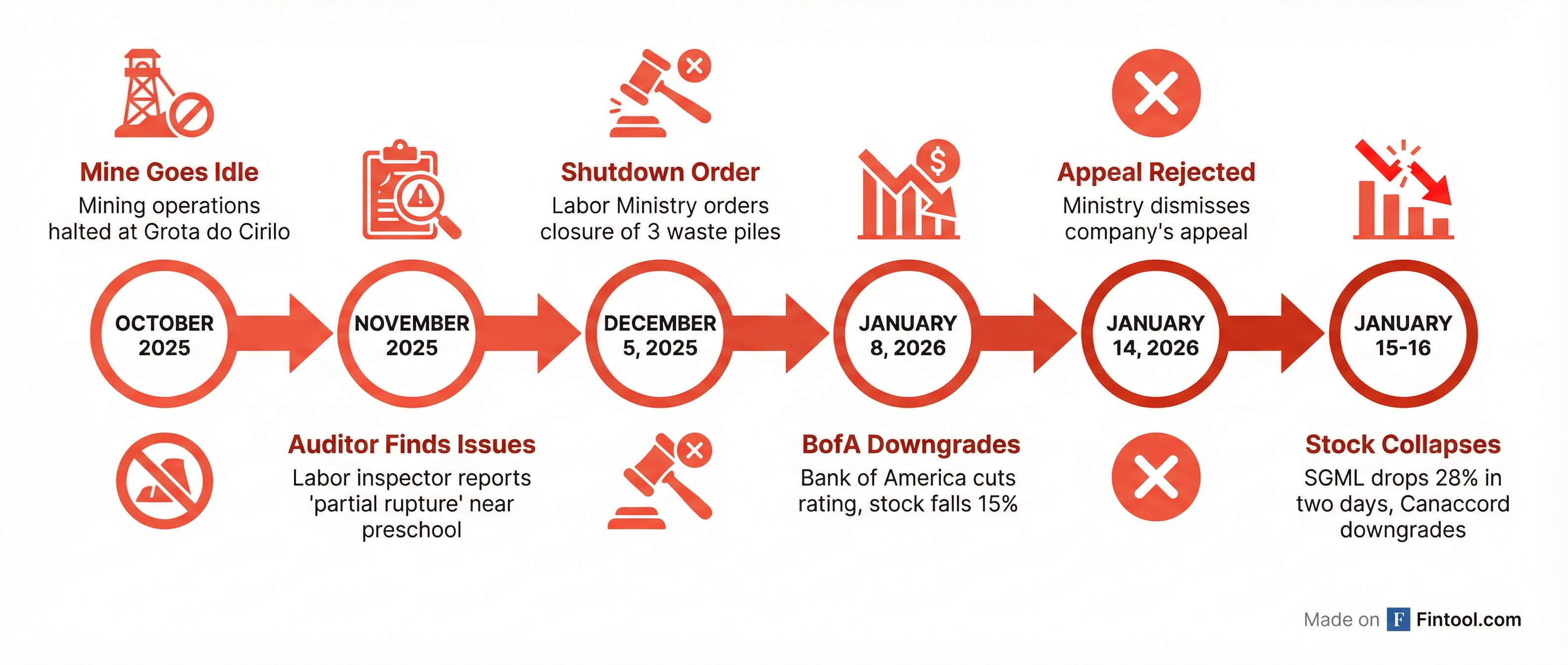

Sigma Lithium shares collapsed 28% over two days after Brazil's Labor Ministry shut down three waste piles at the company's flagship mine, citing a "grave and imminent" risk that evokes memories of Brazil's deadliest mining disasters.

The Grota do Cirilo mine—Brazil's largest lithium operation with 270,000 tonnes of annual production capacity—has been idle since October 2025, and the regulatory crackdown now casts serious doubt on when, or whether, it can safely resume operations.

SGML closed at $12.21 on Friday, down from $16.59 just two days earlier. Trading volume exploded to 12 million shares, roughly eight times the 90-day average, as two Wall Street firms downgraded the stock and a class action law firm announced an investigation.

The Safety Crisis

Labor Ministry inspectors issued the shutdown order on December 5 after finding the mine's waste piles had safety factors below the required 1.3 threshold—the same regulatory minimum that Brazilian mining giants are required to maintain following the catastrophic dam failures at Brumadinho (270 deaths, 2019) and Mariana (19 deaths, 2015).

The three affected piles stand 40 meters high. If they fail, inspectors warn, material could be hurled up to 120 meters—potentially reaching the Piaui River and nearby communities. A November inspection found a "partial rupture" in one pile located behind a preschool, which officials cited as evidence of structural issues.

Sigma Lithium dismissed the company's appeal on Tuesday, January 14. To resume using the prohibited waste piles, Sigma must present documentation proving it has corrected the issues—a process with no clear timeline.

"The company was given ample opportunity to minimize its risks," a labor inspector wrote in a January 6 report rejecting Sigma's argument that the piles are safe.

Sigma maintains the piles "only contain soil, with no contaminants" and are "fully within safety parameters established by authorities." The company's January 13 filing notably omits any mention of the regulatory shutdown, instead highlighting a new board appointment and $11 million sale of lithium fines.

Wall Street Abandons Ship

The stock's collapse accelerated after back-to-back downgrades from major Wall Street firms:

Bank of America cut SGML to Underperform on January 8, citing "lack of clarity on when production would resume" and sending shares down 15% in a single session. The firm raised its price target to $13 from $11 but warned of "operational delays, liquidity concerns, and uncertainty around restarting mining operations."

Canaccord Genuity followed Friday, downgrading from Buy to Hold. While raising its price deck 30% for 2026-2027, the firm said it cannot recommend the stock until mining actually resumes.

One Seeking Alpha analyst downgraded to Sell with a $7 price target, warning: "SGML faces near-term operating losses and potential capital raise as tailings shutdown and delayed restart pressure the balance sheet."

Financial Pressure Mounts

The shutdown compounds an already precarious financial position. Sigma's cash position has declined sharply over the past year:

| Metric | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 |

|---|---|---|---|---|

| Revenue ($M) | $45.9 | $20.9 | $46.7 | $47.7 |

| Net Income ($M) | -$10.8 | -$25.1 | -$8.1 | $4.7 |

| Cash ($M) | $75.3 | $65.6 | $45.9 | $31.1 |

| Total Debt ($M) | $222.8 | $184.4 | $176.7 | $171.8 |

Values retrieved from S&P Global

Cash has declined from $75 million to $31 million while the company has posted three consecutive quarterly losses. With the mine idle since October and no clear restart timeline, the balance sheet is under severe strain.

The company secured a $5 million working capital facility from a major customer in January, with potential for up to 70,500 tonnes of prepaid sales through 2026. But this stopgap financing underscores the urgency: Sigma needs production to resume—and soon.

The Ghost of Brumadinho

The safety concerns carry particular weight in Brazil, where the mining industry remains haunted by two catastrophic tailings dam failures in Minas Gerais state—the same region where Sigma operates.

In January 2019, Vale's dam at Brumadinho collapsed without warning, killing 270 people, most of them employees eating lunch in a cafeteria just downstream. The disaster led to billions in fines, criminal charges, and sweeping regulatory reforms.

Three years earlier, the Mariana dam failure released 40 million cubic meters of toxic tailings into the Doce River basin, contaminating 415 miles of waterway before reaching the Atlantic Ocean. Nineteen people died.

Sigma uses dry-stacked tailings rather than slurry dams—a theoretically safer technology. But Brazilian regulators appear to be applying heightened scrutiny to all mining operations in the wake of those disasters. The Labor Ministry explicitly warned that a collapse at Grota do Cirilo "could cause impacts similar to the disasters in Brumadinho and Mariana."

Corporate Drama Adds Uncertainty

The operational crisis unfolds against a backdrop of boardroom turmoil. CEO Ana Cabral is embroiled in a legal battle with former co-CEO Calvyn Gardner—her ex-husband—who is suing the company over mining rights and has publicly raised safety concerns at Grota do Cirilo.

The company recently reshuffled its board, appointing former Brazilian Agriculture Minister Katia Abreu to replace outgoing director Eugenio de Zagottis, who management said was stepping down "to focus on other business activities."

Pomerantz Law Firm has announced an investigation into potential securities law violations, adding yet another overhang to the battered stock.

What to Watch

Near-term catalysts:

- Any update on regulatory compliance and timeline for waste pile remediation

- Q4 2025 earnings call expected in mid-February for management commentary on restart

- Further developments in the Gardner legal dispute

- Progress on the $70.5 million prepaid sales facility

Key questions for investors:

- Can Sigma generate enough cash from its $850,000 tonnes of stored lithium fines to bridge the production gap?

- Will the company need to raise additional capital, and at what dilution?

- How long can major customers wait before seeking alternative supply?

The bull case hinges on a rapid production restart and lithium price recovery. But with Brazilian regulators showing zero tolerance for safety lapses and management credibility at a low ebb, the risk/reward is heavily skewed to the downside.