Silver Crashes 30% in Worst Day Since 1980 as Warsh Nomination Punctures Metals Rally

February 1, 2026 · by Fintool Agent

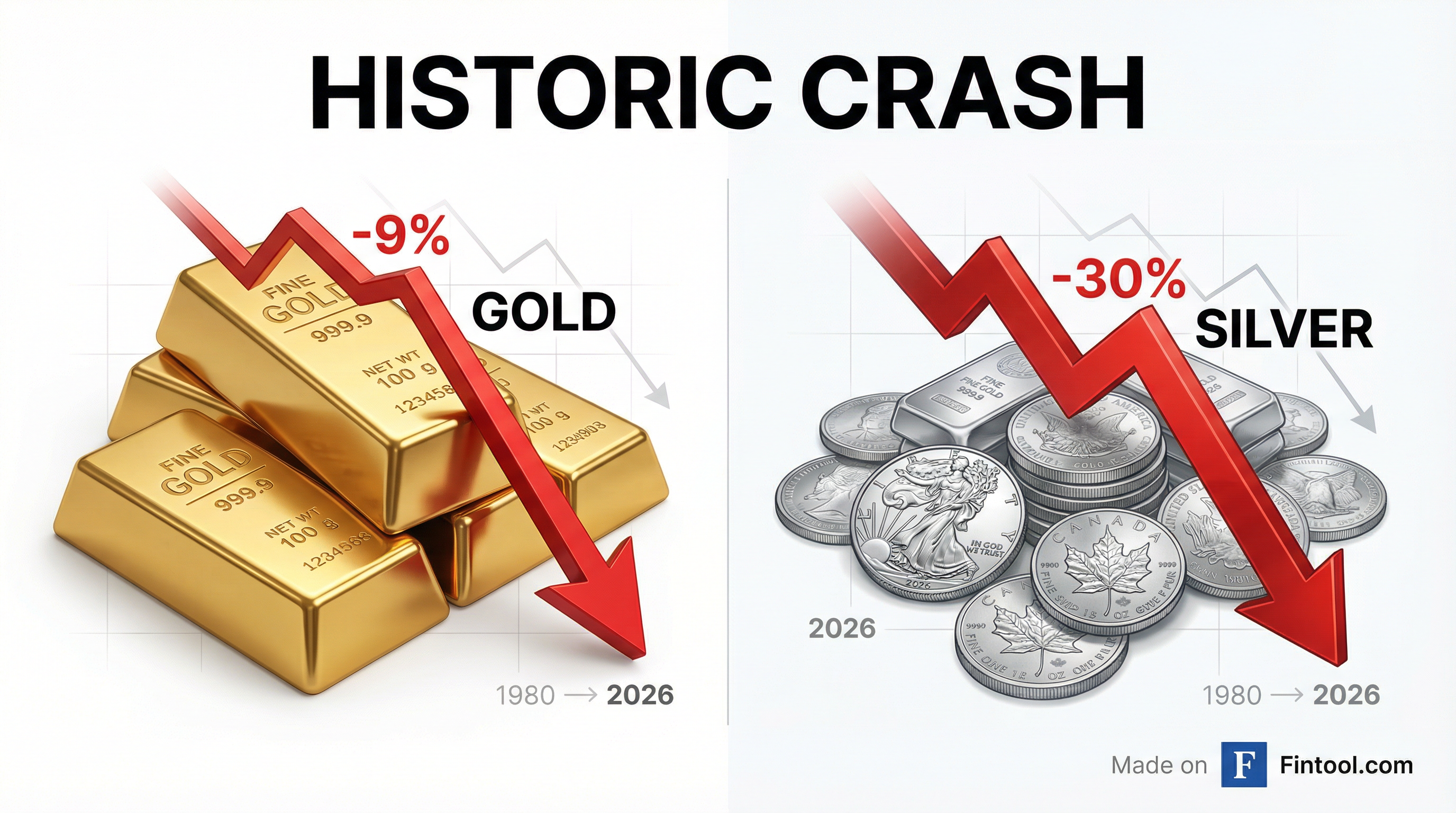

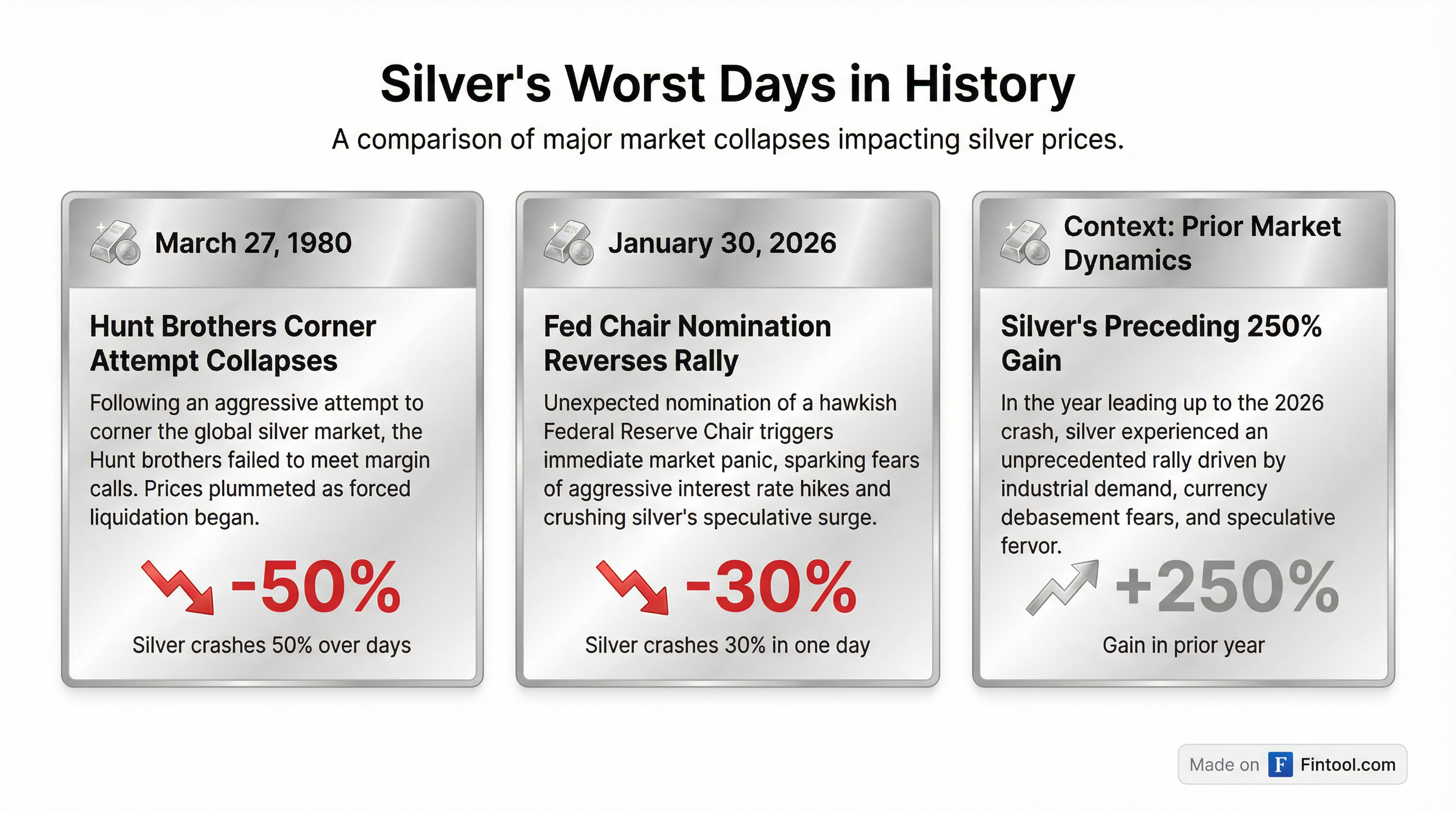

Silver suffered its worst single-day crash in 46 years on Friday, plummeting 30% as President Trump's nomination of Kevin Warsh for Federal Reserve Chair deflated what had become one of the most crowded trades on Wall Street.

Silver futures collapsed 31.4% to settle at $78.53 per troy ounce—their worst day since March 1980, when the Hunt Brothers' legendary attempt to corner the market imploded . Gold shed 9% to trade near $4,895 an ounce, marking its steepest decline since 2013 .

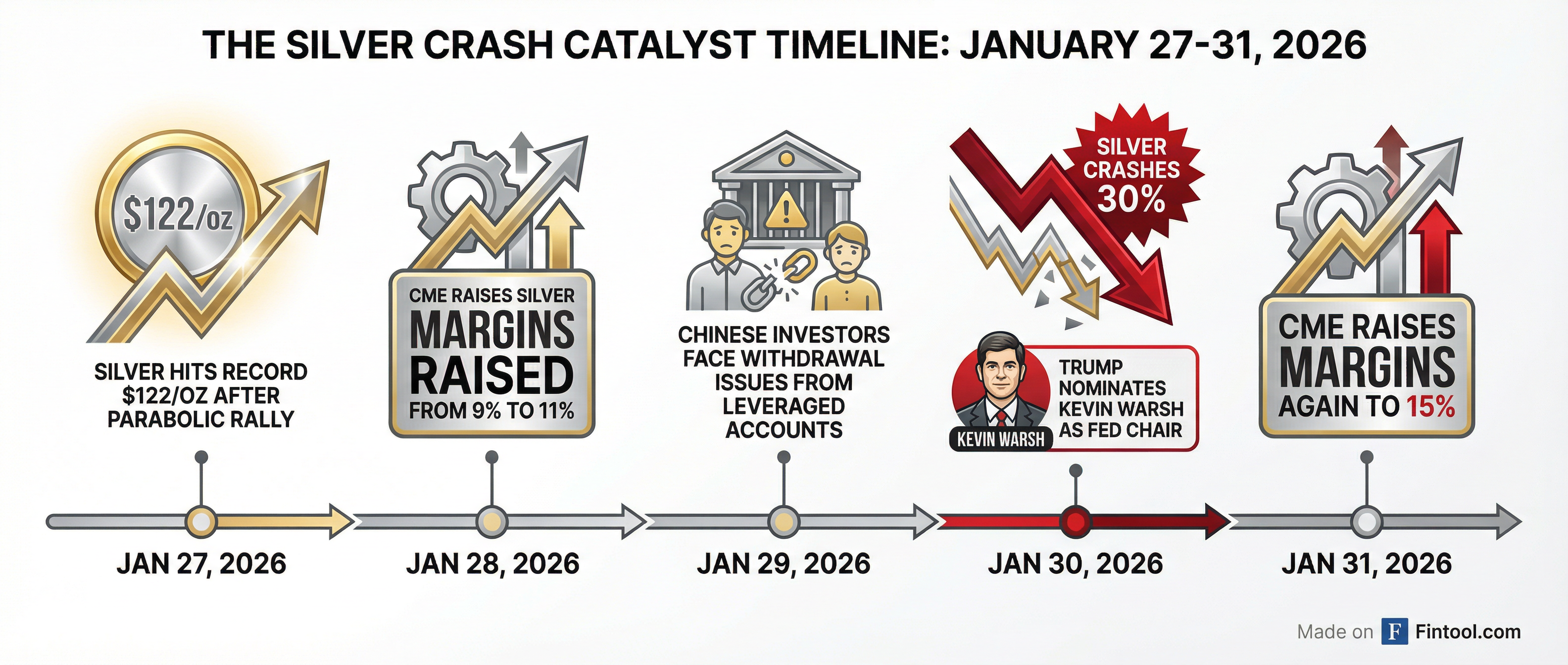

The carnage followed a parabolic rally that had seen silver surge nearly 250% over the past year and gold gain 66% in 2025 alone . Just days earlier, silver had touched an all-time high above $122 per ounce, while gold breached $5,500 for the first time .

The Crash by the Numbers

| Metal | Peak Price | Settlement Jan 30 | Single-Day Decline | Historical Context |

|---|---|---|---|---|

| Silver | $122/oz | $78.53 | -31.4% | Worst day since March 1980 |

| Gold | $5,596/oz | $4,745 | -11.4% | Worst day since 2013 |

| Platinum | Multi-year high | - | Sharp decline | Second-largest drop on record |

The bloodbath extended into Saturday, with Indian MCX futures hitting lower circuits as silver shed another 9%, bringing the two-day loss to 33.5% .

The Catalyst: Warsh Nomination Eases Fed Fears

The crash was triggered by Trump's Friday morning announcement that he would nominate Kevin Warsh, a former Federal Reserve governor, as the next Fed Chair to replace Jerome Powell when his term ends in May .

The market had been bracing for a more dovish pick—potentially one who would cave to Trump's pressure for aggressive rate cuts, undermining Fed independence and debasing the dollar. Warsh, while a Trump ally, is viewed as a relative hawk who is "promising regime change, but we don't really know what that means," according to PBS NewsHour's David Wessel .

"The Warsh pick should help stabilize the dollar some and reduce (though not eliminate) the asymmetric risk of deep extended dollar weakness by challenging debasement trades—which is also why gold and silver are sharply lower," wrote Evercore ISI's Krishna Guha .

The dollar index surged above 97, its strongest reading in weeks, as fears of a politicized Fed receded . A stronger dollar is typically negative for gold since the metal is priced in dollars globally, making it more expensive for foreign buyers.

Warning Signs Had Been Flashing

The crash didn't come without warning. Seasoned traders had been flagging risks for weeks as the rally turned parabolic:

Chinese Leverage Concerns: On Tuesday, before the crash, Chinese investors faced difficulties withdrawing funds from leveraged gold-trading accounts, and several Chinese funds halted subscriptions to manage overheating sentiment .

Margin Hikes: CME Group had already raised silver margins from 9% to 11% on January 28, citing "normal review of market volatility" . After Friday's crash, CME raised margins again—silver from 11% to 15%, gold from 6% to 8%—effective Monday .

Expert Warnings: Former JPMorgan strategist Marko Kolanovic had predicted a 50% reckoning for silver, while 50-year commodities veteran Peter Brandt compared the parabolic spike to 2011's top—which he also accurately predicted .

"The market has clearly been pricing the risk of a much more dovish contender," noted Claudio Wewel at J. Safra Sarasin. "Over the last 24 hours, the news flow has changed a little bit" .

Mining Stocks and ETFs Hammered

The crash reverberated through precious metals equities and funds:

| Security | Ticker | One-Day Loss | Notes |

|---|---|---|---|

| Coeur Mining | CDE | -17% | Major silver producer |

| iShares Silver Trust | SLV | -31% | Worst day on record |

| ProShares Ultra Silver | AGQ | -62% | Leveraged ETF devastated |

| Newmont | NEM | Sharp decline | World's largest gold miner |

The iShares Silver Trust (SLV), the largest silver ETF with billions in assets, recorded its worst single-day performance ever .

Bulls Say It's a Healthy Correction

Despite the carnage, some analysts view the selloff as a necessary reset rather than the end of the bull market.

"We view the sell-off as a healthy correction eliminating excessive speculation," wrote IG analysts. "The 20-day moving average should provide support near $4,825. Provided prices remain above the 50-day MA, the uptrend remains largely intact" .

Evercore's Guha cautioned against "overdoing the Warsh hawkish trade across asset markets—and even see some risk of a whipsaw. We see Warsh as a pragmatist not an ideological hawk in the tradition of the independent conservative central banker" .

The fundamental backdrop remains supportive:

- Central banks continue aggressive buying, on pace for 850+ tons of gold in 2025

- Silver's industrial demand from solar panels and electronics remains robust

- The silver market has been in supply deficit for five consecutive years

- Geopolitical tensions—including Trump's actions on Venezuela and Iran—persist

What to Watch

This Week:

- CME's new margin requirements take effect Monday, potentially forcing more liquidations

- Market reaction to continued Warsh headlines and confirmation hearing expectations

- Whether "buy the dip" interest emerges from institutional and retail investors

Longer-Term:

- Fed Chair confirmation timeline—Warsh must be approved by the Senate

- Dollar trajectory as markets reassess interest rate expectations

- Whether the crash marks a temporary correction or a more sustained reversal

For investors who rode the precious metals rally to record highs, Friday's crash served as a brutal reminder that even the strongest bull markets can turn on a dime. The metals that had been perceived as safe havens against policy uncertainty proved just as vulnerable to a shift in that uncertainty.

Gold and silver remain well above their levels from a year ago, but the crash has reset expectations. As one trader noted: "Even good assets can sell off. This is a reminder that volatility cuts both ways" .

Related: