Simply Good Foods Ousts CEO Tanner After 2.5 Years, Brings Back Founding CEO Scalzo

February 2, 2026 · by Fintool Agent

The Simply Good Foods Company (NASDAQ: SMPL), owner of Quest, Atkins, and OWYN protein snack brands, fired CEO Geoff Tanner on January 18, 2026 and immediately reinstalled founding CEO Joseph Scalzo—the latest example of a board losing confidence in a successor and calling back the leader who built the company.

The move comes with SMPL stock trading at 52-week lows after a 54% decline from its peak, gross margins collapsing 590 basis points year-over-year in Q1 FY26, and the flagship Atkins brand in secular decline.

Scalzo, 66, led Simply Good Foods from its 2017 IPO through July 2023, orchestrating the $1 billion acquisition of Quest Nutrition that transformed the company into a multi-brand nutritional snacking platform. He stepped down and handed the reins to Tanner, who came from J.M. Smucker, but remained as Executive Vice Chairman until August 2024.

The Timing: 10 Days After Earnings

The abrupt nature of Tanner's departure is striking. On January 8, 2026—just 10 days before his exit—Tanner led the Q1 FY26 earnings call, reaffirmed full-year guidance, and signed Sarbanes-Oxley certifications attesting to the accuracy of the company's financial statements.

By January 18, a Saturday, he was gone. Scalzo's employment agreement was signed January 19, and the transition was announced on January 20—Martin Luther King Jr. Day, a market holiday.

The sequencing suggests the board had been negotiating Scalzo's return while Tanner was still publicly leading the company.

Why the Change: Margin Collapse and Atkins Decline

While the company offered only a boilerplate "new chapter" explanation, the financial deterioration under Tanner's tenure tells the story:

Financial Performance Under Tanner

| Metric | Q2 2024 | Q1 2025 | Q4 2025 | Q1 2026 | Change |

|---|---|---|---|---|---|

| Revenue ($M) | $312.2 | $341.3 | $369.0 | $340.2 | Flat YoY |

| Net Income ($M) | $33.1 | $38.1 | -$12.4 | $25.3 | -34% YoY |

| Gross Margin (%) | 37.4% | 38.2% | 34.3% | 32.3% | -590 bps YoY |

| EBITDA Margin (%) | 17.1%* | 19.1%* | 17.3%* | 14.6%* | -450 bps YoY |

*Values retrieved from S&P Global

The damage is concentrated in three areas:

1. Gross Margin Compression: Q1 FY26 gross margin of 32.3% was down 590 basis points year-over-year, driven by elevated cocoa and whey costs, and $4 million in tariff impacts that were only partially offset by pricing and productivity.

2. Atkins in Structural Decline: The legacy brand that gave the company its start is declining 19-20% annually, with two-thirds of the drop driven by lost distribution at key retailers. Management acknowledged the brand has "a long tail of SKUs, many of which turn at below category average levels."

3. OWYN Integration Struggles: The $270 million OWYN acquisition from October 2023 faced product quality issues that hurt velocities and forced a formula reformulation. Q1 net sales lagged consumption meaningfully due to "lingering product quality issues."

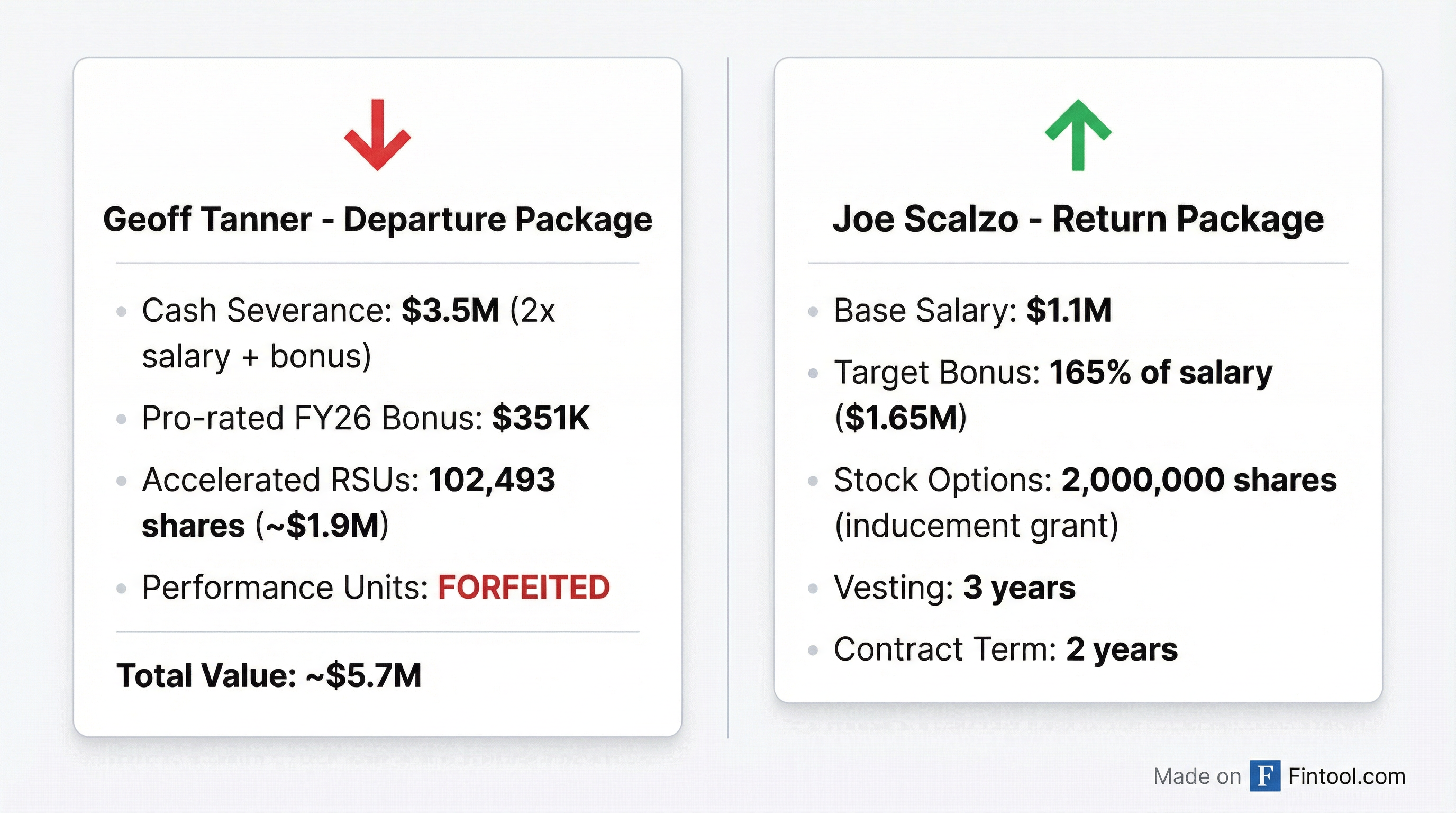

The Severance: $5.7M to Walk Away

Tanner's separation agreement reveals a substantial exit package despite the short tenure:

| Component | Value |

|---|---|

| Cash Severance (2x salary + bonus + COBRA) | $3,519,454 |

| Pro-rated FY26 Bonus | $350,568 |

| Accelerated Time-Based RSUs | 102,493 shares ($1.9M at current prices) |

| Performance Stock Units | Forfeited |

| Estimated Total | ~$5.7 million |

The forfeiture of performance stock units is notable—it suggests the performance metrics tied to those awards would not have been achieved.

Scalzo's Return Package: 2 Million Shares

Scalzo's inducement grant is unusually large—2 million stock options at fair market value, vesting over three years—signaling the board's urgency and the need to make the return worthwhile for an executive who had already departed for the private equity world.

Key terms of Scalzo's employment agreement:

| Term | Details |

|---|---|

| Base Salary | $1,100,000 |

| Target Annual Bonus | 150% of salary ($1.65M target) |

| Inducement Option Grant | 2,000,000 shares, 8-year term |

| Vesting Schedule | 1/3 annually over 3 years |

| Contract Term | 2 years (initial) |

| Work Location | Denver headquarters |

At current prices (~$18), the 2 million options have zero intrinsic value but represent significant upside if Scalzo can engineer a turnaround. At his predecessor's 52-week high of $40, those options would be worth $44 million.

Also Departing: Principal Accounting Officer

In a separate development disclosed in the same 8-K, principal accounting officer Timothy Matthews resigned on January 20, 2026 to pursue an external CFO opportunity, effective February 6. CFO Christopher Bealer will assume the additional duties without a compensation change.

The timing—announced two days after the CEO change—adds to the sense of broader organizational flux.

What Scalzo Inherits

The business Scalzo returns to is substantially different from the one he left:

The Good:

- Quest brand delivering 12% consumption growth, with salty snacks up 40%

- Household penetration for Quest approaching 20%

- Strong balance sheet with net debt at only 0.8x EBITDA

- $224 million remaining on share buyback authorization

The Challenges:

- FY26 guidance of -2% to +2% net sales growth, -4% to +1% EBITDA growth

- Gross margins expected to decline 100-150 bps for the full year

- Atkins brand requiring "revitalization" with ongoing distribution losses

- OWYN brand awareness at only 20%, household penetration at 4.5%

The company reaffirmed its FY26 outlook at the time of the leadership change, suggesting no near-term guidance cut despite the transition.

Market Reaction: Muted Initial Response, Then More Pain

SMPL shares were essentially flat on the first trading day after the announcement (January 21), closing at $21.18, up 0.7%. But the stock has since fallen 14% to $18.13 as of February 2, hitting new 52-week lows.

The muted initial reaction may reflect investor belief that any CEO would be an improvement, combined with skepticism that a 66-year-old returning executive represents a long-term solution.

The Boomerang CEO Playbook

Scalzo joins a growing list of "boomerang CEOs"—founders or former leaders who return after their successors stumble. The track record is mixed:

Successful Returns:

- Howard Schultz at Starbucks (returned 2008, 2022)

- Steve Jobs at Apple (returned 1997)

- Michael Dell at Dell (returned 2007)

Less Successful:

- Bob Iger at Disney (returned 2022, still navigating challenges)

- Jack Dorsey at Twitter (returned 2015, departed 2021)

The key question for Simply Good Foods: Is Scalzo returning to fix a temporarily challenged business, or is the Atkins brand in terminal decline while Quest and OWYN require more investment than the company can afford while maintaining margins?

What to Watch

Near-term catalysts:

- Q2 FY26 earnings (April 2026) – Scalzo's first earnings call as returning CEO

- Spring shelf resets – Distribution gains/losses for Quest vs. Atkins

- Cocoa price trajectory – Company locked in favorable supply for Q4 and into FY27

Strategic questions:

- Will Scalzo accelerate the Atkins rationalization or attempt a revival?

- How much capital will be allocated to OWYN growth vs. share buybacks?

- Is there M&A optionality to add a fourth brand to the portfolio?

The Simply Good Foods board has placed a significant bet that the architect of the company's success can rebuild it. Shareholders sitting on 54% losses from the peak will be watching closely to see if the sequel matches the original.

Related: The Simply Good Foods Company