SiTime Nears $3B Deal for Renesas Timing Unit, Creating AI Infrastructure Powerhouse

February 2, 2026 · by Fintool Agent

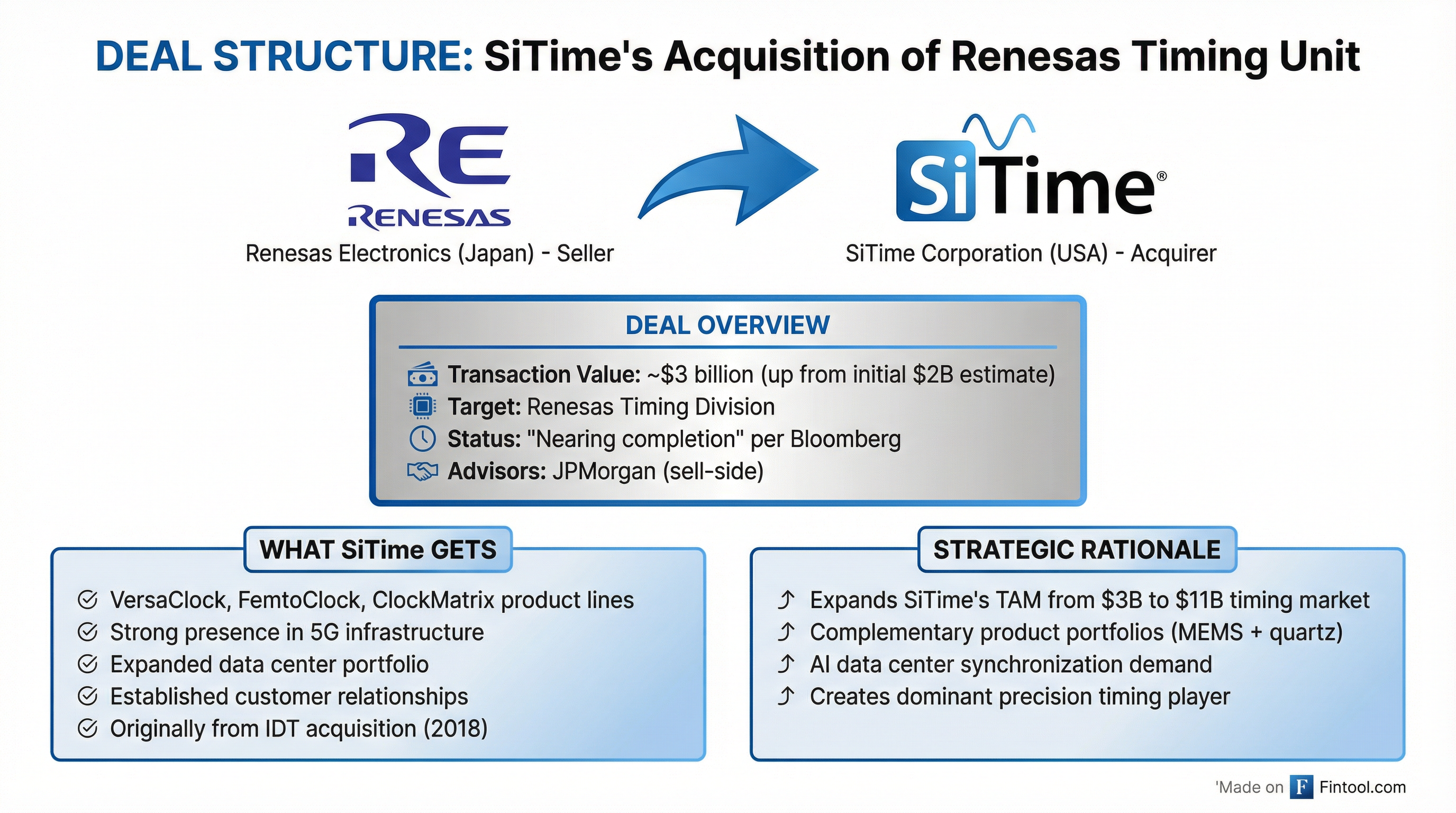

Sitime Corporation is in the final stages of negotiations to acquire Renesas Electronics' timing division for approximately $3 billion, according to Bloomberg—a deal that would create a dominant force in the precision timing market that underpins AI data centers.

The transaction value represents a 50% premium to the $2 billion estimate when Reuters first reported Renesas was exploring a sale in October 2025. Neither company has commented publicly, but the escalating valuation reflects surging demand for timing components critical to AI infrastructure.

The Invisible Backbone of AI

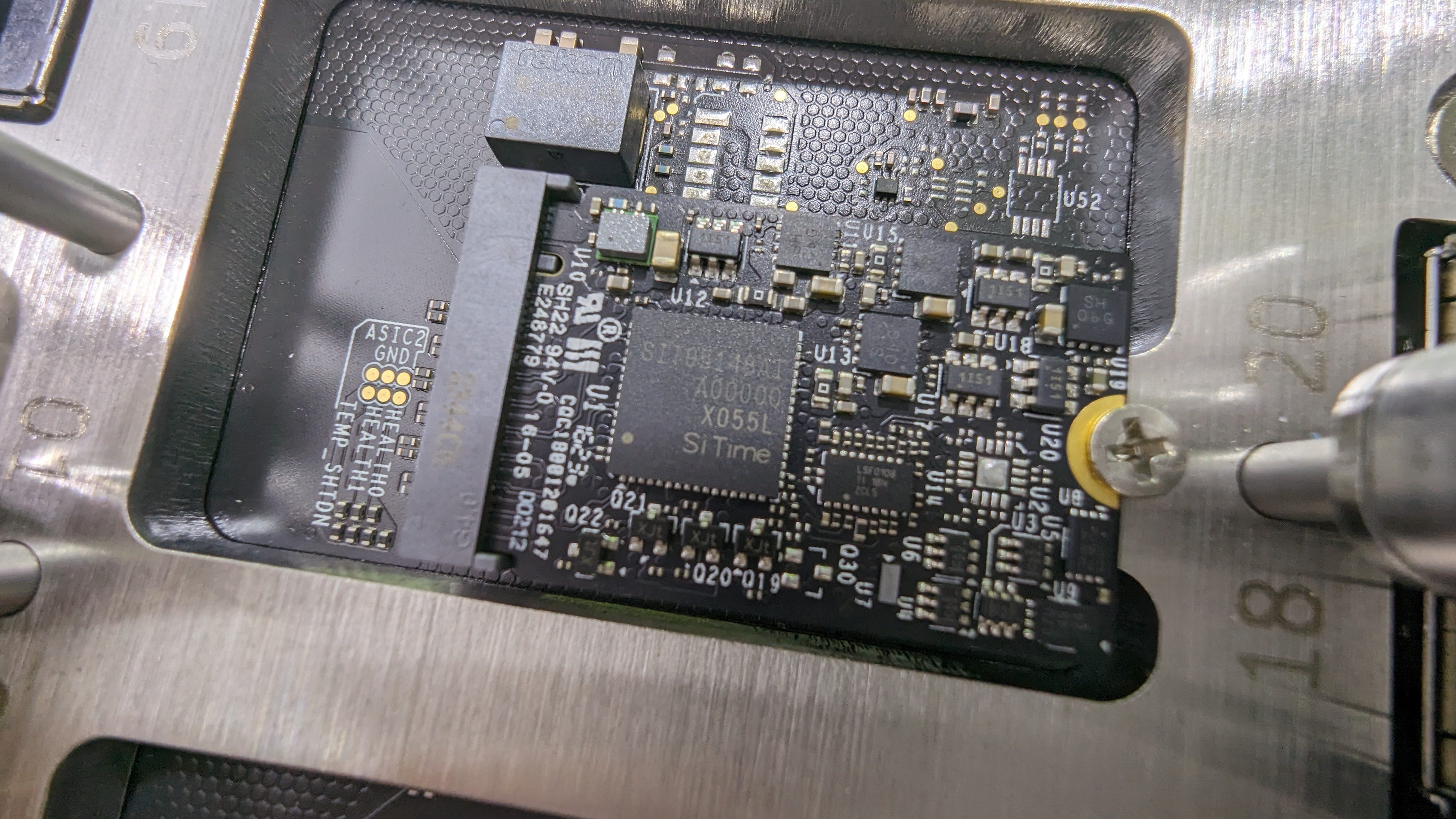

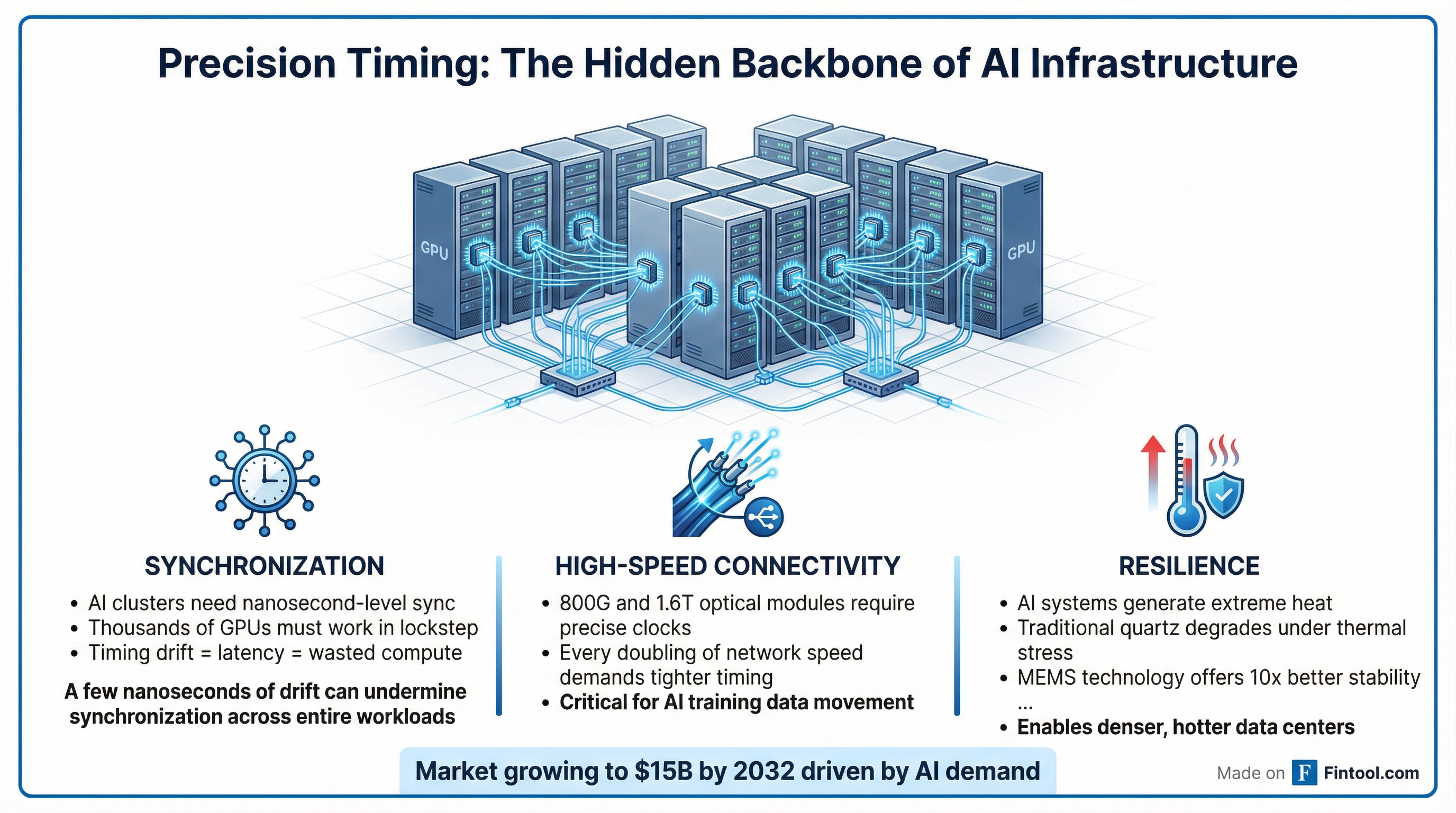

Timing chips are the metronome of modern electronics—they synchronize the flow of data across processors, networks, and storage systems. In AI data centers, where thousands of GPUs must work in lockstep to train massive models, precision timing is essential.

"AI Infrastructure equipment is becoming more dense, and is subject to rapid temperature changes within the system, but still needs to deliver maximum performance and reliability," SiTime noted in its Q3 2025 10-Q. "In 2025, we have benefitted from the strong growth in AI datacenter deployments."

SiTime CEO Rajesh Vashist has been emphatic about the accelerating demands. On the company's Q2 2025 earnings call, he noted that jitter requirements—a key timing specification—have tightened from 70 femtoseconds to below 20 femtoseconds in just three years. "The pace of innovation in this space is astonishing," Vashist said. "It's absolutely amazing."

What SiTime Gets

Renesas's timing division—largely inherited from the company's $6.7 billion acquisition of Integrated Device Technology (IDT) in 2018—brings a portfolio of established products including the VersaClock, FemtoClock, and ClockMatrix lines. These products serve data centers, 5G networks, and telecommunications infrastructure.

The strategic logic is compelling: SiTime's MEMS-based oscillators offer superior performance and resilience, while Renesas's quartz-based timing portfolio brings established customer relationships and complementary applications. Combined, the company would address virtually the entire $11 billion timing market, up from SiTime's current focus on roughly $3 billion of the segment.

Financial Snapshot

SiTime has been on a growth tear, with revenue accelerating quarter-over-quarter through 2025:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $68.1* | $60.3 | $69.5 | $83.6 |

| Gross Margin (%) | 52.6% | 50.3% | 51.9% | 53.5% |

| Net Income ($M) | -$18.8* | -$23.9 | -$20.2 | -$8.0 |

*Values retrieved from S&P Global

The company's data center segment has been the standout, growing 137% year-over-year in Q2 2025. Revenue is shipping to Hong Kong ($28.5M in Q3) and Taiwan ($20.5M) as key geographies, reflecting SiTime's penetration of Asian contract manufacturers serving hyperscalers.

With a market cap of approximately $9.5 billion, SiTime would be executing a transformational acquisition. The company raised $387 million in a follow-on offering in June 2025, bolstering its balance sheet for potential deals. But a $3 billion transaction would likely require significant debt financing—a departure for a company that has operated nearly debt-free.

Why Renesas Is Selling

For Renesas, the divestiture reflects a strategic sharpening toward automotive and industrial semiconductors—its core markets where it commands global leadership in microcontrollers. The timing business, while profitable, is adjacent to Renesas's primary focus.

"A divestment would allow Renesas to raise significant capital and potentially sharpen its focus on its core markets, such as automotive and industrial chips," Reuters reported in October.

JPMorgan is advising Renesas on the sale. The deal had initially attracted interest from Texas Instruments and Infineon, but SiTime emerged as the frontrunner given its exclusive focus on timing and complementary technology platform.

What to Watch

Financing structure: How SiTime funds the deal—equity, debt, or a combination—will determine the impact on existing shareholders.

Integration execution: Merging MEMS and quartz-based product lines requires technical finesse. SiTime's 2023 Aura Semiconductor acquisition ($148M + $120M earnouts) provides a recent playbook for integrating clocking products.

Customer reaction: Key hyperscalers and networking OEMs will be watching whether the combined company can maintain support for both product families.

Regulatory review: Given the strategic importance of timing chips for telecommunications and defense, the deal may face scrutiny from CFIUS or other regulatory bodies.

Related: Sitime | Renesas Electronics