SM Energy Names Beth McDonald CEO as $12.8B Civitas Merger Closes

January 26, 2026 · by Fintool Agent

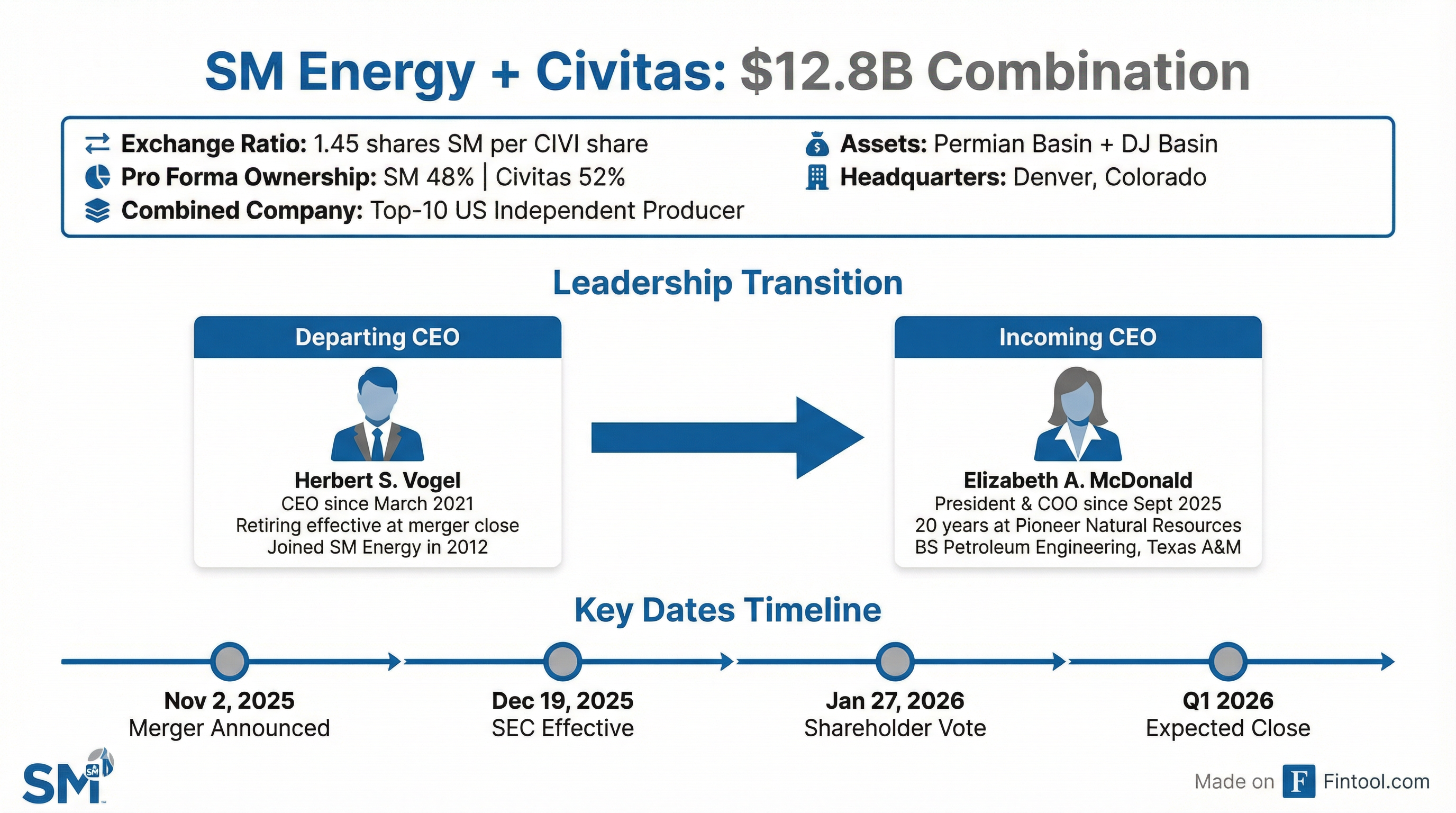

SM Energy confirmed Elizabeth "Beth" McDonald as its next chief executive officer, effective upon the closing of its $12.8 billion merger with Civitas Resources that shareholders will vote on tomorrow.

The Pioneer Natural Resources veteran, 47, takes the reins from Herbert Vogel, who announced his retirement in September after five years leading the Denver-based producer through a period of aggressive portfolio expansion. The combined company will be one of the top 10 independent oil producers in the United States, with significant positions in the Permian Basin and DJ Basin.

The Deal at a Glance

The all-stock merger, announced November 2, 2025, creates a premier Permian and DJ Basin operator:

| Metric | Value |

|---|---|

| Enterprise Value | $12.8 billion |

| Exchange Ratio | 1.45 SM shares per CIVI share |

| Pro Forma Ownership | SM shareholders 48% / CIVI shareholders 52% |

| Headquarters | Denver, Colorado |

| Combined Production | 450 Mboe/d |

| Board Composition | 11 directors (6 SM, 5 Civitas) |

Shareholder meetings for both companies are scheduled for January 27, 2026, with both boards unanimously recommending approval.

McDonald: A Pioneer Pedigree

McDonald joined SM Energy as EVP and COO in September 2024, recruited specifically as Vogel's successor. Her appointment represents continuity in a company that has emphasized technical excellence and operational efficiency.

Key credentials:

- 20 years at Pioneer Natural Resources, rising to EVP of Strategic Planning, Field Development and Marketing

- Led operations spanning both the Permian Basin and South Texas Eagle Ford

- BS in Petroleum Engineering from Texas A&M University

- Licensed Professional Engineer in Texas

"I am honored to have the opportunity to serve as SM Energy's President and Chief Operating Officer," McDonald said when appointed President in September. "This is an exciting time for SM Energy as we embrace a step-change in scale in reserves, production and cash flow."

Her compensation package includes a $900,000 base salary, with short-term incentive target of 120% of salary and long-term equity awards of $5.3 million annually (40% RSUs, 60% performance units).

Blake McKenna, previously SVP of Texas operations, was simultaneously appointed Executive Vice President and COO.

Vogel's Legacy: Growth Amid Volatility

Herbert Vogel became CEO in March 2021, navigating SM Energy through the COVID recovery and subsequent commodity price volatility. Under his leadership, the company:

| Metric | FY 2020 | FY 2024 | Change |

|---|---|---|---|

| Revenue | $1.08B* | $2.56B* | +137% |

| Net Income | -$765M | $770M | Turn to profit |

| EBITDA | $732M* | $1.89B* | +158% |

| EBITDA Margin | 67.7%* | 73.2%* | +5.5 pp |

*Values retrieved from S&P Global

The stock reached an all-time high of $54.36 in June 2022 before retreating amid broader energy market weakness. Shares currently trade around $19, down 65% from that peak but still above Vogel's starting point.

Chairman Julio Quintana praised Vogel's tenure: "Herb's successful tenure is highlighted by significant portfolio expansion and bottom-line growth driven by his leadership culture that encouraged technology, innovation and collaboration."

Market Reaction and Analyst View

Both stocks have traded below their pre-announcement levels since the deal was revealed. SM fell ~10% in the days following the November announcement, while Civitas dropped ~6%, suggesting initial skepticism about merger synergies.

| Stock | Pre-Merger (Nov 1) | Current | Change |

|---|---|---|---|

| SM | $20.89 | $19.18 | -8.2% |

| CIVI | $28.83 | $27.78 | -3.6% |

The analyst consensus target for SM remains $31.00, implying 62% upside from current levels. J.P. Morgan's fairness analysis implied potential value creation for Civitas shareholders of approximately 31.4% under NYMEX strip pricing assumptions.

Litigation Risk

Multiple demand letters and two lawsuits have been filed by stockholders alleging disclosure deficiencies in the joint proxy statement. Both companies have issued supplemental disclosures while denying wrongdoing, specifically to avoid delaying the January 27 vote.

What to Watch

Tomorrow (January 27): Special stockholder meetings for both SM Energy and Civitas. Both boards recommend approval, and major Civitas holder Kimmeridge (5.9% stake) has committed to vote in favor.

Q1 2026: Expected merger close, at which point McDonald officially becomes CEO and Vogel departs.

Post-Close: Integration execution, synergy realization ($40M estimated transaction fees, $140M estimated tax dis-synergies), and capital allocation priorities under new leadership.

Related: SM Energy · Civitas Resources