Southwest Forecasts 300% Profit Surge After Abandoning Open Seating

January 28, 2026 · by Fintool Agent

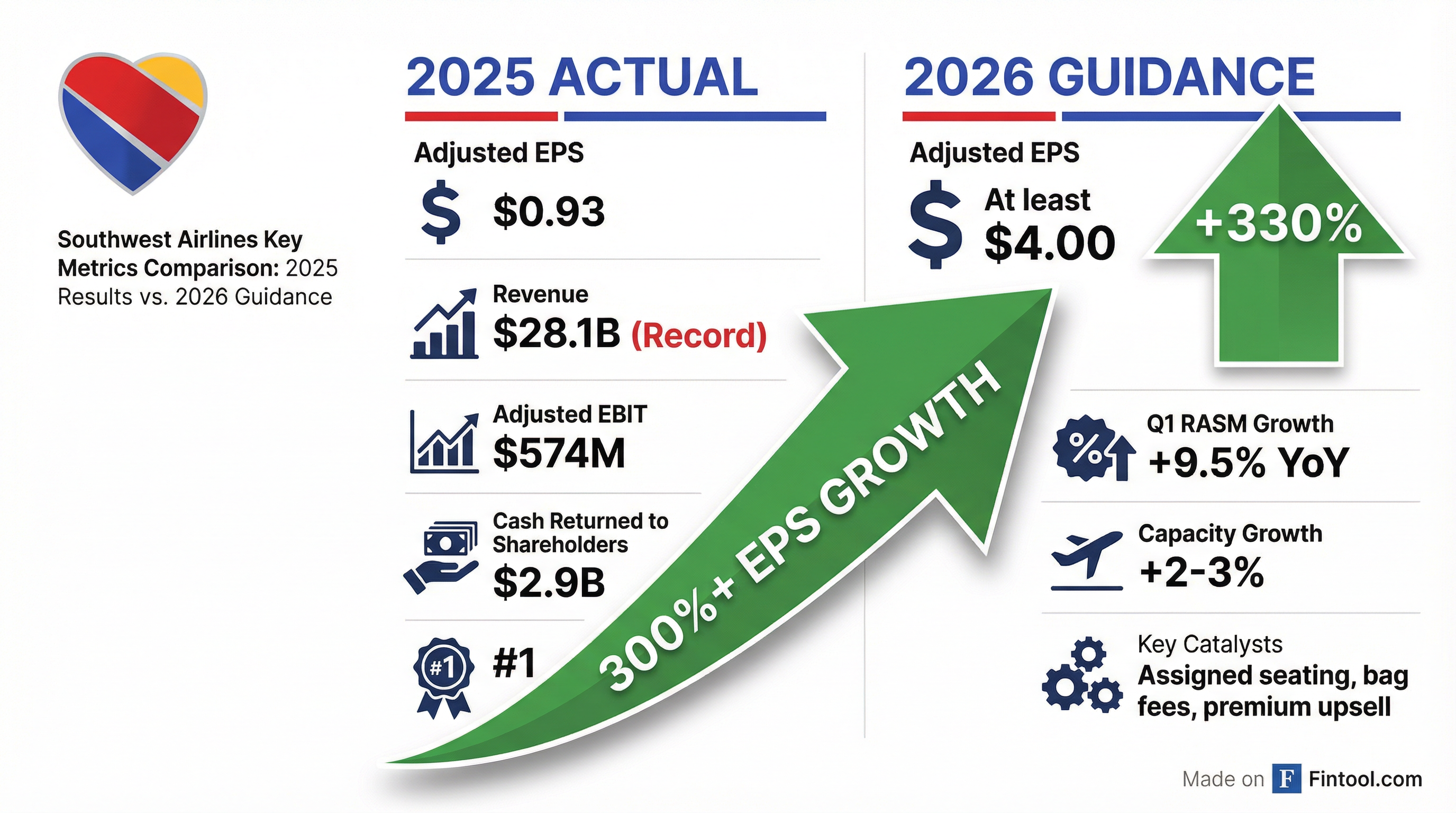

Southwest Airlines is projecting 2026 adjusted earnings per share of at least $4.00—a more than 300% increase from $0.93 in 2025—as the airline's sweeping business model transformation begins generating results just one day after assigned seating flights took off .

The Dallas-based carrier, which ended its 55-year-old open seating policy yesterday, delivered Q4 2025 net income of $323 million and full-year net income of $441 million while posting record annual revenues of $28.1 billion .

Shares rose over 6% in after-hours trading.

The Numbers

| Metric | Q4 2025 | Full Year 2025 |

|---|---|---|

| Operating Revenue | $7.4B (record) | $28.1B (record) |

| Net Income | $323M | $441M |

| Adjusted Net Income | $301M | $512M |

| Adjusted EBIT | $386M | $574M |

| Adjusted EPS | $0.58 | $0.93 |

"The Most Ambitious Transformation in Company History"

CEO Bob Jordan called 2025's overhaul "the most ambitious transformation in Company history," encompassing fundamental changes to how Southwest does business :

- Assigned and extra legroom seating for travel beginning January 27, 2026

- Bag fees implemented after decades of "bags fly free"

- Basic economy fares added to the product offering

- Rapid Rewards program optimization with variable earn and burn rates

- Online distribution expansion through partnerships with Expedia and Priceline

- Cost reduction exceeding $370 million, including the company's first-ever layoffs of non-contract and management employees

"Our performance reflects the extraordinary work of our People, who transformed the business while continuing to serve our Customers with unparalleled hospitality and operational excellence," Jordan said .

The transformation earned Southwest the top ranking in The Wall Street Journal's Best U.S. Airlines of 2025 .

2026 Guidance: "At the Lower End of Internal Forecasts"

Management emphasized that the $4.00+ EPS guidance represents the low end of expectations . With assigned seating just launching, Southwest expects upside from:

- Upsell revenue from close-in bookings, which skew toward business and price-flexible customers

- Growth in business and leisure customer segments attracted by the new product offering

| Guidance Metric | Q1 2026 | Full Year 2026 |

|---|---|---|

| Adjusted EPS | At least $0.45 | At least $4.00 |

| RASM Growth (YoY) | At least +9.5% | — |

| Capacity Growth (YoY) | +1% to 2% | +2% to 3% |

| CASM-X Growth (YoY) | 3.5% | — |

The Q1 CASM-X increase includes a 1.1 percentage point impact from removing six seats from the Boeing 737-700 fleet to enable extra legroom seating .

Capital Returns and Balance Sheet

Southwest returned $2.9 billion to shareholders in 2025 through share repurchases ($2.6 billion) and dividends ($399 million)—representing approximately 14% of shares outstanding .

The company ended 2025 with:

| Balance Sheet Metric | Value |

|---|---|

| Cash & Equivalents | $3.2B |

| Revolving Credit Line | $1.5B |

| Leverage (Adj. Debt/EBITDAR) | 2.4x |

| Unencumbered Aircraft (Book Value) | $17.0B |

Southwest retired $3.3 billion of debt in 2025, including $1.6 billion of convertible notes and prepayment of $1.6 billion in Payroll Support Program obligations. The company also issued $1.5 billion in unsecured bonds "at industry-leading terms" in November 2025 .

Fleet and Operations

The airline ended 2025 with 803 aircraft after receiving 55 Boeing 737-8 deliveries and retiring 55 aircraft (48 Boeing 737-700s and seven 737-800s) .

For 2026, Southwest expects:

- 66 Boeing 737-8 deliveries

- ~60 aircraft retirements

- Capital spending of $3.0-3.5 billion

Southwest also announced six strategic international partnerships with Icelandair, EVA Air, China Airlines, Philippine Airlines, Condor, and Turkish Airlines .

What to Watch

The next month will be critical as Southwest monitors booking behavior following the assigned seating launch. Management committed to providing range-bound guidance when current quarterly results are reported, "if not earlier" .

Key catalysts:

- Close-in booking patterns to gauge premium upsell capture

- Business traveler response to the enhanced product offering

- Q1 2026 results expected in late April

The transformation represents a calculated bet that Southwest customers will accept industry-standard practices in exchange for lower fares and improved operational reliability. Yesterday's launch was the final—and most visible—piece of that puzzle.

Related: