Spectral AI Chief Commercial Officer Departs Months Before FDA Decision and Commercial Launch

February 3, 2026 · by Fintool Agent

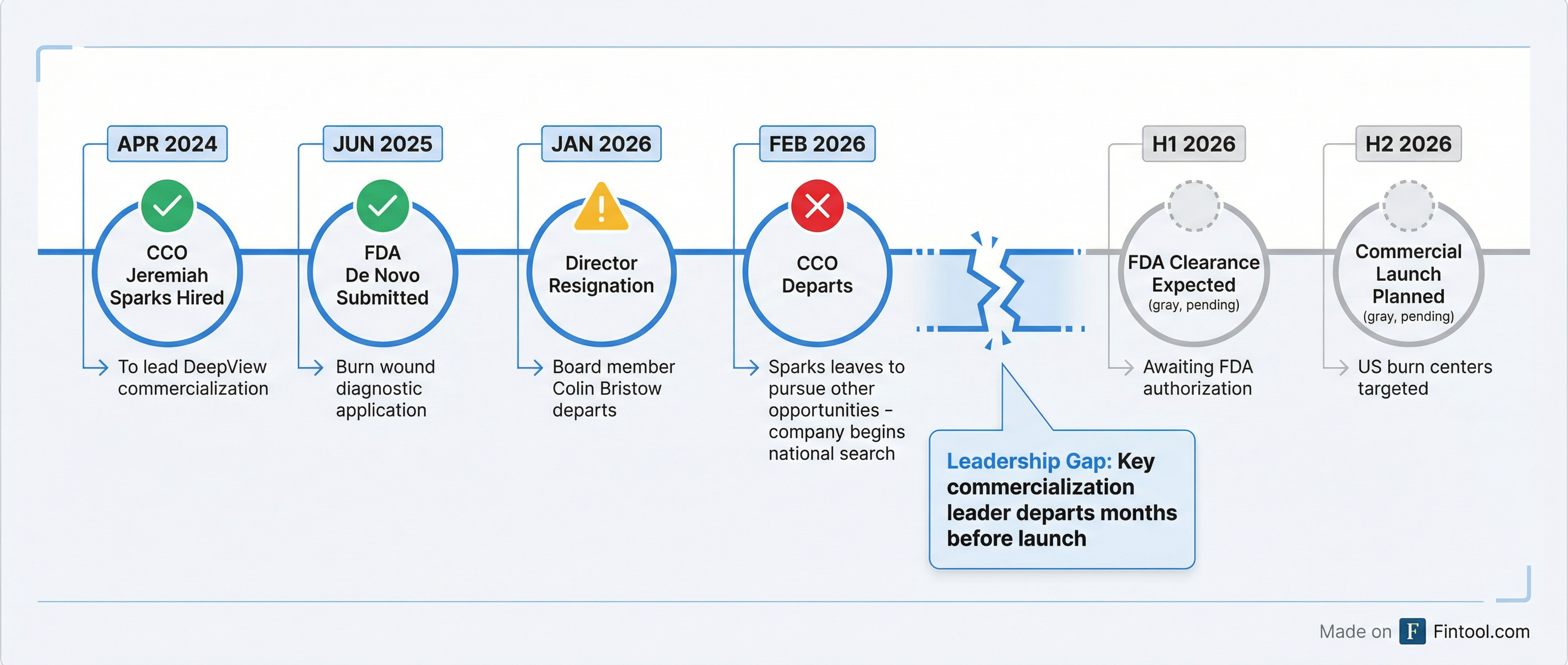

Spectral Ai (NASDAQ: MDAI) announced that Chief Commercial Officer Jeremiah Sparks has resigned, effective February 1, 2026—just months before the company expects FDA clearance of its flagship DeepView burn wound diagnostic system and planned commercial launch.

The departure marks the second executive-level exit in less than a month. Board member Colin Bristow resigned on January 5, 2026. Both departures come at a critical inflection point for the pre-revenue company, which is transitioning from a research organization to a commercial entity.

Shares rose 2.4% to $1.74 in Monday trading, suggesting investors may be taking a wait-and-see approach rather than reading the departure as a red flag.

The Timing Problem

Sparks was hired in April 2024 specifically to lead DeepView's commercialization. He brought over 20 years of medical device marketing experience, including stints at Johnson & Johnson, Allergan, and most recently as Vice President of Global Strategy at AVITA Medical.

His departure comes at the worst possible time:

| Milestone | Timing | Status |

|---|---|---|

| FDA De Novo Submission | June 2025 | Complete |

| FDA Clearance Expected | H1 2026 | Pending |

| US Commercial Launch | H2 2026 | Planned |

| UK Commercial Sales | 2025-2026 | Initial units deployed |

According to recent analyst coverage, Sparks was preparing to add four additional commercialization team members to support sales and professional education ahead of the launch. That hiring is now in limbo as the company conducts a "national search" for his replacement.

What Spectral AI Said

The 8-K filing contains the standard boilerplate: "Mr. Sparks' departure was not the result of any disagreement with the Company on any matter relating to the Company's operations, policies, or practices."

To ensure a smooth transition, Sparks has agreed to a 90-day consulting arrangement at $4,000 per week—totaling roughly $48,000 to help hand off ongoing projects and commercial activities.

The Commercial Opportunity at Stake

DeepView is not just any medical device. It received FDA Breakthrough Device Designation in 2018 and is backed by a potential $150 million contract from BARDA (Biomedical Advanced Research and Development Authority), part of the U.S. Department of Health and Human Services.

The initial target market includes:

- ~100 burn centers across the United States

- ~700 trauma centers with burn patients

- 5,400+ hospitals with emergency rooms where burn injuries present

The DeepView System uses AI algorithms trained on over 340 billion clinically validated data points to predict burn wound healing potential in approximately 20-25 seconds—far faster than traditional clinical assessment methods.

Management has emphasized that many of the burn centers that participated in clinical trials are expected to be early adopters. The BARDA contract also includes provisions to help fund initial device placements following FDA clearance.

Stock Performance Under Sparks

Since Sparks joined in April 2024, MDAI shares have declined approximately 25%, from $2.33 to $1.74. However, the stock is up 20% year-to-date in 2026 as investors anticipate the FDA decision.

| Metric | Value |

|---|---|

| Current Price | $1.74 |

| 52-Week Range | $1.04 - $3.21 |

| Market Cap | $54M |

| YTD 2026 Change | +20% |

| Change Since CCO Joined | -25% |

The company remains pre-revenue in terms of product sales. Revenue comes entirely from government research contracts, primarily the BARDA agreement. For 2025, the company reduced revenue guidance from $21.5 million to $18.5 million due to the government shutdown's impact on BARDA reimbursements.

What to Watch

Near-term catalysts:

- FDA De Novo decision expected in H1 2026

- New CCO hire timing and caliber

- BARDA contract milestones and potential option exercises

Key risks:

- Leadership vacuum during critical commercialization phase

- FDA review could extend beyond H1 2026

- Government funding uncertainty given recent shutdown impacts

- Small cash position (~$18M including October raise) to fund commercial buildout

The departure raises an uncomfortable question: If the commercial opportunity is as compelling as management suggests, why would the executive hired specifically to capture it leave four months before the finish line?

The 90-day consulting agreement suggests the company needs time to find a replacement. Investors should watch for announcements on the CCO search—the speed and quality of the hire will signal whether this is a bump in the road or a warning sign.

Related Companies: Spectral Ai