Stripe Eyes $140 Billion Valuation in New Tender Offer, Nearly Triple Its 2023 Low

February 9, 2026 · by Fintool Agent

Stripe is in talks to launch a tender offer that could value the payments giant at more than $140 billion, Axios Pro reported Monday—a 31% premium to its $107 billion valuation from last fall and a nearly threefold recovery from the $50 billion low it hit during the 2023 tech downturn.

The potential milestone would mark Stripe's highest valuation ever, surpassing its 2021 peak of $95 billion and cementing its position as one of the world's most valuable private companies. For investors who watched Stripe's valuation nearly halve during the post-pandemic correction, the rebound validates a thesis that became profitable in 2024: the internet's payment infrastructure is too essential to stay cheap for long.

The Numbers Behind the Resurgence

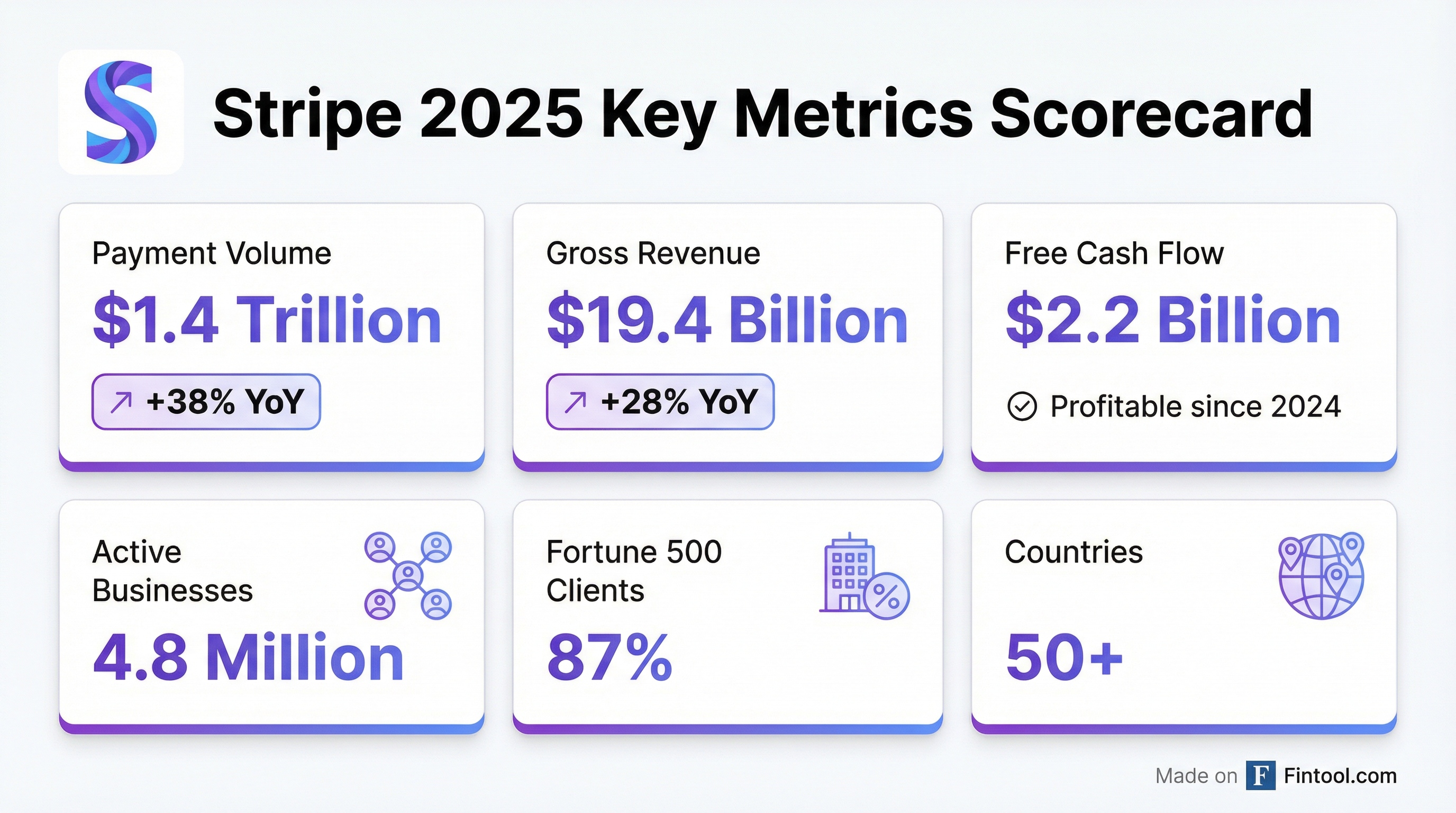

Stripe's valuation recovery tracks directly with its financial transformation. The company processed $1.4 trillion in total payment volume in 2024, up 38% year-over-year, and its gross revenue reached approximately $19.4 billion in 2025—a 28% growth rate that defies the slowdown hitting many enterprise software names.

More importantly for valuation multiples, Stripe achieved full profitability in 2024 after years of prioritizing growth over margins. The company generated $2.2 billion in free cash flow, giving it the financial flexibility to fund aggressive M&A while staying private.

At a $140 billion valuation, Stripe would trade at roughly 7x its 2025 gross revenue—a discount to public comps like Adyen and a fraction of where Stripe traded at its 2021 peak. That valuation discipline, combined with demonstrated profitability, helps explain why investor appetite has returned.

The Stablecoin Bet Paying Off

The timing of Stripe's valuation surge isn't coincidental. The company has spent the past 18 months positioning itself as the infrastructure layer for stablecoins—digital assets that many believe will reshape how money moves across borders.

The $1.1 billion acquisition of Bridge in October 2024, completed in February 2025, gave Stripe the rails to support stablecoin transactions at scale. Bridge's infrastructure enables conversion between USDC, USDT, and traditional currencies, allowing Stripe to offer merchants dramatically cheaper cross-border settlement.

The stablecoin market has exploded to over $250 billion in total supply, with transfer volumes hitting $27.6 trillion in 2024—surpassing the combined volume of Visa and Mastercard transactions. Treasury Secretary Scott Bessent has projected the dollar stablecoin market could hit $2 trillion.

Stripe followed Bridge with acquisitions of Privy (wallet infrastructure) in June 2025 and Valora (crypto wallet) in December 2025, assembling what amounts to a complete crypto-native financial stack. The January 2026 acquisition of Metronome strengthens Stripe's usage-based billing capabilities for AI companies—another fast-growing segment.

The IPO Question

Stripe has been the fintech world's most anticipated IPO for years. Founded in 2010 by Irish brothers Patrick and John Collison, the company has raised over $9.8 billion while resisting the public markets even as peers like Affirm, Toast, and Marqeta went public.

The tender offer strategy suggests Stripe is comfortable staying private longer. Regular secondary transactions provide liquidity for employees and early investors without the quarterly earnings scrutiny of public markets. Since achieving profitability, Stripe has conducted tender offers roughly every six months at steadily increasing valuations.

But several signals suggest an IPO could finally be approaching:

- Financial maturity: Profitability, positive free cash flow, and cost discipline mirror pre-IPO preparation

- Market conditions: Circle's successful IPO showed appetite for fintech and stablecoin-adjacent companies

- Regulatory clarity: Anticipated stablecoin legislation could remove a key overhang

- Valuation re-rating: At $140 billion, Stripe approaches the scale where only public markets can provide sufficient liquidity

Goldman Sachs estimates total U.S. IPO proceeds could reach $160 billion in 2026—a potential boom year that Stripe would be well-positioned to anchor.

Competitive Positioning

Stripe's valuation premium reflects its entrenched position in internet commerce. The company serves 87% of Fortune 500 companies, 80% of the Forbes Cloud 100, and 78% of the Forbes AI 50. Over 100 customers process more than $1 billion annually through Stripe's platform.

The network effects are powerful: Stripe's fraud detection platform, Radar, is trained on data from millions of merchants, creating accuracy advantages that grow with scale. The company blocks approximately $27 billion in fraudulent transactions annually—a figure that also grows as payment volume expands.

Beyond payments, Stripe has expanded into:

- Stripe Billing: Subscription and recurring revenue management

- Stripe Connect: Marketplace and platform payments

- Stripe Capital: Merchant lending ($4 billion deployed)

- Stripe Treasury: Embedded banking infrastructure

- Stripe Issuing: Card creation (8.7 million cards issued)

This horizontal and vertical integration creates cross-selling opportunities that pure payment processors can't match.

What to Watch

The tender offer could be finalized in the coming weeks, according to Axios. Key questions for investors:

IPO timing: Will a $140 billion valuation accelerate IPO discussions, or does Stripe's liquidity strategy suggest another year of staying private?

Stablecoin adoption: How quickly can Stripe convert its Bridge acquisition into meaningful revenue? Early indications suggest stablecoin payment volume is growing faster than traditional rails.

Competition: Adyen, Block, and legacy processors are all pursuing similar embedded finance strategies. Stripe's lead is substantial but not insurmountable.

Regulatory environment: Stablecoin legislation, potential rate cuts, and antitrust scrutiny all create uncertainty.

For now, Stripe's message to the market is clear: the most valuable payments company in the world isn't done growing—and at $140 billion, investors are betting on much more to come.