Talen Energy Doubles Down on Data Center Power Play with $3.45B Gas Acquisition

January 19, 2026 · by Fintool Agent

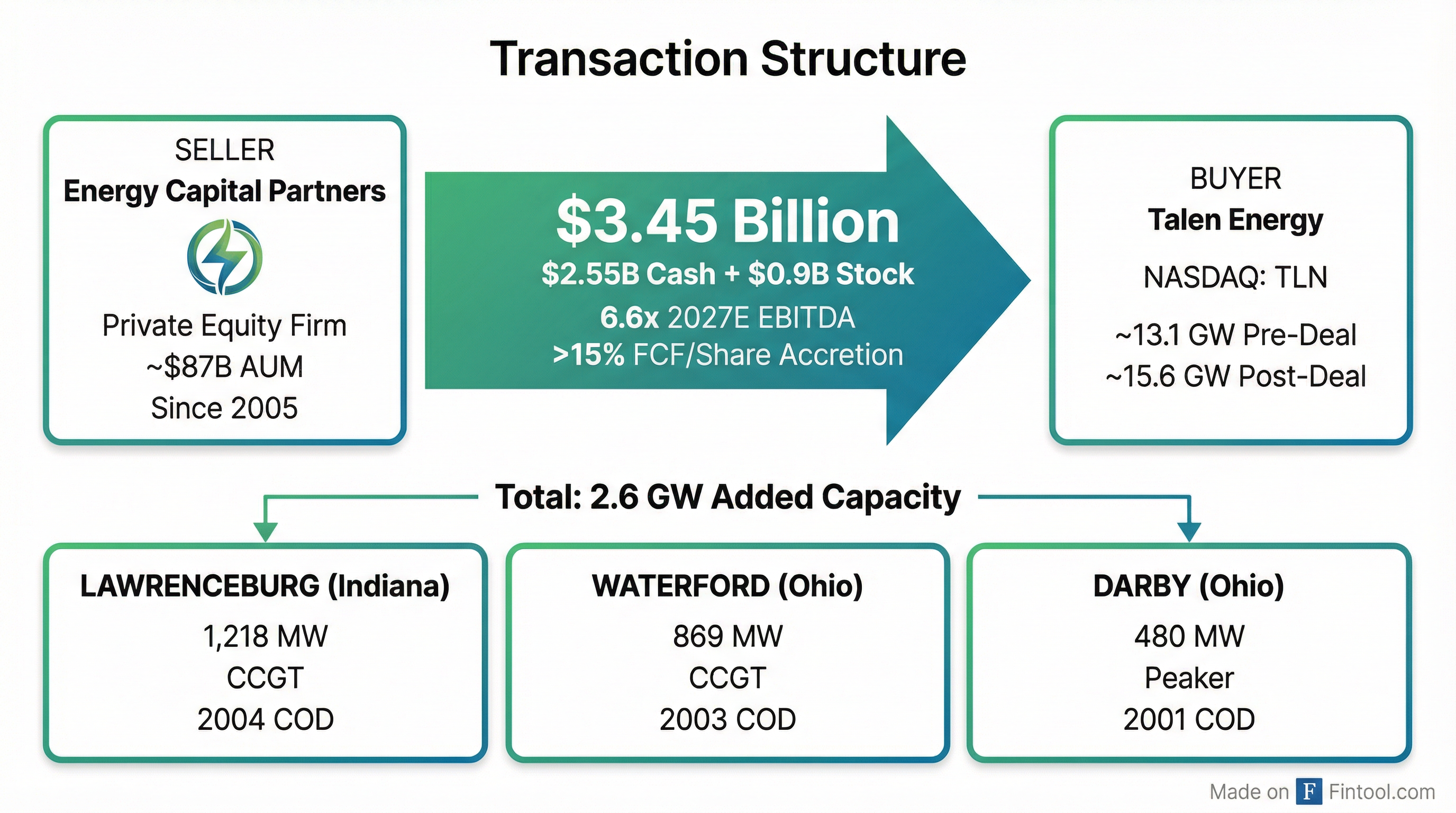

Talen Energy is buying 2.6 gigawatts of natural gas generation in Ohio and Indiana for $3.45 billion from Energy Capital Partners—a transaction that will double the company's annual power output in under two years and position it as a dominant supplier to AI data centers in the PJM grid.

The deal, announced January 15, sent TLN shares up 11.8% to $419.07 in a single session—a rare double-digit move that signals investor conviction in Talen's strategy of consolidating gas-fired capacity as hyperscalers scramble for power.

The Deal at a Glance

Talen is acquiring three power plants from Energy Capital Partners: the 1,218-megawatt Lawrenceburg combined-cycle plant in Indiana, the 869-megawatt Waterford combined-cycle plant in Ohio, and the 480-megawatt Darby peaking facility in Ohio.

The purchase price consists of $2.55 billion in cash (funded through new debt) and $900 million in Talen stock—2.4 million shares that will give ECP approximately 5% ownership of the combined company.

At 6.6x 2027 projected EBITDA, the valuation reflects a $1,344-per-kilowatt price tag for highly efficient baseload assets with average heat rates of approximately 7,000 Btu/kWh and capacity factors exceeding 80%.

| Metric | Value |

|---|---|

| Purchase Price | $3.45B |

| Cash Portion | $2.55B |

| Stock Portion | $900M (2.4M shares) |

| EV/EBITDA Multiple | 6.6x 2027E |

| Capacity Added | 2.6 GW |

| FCF Conversion | 85% |

| FCF/Share Accretion | >15% annually through 2030 |

Why Gas, Why Now?

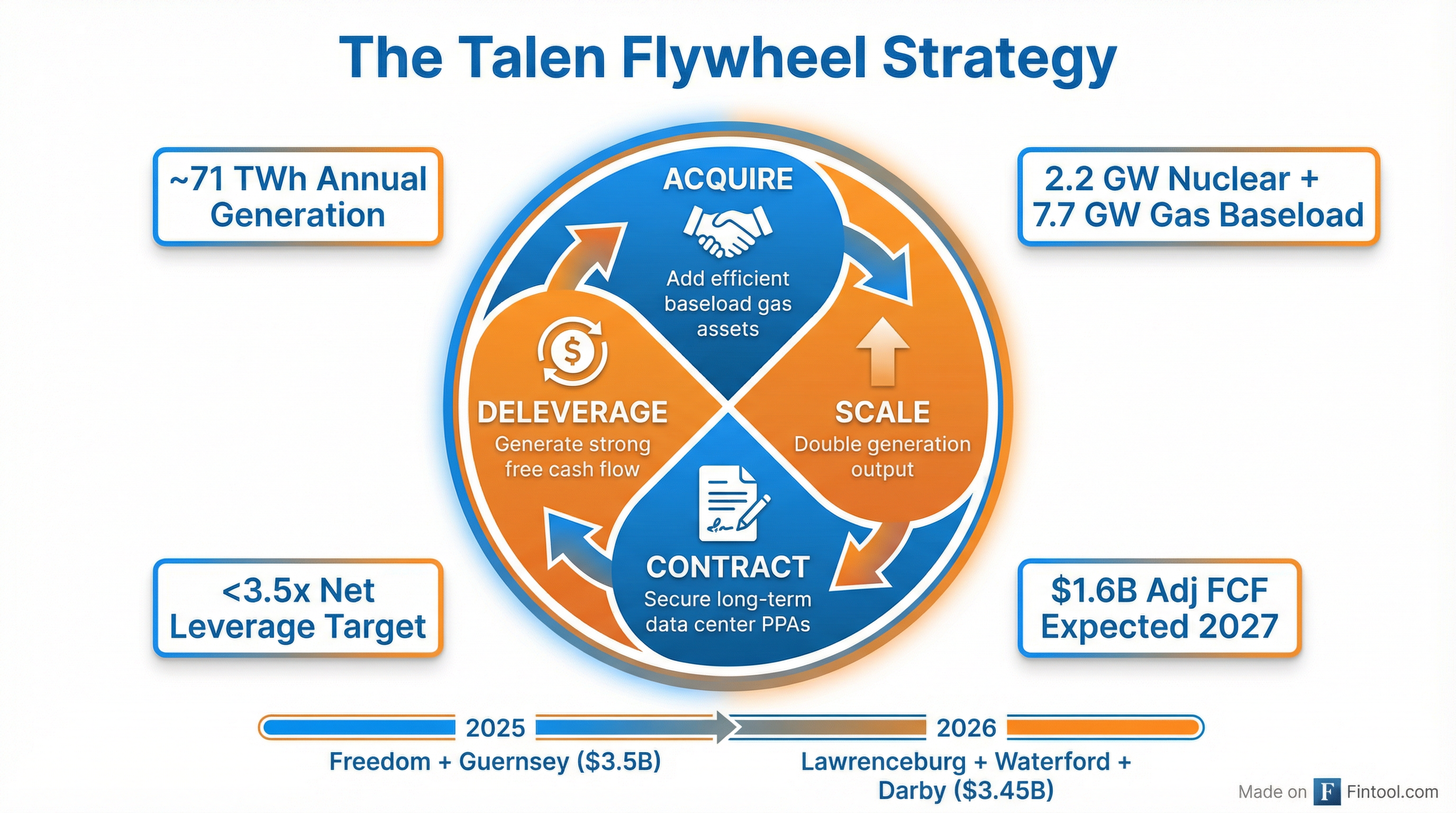

The acquisition is the second leg of what Talen calls its "flywheel strategy"—a plan to systematically accumulate baseload generation capacity to serve the explosive growth in data center demand across PJM, the regional grid operator covering 13 states from New Jersey to Illinois.

The numbers driving this thesis are staggering. FirstEnergy, a major PJM utility, expects its system peak load to increase 15 gigawatts—nearly 50%—from 33.5 GW today to 48.5 GW by 2035, driven almost entirely by data center interconnection requests. Across the entire PJM footprint, peak load projections are forecasted to jump 48 GW, or 30% of current peak load, within a decade.

"AI and data center capital budgets overall continue to expand, not contract," Talen CEO Mac McFarland said on the investor call. "We are seeing new announcements and different kinds of strategies to power growing data center demand."

PPL Corporation, another PJM utility, reported that its pipeline of data center projects in advanced planning stages has jumped more than 40% since early 2025—from 14.4 GW to 20.5 GW—with over 5 GW already under construction.

The Flywheel in Motion

This deal follows Talen's $3.5 billion acquisition of the Freedom and Guernsey power plants in 2025—also gas-fired assets in PJM. Combined, the two transactions will approximately double Talen's expected annual generation output inside of two years, adding approximately 5 GW of baseload capacity to the company's 2.2 GW nuclear Susquehanna plant.

| Metric | Pre-Deal | Post-Deal | Change |

|---|---|---|---|

| Owned Capacity | 13.1 GW | 15.6 GW | +19% |

| Annual Generation | 55 TWh | 71 TWh | +29% |

| Natural Gas Fleet Heat Rate | 7,780 Btu/kWh | 7,600 Btu/kWh | -180 Btu |

| Capacity Factor | 48% | 52% | +4 pts |

The strategic logic is clear: baseload gas plants with 80%+ capacity factors generate steady cash flows that can be used to pay down debt, fund share buybacks, and pursue additional acquisitions. Talen's board approved a $2 billion share repurchase program in September 2025, which the company can continue executing while maintaining its target of sub-3.5x net leverage by year-end 2026.

Management projects 2027 adjusted EBITDA of approximately $2.6 billion for the combined company—a 235% increase from $770 million in 2024—with cash flows increasingly diversified across nuclear and natural gas baseload assets expected to account for over 75% of EBITDA.

Market Reaction

TLN stock surged 11.8% on the announcement day before giving back some gains the following session as investors digested the financing implications.

The selloff on January 16 likely reflects concerns about the $2.55 billion in new debt required to fund the cash portion. Talen's total debt stood at approximately $3 billion at the end of Q3 2025*, and the financing will nearly double the company's leverage on a pro forma basis—though management insists robust cash flows will enable rapid deleveraging.

*Values retrieved from S&P Global.

Shares closed Friday at $371.66, still up modestly from pre-announcement levels but well off the $419 intraday high.

What to Watch

Regulatory timeline. The deal requires Hart-Scott-Rodino clearance, FERC approval, and sign-off from the Indiana Utility Regulatory Commission. Talen expects to close early in the second half of 2026.

Data center contracting. Talen is working on a new data center power purchase agreement that could add further upside. CEO McFarland said the company would "announce the deal when it is ready."

ECP lockup expiration. Energy Capital Partners will be subject to a phased lockup—90 days on 50% of shares and 180 days on the remainder—creating potential selling pressure in the second half of 2026.

PJM capacity auctions. The recent PJM capacity auction cleared at maximum allowable prices with every megawatt of coal capacity selected, while reserve margins fell below reliability targets. This structural tightness supports Talen's thesis that dispatchable baseload generation will command premium pricing.

The Bottom Line

Talen Energy is betting that the AI infrastructure buildout will require vast amounts of reliable, dispatchable power—and that highly efficient gas plants in constrained markets will be the bottleneck asset. The $3.45 billion acquisition is expensive in absolute terms, but at 6.6x EBITDA and over 15% projected FCF accretion, the math works if data center demand materializes as forecast.

The risk is execution: absorbing nearly $7 billion of acquisitions in two years while maintaining balance sheet discipline is no small feat. But with PJM demand projections now showing 30% load growth by 2035, the alternative—standing still while competitors gobble up scarce generation assets—may be the bigger risk.