Tango Therapeutics Founder Passes Baton as Pivotal Cancer Trial Looms

January 8, 2026 · by Fintool Agent

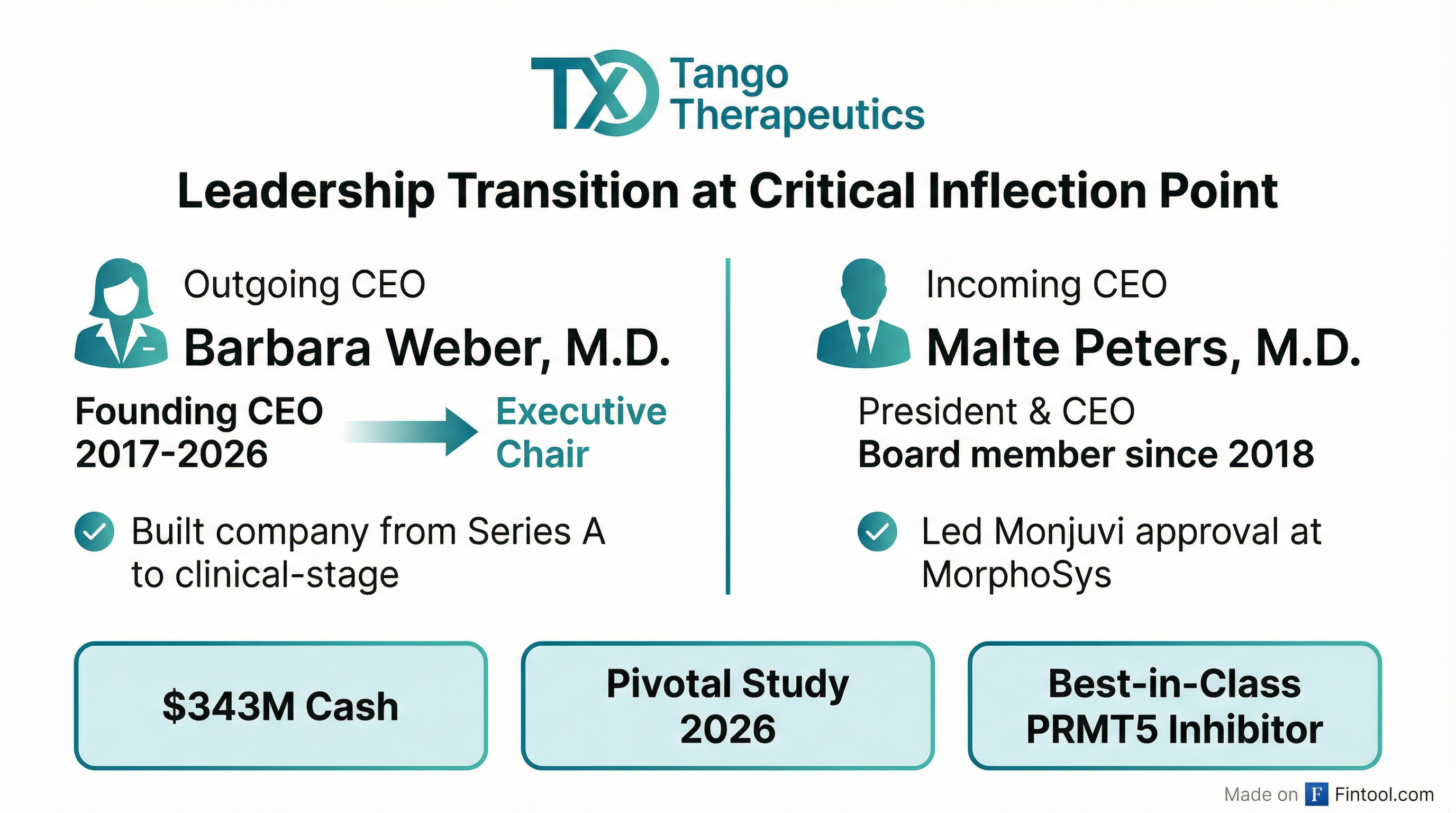

Tango Therapeutics announced that founding CEO Barbara Weber, M.D., is retiring after eight years at the helm, handing the reins to board member Malte Peters, M.D., just as the clinical-stage biotech prepares to launch its first pivotal trial . The orderly succession—with Weber transitioning to Executive Chair for 2026 before becoming non-executive chair in 2027—comes at a critical inflection point: the company's lead drug vopimetostat is set to enter a Phase 3 study in second-line pancreatic cancer this year .

Shares jumped 20% on the announcement, extending a remarkable turnaround from $1.03 in May 2025 to above $11 today—a tenfold gain fueled by positive clinical data and growing conviction that Tango may have a best-in-class PRMT5 inhibitor.

The Transition: Planned Succession, Not Crisis

This is not a departure driven by activist pressure, scandal, or performance issues. Weber's exit follows "a thorough formal search process," according to Lead Independent Director Alexis Borisy, who will step down as Board Chair to take that role . The transition was carefully orchestrated to ensure continuity through Tango's most important year yet.

Weber, a physician-scientist who spent 25+ years in cancer research before building Tango from a Third Rock Ventures concept in 2015, led the company through its Series A, IPO, and clinical development of vopimetostat . Her academic work on breast cancer genetics at the University of Pennsylvania—including contributions to understanding BRCA1/2 mutations—established her as a leader in precision oncology long before she entered industry .

"It has been an extraordinary privilege to build and lead Tango from its inception," Weber said in the announcement. "With vopimetostat now advancing into its first registrational trial and actively enrolling potentially transformative combination studies, this is the right moment for Malte's leadership expertise and strategic vision to propel Tango into the next phase of growth."

Why Peters? Late-Stage Expertise for Pivotal Execution

Peters brings exactly what Tango needs at this juncture: deep experience shepherding drugs through late-stage development and regulatory approval. As Chief Research and Development Officer at Morphosys, he led the team that secured global approval for Monjuvi (tafasitamab) in combination with lenalidomide for diffuse large B-cell lymphoma .

Before MorphoSys, Peters spent 12 years at Novartis Oncology, contributing to 28 cancer therapy approvals, and served as Global Head of Clinical Development at Sandoz Biopharmaceuticals, where he led biosimilar submissions for Enbrel and Rituximab .

He's no stranger to Tango—Peters has served on the board since 2018 and Weber noted they've "worked closely together for over 15 years" . His compensation package reflects the pivotal moment: $720,000 base salary, 60% target bonus, 1.65 million stock options, and 350,000 RSUs .

The Stakes: Vopimetostat and the MTAP Opportunity

Tango's entire investment thesis rests on vopimetostat (formerly TNG462), an MTA-cooperative PRMT5 inhibitor targeting MTAP-deleted cancers—a biomarker present in approximately 60,000 U.S. cancer patients annually .

The October 2025 data release was the inflection point that sent shares soaring:

| Metric | All Patients (n=94) | 2L Pancreatic Cancer | Histology Selective |

|---|---|---|---|

| Overall Response Rate | 27% | 25% | 49% |

| Disease Control Rate | 78% | 71% | 89% |

| Median PFS | 6.4 months | 7.2 months | 9.1 months |

For context, standard of care chemotherapy in second-line pancreatic cancer delivers median PFS of just 2-3.5 months . Vopimetostat more than doubled that benchmark.

The FDA has already aligned on the pivotal trial design: approximately 300 patients randomized 1:1 to vopimetostat 250mg daily versus standard chemotherapy in second-line MTAP-deleted pancreatic cancer, with PFS as the primary endpoint . Enrollment is expected to begin in 2026 .

The Competition: First-Mover Advantage

Tango isn't alone in the PRMT5 race, but it appears to have a meaningful head start:

Bristol-Myers Squibb (BMS-504): Still dose-finding with a study comparing 200, 400, and 600mg. No pivotal alignment yet. Pursuing front-line pancreatic cancer with gemcitabine, which may become less relevant as KRAS inhibitors move to first-line .

Amgen: Molecule appears to have fallen out of favor due to PK, bioavailability, and efficacy concerns .

AstraZeneca/BMS: Early-stage followers, approximately two years behind .

Tango's competitive moat extends beyond timing. The company has a unique collaboration with Revolution Medicines to combine vopimetostat with KRAS inhibitors daraxonrasib and zoldonrasib—the first PRMT5 inhibitor in clinical combination with RAS-targeted therapy . With 90% of MTAP-deleted pancreatic cancers harboring co-occurring KRAS mutations , this combination could unlock front-line treatment.

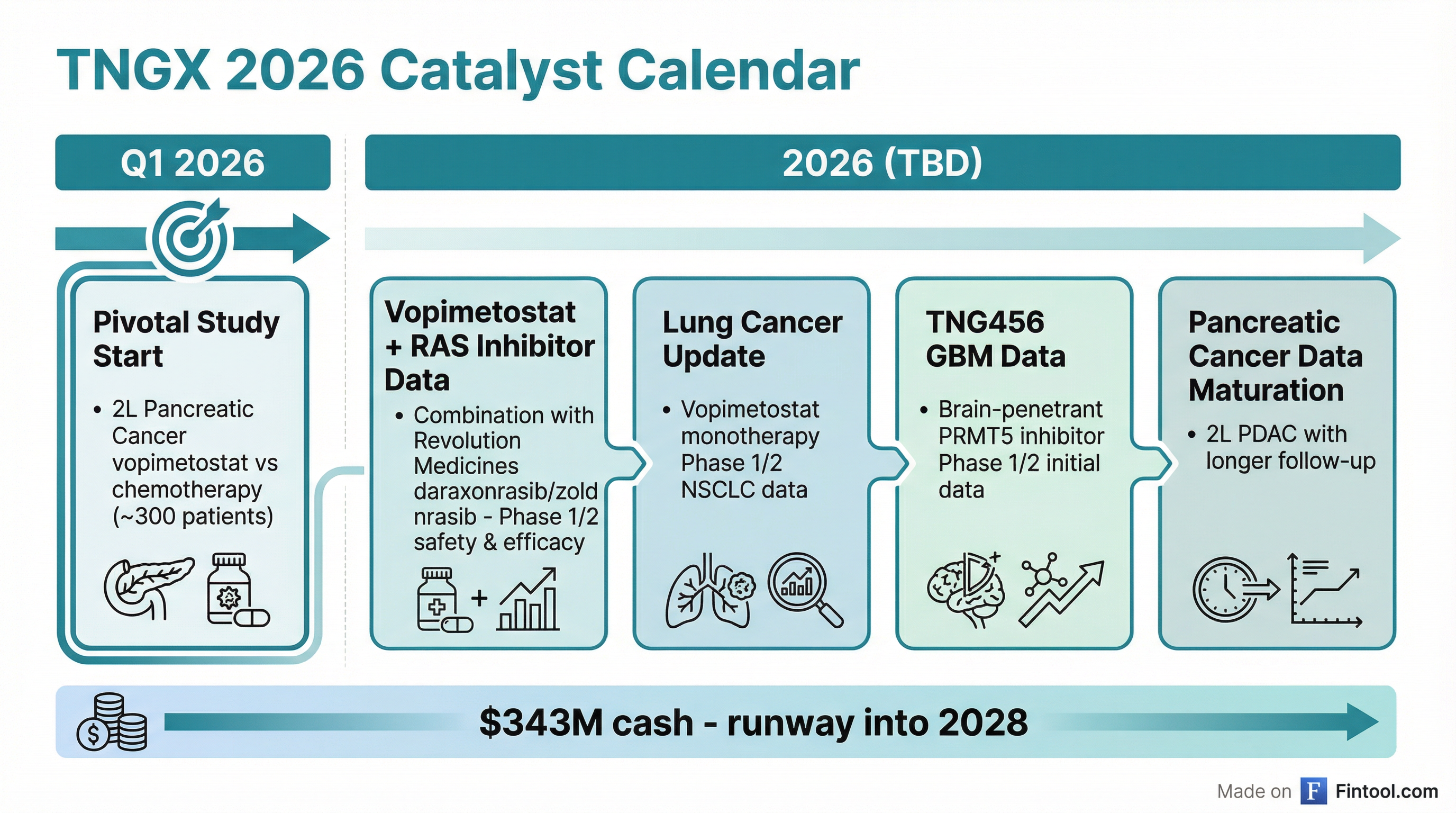

2026 Catalyst Calendar

Peters inherits a loaded pipeline with multiple binary events:

| Catalyst | Timing | Significance |

|---|---|---|

| Pivotal Study Initiation | 2026 | 2L Pancreatic Cancer vs. chemotherapy |

| Vopimetostat + RASi Data | 2026 | Combo with Revolution Medicines inhibitors |

| NSCLC Data Update | 2026 | Lung cancer monotherapy maturation |

| TNG456 GBM Data | 2026 | Brain-penetrant PRMT5 in glioblastoma |

The cash position—$343 million as of December 31, 2025—provides runway into 2028 , covering the pivotal study and all ongoing clinical activities .

Market Reaction: A Vote of Confidence

The stock's 20%+ surge on announcement day reflects market approval of the transition's timing and Peters' credentials. Year-to-date, TNGX is up 28%, and the stock has more than doubled over six months.

| Period | TNGX Performance |

|---|---|

| YTD 2026 | +28% |

| 6-Month | +110% |

| Since Oct 2025 Data | +32% |

| From May 2025 Low | +1,000%+ |

The current $1.25 billion market cap values Tango at approximately 3.6x its cash position—a premium that reflects conviction in vopimetostat's best-in-class potential but leaves substantial upside if the pivotal trial succeeds.

What to Watch

Near-term: Pivotal study initiation will be the next major milestone. Execution on enrollment pace will be critical, particularly as pancreatic cancer patients have urgent treatment needs and limited time for testing delays.

Mid-term: The Revolution Medicines combination data could be transformative. Management has indicated they need to demonstrate response rates "demonstrably better than 30%" to establish a clear path to front-line treatment .

Risks: The PRMT5 inhibitor class remains novel, and durability questions linger. Competition from Bristol-Myers Squibb could intensify if they resolve their dosing questions. And pancreatic cancer remains brutally difficult—many promising drugs have failed in late-stage development.

Peters' first act as CEO will be proving that the baton pass doesn't disrupt momentum at the exact moment Tango enters its defining chapter.

Related