Team Inc Names Gary Hill CEO as Keith Tucker Exits After 20 Years

January 26, 2026 · by Fintool Agent

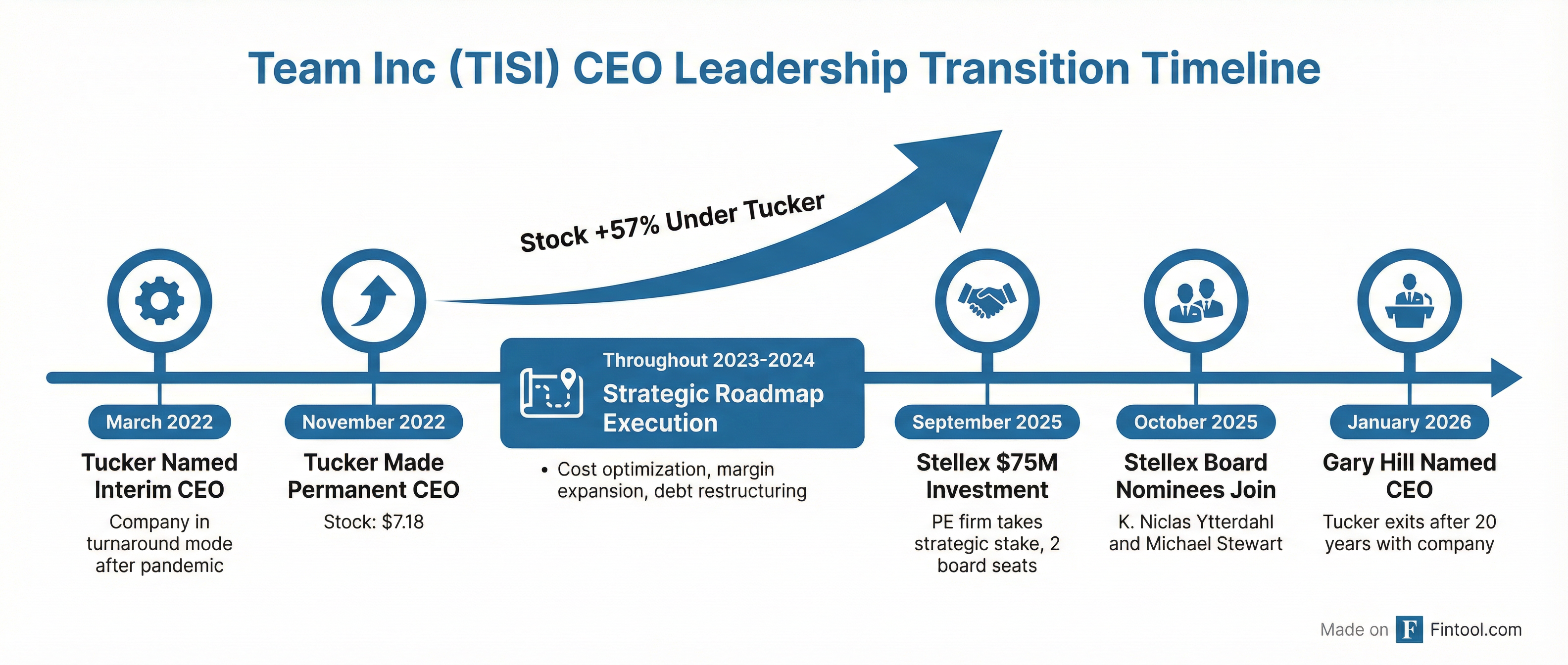

Team Inc. (NYSE: TISI) announced a CEO transition Monday, with Keith Tucker departing after two decades and Gary Hill taking the helm effective February 1. The move comes just four months after private equity firm Stellex Capital invested $75 million in the Sugar Land, Texas-based industrial services provider and installed two directors on its board.

Shares rose 1.9% to $14.00 on muted volume, reflecting investor acceptance of a transition that appears more orchestrated than unexpected.

The Timing Says Everything

The 8-K filing states Tucker's departure "is not the result of any disagreement with the Company on any matter relating to the Company's operations, policies, or practices." That's standard boilerplate, but the timeline tells a clearer story.

In September 2025, Stellex—a PE firm with over $5 billion in AUM focused on industrial services—pumped $75 million into Team Inc through preferred stock and warrants. The deal immediately reduced debt, provided financial flexibility, and gave Stellex the right to nominate two board members.

By late October, Stellex nominees K. Niclas Ytterdahl and Michael Stewart had joined the board. Ninety days later, the CEO is out.

This is a textbook PE playbook: inject capital, take board seats, install new leadership to execute the growth phase. Tucker stabilized the ship; now Stellex wants someone to gun the engines.

Tucker's Track Record: Turnaround Artist

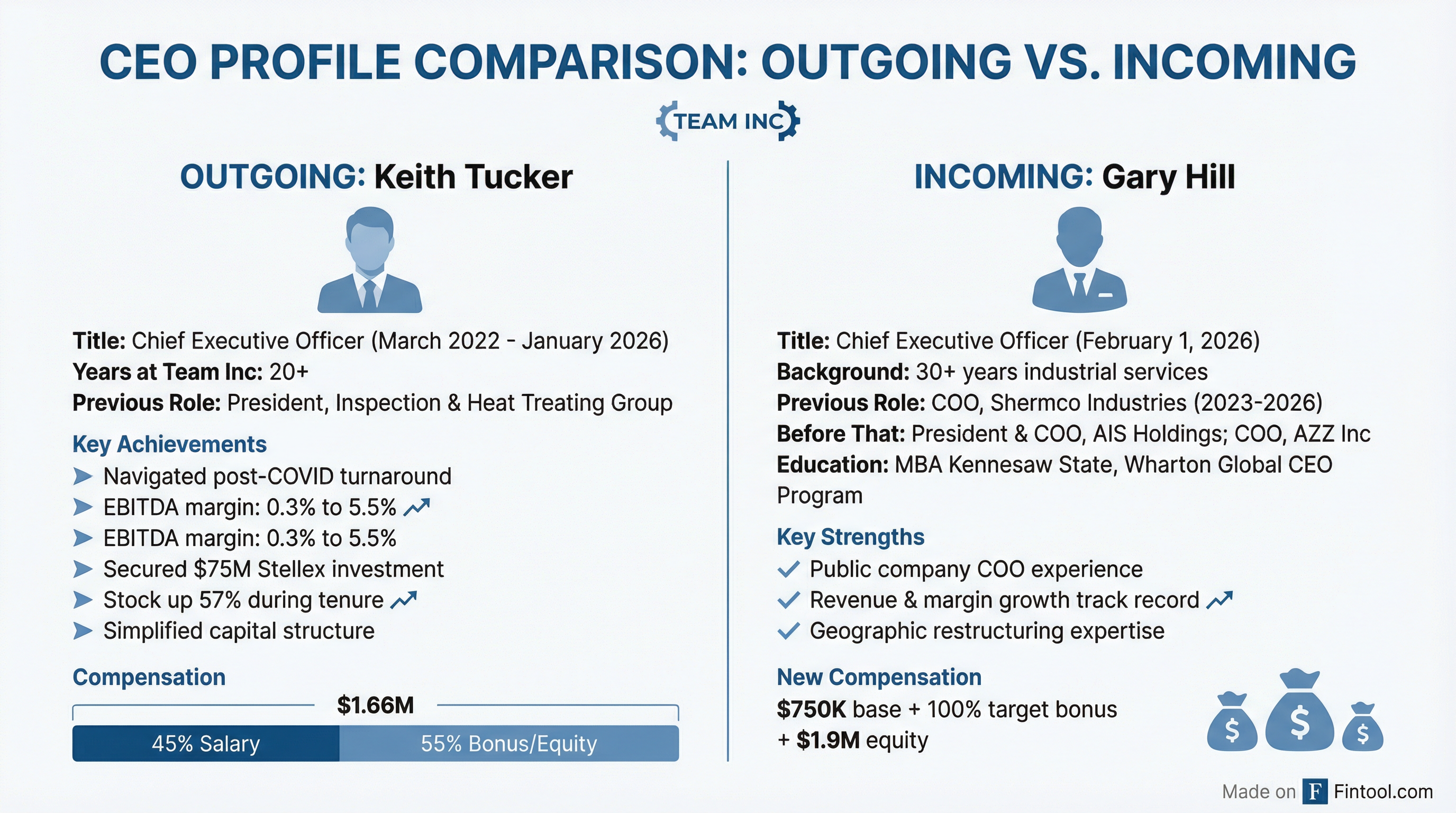

Tucker joined Team Inc in 2005 and worked his way up through operational roles, becoming interim CEO in March 2022 during a difficult period. He was named permanent CEO that November.

The company he inherited was bleeding—negative EBITDA margins of -4.6% in 2021 and still negative in 2022. Tucker's cost discipline and operational focus reversed the trajectory:

| Metric | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|

| Revenue ($M) | $794 | $840 | $863 | $852 |

| EBITDA ($M) | -$36.7 | -$2.6 | $25.2 | $46.9 |

| EBITDA Margin | -4.6% | -0.3% | 2.9% | 5.5% |

| Net Income ($M) | -$186 | $70* | -$76 | -$38 |

*FY 2022 included significant one-time items

The stock tells an even cleaner story. When Tucker took over as interim CEO in March 2022, TISI traded around $8.93. When he became permanent CEO in November 2022, it was $7.18. Today it's $14.00—a 57% gain from his earliest involvement and 95% from his lowest point.

On the last earnings call, Tucker expressed confidence in the company's trajectory: "Over the past two years, we have worked to simplify our business, expand our margins, simplify our capital structure and improve our balance sheet... I believe that we are well positioned to sustainably and profitably grow well into the future."

Chairman Michael Caliel acknowledged Tucker's contributions while telegraphing the rationale for change: "Keith successfully guided TEAM through a critical period... With the Company now on stable footing and the recent Stellex strategic investment positioning it for the next phase of growth, this is an appropriate time for a leadership transition."

Translation: The turnaround CEO has done his job. Time for the growth CEO.

Enter Gary Hill: The Operator

Hill, 60, brings over 30 years of industrial services experience and a resume that reads like a PE investor's wish list.

Most recently, he served as COO of Shermco Industries, a leading electrical testing and maintenance provider. His timing there is notable—Shermco announced in August 2025 that it was being acquired by Blackstone for approximately $1.6 billion. With that deal progressing, Hill was available for his next challenge.

Before Shermco, Hill held increasingly senior roles at Azz Inc., ultimately serving as COO from 2020 to 2022. The company's own descriptions note he "helped drive significant revenue and margin growth" during his tenure.

His background includes:

- Shermco Industries (2023-2026): COO overseeing electrical testing, maintenance, and repair services

- AIS Holdings (2022-2023): President & COO of AZZ/Fernweh Group joint venture

- AZZ Inc (2013-2022): Multiple roles culminating in COO

- Earlier career: Operational and commercial roles at Aquilex, Crane Company, and Westinghouse

Hill holds an MBA from Kennesaw State University and completed the Wharton School's Global CEO program.

The Compensation Package

Hill's deal is structured to align his interests with aggressive value creation:

| Component | Details |

|---|---|

| Base Salary | $750,000 annually |

| Annual Bonus Target | 100% of base (max 200%) |

| Sign-on RSUs | $562,500 (vesting over 3 years) |

| 2026 PSUs | $1,312,500 (performance-based) |

| Relocation | Up to $100,000 + $3,000/month housing for 18 months |

| Severance (no cause) | 18 months base salary |

| Change of Control | 2 years salary + 2 years bonus |

The PSU grant structure is particularly telling—performance-based equity worth over $1.3 million signals the board expects measurable results. The change-of-control provision (2 years of salary plus bonus) also suggests Stellex may have an eventual exit in mind.

Financial Position: Stable But Leveraged

Team Inc enters this transition in meaningfully better shape than it was three years ago, but challenges remain.

Recent quarterly performance shows volatility in results:

| Metric | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|

| Revenue ($M) | $199 | $248 | $225 |

| Net Income ($M) | -$30 | -$4 | -$11 |

| EBITDA ($M) | $2.4 | $20.7 | $10.1 |

| EBITDA Margin | 1.2% | 8.3% | 4.5% |

The Stellex investment reduced total debt from $416 million to $351 million, with proceeds used to pay down approximately $67 million of existing obligations. The company also extended maturities on its ABL facility to October 2028 and term loans to 2030.

Management has targeted at least 10% EBITDA margins over time—nearly double current levels. That's the mountain Hill has been brought in to climb.

What to Watch

Near-term catalyst: The company reaffirmed its 2025 outlook alongside the CEO announcement. Q4 earnings will be the first test of whether the transition creates any operational disruption.

Strategic direction: Hill's background is heavily operational. Expect renewed focus on geographic restructuring, sales/operations alignment, and execution—the same playbook he ran at Shermco and AZZ.

Stellex influence: With two board seats and warrants providing equity upside, Stellex will push for accelerated value creation. The delayed draw option allowing up to $30 million in additional preferred stock suggests dry powder for acquisitions or growth investments.

Tucker's severance: The 8-K notes a "severance and consulting agreement" is expected. The terms, when disclosed, may signal whether this was truly amicable or more of a push.

Long-term: Stellex typically holds investments for 3-5 years before seeking exits. Hill's change-of-control protections aren't just boilerplate—they're preparation.

Related