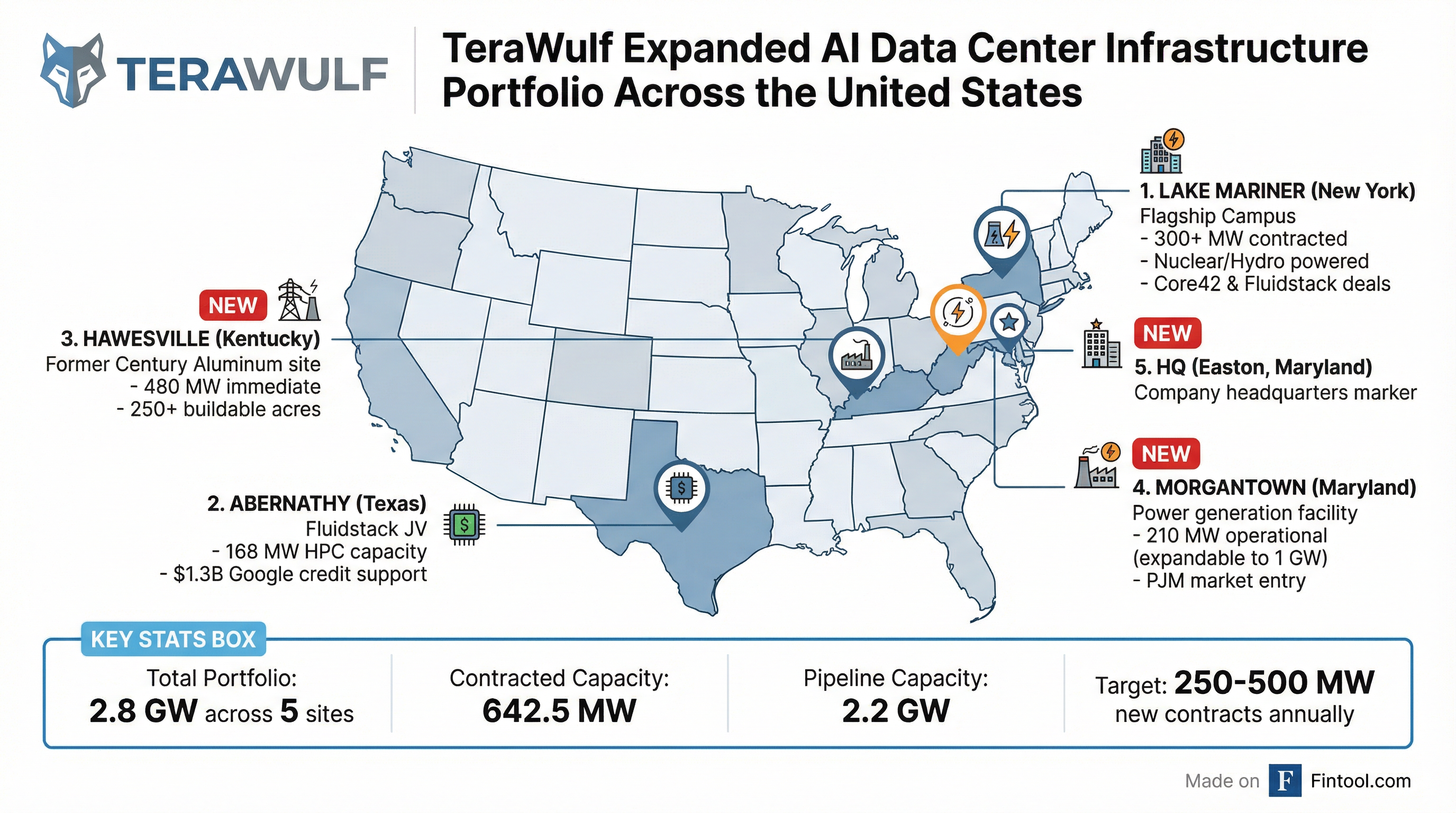

TeraWulf Doubles Infrastructure Portfolio to 2.8 GW With Kentucky and Maryland Acquisitions

February 2, 2026 · by Fintool Agent

Terawulf stock surged 11.6% in after-hours trading Monday after the company announced acquisitions that more than double its power infrastructure portfolio, positioning the former Bitcoin miner as a major player in the scramble to build AI data center capacity.

The company acquired two strategically located brownfield sites—a former Century Aluminum plant in Hawesville, Kentucky and the Morgantown Generating Station in Maryland—adding approximately 1.5 GW of capacity to its portfolio. TeraWulf's total infrastructure now spans 2.8 GW across five sites, with 642.5 MW of contracted capacity and 2.2 GW in its development pipeline.

The Deal Terms

Hawesville, Kentucky: TeraWulf acquired the former Century Aluminum industrial site, which includes more than 250 buildable acres with approximately 480 MW of existing power availability. The transaction closed February 2, 2026, with Century Aluminum receiving $200 million in cash plus a 6.8% minority equity stake in Raylan Data Holdings, TeraWulf's development entity for the site.

The site offers immediate access to power infrastructure, including multiple high-voltage transmission lines, an on-site energized substation, and direct connection to the regional transmission network.

Morgantown, Maryland: TeraWulf is acquiring the Morgantown Generating Station, a grid-connected power generation facility with approximately 210 MW of operational capacity today and the ability to expand to 1 GW. The acquisition, signed in late 2025, is pending FERC approval and other regulatory consents.

The Maryland site establishes TeraWulf's presence in the PJM market—the largest competitive wholesale electricity market in the United States.

| Site | Location | Immediate Capacity | Expansion Potential | Status |

|---|---|---|---|---|

| Hawesville | Kentucky | 480 MW | TBD | Closed |

| Morgantown | Maryland | 210 MW | Up to 1 GW | Pending FERC |

| Total New Capacity | ~690 MW | ~1.5 GW |

Strategic Rationale: Brownfield to Data Center

CEO Paul Prager framed the acquisitions as central to TeraWulf's strategy of repurposing legacy industrial assets for the AI era.

"These acquisitions reflect our strategy of reinvesting in existing energy infrastructure to support grid reliability, long-term economic activity, and responsible growth. Hawesville provides immediate access to scalable power, while Morgantown allows us to expand existing generation to meet growing load demand in a way that is net-positive for the grid."

The brownfield approach offers several advantages over greenfield development:

- Faster time-to-market: Existing power infrastructure and grid connections reduce development timelines

- Lower risk: Established industrial sites have permitting history and community relationships

- Grid benefits: Sites can provide surplus electricity to support regional reliability

- Regional diversification: Multiple sites across different power markets mitigate execution risk

Prager emphasized the importance of geographic diversity: "Regional diversity has become increasingly important as grid congestion, permitting timelines, and weather and policy considerations vary by market."

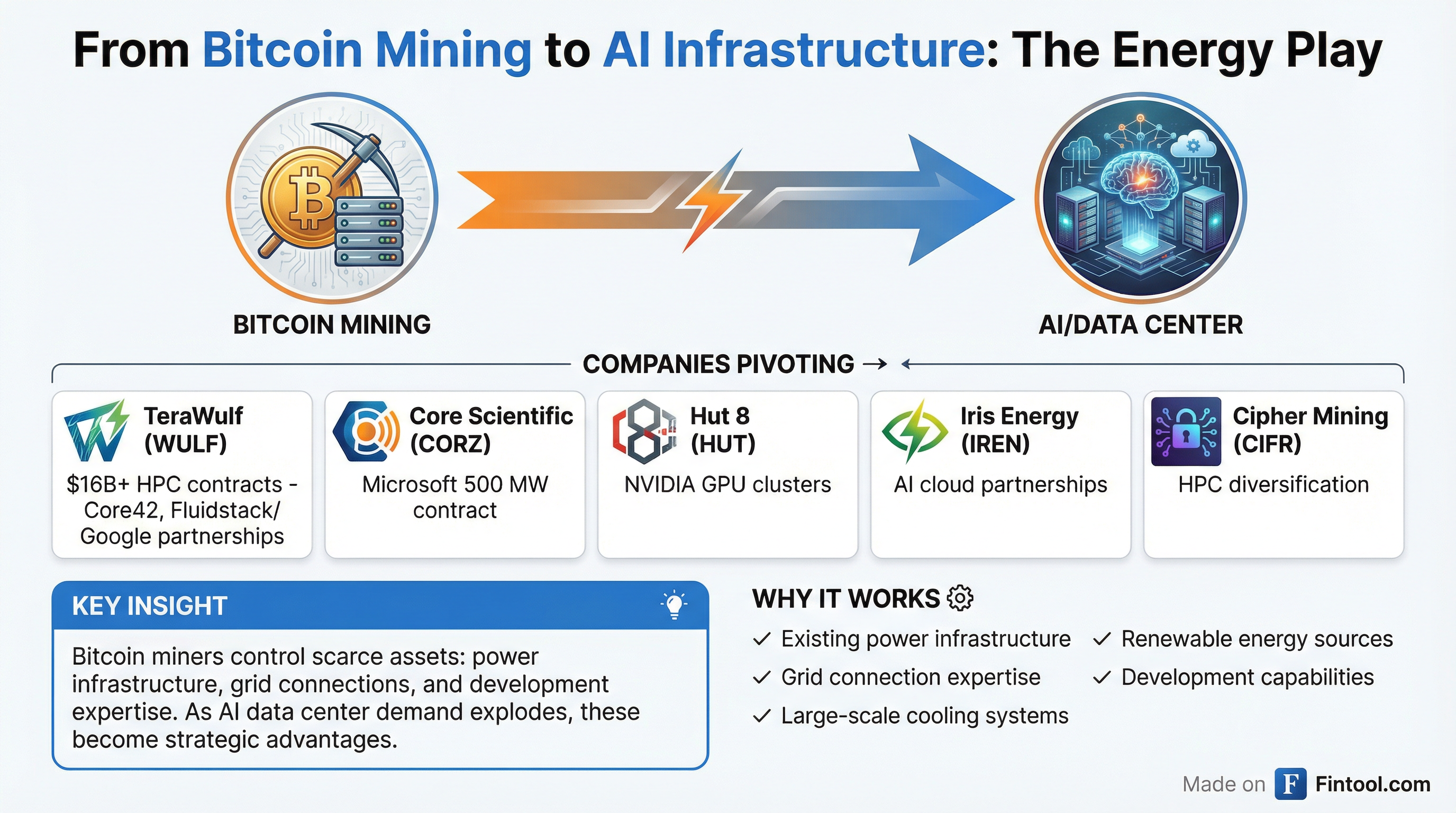

The Bitcoin Miner Pivot

TeraWulf is part of a broader industry transformation as Bitcoin miners leverage their power infrastructure expertise to serve the booming AI data center market.

The company has rapidly pivoted from pure Bitcoin mining to a dual-segment model, securing over $16 billion in long-term HPC hosting contracts:

| Customer | Capacity | Contract Value | Duration |

|---|---|---|---|

| Core42 (G42) | 70+ MW | $1B+ | 10 years |

| Fluidstack/Google | 360+ MW | $6.7B | 10 years |

The Fluidstack partnership, announced in October 2025, includes a 168 MW joint venture at TeraWulf's Abernathy, Texas campus with Google providing approximately $1.3 billion in credit support for the project financing.

Market Reaction and Valuation

TeraWulf shares closed at $13.44 during regular trading, up 0.5%, before surging to $15.00 in after-hours trading—an 11.6% gain—as investors digested the acquisition news.

The stock has gained approximately 550% over the past year, rising from $2.06 to current levels, as the company transitioned from pure Bitcoin mining to AI infrastructure. TeraWulf's market capitalization now stands at approximately $5.6 billion.*

| Metric | Value |

|---|---|

| Market Cap | $5.6B* |

| 52-Week Range | $2.06 - $17.05* |

| Total Portfolio | 2.8 GW |

| Contracted Capacity | 642.5 MW |

| Pipeline Capacity | 2.2 GW |

*Values retrieved from S&P Global.

What to Watch

FERC Approval: The Morgantown acquisition requires Federal Energy Regulatory Commission approval and other regulatory consents. Any delays could impact TeraWulf's expansion timeline.

Development Execution: Converting brownfield sites to operational data centers requires significant capital expenditure and construction management. TeraWulf plans to develop both sites in phases alongside customer demand.

Contract Pipeline: With 250-500 MW of targeted new contracted capacity annually, the company's ability to convert its 2.2 GW pipeline into long-term hosting agreements will be critical.

Bitcoin Exposure: While HPC contracts provide stable, long-term revenue, TeraWulf maintains Bitcoin mining operations. Bitcoin's price volatility will continue to impact segment profitability.