Terex Shareholders Approve $9 Billion REV Group Merger, Creating Specialty Equipment Giant

January 28, 2026 · by Fintool Agent

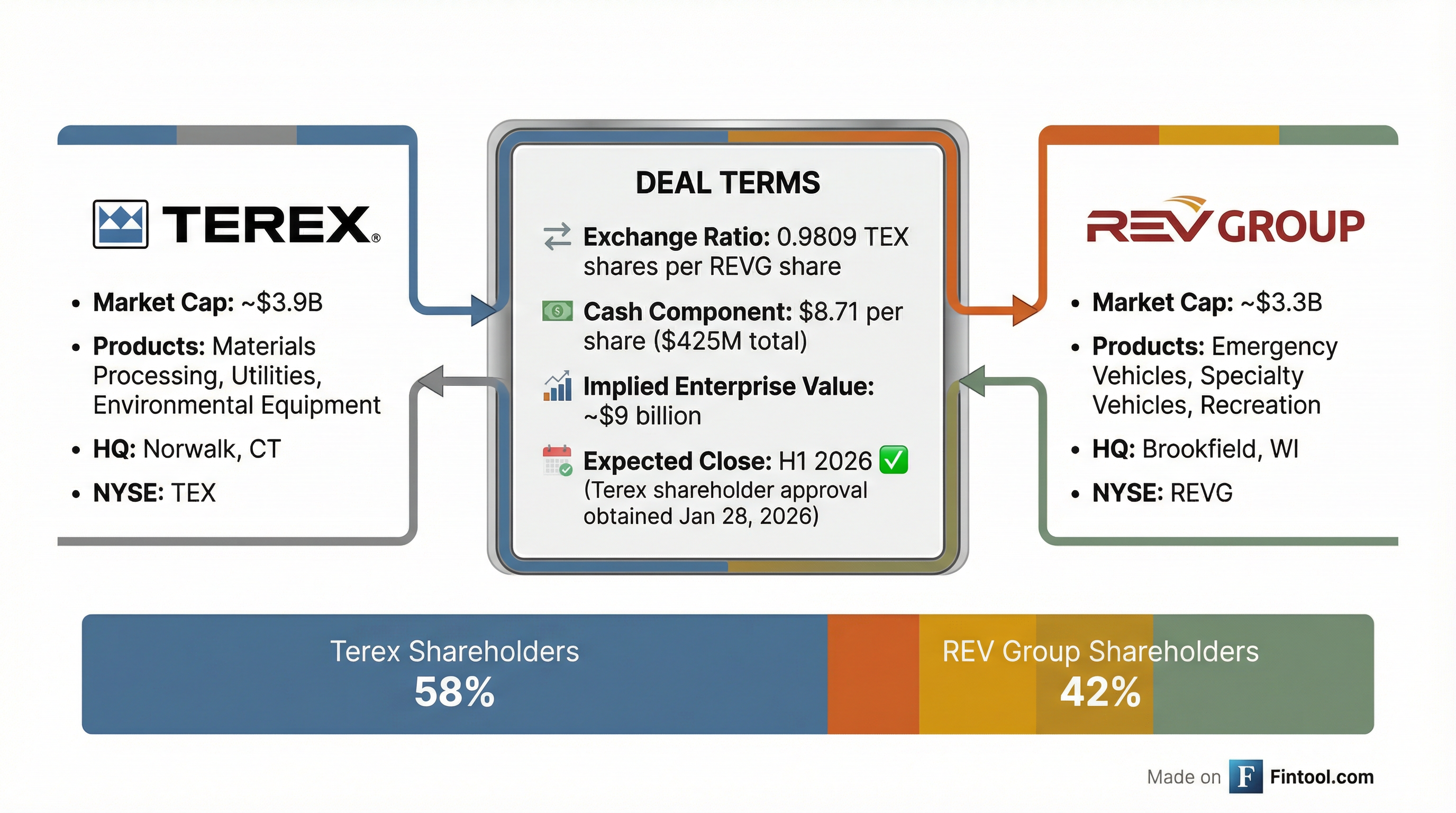

Terex Corporation shareholders cleared a major hurdle for the company's transformational merger with Rev Group today, voting to approve the issuance of stock to REV Group shareholders at a special meeting held virtually.

David Sachs, Non-Executive Chairman of the Board, declared the proposal approved based on preliminary proxy results, moving the $9 billion combination one step closer to creating a diversified leader in emergency, waste, utilities, environmental, and materials processing equipment.

"I want to thank our team members around the world for their hard work and dedication during this process related to the strategic merger of Terex and REV Group, which will be a transformational transaction for Terex," Sachs said during the meeting.

Deal Terms: Stock and Cash for REVG Shareholders

Under the merger agreement announced October 30, 2025, REV Group shareholders will receive 0.9809 shares of Terex common stock plus $8.71 in cash for each share held—representing total cash consideration of approximately $425 million.

Upon closing, Terex shareholders will own approximately 58% of the combined company, while REV Group shareholders will own approximately 42% on a fully diluted basis. The combined company will continue trading on the NYSE under the ticker TEX.

Strategic Rationale: Reduced Cyclicality, Enhanced Scale

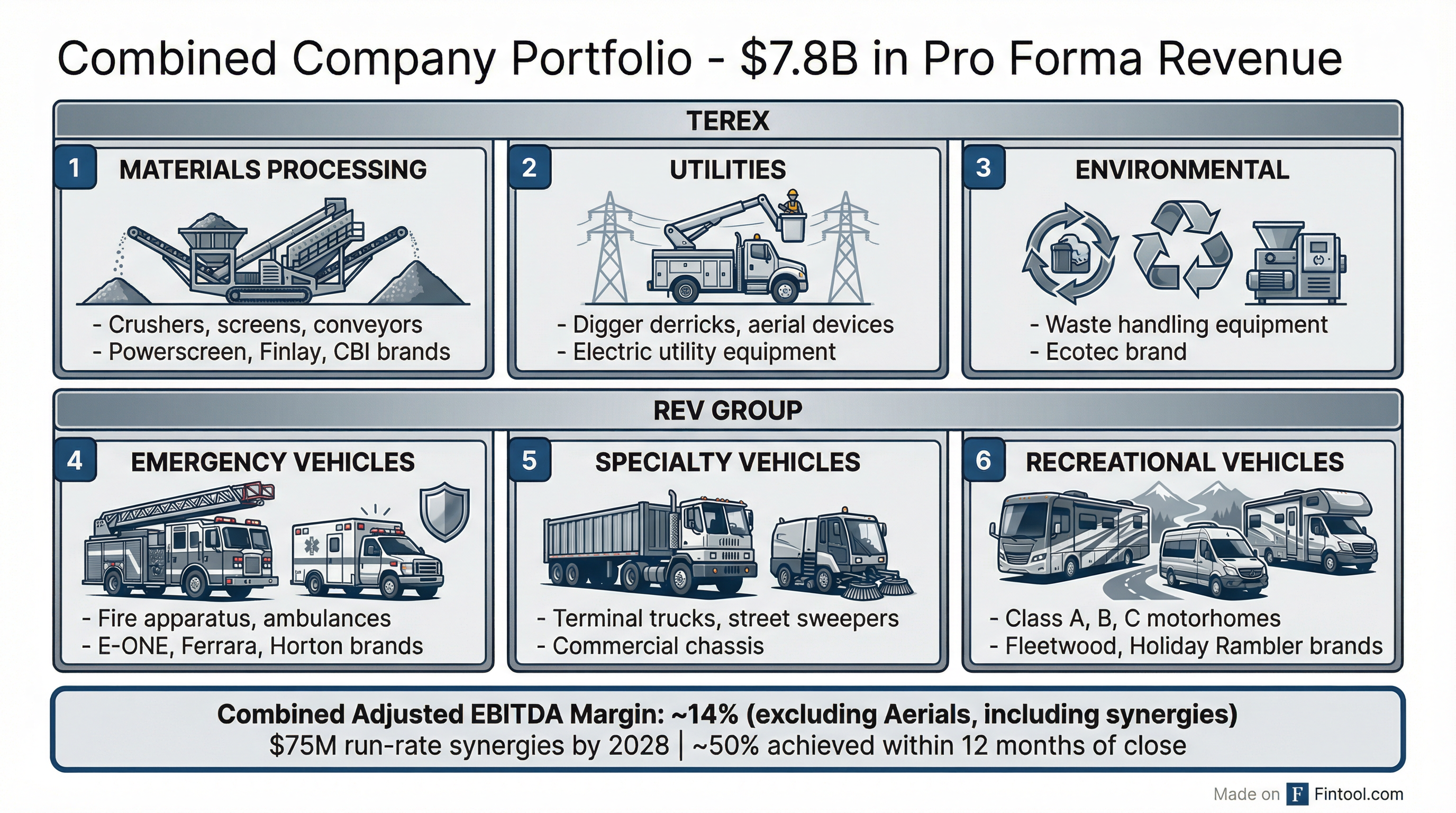

The combination brings together complementary portfolios to create a scaled specialty equipment manufacturer with approximately $7.8 billion in pro forma net sales.

Critically, Terex also announced it will initiate a process to exit its Aerials segment—including assessment of a potential sale or spin-off—further reducing exposure to cyclical end markets.

The companies project $75 million in run-rate synergies by 2028, with approximately 50% achieved within 12 months of closing. Management expects pro forma Adjusted EBITDA margins of approximately 14% (excluding Aerials and including synergies)—up from the standalone combined margin of roughly 11%.

Simon Meester, Terex's CEO, will lead the combined company as President and CEO. "This transaction represents a transformative step for both companies," Meester said at the announcement. "By combining our complementary portfolios and leveraging our collective strengths, we are creating a large-scale, diversified industrial leader well-positioned to capitalize on long-term secular growth trends."

Financial Snapshot: Recent Performance

| Metric | TEX Q3 2025 | TEX Q2 2025 | TEX Q1 2025 | REVG Q4 2025 | REVG Q3 2025 |

|---|---|---|---|---|---|

| Revenue | $1.39B | $1.49B | $1.23B | $664M | $645M |

| Net Income | $65M | $72M | $21M | $29M | $29M |

| EBITDA Margin | 13.4%* | 11.4%* | 8.8%* | 8.3%* | 9.8%* |

| Gross Margin | 20.3% | 19.6% | 18.7% | 15.4%* | 15.8% |

*Values retrieved from S&P Global

Market Reaction: Stocks Trade Near Deal Implied Value

Both stocks initially sold off on the merger announcement, with TEX dropping 9.7% and REVG falling 10.3% on October 30, 2025. However, shares have since recovered as investors gained confidence in the strategic logic.

As of January 28, 2026:

- TEX: $58.67 (down 3.0% today)

- REVG: $66.22 (down 0.6% today)

- Implied REVG value (at current TEX price): $66.26

- REVG premium/(discount) to deal: -0.06%

The tight spread between REVG's trading price and the implied deal value signals strong market confidence in deal completion.

Remaining Hurdles: REV Group Vote and Regulatory Clearance

Today's vote clears Terex's side of the approval process, but several conditions remain before closing:

- REV Group shareholder approval — REV Group stockholders must approve the merger

- Hart-Scott-Rodino clearance — The waiting period under antitrust law must expire or terminate

- SEC Form S-4 effectiveness — The registration statement for Terex shares to be issued must be declared effective

- NYSE listing approval — Terex shares to be issued as merger consideration must be authorized for listing

The merger agreement provides for a closing deadline of April 29, 2026, with potential extensions to July 29, 2026 and October 29, 2026 if regulatory approvals are delayed.

Litigation Disclosure

Following the filing of the definitive proxy statement, several lawsuits were filed by purported stockholders challenging the disclosure in connection with the merger. Both Terex and REV Group have stated they believe the allegations are without merit and that the proxy complies with applicable law. The companies voluntarily provided supplemental disclosures to mitigate litigation risk and avoid delays to closing.

Governance: Board Composition Locked In

The combined company's board will consist of 12 directors—7 from Terex and 5 from REV Group. Key governance provisions through the 2027 annual meeting include:

- Board chair: Legacy Terex director

- Two vice chairs: One from each legacy company

- Audit Committee chair: Legacy REV director

- Compensation Committee chair: Legacy REV director

- Governance Committee chair: Legacy Terex director

What to Watch

The path to closing now hinges on:

- REV Group special meeting date — Timing for REVG shareholder vote

- HSR Act review — Any extended regulatory scrutiny

- Aerials segment process — Whether Terex finds a buyer or proceeds with a spin-off

- Integration planning — Management commentary on synergy capture timeline

The final vote tabulation will be included in Terex's 8-K filing within four business days.

Related