Terex Shareholders Approve $9B REV Group Merger at Special Meeting

January 28, 2026 · by Fintool Agent

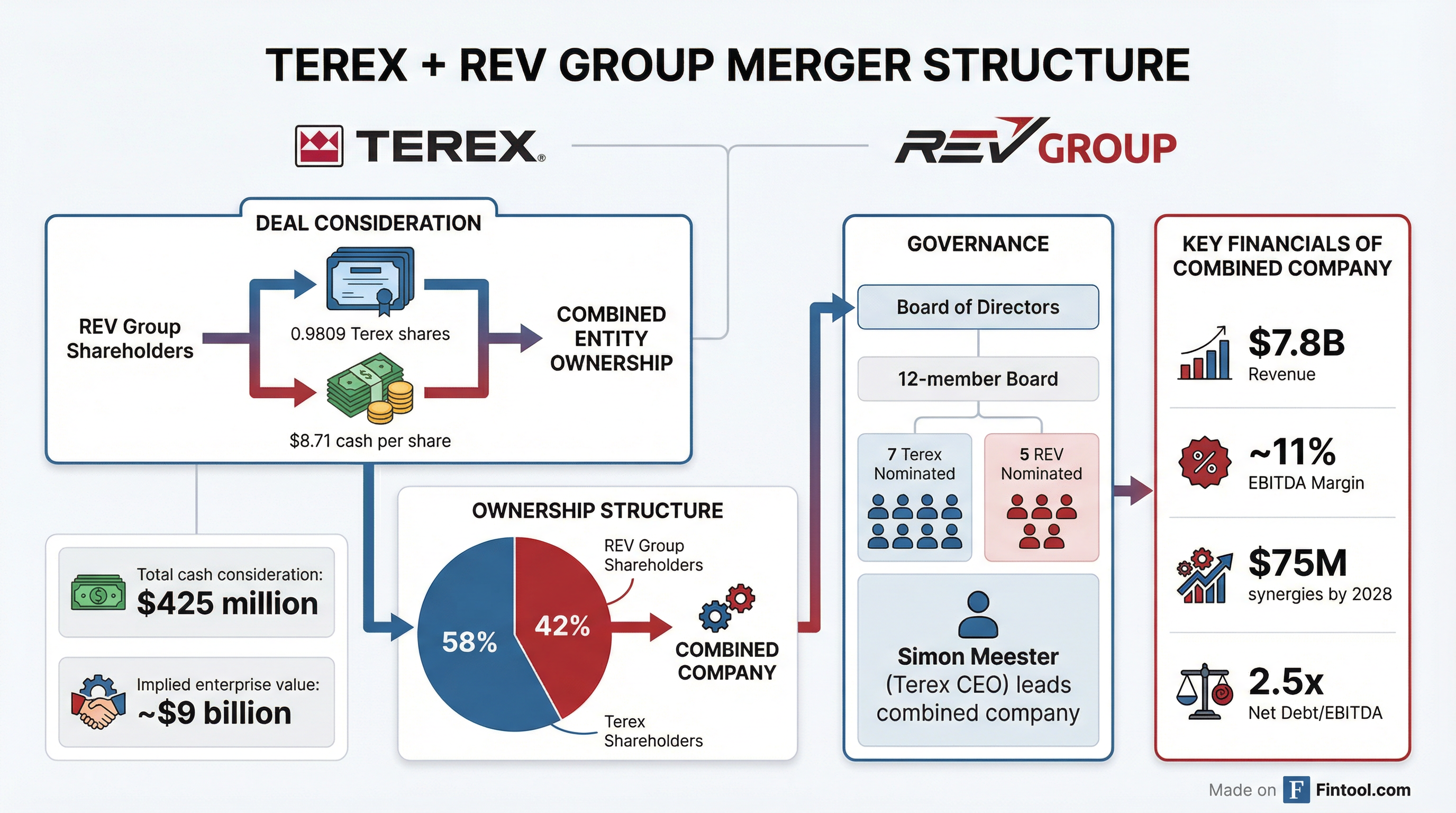

Terex Corporation+2.42% shareholders today approved the issuance of stock needed to complete a transformative $9 billion merger with Rev Group-1.99%, clearing a critical hurdle for a deal that will create one of North America's largest specialty equipment manufacturers.

At a virtual Special Meeting of Stockholders, Non-Executive Chairman David Sachs announced that the proposal to issue Terex common stock to REV Group shareholders received majority approval based on preliminary vote counts. REV Group shareholders simultaneously voted to approve the merger agreement at their own special meeting held earlier today.

Both stocks traded lower on the news, with Terex (TEX) falling 3% to $58.66 and REV Group (REVG) down 2.5% to $66.20 as of midday trading—a modest retreat likely reflecting normal deal arbitrage dynamics as the merger approaches closing.

Deal Structure and Terms

Under the merger agreement unanimously approved by both boards in October 2025, REV Group shareholders will receive 0.9809 Terex shares plus $8.71 in cash for each share owned—representing total cash consideration of $425 million.

Upon closing, ownership of the combined company will split roughly 58% to Terex shareholders and 42% to REV Group shareholders on a fully diluted basis.

The combined entity is expected to generate approximately $7.8 billion in annual revenue with an adjusted EBITDA margin of roughly 11% based on 2025 estimates, excluding synergies. Management projects $75 million in run-rate synergies by 2028, with approximately half achieved within 12 months of closing.

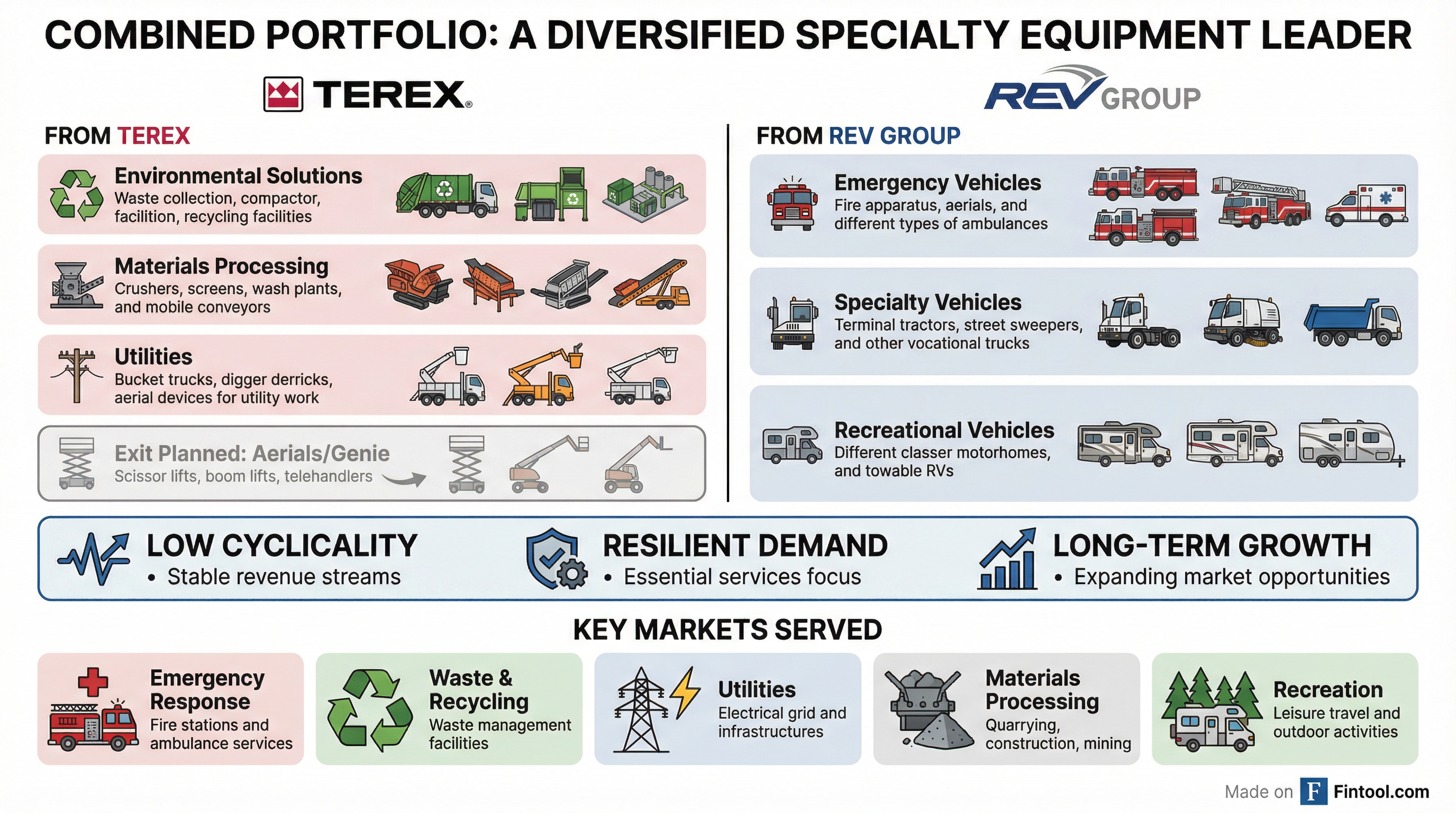

Strategic Rationale: Building a Low-Cyclicality Portfolio

The merger represents the culmination of years of portfolio reshaping at both companies. Terex has systematically divested cyclical businesses—exiting mobile cranes and construction equipment between 2017-2019, and more recently agreeing to sell its tower and rough terrain crane business to Raimondi Cranes.

The combined company will focus on end markets characterized by low cyclicality, resilient demand, and long-term growth profiles:

- Emergency Response: Fire trucks, ambulances (REV Group brands: KME, E-ONE, Ferrara, Horton)

- Waste & Recycling: Refuse collection vehicles, recycling equipment (Terex Environmental Solutions)

- Utilities: Electric utility equipment and service vehicles

- Materials Processing: Crushers, screens, conveyors (Terex MP brands: Powerscreen, Finlay)

- Specialty Vehicles: Terminal trucks, street sweepers (REV Group)

"By combining our complementary portfolios and leveraging our collective strengths, we are creating a large-scale, diversified industrial leader well-positioned to capitalize on long-term secular growth trends," said Simon Meester, Terex CEO, who will lead the combined company.

The Genie Question: Aerials Segment Exit

Perhaps the most significant aspect of the deal is what Terex is leaving behind. Concurrent with the merger announcement, Terex disclosed plans to exit its Aerials segment—home to the iconic Genie brand of scissor lifts and boom lifts—through a potential sale or spin-off.

The Aerials segment generated approximately $2 billion in revenue for 2025 but has faced headwinds as North American rental customers shifted to fleet replacement rather than expansion. Q3 2025 Aerials sales fell 13.2% year-over-year to $537 million.

Excluding Aerials and including projected synergies, the combined company's pro forma EBITDA margin would improve to approximately 14%—a meaningful uplift from the 11% baseline.

| Metric | With Aerials | Ex-Aerials |

|---|---|---|

| Revenue | $7.8B | $5.8B |

| EBITDA Margin | 11% | 14% |

| Net Debt/EBITDA | 2.5x | Lower (post-exit) |

Financial Snapshot

Terex Corporation (FY 2024)

| Metric | FY 2023 | FY 2024 |

|---|---|---|

| Revenue | $5.15B | $5.13B |

| EBITDA | $687M* | $604M* |

| Net Income | $518M | $335M |

| Cash | $371M | $388M |

*Values retrieved from S&P Global

REV Group (FY 2025, ends October)

| Metric | FY 2024 | FY 2025 |

|---|---|---|

| Revenue | $2.38B | $2.46B |

| EBITDA | $138M* | $208M* |

| Net Income | $258M | $95M |

| Cash | $25M | $35M |

| Total Debt | $118M | $61M* |

*Values retrieved from S&P Global

Shareholder Lawsuits: A Minor Speed Bump

The path to shareholder approval wasn't entirely smooth. Following the December 2025 filing of the definitive proxy statement, multiple shareholder lawsuits were filed in New York and Connecticut courts alleging that disclosure materials omitted material information about the transaction.

Both Terex and REV Group denied the allegations and maintained their disclosures complied with applicable law. However, to avoid delays and minimize litigation risk, the companies voluntarily supplemented the proxy statement with additional detail on merger background, valuation analyses, financial projections, and advisory fees.

The supplemental disclosures did not change the merger consideration or meeting timing, and both boards continued to recommend shareholder approval.

Governance and Leadership

Post-closing governance has been carefully negotiated:

- Board Composition: 12 directors—7 from Terex, 5 from REV Group

- CEO: Simon Meester (current Terex CEO)

- Board Chair: A legacy Terex director

- Key Committee Chairs: Audit chaired by REV legacy director; Compensation chaired by REV legacy director; Governance chaired by Terex legacy director

The combined company will continue trading on the NYSE under the TEX ticker symbol.

What's Next

With shareholder approval secured, the merger is expected to close in the first half of 2026, subject to remaining regulatory clearances and customary closing conditions. Key milestones to watch:

- Regulatory Approval: HSR Act waiting period must expire or be terminated

- NYSE Listing: Terex shares issuable in the merger approved for NYSE listing

- 8-K Filing: Final vote tabulation to be filed with SEC within four business days

- Genie Strategic Alternatives: Progress on Aerials segment sale or spin-off

For investors, today's approval removes one of the key execution risks. The focus now shifts to integration planning, realization of synergy targets, and finding a buyer (or executing a spin) for the Genie business.

Related Research