Toyota Raises Buyout Offer to $35 Billion After Elliott Pressure

January 14, 2026 · by Fintool Agent

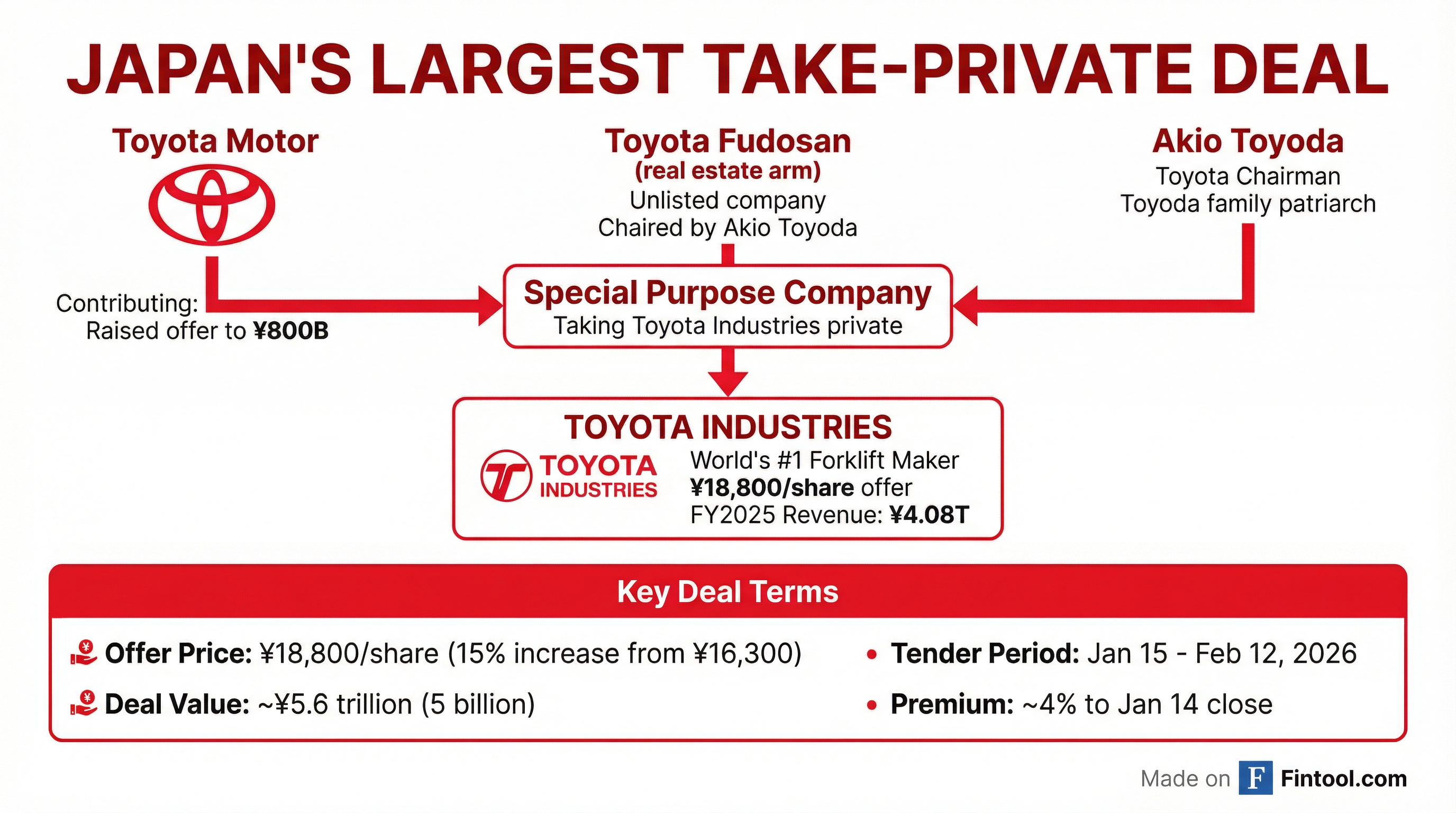

Toyota Motor+2.96% capitulated to activist investor pressure on Wednesday, raising its offer for group company Toyota Industries by 15% to ¥18,800 per share—valuing Japan's largest take-private deal at approximately ¥5.6 trillion ($35-39 billion).

The tender offer begins Thursday, January 15, and runs through February 12.

The revised price represents a major victory for Elliott Investment Management, which spent $1.7 billion building a 5% stake and waged a public campaign arguing the original ¥16,300 offer significantly undervalued the nearly century-old company that spawned the Toyota automotive empire.

The Deal Structure

The transaction will take Toyota Industries private through a special-purpose company controlled primarily by Toyota Fudosan, an unlisted real estate firm chaired by Akio Toyoda—the Toyota Motor chairman and great-grandson of Toyota Industries founder Sakichi Toyoda.

Toyota Motor increased its contribution to up to ¥800 billion, up from ¥706 billion under the original terms.

| Deal Term | Original (June 2025) | Revised (January 2026) |

|---|---|---|

| Offer Price | ¥16,300/share | ¥18,800/share |

| Premium to Announcement | 23% | 4% to Jan 14 close |

| Toyota Motor Contribution | ¥706 billion | ¥800 billion |

| Total Deal Value | ¥4.7 trillion | ¥5.6 trillion |

Toyota Industries shares closed at ¥18,025 on Wednesday, approximately 4% below the increased offer price—suggesting investors now believe the deal will proceed.

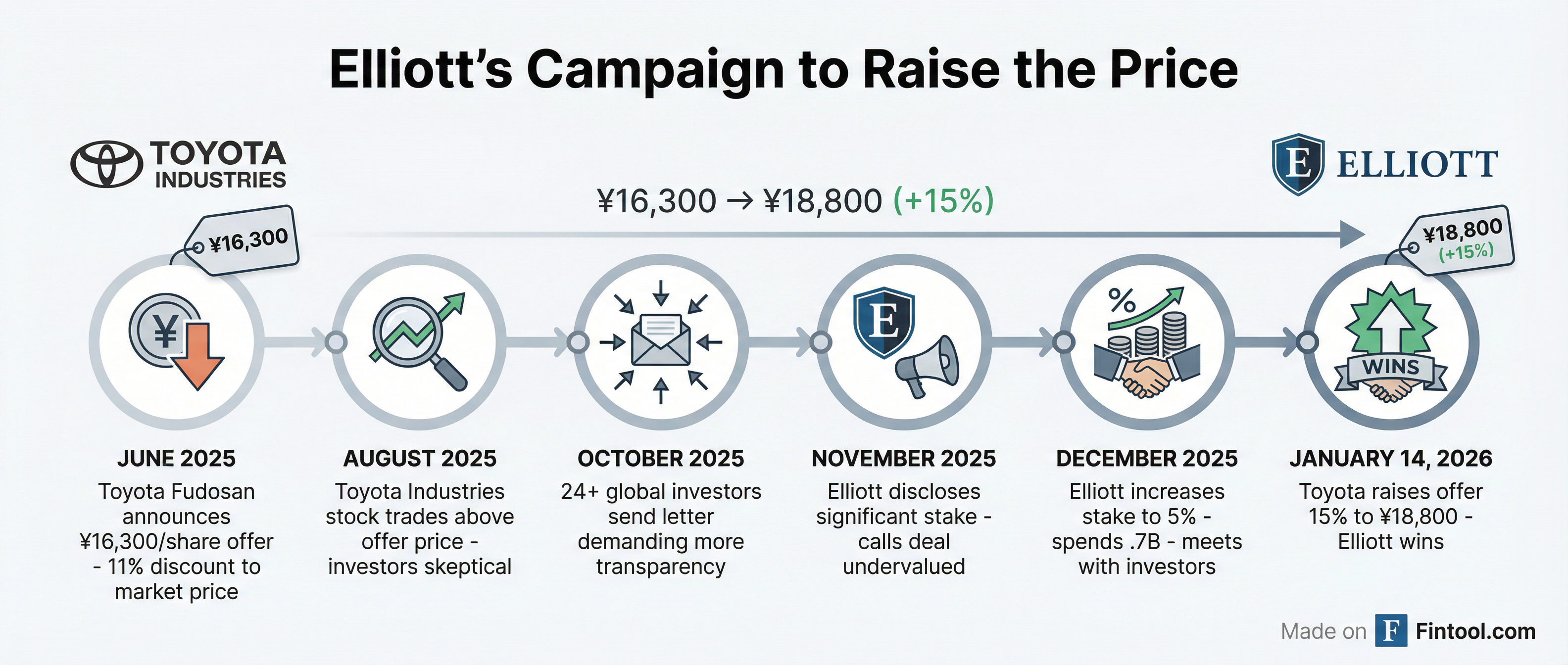

Elliott's Winning Campaign

Paul Singer's Elliott Investment Management launched one of the most high-profile activist campaigns in Japanese corporate history, directly challenging the nation's most powerful business family.

The fund disclosed in November 2025 that it had built a "significant" stake and criticized the proposed deal as "undervaluing Toyota Industries" while reflecting "a process that has lacked transparency and has fallen short of proper governance practices."

By December, Elliott had ramped its stake to 5.01%, spending ¥268 billion ($1.7 billion) on shares acquired "for investment purposes and potentially making important shareholder proposals."

Elliott wasn't alone. More than two dozen global investors—including several based in Japan—sent a letter to Toyota Industries' board in August 2025 arguing the deal lacked transparency and hurt minority shareholders.

The market signaled its skepticism clearly: Toyota Industries shares traded above the original offer price from late August onward, removing any incentive for shareholders to tender at ¥16,300 when they could sell for more in the open market.

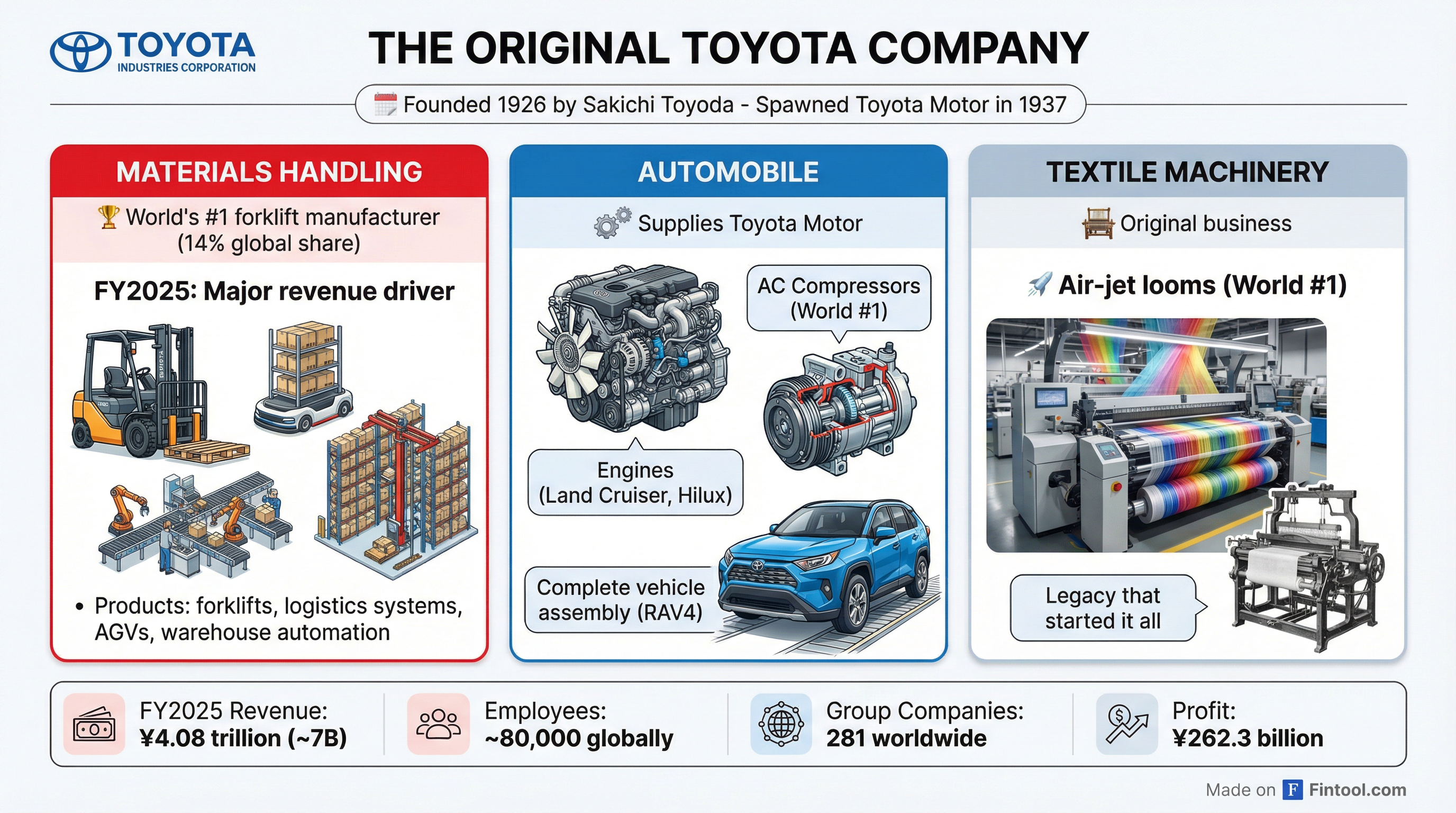

The Original Toyota Company

Toyota Industries is no ordinary acquisition target. Founded in 1926 by Sakichi Toyoda, the company is the original Toyota business—the textile machinery manufacturer from which Toyota Motor was spun off in 1937.

Today, the company is the world's largest forklift manufacturer by revenue, commanding approximately 14% global market share. Its FY2025 forklift-related revenue reached $18.26 billion, ahead of KION Group ($8.96B) and Jungheinrich ($5.60B).

| FY2025 Financial Highlights | |

|---|---|

| Net Sales | ¥4.08 trillion ($27B) |

| Operating Profit | ¥221.6 billion |

| Net Profit | ¥262.3 billion |

| Employees | 80,000 globally |

| Subsidiaries | 281 companies |

Source: Toyota Industries Annual Report 2025

Beyond forklifts, Toyota Industries supplies critical components to Toyota Motor:

- Engines: Powers the Land Cruiser, Hilux, and other Toyota vehicles

- AC Compressors: World's #1 supplier of automotive air-conditioning compressors

- Vehicle Assembly: Contract manufactures the RAV4 and other models

- Textile Machinery: The original business, still world leader in air-jet looms

Sales to Toyota Motor and subsidiaries reached ¥588.6 billion in FY2025, up from ¥549.2 billion the prior year.

Consolidating the Toyoda Dynasty

The privatization strengthens the founding Toyoda family's grip over Japan's most powerful industrial group.

Akio Toyoda—who led Toyota Motor as CEO for 14 years before becoming chairman in 2023—serves as chairman of Toyota Fudosan, the unlisted real estate company leading the buyout. Critics have argued this creates conflicts of interest, with the family effectively setting the price at which it acquires the business.

Toyota's advisory committee told the automaker that the revised terms, including the higher price, did not benefit any specific party and did not unfairly advantage Toyoda or Toyota Fudosan at the company's expense. Negotiations were conducted without Toyoda's involvement to ensure fairness, according to company filings.

Implications for Japanese Corporate Governance

The raised offer represents a watershed moment for shareholder activism in Japan.

The transaction is being closely watched as Japan's regulators and government push to unwind cross-shareholdings—the dense web of equity stakes that Japanese companies hold in each other—and improve corporate governance standards.

Elliott's success could encourage more activist campaigns targeting Japanese companies, particularly those involved in privatizations or restructurings perceived as undervaluing minority shareholders.

What's Next

The tender offer period runs from January 15 through February 12, 2026. Toyota Industries' board now recommends shareholders tender their shares.

Key questions to watch:

- Tender rate: Will enough shareholders accept the ¥18,800 offer?

- Elliott's response: Has the activist fund been satisfied, or will it push for more?

- Regulatory review: Any antitrust or foreign investment concerns in key markets?

- Integration: How will Toyota consolidate the company post-close?